Drilling Lubricants Market Report Scope & Overview:

Get More Information on Drilling Lubricants Market - Request Sample Report

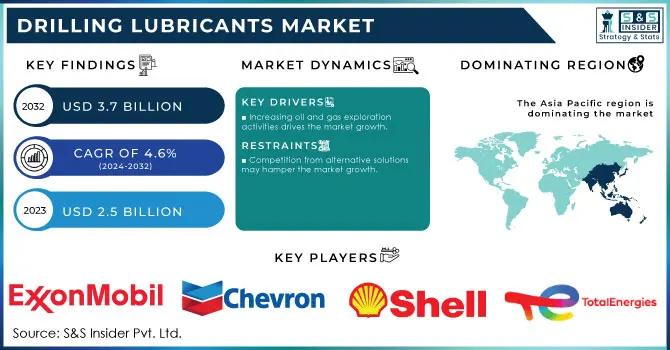

The Drilling Lubricants Market Size was valued at USD 2.5 Billion in 2023 and is expected to reach USD 3.7 Billion by 2032 and grow at a CAGR of 4.6% over the forecast period 2024-2032.

As the global population and industrial activity continue to grow, so does the demand for oil and gas, increasing the need further to expedite drilling. With the current exploration and production activities surging, oil & gas players are becoming aware of adding value to their operations by employing proprietary drilling lubricants to maximize their on-field processes. These lubricants are designed to optimize performance by minimizing friction between the drill bit and wellbore, gaining both drilling efficiencies as well as extending equipment life. These lubricants help reduce maintenance-related operational costs and downtime by reducing wear and tear. The ongoing push to drill deeper and in many cases, into ever more difficult and sensitive environments, means the high-performance 'lubricant component has an even greater role to play in helping companies continue to meet production demands without compromising on safety or environmental objectives.

According to the U.S. Energy Information Administration (EIA), in its 2023 report on oil and natural gas drilling activity, the number of active drilling rigs in the United States increased to 770 in August 2023, representing a 12% rise compared to the same period in 2022. This surge highlights the growing demand for efficient drilling operations in response to rising global oil prices and increased consumption.

Health and safety are increasingly important in the drilling industry as there has been a drive to protect workers and the environment. An increase in understanding of the potential risks related to conventional drilling lubricants that may contain toxic substances is driving operators to find a safer alternative solution. This has led to a major development of non-toxic or low-odor lubricants that suspend the driller efficiency risk for health effects. Not only do these safer formulations conform to the most stringent regulatory standards, but they are also a manifestation of corporate responsibility and environmental stewardship. Say no to accidents, and more ecological footprints in any aspect a company is operating by making use of safe biodegradable lubricant thus not putting worker safety at risk and positive impact on the work base higher than ever. This trend underscores how lubricant innovation must go hand-in-hand with the practicality of manufacturers to roll out products that are both ultra-trend towards health and safety compliance while also driving operational efficiencies.

The U.S. Bureau of Labor Statistics (BLS) reported in its 2022 data that the oil and gas extraction industry had an injury and illness incidence rate of 3.3 cases per 100 full-time workers, which is higher than the national average for all industries (2.7 cases per 100 full-time workers). This statistic emphasizes the ongoing challenges related to health and safety in the drilling sector. To address these issues, regulatory bodies like the Occupational Safety and Health Administration (OSHA) have implemented strict guidelines, prompting companies to adopt safer practices, including the use of non-toxic and low-odor lubricants.

Drilling Lubricants Market Dynamics

Drivers

-

Increasing oil and gas exploration activities drives the market growth.

Oil and gas exploration activities are increasing, which is primarily driving the growth of the drilling lubricants market over the forecast period. With global energy needs growing due to population and industrial growth, oil and gas firms are increasing exploration for new reserves. Higher exploration adoption results in the use of higher-end drilling technologies including but not limited to horizontal and offshore having advanced lubricants operating. High-performance drilling lubricants are urgently needed, as these products reduce friction and increase the speed compared to conventional techniques and prolong the service life of equipment, thereby providing significant cost savings. Furthermore, increasing the drive to explore more hostile environments–such as deepwater and Arctic areas–escalates the requirement for high-end lubricants that can withstand such challenging operating conditions. As a result, the increasing exploration activities in the oil and gas sector are significantly boosting the growth of the drilling lubricants market.

Globally, oil and natural gas production amounted to 4.5 billion barrels per day back in 2022 according to the U.S. Energy Information Administration (EIA) in its latest update for 2023; with an average of nearly 750 active oil and gas rigs positioned within the continental U.S., signaling a continued increase in exploration an output capacity amid growing energy needs on the one hand;

Restrain

-

Competition from alternative solutions may hamper the market growth.

One of the key factors hampering the growth of the global traditional drilling lubricants market is the emergence of alternative drilling technologies as a competition to them. Examples of water-based drilling fluids and lower-lubrication methods are beginning to be adopted as companies aim to optimize efficiency while minimizing the impact on climate. For example, water-based systems can provide sufficient cooling and lubrication and are not reliant on petroleum-based products common in environmentally sensitive locations. Furthermore, with innovation in drilling techniques like air drilling and foam drilling, the requirement for conventional lubricants is diminished altogether which further reduces the market dependence on traditional formulations. As regulators are tightening lubricant controls and corporations are reviewing their sustainability commitments, these alternatives not only strive to maximize drilling performance but also represent an opportunity for change.

Drilling Lubricants Market Segmentation Overview

By Technique

Diamond Drilling held the largest market share around 30% in 2023. In diamond drilling, diamonds are embedded into the drill bit allowing a smooth passage with little wear on the equipment. There is a considerable demand for specialized drilling lubricants that improve performance while protecting the drill bit from excessive heat and friction, owing to their efficiency in mineral exploration and geotechnical investigations. As the diamond drill gives high-quality core samples due to its high precision and accuracy, it adds imperative to the market. With the ever-increasing global mining & resource extraction activities, diamond drilling adoption is also expected to continue rising thus increasing the need for appropriate types of compatible drilling lubricants for optimizing its performance with desired operational safety and efficiency.

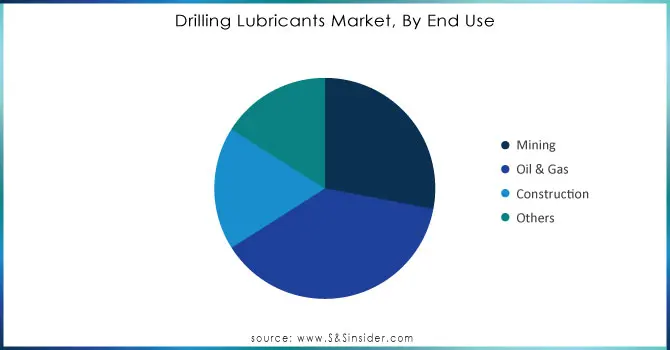

By End-Use

Oil & Gas held the largest market share around 38% in 2023. This is due to its place as one of the key global energy sources and a constant demand for hydrocarbon exploration and extraction. Oil and gas operations are one of the most critical industries across the globe, which is why sophisticated drilling processes require advanced lubricants to help them improve performance, decrease friction, and extend equipment life. The extreme conditions in which drilling often takes place including deepwater environments and high-temperature reservoirs only add complexity to these operations highlighting even more the need for high-performance lubricants capable of enduring such scenarios. Such growth stimulates the consumption of lubricants designed explicitly for oil and gas applications, alongside pushing lubricant formulations to be modified to cater to the changing needs of this vibrant industry. This makes the oil and gas industry a major constituent of the drilling lubricants market, dictating its trends and developments throughout different links in the supply chain.

Need Any Customization Research On Drilling Lubricants Market - Inquiry Now

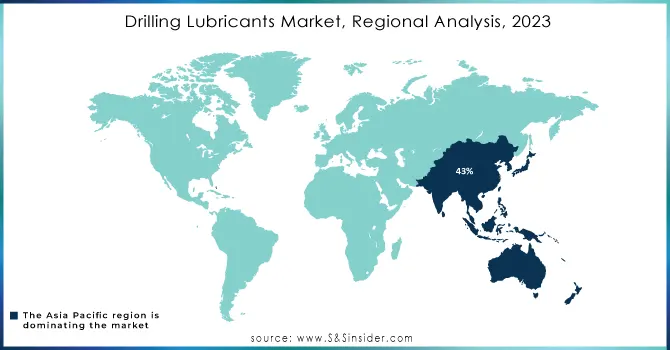

Drilling Lubricants Market Regional Analysis

Asia Pacific held the largest market share around 43% in 2023. The region possesses some of the largest oil and gas reserves in the world, with countries like China, India, and Australia being a major driver for exploration and production. In addition, from rapid industrialization and urbanization continue to increase energy demand which supports investment in the sector even more. Further, rising advancements in drilling technology and shift towards cost-effective and sustainable handling has influenced companies to utilize specific type of drilling lubricants for optimum performance while minimizing environment footprint. Such initiatives by the government towards improving energy self-reliance and foreign investments in the oil and gas sector further augment the market growth. Additionally, continuous shale gas and offshore resources development provides considerable potential for drillers to take advantage of in the region, making it a major target for drilling lubricant suppliers who want to get their share from developing market conditions over Asia-Pacific.

According to the International Energy Agency (IEA), Asia-Pacific accounted for approximately 40% of global oil demand in 2022, with China being the largest importer of crude oil, importing over 500 million tons in that year. Additionally, the Australian government’s Department of Industry, Science, Energy and Resources reported a 20% increase in exploration spending in Australia in 2023, highlighting the region's commitment to expanding its oil and gas capabilities.

Key Players in Drilling Lubricants Market

-

ExxonMobil Corporation – (Mobil SHC Gear, Mobil DTE 10 Excel)

-

Chevron Corporation – (Chevron Drill Oil, Chevron Rando HD)

-

Royal Dutch Shell plc – (Shell Gadus, Shell Tellus)

-

BP plc – (BP Energrease, BP Vanellus)

-

TotalEnergies SE – (Total Drilfluid, Total Hydrelf)

-

Schlumberger Limited – (MI SWACO Drilling Lubricants, Schlumberger Oil Mud Lubricants)

-

Halliburton Company – (Baroid Bore-Hole Stabilizers, Dril-N Lubricant)

-

Baker Hughes Company – (Baker Hughes Drilling Fluid Lubricants, Drilling Lubes by Baker Hughes)

-

Dow Inc. – (DOWSIL Drilling Additives, Dow Chemical Polyethylene Glycols)

-

BASF SE – (BASF Lubricant Additives, BASF High-Performance Fluid)

-

Croda International Plc – (Croda Lubricant Esters, Croda Drilling Fluid Additives)

-

Lubrizol Corporation – (Lubrizol Performance Fluids, Lubrizol Additive Technology)

-

Newpark Resources Inc. – (Newpark TerraMax, Newpark Evolution Fluid Systems)

-

Petrobras – (Petrobras HDB Fluid, Petrobras Drill Lubes)

-

Clariant AG – (Clariant Lube Additives, Clariant Drilling Additives)

-

Afton Chemical Corporation – (HiTEC Drilling Lubricants, Afton Drilling Fluid Additives)

-

Idemitsu Kosan Co., Ltd. – (Idemitsu Drill Oils, Idemitsu Lubricant Products)

-

Sinopec Limited – (Sinopec Drill Lube, Sinopec Gear Oil)

-

Ashland Global Holdings Inc. – (Aquathol Drilling Fluid Additives, Ashland Lubricant Technology)

-

Calumet Specialty Products Partners, L.P. – (Calumet Versagel, Calumet Royal Drilling Lubricants)

Recent Development:

-

In 2023, ExxonMobil Corporation Introduced Mobil SHC 600 Series, an advanced line of synthetic drilling lubricants designed for high-temperature applications, offering superior wear protection and thermal stability.

-

In 2023 Chevron Corporation Launched Chevron Drill Oil with enhanced biodegradability, aimed at reducing environmental impact while maintaining performance in drilling operations.

-

In 2022 Royal Dutch Shell plc released shell drilling solutions, a new range of high-performance drilling fluids and lubricants designed to improve efficiency and reduce downtime.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.5 billion |

| Market Size by 2032 | US$ 3.7 Billion |

| CAGR | CAGR of4.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technique (Down The Hole Drills (DTH)/Rotary Air Blast Drilling (RAB), Diamond Drilling, Top Hammer Drilling, Reverse Circulation Drilling, Others) •By End-Use (Mining, Oil & Gas, Construction, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ExxonMobil Corporation, Chevron Corporation, Royal Dutch Shell plc, BP plc, TotalEnergies SE, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Dow Inc., BASF SE, Croda International Plc, Lubrizol Corporation, Newpark Resources Inc., Petrobras, Clariant AG, Afton Chemical Corporation, Idemitsu Kosan Co., Ltd., Sinopec Limited, Ashland Global Holdings Inc., Calumet Specialty Products Partners, L.P. and others. |

| Key Drivers | • Increasing oil and gas exploration activities drives the market growth. |

| RESTRAINTS | • Competition from alternative solutions may hamper the market growth. |