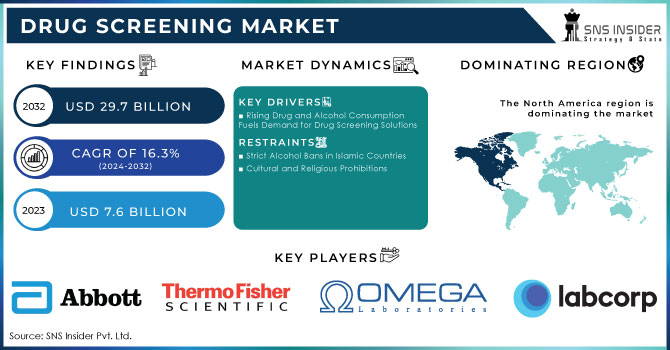

Drug Screening Market Size Analysis:

The Drug Screening Market size was valued at USD 7.6 billion in 2023 and is expected to reach USD 29.7 billion by 2032 and grow at a CAGR of 16.3% over the forecast period 2024-2032.

Get More Information on Drug Screening Market - Request Sample Report

There has been an increasing trend of substance abuse across the globe, resulting in increased demand for drug-testing solutions to promote the growth of the market for drug screening. It is being strictly regulated by governments all over the world to make alcohol and drug testing compulsory in certain workplaces and public places for safety reasons. Furthermore, more government initiatives undertaken to monitor and combat this menace are an added support to the growth of the market. For instance, the National Institute on Drug Abuse report shows that in 2021, over 106,000 people in the U.S. died from drug overdoses, which sets an intense need for reliable drug testing. More than 50% of workplace accidents and 40% of employee theft can be traced back to substance abuse, according to the U.S. Department of Justice, which fuels further the demand for drug testing solutions.

Several governmental initiatives are reinforcing the market's growth. For example, the U.S. government passed the Consolidated Appropriations Act of 2023, under which funding is allocated to SAMHSA to support programs related to substance use disorders. In Canada, the SUAP also finances several drug prevention and treatment projects. Additionally, in December of 2021, the UK launched its 10-year plan on driving down drugs-related crimes and supporting recovery from addiction, providing yet another example of a collective push globally toward subduing substance abuse.

Advances in drug testing technologies point-of-care and rapid testing solutions are driving growth in the market. New products such as Singapore's saliva test kit for roadside drug detection illustrate product development within the market. However, the regulatory environment is challenging, especially in high-market-potential areas, which slows the approval of new technologies.

Leading players like F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., and Bio-Rad Laboratories, Inc. are leading the market through product innovations and strategic mergers. For instance, in 2023, BRITISH CANNABIS acquired PhytoVista Laboratories, enhancing their drug testing capabilities. The competition would be of moderate levels because of the presence of advanced breathalyzers and sweat patch tests. However, the level of concentration is high due to the end-users in the research and diagnostics industries.

Table: SWOT Analysis of the Drug Screening Market

| Strengths | Weaknesses |

|---|---|

| High demand for drug screening tests | High costs associated with advanced technologies |

| Established market players | Regulatory challenges |

| Continuous technological advancements | Limited awareness in emerging markets |

| Opportunities | Threats |

|---|---|

| Expansion into emerging markets | Intense competition |

| Increased focus on personalized medicine | Rapid technological changes |

| Collaborations and partnerships | Changes in regulatory frameworks |

Drug Screening Market Dynamics

Drivers

-

Rising Drug and Alcohol Consumption Fuels Demand for Drug Screening Solutions

Some of the most important factors that help develop the drug screening market are the increasing use of drugs and alcohol. According to the World Drug Report 2023, it is estimated that in 2021, approximately 1 in every 17 people aged 15–64 had used a drug during the past year. In that same year, the number of users increased from 240 million in 2011 to 296 million, and for that, this constituted a 23% increase. This rise has been traced in part to population growth; cannabis is the second most used drug, with 219 million users, or 4.3% of the adult world population.

Drug use is not the only concern: alcohol-related problems also include violent and other crimes. One instance of that in the United States is alcohol-impaired driving crashes, which accounted for 13,384 deaths in 2021, 14% more than a year earlier, according to data from the U.S. Department of Transportation's National Highway Traffic Safety Administration. The rising incidence of illegal drug and alcohol use is increasing the demand for suitable drug screening solutions, especially in road safety testing and workplace testing. As a result, the demand for drug screening products and services will increase geometrically, thereby propelling the overall market growth.

Restraints

-

Strict Alcohol Bans in Islamic Countries

-

Cultural and Religious Prohibitions

Drug Screening Market Segmentation Analysis

By Product

The consumables segment dominated the market in 2023, holding a share of 36.2% spurred by the significant role consumables like kits, reagents, columns, calibrators, blue dye tablets, specimen, and temperature test strips, and controls serve for drug testing. All these consumables are important for boosting confirmation testing. In June 2023, the Office of Addiction Services and Supports launched a statewide ordering system for xylazine test strips, reportedly ordering nearly 100,000. The system will offer free test strips to the public and clinicians, providing a core component of harm reduction to combat the risks posed by xylazine and its expanding illicit trade. This development is expected to induce further growth in the market over time.

Rapid testing devices are expected to record the fastest growth over the review period due to the fast rise in substance use, including opioids. WHO estimates that 296 million people globally used drugs at least once in 2021, and about 60 million of those comprised opioid users. The increased intake of opioids and other drugs will lead to increased demand for rapid testing devices. Besides, strategic programs like new product developments, partnerships, and mergers & acquisitions by state and non-state agencies promote programs to limit drug abuse, thereby driving market growth. For instance, recently this October 2023, Kerala Police initiated the SoToxa Mobile Test, which is a portable rapid drug testing kit, based on human saliva samples, where the result can be delivered within five minutes. This system can detect drug use up to two days prior, further advancing rapid testing technology.

By Sample Type

The urine sample segment was the market leader in 2023, with a greater share of 40.1%. This is mainly due to the rising collection of urine for testing purposes. UDM plays a crucial role in maintaining adherence to prescribed regimens and avoiding misuse or abuse of substances. UDM is highly beneficial in screening patients with opioid therapy to maintain compliance and detect misuse. Additionally, urine testing is one of the very few methods that are acceptable both by the Department of Health as well as the Department of Transportation. These samples would be for use in both point-of-care as well as laboratory diagnostics.

The oral fluid segment will be the fastest-growing during the forecast period. Oral fluid samples detect drug concentrations that are essentially correlated with plasma levels, which makes them good for the identification of recent use, cases of impairment, and many other conditions. However, oral fluid samples need proper equipment for collection to maintain the integrity of the samples. Quantification, for instance, is sometimes tricky with oral fluid samples, as some devices used for collection absorb the fluid collected, resulting in less accurate identification results for drugs. Despite these challenges, however, developments in product formulation and the introduction of special collection devices, such as Oral-Eze, improved the efficiency and reliability of oral fluid sample collection.

By Drug

The cannabis/marijuana segment led the market throughout the year 2023 with the highest share of 24.6%. This is mainly because cannabis is the most abused illegal drug, which also drives demand for testing kits and equipment. The higher use of cannabis in major markets increases the demand for testing supplies and instruments.

The cannabis/marijuana segment is also expected to grow the fastest within the forecast period. In the U.S., marijuana is classified as a hallucinogen under the Controlled Substances Act, hence it is not legal at the federal level, though it has been legalized and decriminalized for recreational use in many states. Some other countries that have legalized its use recently include Canada, parts of the United States, and Uruguay. The fact that cannabis is the most commonly abused illicit substance worldwide means that the market for testing solutions is also expected to continue along that trend in the following years. Increased demand for legal cannabis due, among others, to medical use, remains one of the fundamental drivers that have boosted the market in previous years. Many countries have recently legalized medical marijuana to treat a myriad of other conditions. There have been many studies that indicate how effective medical marijuana can be for symptom relief in substance use disorders as well as other medical issues.

By End Use

The drug testing laboratories segment accounted for the largest share of 36.0% in 2023. Such dominance can be attributed to the wide reach and comprehensive services offered by testing laboratories. These often have testing capabilities for a wide range of substances, which is generally not the case in rapid tests. Moreover, rigorous testing procedures ensure better accuracy in the results obtained from laboratory tests, which becomes very important while initiating appropriate treatment by drug use or overdose.

The workplace segment is likely to be the largest growing segment during the forecast period. Public and private organizations have rigid policies for the non-existence of drugs in the workplace, thereby fueling growth. In this regard, most employers in the drug abuse testing market conduct pre-employment tests as well as periodic tests for currently employed employees. Urine tests are the most widely used form of workforce drug testing, and some of the major users are government agencies and employers. Also tested for in these tests include amphetamines, marijuana, methamphetamines, cocaine, Phenylcyclohexyl Piperidine (PCP), and opiates. Increasing demand for keeping the premises drug-free at companies is the primary motivating factor behind the growth in this sector of workplace drug testing.

Regional Insights

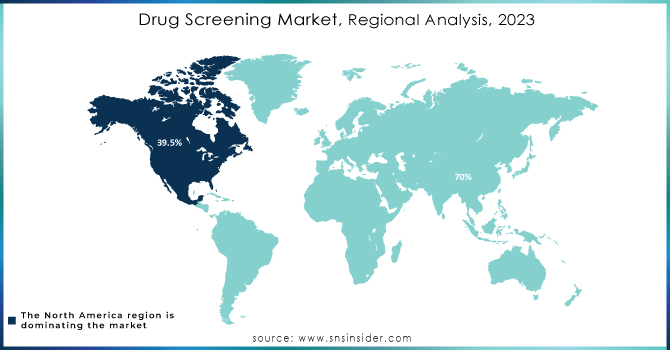

North American drug screening market also dominated with a high 39.5% share in 2023 with the presence of key market players like Bio-Rad Laboratories and stringent government regulations towards substance abuse, further accented by the move such as San Francisco's need to enroll anybody seeking county funds in treatment. Alcohol consumption is likely to rise in the United States to align with growing markets and reported high usage levels of cannabis and prescription stimulants are also likely to fuel the U.S. market.

The market for drug testing is growing in Europe, especially in the UK and France, which is more driven by greater safety awareness in the workplace and investment from governments to control the abuse of drugs. Funding has been provided by the UK Office for Life Sciences that advances the testing technologies, whereas France is witnessing greater demands for testing based on increasing illicit consumption of drugs.

The region with the fastest growth is likely to be Asia Pacific, which will be influenced by a more dynamic government action plan to prevent drug use and advances in testing technology. Countries like China and Japan are seriously expanding their ability to conduct drug tests: not only have they been deploying new rapid test kits but also collaborative efforts to improve their services as rates of youth substance abuse continue to increase.

Need any customization research on Drug Screening Market- Enquiry Now

Drug Screening Market Key Players

-

Premier Biotech, Inc.

-

Omega Laboratories, Inc.

-

Psychemedics Corporation

-

Labcorp

-

Abbott

-

Thermo Fisher Scientific Inc.

-

Alfa Scientific Designs, Inc.

-

OraSure Technologies Inc.

-

ACM Global Laboratories

-

CareHealth America Corp

-

Sciteck, Inc.

-

F. Hoffmann-La Roche Ltd

-

MPD Inc.

-

Shimadzu Corporation

-

Lifeloc Technologies, Inc.

-

Drägerwerk AG & Co. KGaA

-

Clinical Reference Laboratory, Inc.

-

American Bio Medica Corporation

-

Intoximeters, Inc.

-

AccuSourceHR, Inc.

-

Cordant Health Solutions

-

Intoxalock

-

Millennium Health and Others.

Recent Developments in the Drug Screening Market

In February 2024, Swedish sample collection company Capitainer announced a successful fundraising round securing an amount of USD 7.7 million using Series A financing. This capital raising will be used to increase and improve production capacity and strengthen its sales platform in its self-sampling blood collection products in the EU and the US and drive significant collaborations.

In Feb 2024, Veriteque announced a new distribution agreement with OraSure Technologies, which is a leading developer of in vitro diagnostic products. According to this deal, Veriteque will employ OraSure's rapid POC tests for various infectious diseases, such as HIV, HCV, and syphilis, within some specific territories. This partnership aims to provide greater access to these critical, life-saving tests among healthcare providers and patients within those certain areas.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.6 Billion |

| Market Size by 2032 | USD 29.7 Billion |

| CAGR | CAGR of 16.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables, Instruments, Rapid Testing Devices, Services) • By Sample Type (Urine Samples, Oral Fluid Samples, Hair Samples, Other Samples) • By Drug (Alcohol, Cannabis/Marijuana, Cocaine, Opioids, Amphetamine & Methamphetamine, LSD, Others) • By End Use (Drug Testing Laboratories, Workplaces, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Premier Biotech, Inc., Omega Laboratories, Inc., Psychemedics Corporation, Labcorp, Quest Diagnostics, Abbott, Thermo Fisher Scientific Inc., Alfa Scientific Designs, Inc., and Others |

| Key Drivers | • Rising Drug and Alcohol Consumption Fuels Demand for Drug Screening Solutions |

| RESTRAINTS | • Strict Alcohol Bans in Islamic Countries • Cultural and Religious Prohibitions |