Get more information on Dolomite Market - Request Sample Report

The Dolomite Market Size was valued at USD 1.92 billion in 2023 and is expected to reach USD 3.42 billion by 2032 and grow at a CAGR of 7.61% over the forecast period 2024-2032.

The dolomites market is fast-growing, with a huge number of applications due to growing demands from the construction, agriculture, and steel industries. Dolomites, being one of the most important minerals, consist of calcium magnesium carbonate that has more than one application: dolomites are used as an aggregate in the construction sector, a soil conditioner in agriculture, and a flux in the steel-making process. The development of infrastructure in newly developing economies, primarily Asian-Pacific regions, is regularly upscaling the demand for dolomites. As an example, the improvement in India's infrastructure and housing facilities, proposed by the government, has elevated the direct consumption of dolomites in cement and concrete production. Such rising construction activities are a result of a huge market demand, which will persist strongly in the years to come.

Growth in the dolomites market follows construction as the second in demand with rising agricultural sector demand for quality fertilizers and soil enhancers. Product provides soil conditioning along with vital nutrients which in turn enrich the soil fertility; higher crop yields result due to this. Current events indicate the same direction, where companies such as Omya AG recently launched dolomite-based products for healthy soils and sustainable agriculture. These products are also manufactured to overcome the problems arising from soil degradation and depletion of nutrients, thereby fulfilling the growing global food requirements. Furthermore, the encouragement of organic farming is increasing the demand for dolomites among farmers who opt for environmentally friendly agricultural practices.

Dolomites are consumed in the steel industry, where they serve as a flux in the process of impurities extraction during steel production. It will be in proportion to the probable increase in demand within the global steel market, especially from countries like Southeast Asia. Consequently, dolomites will be added to the list of in-demand products. Companies like Minerals Technologies Inc. have been installing additional production facilities to meet this increasing demand. They have concentrated on the optimization of extraction and processing techniques to make the product as good as possible, thus maintaining a solid and constant supply to maintain their competitive position in the market. In addition, ongoing modernization processes in the steel industry and technological innovations support the demand for high-quality dolomites, further underlining their critical role in metal production.

Environmental regulations are also changing the landscape of the dolomite market. Many companies have shifted towards adopting new extractive techniques that minimize ecological impacts due to the increasingly critical pressure toward sustainable and environmentally friendly mining. One such company is Carmeuse Lime & Stone, which has already taken some steps forward in doing more for its sustainability efforts. Such businesses invest in carbon emission reduction through dolomite extraction as well as processing. Beyond compliance with environmental requirements, this commitment to sustainability responds to one of the emerging consumer preferences for eco-friendly products. The more the public is aware of green issues, the more demand for sustainably sourced dolomites is expected to be surging up in different applications.

Technological advancements in processing dolomites create opportunities for value addition in various sectors. New dolomite-based products, such as dolomitic lime and dolomite fertilizers, are already emerging as functions and applications are added to this mineral. For example, companies such as Graymont invested in research and development to produce high-purity dolomites for very specific industrial applications, which can also include the food-grade market and specialized industrial use. This product diversification and quality enhancement focus meets the changing needs of diverse industries further enhancing the competitive environment for dolomites. With such progressions in the market, it is obvious that the strategic relevance of dolomites would continue to gain momentum across diverse sectors and thus remain relevant in the global industrial framework.

Drivers:

Increased Demand for Construction Materials Boosting Dolomites Market Growth

The growth of the construction industry is one of the main impelling factors pushing the dolomites market. With a rapid urbanization process prevailing globally, especially in emerging economies, there has been an increased demand for quality building materials. Dolomites are mainly used primarily because of their unique properties across various construction applications, which are significant aggregates for concrete, for soil stabilization, and as constituents in cement production. Dolomites can be used to strengthen construction materials, hence their popularity with builders and contractors. For instance, in India and China, the governments' infrastructure development activity has spurtted massive consumption of dolomite in road and bridge building works. Dolomites also act as an effective substitute for other, more environmentally destructive materials. This trend towards environment-friendliness in the industry adds to the popularity of dolomites as the construction material of choice. This trend encourages dolomite sourcing by construction companies for both performance and regulatory requirements. Larger firms, such as Carmeuse and Lhoist Group, expand their dolomite production to cater to this increasing demand more conclusively enforcing the mineral's role in modern construction practice, thus securing its market growth.

Agricultural Applications Driving Increased Utilization of Dolomites

A growing application of dolomites in agricultural uses, especially as soil conditioners and fertilizers fuels the growth of the market. Farmers are slowly realizing that healthy soils are essential for yields of crops and how to farm sustainably. Some much-needed nutrient resources present in dolomites include calcium and magnesium. They neutralize acidic soils and, hence, improve availability of nutrients to the plant. There also seems to be an improvement in agricultural structures, and facultative microbial activity, and its contributions lead to healthier crops. Presently, dolomites are finding their way as a solution to various acidity problems of soil in parts of Southeast Asia and South America. For example, Omya AG produces specific specialized products of dolomite for agricultural purposes, showing the versatility of dolomites. The awareness of organic farming and sustainable agriculture is on the rise, and dolomites are increasingly being used as eco-friendly substitutes for chemical fertilizers. With growing food production requirements worldwide, usage of dolomites in agriculture will rise, thus becoming one of the primary driving forces in the overall dolomites market.

Restraint:

Price Volatility of Raw Materials Presents Challenges for Producers

Price volatility in raw materials is an important constraint within the dolomites market. That puts huge pressure on the low cost of producers and, of course, maintains profitability. Operations costs involved with dolomite extraction and processing are high: mining, transportation, and processing. Price fluctuations in such involuntary inputs as energy and labor impact the cost structure for dolomite producers. Higher such raw material prices will result in increased costs for the producers, making them increase their selling price, which in turn reduces competitiveness, particularly with applications in construction and agriculture. Moreover, volatile pricing would create uncertainty in demand as end-users may opt for alternative materials if the pricing of dolomite becomes excessively high. Companies in this market need to address these fluctuations through different hedging strategies: for example, spreading the supplier base, streamlining production processes to minimize possible volatility in input costs, or investing in technologies that minimize the usage of volatile inputs. Without sound risk management, raw material price volatility is always going to be an important challenge for the producers in the Dolomites market.

Opportunity:

Innovations in Dolomite-Based Products Offer New Market Opportunities

The ever-increasing innovations in dolomite-based products can be a significant opportunity for growth in the market for dolomites. Further, as specific industries search for specialized solutions for their applications, producers now primarily target the development of high-performance dolomite products that might meet their performance standards. Along with purification, particle size, or other surface modifications for reactivity, dolomites are now more used for their industrial applications. These are some of the examples where advances in processing technologies are being used to generate special dolomites for industries for glass and ceramics. These industries require very pure and consistent quality, and companies like Minerals Technologies Inc are investing in research and development with new products for the various dolomites that would fill a gap in the market according to the needs of specific applications. The trend toward sustainable and eco-friendly materials further accelerates innovation, for which manufacturers are looking to innovate in new applications, thus creating opportunities in dolomites for green building materials and agricultural solutions. Manufacturers will be able to capitalize on emerging opportunities and enhance their competitive positioning in the dolomites market by making product development consistent with market trends and sustainability initiatives.

Challenge:

Environmental Regulations Challenge Dolomites Production Practices

Growing environmental regulations that further limit the ecological footprint of mining activities are becoming significant pressures for the dolomites market. Increasing awareness of sustainable development throughout the world translates into more limiting regulatory policies. Companies in this market would be forced to devise practices that reduce their environmental footprint. Mining activities should conform to different environmental regulations, from the need to carry out an extensive environmental impact assessment to environmentally friendly extraction activities. These requirements may also imply a significant operational cost rise for dolomite producers since the investment will be in technology and procedures that prevent or minimize environmental destruction. The measures of compliance may seriously burden smaller operators and further freeze their chances of fair market competition. Failure to comply with the requirements would lead to severe penalties, legal battles, and reputational damage, giving further complexity to the operational landscape. Thus, companies of Dolomites will have to be proactive about adaptability in their practices and strategies that meet the principle of evolution in regulations while keeping mining sustainable and responsible. Environmentally responsible practices can also lead to opportunities for differentiation since companies position themselves ahead of environmentally conscious markets in the future.

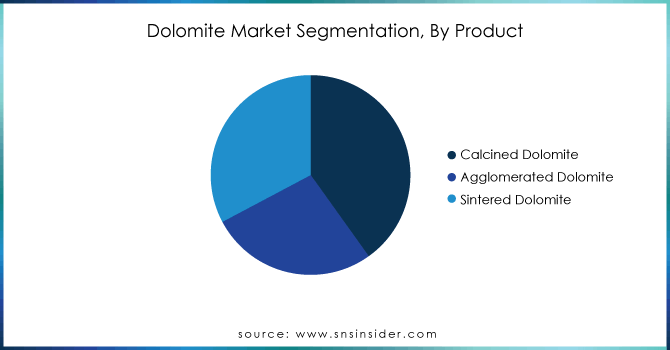

By Product

The calcined dolomites segment dominated the dolomites market and accounted for nearly 55% market share in 2023. Calcined dolomites are the outcome of heating raw dolomite to extremely high temperatures and are applied mainly to various applications, which include steel production, glass manufacturing, and refractory. Their high purity level and specific chemical properties make them applicable to varied industrial operations. For instance, the calcined dolomite in steel production serves as a flux that helps eliminate impurities and, hence, improves the quality of the final product. The demand for high-quality aggregates and binders from the construction industry also added a supporting force to the development of the calcined segment. Companies such as Carmeuse Lime & Stone have heavily invested in the production of calcined dolomites to cater to the huge requirements that have been witnessed across these sectors, forming the leading role in the dolomites market.

By End-use

In 2023, iron and steel dominated the dolomites market and accounted for an estimated market share of 40% in the dolomites market. This is because the dolomites play a crucial role in the steel-making process, which acts as a flux eliminating impurities from iron ore thereby further enhancing the quality of the produced product. Demand for Steel Related to Infrastructure Development and High-Speed Urbanization Thus, has been strong enough to underpin this segment. For instance, large steel manufacturers like Tata Steel and ArcelorMittal have scaled up their capacity and have instead centered their production on the dolomites to increase the value of their production operations. In addition, the growth in the automotive and building sectors currently is also an influence, which, in turn, fuels the high steel demand and fuels the market share of the iron and steel segment of the dolomites.

Get Customized Report as per your Business Requirement - Request For Customized Report

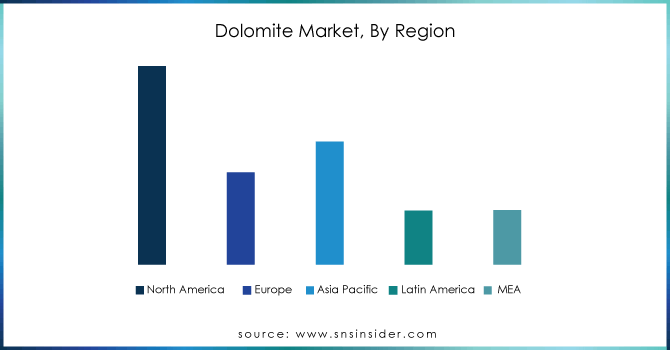

In 2023, the Asia-Pacific region dominated the dolomites market and accounted for a revenue share of about 40%. This is due to the strong construction and industrial sectors of the region, primarily China and India. China is one of the largest cement-producing regions and is also a significant player concerning construction activity, with tremendous demands for dolomites. Dolomites are important for cement production as well as other construction materials. More recently, dolomites have also been accepted in the agricultural field in India as a soil conditioner and fertilizer, thus contributing to this increasing demand for dolomites. Omya and Carmeuse have strengthened their presence in the region with greater production capacity to meet the said demand. Further, the government initiative towards infrastructure improvement and urbanization in developing economies would also continue to drive this consumption of dolomites in the Asia-Pacific region.

However, the North American region emerged as the fastest growing region in the dolomites market, with an estimated CAGR of about 6% in 2023. This is due to an increase in sustainable construction trends and the demand for high-quality building materials in the United States and Canada. This shift in construction material change in North America is gradually and increasingly focusing on green materials, and hence, dolomites are growing in their demand due to properties and minimizing environmental damage. Moreover, the region is vigorously pursuing infrastructure development projects that pertain primarily to renewable energy projects and smart cities, thereby high demand for dolomite in various applications such as construction on roads and water treatment applications. Key players in the region consisting of the U.S. Silica and Graymont, are investing in advanced dolomite production technologies. This is to cater to the growing demand of the market. With increased recognition of the benefits of dolomites, North America is expected to grow lucratively for the next few years.

Key Players

Calcinor (calcined dolomite, dolomitic lime)

CARMEUSE (calcined dolomite, dolomitic lime)

Essel Mining & Industries Limited (EMIL) (dolomite lumps, dolomite powder)

Imersys S.A. (natural dolomite, calcined dolomite)

JFE Mineral & Alloy Company, Ltd. (dolomite pellets, calcined dolomite)

Lhoist (lime, dolomitic limestone)

Omya AG (dolomite powder, calcined dolomite)

RHI Magnesita (magnesia-dolomite, dolomite refractory)

Sibelco (ground dolomite, crushed dolomite)

VARDAR DOLOMITE (industrial dolomite, agricultural dolomite)

ACG Materials (dolomitic limestone, ground dolomite)

Buehler (dolomite granules, calcined dolomite)

Graymont (quicklime, dolomitic lime)

Huber Engineered Materials (ground dolomite, calcined dolomite)

Martin Marietta (dolomitic limestone, crushed dolomite)

Minerals Technologies Inc. (precipitated dolomite, dolomite powder)

Nordic Mining (natural dolomite, calcined dolomite)

Schaefer Kalk (calcined dolomite, dolomitic lime)

U.S. Silica (dolomite sand, ground dolomite)

W. R. Grace & Co. (dolomitic hydrate, dolomite powder)

Calcinor - Company Financial Analysis

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 1.92 billion |

|

Market Size by 2032 |

US$ 3.42 Billion |

|

CAGR |

CAGR of 7.61 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Calcined Dolomite, Agglomerated Dolomite, and Sintered Dolomite) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Calcinor, Carmeuse, Essel Mining & Industries Limited (EMIL), Imersys S.A., JFE Mineral & Alloy Company, Ltd., Lhoist, Omya AG, RHI Magnesita, Sibelco, Vardar Dolomiteand other players |

|

Key Drivers |

•Increased Demand for Construction Materials Boosting Dolomites Market Growth |

|

RESTRAINTS |

•Price Volatility of Raw Materials Presents Challenges for Producers |

Ans: The Dolomite Market was valued at USD 1.92 billion in 2023.

Ans: The expected CAGR of the global Dolomite Market during the forecast period is 7.61%.

Ans: The calcined product type segment will grow rapidly in the Dolomite Market from 2024-2032.

Ans: Factors such as rising in the construction sector drives the growth of dolomite market

Ans: North America is expected to hold the largest market share in the global Dolomite Market during the forecast period.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Product, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Dolomite Market Segmentation, by Product

7.1 Chapter Overview

7.2 Calcined

7.2.1 Calcined Market Trends Analysis (2020-2032)

7.2.2 Calcined Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Agglomerated

7.3.1 Agglomerated Market Trends Analysis (2020-2032)

7.3.2 Agglomerated Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Sintered

7.4.1 Sintered Market Trends Analysis (2020-2032)

7.4.2 Sintered Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Dolomite Market Segmentation, by End-use

8.1 Chapter Overview

8.2 Iron & Steel

8.2.1 Iron & Steel Market Trends Analysis (2020-2032)

8.2.2 Iron & Steel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Construction

8.3.1 Construction Market Trends Analysis (2020-2032)

8.3.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Glass & Ceramics

8.4.1 Glass & Ceramics Market Trends Analysis (2020-2032)

8.4.2 Glass & Ceramics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Water Treatment

8.5.1 Water Treatment Market Trends Analysis (2020-2032)

8.5.2 Water Treatment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Agriculture

8.6.1 Agriculture Market Trends Analysis (2020-2032)

8.6.2 Agriculture Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Animal Feed

8.7.1 Animal Feed Market Trends Analysis (2020-2032)

8.7.2 Animal Feed Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Dolomite Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Dolomite Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Dolomite Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Dolomite Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Dolomite Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Dolomite Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Dolomite Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Dolomite Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Dolomite Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10. Company Profiles

10.1 Calcinor

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 CARMEUSE

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Essel Mining & Industries Limited (EMIL)

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Imersys S.A.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 JFE Mineral & Alloy Company, Ltd.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Lhoist

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Omya AG

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 RHI Magnesita

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Sibelco

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 VARDAR DOLOMITE

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusio

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Calcined

Agglomerated

Sintered

By End-use

Iron & Steel

Construction

Glass & Ceramics

Water Treatment

Agriculture

Animal Feed

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Composites Market Size was USD 104.6 Billion in 2023 and is expected to reach USD 231.2 Billion by 2032 and grow at a CAGR of 9.2% by 2024-2032.

The Sodium Nitrite Market size was USD 426.2 Million in 2023 and is expected to reach USD 621.8 Million by 2032, growing at a CAGR of 4.3% from 2024 to 2032.

The High-Performance Fibers Market Size was valued at USD 13.42 Billion in 2023 and is expected to reach USD 26.53 Billion by 2032 and grow at a CAGR of 7.90% over the forecast period 2024-2032.

Green Coatings Market was valued at USD 98.64 Billion in 2023 and is expected to reach USD 144.21 Billion by 2032, growing at a CAGR of 4.31% from 2024-2032.

The Extruders Market Size was valued at USD 10.0 billion in 2023 and is expected to reach USD 14.9 billion by 2032 and grow at a CAGR of 4.5% 2024-2032.

Fluorosurfactant Market was valued at USD 635.7 million in 2023 and is expected to reach USD 1117.3 million by 2032, at a CAGR of 6.5% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone