Get more information on DRAM Module and Component Market - Request Sample Report

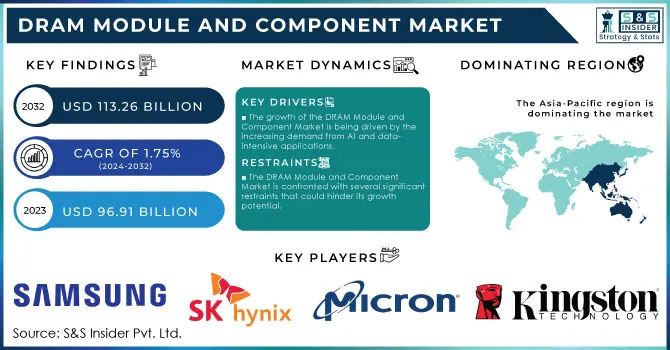

The DRAM Module and Component Market Size was valued at USD 96.91 Billion in 2023 and is expected to reach USD 113.26 Billion by 2032, and grow at a CAGR of 1.75% over the forecast period 2024-2032.

The DRAM Module and Component Market is positioned for robust growth, propelled by surging demands from sectors like big data, artificial intelligence (AI), and machine learning. As organizations increasingly depend on high-performance computing to manage extensive datasets, the need for advanced memory solutions is becoming critical. This growth trajectory underscores the essential role of DRAM in supporting data-intensive applications, particularly within AI and cloud computing environments. Major players are responding to this escalating demand by innovating their product offerings; for instance, Innodisk recently launched a DDR5 6400 64GB DRAM series tailored for edge AI and generative AI applications, exemplifying the industry's pivot towards memory solutions that meet sophisticated computational needs. Data center operators are intensifying investments to expand their facilities in response to increased workloads, highlighted by Microsoft's significant financial commitment to its data centers in Ohio to address rising power demands. In a landscape where performance and efficiency are vital, DRAM manufacturers are poised to leverage these trends, solidifying their position within the technology supply chain. As concerns around data privacy and ethical considerations gain traction, the memory market must navigate these challenges while delivering high-performance solutions. Compounding these dynamics, prices for DRAM and NAND flash are on the rise, with projections indicating a continuous upward trend throughout 2024. After a period of price declines, contract prices for DRAM are expected to climb by 13% to 18% in the first quarter, while NAND flash prices may increase by 18% to 23%. This suggests that buyers are locking in higher prices as demand escalates. As NAND flash buyers complete their inventory restocking, more modest price hikes of 3% to 8% are anticipated for the second quarter. Meanwhile, steady gains in DRAM prices are expected throughout the year, driven by the increasing adoption of DDR5 memory, further enhancing the market’s growth potential in a data-driven economy.

Drivers

The growth of the DRAM Module and Component Market is being driven by the increasing demand from AI and data-intensive applications.

The DRAM Module and Component Market is experiencing robust growth driven by the escalating demand for data-intensive applications, particularly fueled by the rise of big data, artificial intelligence (AI), and machine learning. As organizations increasingly rely on high-performance computing to process and analyze vast amounts of data, advanced memory solutions have become essential. Reports indicate that the AI sector is rapidly expanding, with significant investments in data centers to accommodate rising workloads, as seen with DigitalBridge's acquisition of Yondr to enhance data center capacity amid growing AI demands. Furthermore, Innodisk's recent launch of a high-capacity DDR5 6400 DRAM series exemplifies the industry's shift towards providing specialized memory solutions for edge AI and other computationally intensive applications. The need for enhanced data processing capabilities aligns with the global transition towards cloud computing and the Internet of Things (IoT). The increasing reliance on real-time data analytics necessitates higher memory capacities, further driving demand for DRAM. Notably, rising electricity costs and concerns about sustainability are prompting data center operators to seek more efficient computing solutions, reinforcing the critical role of DRAM and module components in powering these technologies. With such trends indicating a sustained demand surge, the DRAM Module and Component Market is poised for significant growth, offering manufacturers opportunities to innovate and meet the evolving needs of a data-driven economy.

Restraints

The DRAM Module and Component Market is confronted with several significant restraints that could hinder its growth potential.

High production costs are a primary concern, stemming from the capital-intensive nature of DRAM manufacturing. Companies like Kioxia are innovating with advanced NAND technologies but face rising expenses for equipment and materials, particularly silicon, which have tightened profit margins. Additionally, supply chain disruptions continue to create obstacles, as seen in the financial struggles of firms like CommScope, which find it challenging to manage costs and inventory amid global uncertainties. These disruptions can lead to fluctuations in component availability, affecting production schedules and driving up prices for products. Rapid technological advancements further contribute to market volatility, resulting in shorter product life cycles, compelling companies to invest heavily in research and development to keep pace with innovations, especially in AI and machine learning. The rise of alternative memory technologies, such as NVMe and storage-class memory, also poses a threat to the traditional DRAM landscape. Lastly, the evolving regulatory framework focused on environmental sustainability adds compliance costs, complicating operational strategies. To navigate these challenges, stakeholders must adapt and devise strategies that respond to technological progress and regulatory demands.

by Memory

The DRAM module and component market analysis indicates that the 8GB memory module is the leading segment, capturing about 45% of market revenue in 2023. This dominance is driven by its ideal balance of performance and cost, making it a preferred choice for personal computers, laptops, and mobile devices. The 8GB module meets the demands for multitasking and high-speed processing while keeping system costs manageable. Recent innovations by companies like Samsung and Micron have further bolstered this trend, with new 8GB DRAM modules optimized for gaming, AI, and enterprise applications. As data-intensive tasks such as gaming, video editing, and AI become more prevalent, the 8GB module is increasingly seen as the minimum requirement for smooth operation. Additionally, the rise of cloud computing and virtualization ads to the demand for these modules. Overall, the 8GB segment is poised to remain strong, supported by ongoing product advancements and sustained market demand.

by End-User Industry

The analysis of the DRAM module and component market indicates that the mobile device sector is the leading revenue contributor, capturing about 35% of the market share in 2023. This leadership is largely driven by the rising demand for smartphones and tablets, which require high-performance memory solutions to support sophisticated applications and enhanced user experiences. As mobile technology advances, manufacturers are incorporating features such as high-resolution displays, augmented reality (AR), and artificial intelligence (AI), all of which demand significant memory resources. Major players like Samsung and SK Hynix are focused on developing DRAM solutions specifically for mobile applications, improving performance while also optimizing power efficiency. For example, Samsung recently launched LPDDR5X memory chips aimed at meeting the needs of 5G smartphones and AI applications, while SK Hynix unveiled mobile DRAM products that offer enhanced bandwidth and reduced latency.

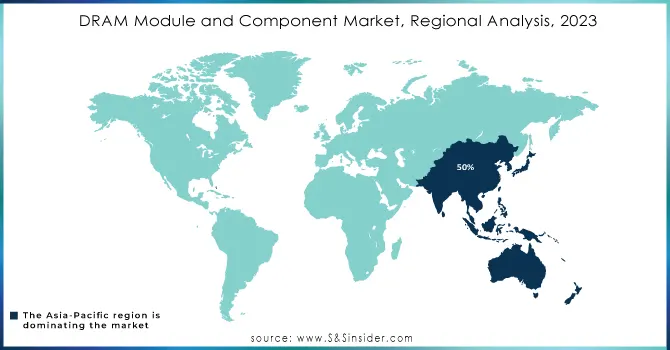

The Asia-Pacific region stands as the leader in the DRAM and module component market, capturing around 50% of the global market share in 2023. This commanding position is largely attributed to the concentration of major semiconductor manufacturers, cutting-edge production capabilities, and a rapidly expanding consumer electronics sector. Key countries such as South Korea, Japan, China, and Taiwan play crucial roles in this dynamic market, hosting industry giants like Samsung, SK Hynix, Micron Technology, and Nanya Technology.

South Korea continues to be a dominant force, with Samsung and SK Hynix at the forefront of DRAM production. Samsung recently unveiled advancements in its DDR5 DRAM technology designed to enhance performance for data centers and AI applications, while SK Hynix launched its next-generation LPDDR5X DRAM, optimized for high-performance mobile devices and gaming. In China, the semiconductor landscape is undergoing significant expansion, with companies like Yangtze Memory Technologies Co. (YMTC) heavily investing in DRAM production to lessen reliance on foreign suppliers. The Chinese government is also supporting initiatives aimed at strengthening domestic semiconductor manufacturing, which is expected to elevate the country’s standing in the global DRAM sector. Japan remains a hub of innovation, with firms such as Micron Technology introducing DRAM solutions that emphasize energy efficiency and processing speed across various applications, including automotive and enterprise sectors.

North America is the fastest-growing region in the DRAM Module and Component Market in 2023, largely due to technological advancements and rising demand across various sectors. The United States plays a crucial role, with industry leaders like Micron Technology, Intel, and AMD driving innovation in DRAM production. The increasing need for high-performance memory solutions in data centers, cloud computing, artificial intelligence (AI), and gaming fuels this growth. Micron, for instance, is enhancing its DRAM offerings to cater to the evolving requirements of AI applications and big data analytics. Additionally, the U.S. government is actively supporting semiconductor manufacturing through initiatives like the CHIPS for America Act, which aims to strengthen domestic supply chains and reduce dependence on foreign suppliers. This strategic focus on innovation and investment in memory technologies positions North America to maintain its momentum and further expand its presence in the global DRAM market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major key Players in DRAM Module and Component Market with product:

Samsung Electronics (DDR5 DRAM, LPDDR5, GDDR6)

SK Hynix (DDR4, LPDDR4X, HBM2E)

Micron Technology (DDR4, LPDDR5, 3D XPoint Memory)

Kingston Technology (ValueRAM, HyperX DDR4)

Nanya Technology Corporation (DDR3, DDR4 Modules)

Winbond Electronics (Low-Power DRAM, Mobile DRAM)

Powerchip Technology (DDR3, DDR4)

Intel Corporation (Optane Memory, Persistent Memory Modules)

ADATA Technology (XPG Gaming DRAM, Premier DDR4)

Crucial (Micron Brand) (Ballistix Gaming Memory, DDR5)

Transcend Information (JetRam, Industrial DRAM Modules)

Team Group (T-Force Gaming Memory, DDR4)

SMART Modular Technologies (DDR4, NVMe NVRAM)

Elpida Memory (Micron subsidiary) (Mobile DRAM, Embedded DRAM)

Toshiba Corporation (Flash Memory Modules, Embedded DRAM)

Apacer Technology (Industrial DRAM, Ruggedized Modules)

PNY Technologies (XLR8 Gaming DRAM, Performance DDR4)

Qimonda (now defunct, tech licensed) (GDDR3, Graphics DRAM)

Goldkey Technology (DDR3 Modules, DDR4 Modules)

Innodisk Corporation (Industrial DRAM, Wide-Temp DRAM Modules)

Some of the major suppliers providing key raw materials for DRAM and module components. These materials include silicon wafers, chemicals, photomasks, gases, and other semiconductor manufacturing essentials.

Shin-Etsu Chemical Co., Ltd.

SUMCO Corporation

Siltronic AG

Tokyo Ohka Kogyo Co., Ltd. (TOK)

JSR Corporation

Merck Group (EMD Electronics in the U.S.)

Mitsui Chemicals

Linde PLC

Air Liquide

Dow Chemical Company

BASF SE

Entegris, Inc.

Momentive Performance Materials

Toppan Photomasks, Inc.

Photronics, Inc.

Honeywell International Inc.

Sumitomo Chemical Co., Ltd.

Cabot Microelectronics (CMC Materials)

Showa Denko K.K.

GlobalWafers Co., Ltd.

Recent Development

August 6, 2024 Samsung has started mass production of the world's thinnest LPDDR5X DRAM packages, featuring 12 GB and 16 GB capacities, with a thickness of around 0.65 mm, which is 0.06 mm thinner than typical LPDDR5X packages. This new design improves airflow and thermal management in smartphones, crucial for high-performance application processors, including those with sophisticated on-device AI capabilities.

July 30, 2024 South Korean mobile phone module manufacturer Dreamtech Co. is expanding its operations in India by entering the memory semiconductor market in collaboration with Samsung Electronics. Starting in the fourth quarter of 2024, the company plans to produce new memory semiconductor modules at its newly opened factory in Greater Noida, which has been operational since June 2024.

January 23, 2024 A TrendForce report reveals that DRAM and NAND flash prices are sharply increasing, with predictions of further hikes throughout 2024. Following two years of declining prices, the analysis indicates that contract prices for DRAM could rise by 13 to 18 percent in the first quarter, while NAND flash prices may increase by 18 to 23 percent.

June 17, 2024 Samsung has introduced the Multi-Ranked Buffered Dual In-Line Memory Module (MCRDIMM), designed to enhance memory capacity and bandwidth without increasing server board slots. by combining two DDR5 components, MCRDIMM achieves data transmission speeds of up to 8.8 Gb/s, effectively doubling existing bandwidth.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 96.91 Billion |

| Market Size by 2032 | USD 113.26 Billion |

| CAGR | CAGR of 1.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by type (DDR2, DRAM, DDR3 DRAM, DDR4 DRAM, DDR5 DRAM, LPDRAM, GDDR, HBM, Others) • by memory (Up to 1GB, 2GB, 3-4GB, 6-8GB, >8GB) • by End-User Industry (Consumer Electronics, Mobile Devices, Servers, Computers, Automobiles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, SK Hynix, Micron Technology, Kingston Technology, Nanya Technology Corporation, Winbond Electronics, Powerchip Technology, Intel Corporation, ADATA Technology, Crucial, Transcend Information, Team Group, SMART Modular Technologies, Elpida Memory, Toshiba Corporation, Apacer Technology, PNY Technologies, and Innodisk Corporation. |

| Key Drivers | • The growth of the DRAM and module component market is being driven by the increasing demand from AI and data-intensive applications. |

| RESTRAINTS | • The DRAM and module component market is confronted with several significant restraints that could hinder its growth potential. |

Ans: The DRAM Module and Component Market Size was valued at USD 96.91 billion in 2023 and is expected to reach USD 113.26 billion by 2032.

Ans: Asia-Pacific is dominating in in DRAM Module and Component market in 2023.

Ans: Samsung Electronics, SK Hynix, Micron Technology, Kingston Technology, Nanya Technology Corporation, Winbond Electronics, Powerchip Technology, Intel Corporation, ADATA Technology, Crucial, Transcend Information, Team Group, SMART Modular Technologies, Elpida Memory, Toshiba Corporation, Apacer Technology, PNY Technologies, and Innodisk Corporation.

Ans: The increasing demand for high-performance memory solutions in data centers and cloud computing applications is a key driver for the DRAM module and component market.

Ans: 8GB segment is dominating in DRAM Module and Component in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. DRAM Module and Component Market Segmentation, by Type

7.1 Chapter Overview

7.2 DDR2 DRAM

7.2.1 DDR2 DRAM Market Trends Analysis (2020-2032)

7.2.2 DDR2 DRAM Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 DDR3 DRAM

7.3.1 DDR3 DRAM Market Trends Analysis (2020-2032)

7.3.2 DDR3 DRAM Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 DDR4 DRAM

7.4.1 DDR4 DRAM Market Trends Analysis (2020-2032)

7.4.2 DDR4 DRAM Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 DDR5 DRAM

7.5.1 DDR5 DRAM Market Trends Analysis (2020-2032)

7.5.2 DDR5 DRAM Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 LPDRAM

7.5.1 LPDRAM Market Trends Analysis (2020-2032)

7.5.2 LPDRAM Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 GDDR

7.7.1 GDDR Market Trends Analysis (2020-2032)

7.7.2 GDDR Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 HBM

7.8.1HBM Market Trends Analysis (2020-2032)

7.8.2 HBM Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Others

7.9.1Others Market Trends Analysis (2020-2032)

7.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. DRAM Module and Component Market Segmentation, by Memory

8.1 Chapter Overview

8.2 Up to 1GB

8.2.1 Up to 1GB Market Trends Analysis (2020-2032)

8.2.2 Up to 1GB Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 2GB

8.3.1 2GB Market Trends Analysis (2020-2032)

8.3.2 2GB Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 3-4GB

8.4.1 3-4GB Market Trends Analysis (2020-2032)

8.4.2 3-4GB Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 6-8GB

8.5.1 6-8GB Market Trends Analysis (2020-2032)

8.5.2 6-8GB Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 8GB

8.6.1 8GB Market Trends Analysis (2020-2032)

8.6.2 8GB Market Size Estimates and Forecasts to 2032 (USD Billion)

9. DRAM Module and Component Market Segmentation, by End-User Industry

9.1 Chapter Overview

9.2 Consumer Electronics

9.2.1 Consumer Electronics Market Trends Analysis (2020-2032)

9.2.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Mobile Devices

9.3.1 Mobile Devices Market Trends Analysis (2020-2032)

9.3.2 Mobile Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Servers

9.4.1 Servers Market Trends Analysis (2020-2032)

9.4.2 Servers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Computers

9.5.1 Computers Market Trends Analysis (2020-2032)

9.5.2 Computers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Automobiles

9.6.1 Automobiles Market Trends Analysis (2020-2032)

9.6.2 Automobiles Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America DRAM Module and Component Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.2.5 North America DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.2.6.3 USA DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.2.7.3 Canada DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.2.8.3 Mexico DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe DRAM Module and Component Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.1.6.3 Poland DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.1.7.3 Romania DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.1.8.3 Hungary DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.1.9.3 Turkey DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe DRAM Module and Component Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.5 Western Europe DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.6.3 Germany DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.7.3 France DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.8.3 UK DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.9.3 Italy DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.10.3 Spain DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.13.3 Austria DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific DRAM Module and Component Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.5 Asia-Pacific DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.6.3 China DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.7.3 India DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.8.3 Japan DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.9.3 South Korea DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.10.3 Vietnam DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.11.3 Singapore DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.12.3 Australia DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East DRAM Module and Component Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.1.5 Middle East DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.1.6.3 UAE DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.1.7.3 Egypt DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.1.9.3 Qatar DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa DRAM Module and Component Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.2.5 Africa DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.2.6.3 South Africa DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America DRAM Module and Component Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.6.5 Latin America DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.6.6.3 Brazil DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.6.7.3 Argentina DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.6.8.3 Colombia DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America DRAM Module and Component Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America DRAM Module and Component Market Estimates and Forecasts, by Memory (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America DRAM Module and Component Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 Samsung Electronics

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 SK Hynix

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Micron Technology

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Kingston Technology

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Nanya Technology Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysi

11.6 Winbond Electronics

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Powerchip Technology

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Intel Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 ADATA Technology

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Crucial

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segment:

BY TYPE

DDR2 DRAM

DDR3 DRAM

DDR4 DRAM

DDR5 DRAM

LPDRAM

GDDR

HBM

Others

BY MEMORY

Up to 1GB

2GB

3-4GB

6-8GB

8GB

BY END-USER INDUSTRY

Consumer Electronics

Mobile Devices

Servers

Computers

Automobiles

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Metal-Air Battery Market was valued at USD 555.9 Million in 2023 and is projected to reach USD 1793.5 Million by 2032, growing at a CAGR of 13.90% from 2024 to 2032.

The Military Radar Market Size was valued at USD 15.25 Billion in 2023 and is expected to grow at a CAGR of 4.58% to reach USD 22.81 Billion by 2032.

Touch Sensor Market was valued at USD 6.3 Billion in 2023 and is expected to reach USD 17.5 Billion by 2032, growing at a CAGR of 12.07% from 2024-2032.

The Flat Panel Displays Market Size was valued at USD 151.4 Billion in 2023 and is expected to reach USD 233.90 Billion by 2032 and grow at a CAGR of 4.98% over the forecast period 2024-2032.

The Factory Automation Sensor Market Size was valued at USD 15.98 billion in 2023 and is expected to reach USD 26.26 billion by 2032 and grow at a CAGR of 5.68% by 2032.

The Laser Diode Market Size was valued at USD 6.59 billion in 2023 and is expected to grow at a CAGR of 13.42% to reach USD 20.41 billion by 2032.

Hi! Click one of our member below to chat on Phone