To Get More Information on DNA Synthesizer Market - Request Sample Report

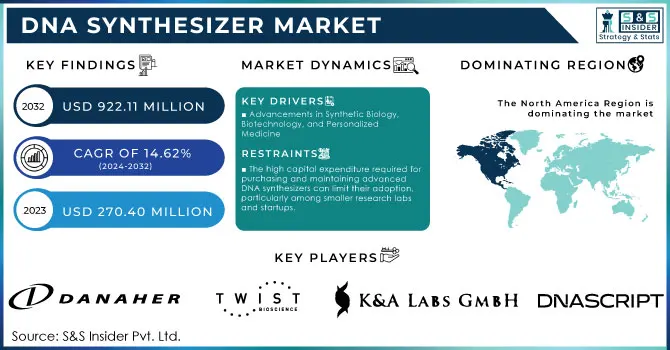

The DNA Synthesizer Market size valued at USD 270.40 million in 2023 and is expected to reach USD 922.11 million by 2032 with a CAGR of 14.62% during the forecast period of 2024-2032.

Recent advancements in DNA synthesizer technology are driving a transformative shift in genomic research, biotechnology, and drug development. Key factors propelling this evolution include technological breakthroughs in DNA synthesis cost reduction, increased speed, and the growing importance of synthetic biology, gene therapies, and personalized medicine. These developments are making DNA synthesizers an essential tool across multiple sectors.

One of the most significant advancements in the DNA synthesizer market has been the substantial reduction in DNA synthesis costs. Over the past decade, the cost of synthesizing DNA has dropped by over 90%, primarily due to innovations in high-throughput DNA synthesizers and enzyme-based synthesis technologies. A study published in Nature Reviews Molecular Cell Biology in 2022 emphasized that DNA synthesis costs are now at a point where it is possible to produce entire genomes in a relatively short time frame, thanks to improvements in the speed and accuracy of DNA synthesizers. This cost reduction has dramatically improved the scalability and precision of DNA production, enabling the efficient creation of longer and more complex genetic sequences. As a result, the demand for DNA synthesizers is surging in the fields of gene therapy and biopharmaceutical development, where researchers rely on precise DNA synthesis to develop therapeutic proteins and monoclonal antibodies.

In particular, synthetic biology has driven a surge in the adoption of DNA synthesizers. According to a 2023 study published in Heliyon, synthetic biology is facilitating breakthroughs in the development of biofuels, new drugs, and environmentally sustainable solutions. The ability to design and synthesize custom DNA sequences quickly is making these advancements possible. DNA synthesizers play a critical role in enabling the engineering of microorganisms for producing valuable compounds, such as biofuels and pharmaceuticals. Recent research has shown that DNA synthesis is essential for speeding up drug discovery, with some estimates suggesting that DNA synthesizers could shorten development timelines by as much as 50%, according to a study published by the Journal of Industrial Microbiology and Biotechnology in 2023.

The growing demand for personalized medicine is another key factor boosting the DNA synthesizer market. The integration of synthetic DNA into gene-editing technologies like CRISPR is making it possible to develop highly targeted therapies for genetic disorders, including sickle cell anemia and Duchenne muscular dystrophy. A recent report in Heliyon 2024 highlighted that CRISPR-based therapies are now entering clinical trials for these genetic diseases, marking a major milestone in gene therapy. Additionally, gene-based diagnostics are benefiting from advancements in DNA synthesis, with custom-designed sequences helping to detect pathogens and predict disease risk more accurately. As more personalized treatments emerge, the need for precise and cost-effective DNA synthesizers is expected to increase significantly.

The impact of synthetic DNA is further amplified by research funding and technological innovations. For example, initiatives like the NIH’s genome completeness projects in 2023 and the UKRI’s synthetic biology investments in 2024 are accelerating the development of DNA synthesizer technology. These initiatives support the growing demand for DNA synthesis tools that can enable advancements in biotechnology, molecular diagnostics, and therapeutic development.

Overall, the DNA synthesizer market is undergoing rapid growth due to technological advancements that are reducing costs, improving efficiency, and expanding the range of applications for synthetic DNA. As synthetic biology, gene therapies, and personalized medicine continue to advance, the demand for high-performance DNA synthesizers will continue to rise. With ongoing investments and innovations, the DNA synthesizer market is poised to play a pivotal role in shaping the future of biotechnology, genomic research, and healthcare.

Drivers

Advancements in Synthetic Biology, Biotechnology, and Personalized Medicine

The DNA synthesizer market is primarily driven by several key factors, including advancements in synthetic biology, biotechnology, and the growing demand for personalized medicine. One of the most significant drivers is the rapid reduction in the cost of DNA synthesis, which has fallen by over 90% in the past decade. This decrease in cost has been driven by technological innovations in high-throughput DNA synthesis and the use of enzymatic methods, making DNA production faster, cheaper, and more accurate. These advancements have opened the door for applications across various industries, including drug discovery, genetic engineering, and biopharmaceuticals.

Moreover, the rise of synthetic biology is a crucial factor propelling the market. The ability to design and create custom DNA sequences enables researchers to develop novel therapeutics, biofuels, and environmentally sustainable solutions. DNA synthesizers are at the heart of this innovation, helping to rapidly generate large-scale, complex genetic sequences for research and commercial applications.

Another significant driver is the increasing demand for personalized medicine. As genetic therapies and gene-editing technologies, like CRISPR, evolve, there is a growing need for precise, tailored DNA synthesis for gene therapies, genetic testing, and diagnostic applications. The continuous development of CRISPR-based technologies and genomic editing tools is fueling the demand for high-quality, customizable DNA sequences, further accelerating growth in the DNA synthesizer market. These drivers are contributing to an expanding range of applications, positioning the market for substantial growth in the coming years.

Restraints

The high capital expenditure required for purchasing and maintaining advanced DNA synthesizers can limit their adoption, particularly among smaller research labs and startups.

The sophisticated technology and expertise required to operate and maintain DNA synthesizers can pose challenges, potentially hindering market growth and accessibility for less experienced users.

By Application

In 2023, Drug Discovery & Development held the largest share of the DNA synthesizer market, driven by the increasing demand for precision therapies and gene editing technologies. This segment accounted for approximately 40.0% of the total market share. DNA synthesizers are crucial in designing and synthesizing custom DNA sequences for drug development, particularly in areas like gene therapy, cancer treatment, and rare diseases. With the rising prevalence of chronic diseases and advancements in genomics, the need for DNA synthesis in drug discovery remains robust.

The Genetic Engineering segment is the fastest-growing application, expected to expand at a compound annual growth rate (CAGR) of 18% over the next few years. This growth is attributed to the rapid advancements in synthetic biology and the increasing use of CRISPR and other gene-editing technologies. Genetic engineering is integral to the development of novel bioproducts, biofuels, and therapeutics, creating significant demand for DNA synthesis tools capable of supporting complex genetic modifications and large-scale production.

By Type

Benchtop DNA Synthesizers dominated the market in 2023, holding around 55.0% of the market share. These compact and affordable devices are widely used by research labs, academic institutions, and small-scale biotech companies for their convenience and cost-effectiveness in synthesizing shorter DNA sequences. The increasing demand for DNA synthesis in genetic research and personalized medicine continues to drive the widespread use of benchtop synthesizers, especially in academic and research settings.

Large-scale DNA Synthesizers are the fastest-growing segment, projected to grow at a CAGR of 15%. The increasing demand for high-throughput DNA synthesis in commercial applications, including biopharmaceuticals, genetic engineering, and synthetic biology, is driving this growth. These systems are capable of synthesizing larger and more complex DNA sequences, making them essential for industries engaged in large-scale gene synthesis and drug development.

The DNA synthesizer market is experiencing varied growth across regions, with North America dominant in 2023, holding the largest market share. This dominance is driven by the region’s strong biotechnology and pharmaceutical sectors, advanced research institutions, and high investments in genetic research, personalized medicine, and drug discovery. The U.S., in particular, benefits from a well-established ecosystem for biopharmaceutical innovation and regulatory support for genomic research. The increasing adoption of CRISPR and other gene-editing technologies has further propelled the demand for DNA synthesizers in North America. The region’s market is expected to continue growing steadily due to ongoing investments in R&D and healthcare advancements.

Europe held a significant share of the market as well, driven by the thriving pharmaceutical and biotech industries in countries like Germany, the U.K., and Switzerland. The region benefits from strong academic research initiatives and regulatory frameworks that support genetic engineering and gene therapies. Europe’s steady growth is also aided by a well-established healthcare infrastructure and a rising demand for personalized medicine, making it a key player in the DNA synthesizer market.

The Asia-Pacific region is the fastest-growing market, projected to expand at a CAGR of over 15%. This growth is attributed to the rapid development of biotech industries, increasing healthcare investments, and expanding genetic research in countries like China, India, and Japan. The rising demand for personalized medicine, genetic testing, and affordable DNA synthesis technologies is a key driver in the region's market growth.

Do You Need any Customization Research on DNA Synthesizer Market - Enquire Now

Danaher - Applied Biosystems DNA Synthesizers

Twist Bioscience - Twist Bioscience DNA Synthesis Platform

Kilobase - Kilobase DNA Synthesizer

LGC Limited - LGC Biosearch Technologies Custom DNA Synthesis

CSBio - CSBio DNA Synthesizers

K&A Labs GmbH - K&A DNA Synthesizers

DNA Script - DNA Script Synteza

OligoMaker ApS - OligoMaker DNA Synthesizers

PolyGen GmbH - PolyGen DNA Synthesizers

Biolytic Lab Performance Inc. - Biolytic DNA Synthesizers

In November 2024, Twist Bioscience, a leading DNA synthesis platform developer, partnered with Absci, a de novo designer, in a new collaboration focused on AI-driven antibody development. This marks the latest of three recent partnerships that Twist has launched or advanced, aiming to enhance innovation in the biotechnology sector.

In November 2024, DNA Script appointed Marc Montserrat as CEO to spearhead long-term commercial growth for its pioneering enzymatic DNA synthesis platform. Founder Thomas Ybert transitions to the role of Chief Scientific Officer, reinforcing the company’s dedication to advancing scientific discovery and innovation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 270.40 million |

| Market Size by 2032 | US$ 922.11 million |

| CAGR | CAGR of 14.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Drug Discovery & Development, Genetic Engineering, Clinical Diagnostics) • By Type (Benchtop DNA Synthesizers, Large-scale DNA Synthesizers) • By End-use (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Clinical Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Danaher, Twist Bioscience, Kilobase, LGC Limited, CSBio, K&A Labs GmbH, DNA Script, OligoMaker ApS, PolyGen GmbH, Biolytic Lab Performance Inc. |

| Key Drivers | • Advancements in Synthetic Biology, Biotechnology, and Personalized Medicine |

| Restraints | • The high capital expenditure required for purchasing and maintaining advanced DNA synthesizers can limit their adoption, particularly among smaller research labs and startups. • The sophisticated technology and expertise required to operate and maintain DNA synthesizers can pose challenges, potentially hindering market growth and accessibility for less experienced users. |

Ans: benchtop DNA synthesizers segment is expected to held the highest market share of 55% in 2023.

Ans: DNA synthesizer Market is anticipated to expand by 14.62% from 2024 to 2032.

Ans: The DNA synthesizer Market is expected to grow to USD 922.11 million by 2032.

Ans: DNA synthesizer market size was valued at USD 270.40 million in 2023.

Ans: Technical Complexity and Expertise Requirements.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. DNA Synthesizer Market Segmentation, by Application

7.1 Chapter Overview

7.2 Drug Discovery & Development

7.2.1 Drug Discovery & Development Market Trends Analysis (2020-2032)

7.2.2 Drug Discovery & Development Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Genetic Engineering

7.3.1 Genetic Engineering Market Trends Analysis (2020-2032)

7.3.2 Genetic Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Clinical Diagnostics

7.4.1 Clinical Diagnostics Market Trends Analysis (2020-2032)

7.4.2 Clinical Diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

8. DNA Synthesizer Market Segmentation, by Type

8.1 Chapter Overview

8.2 Benchtop DNA Synthesizers

8.2.1 Benchtop DNA Synthesizers Market Trends Analysis (2020-2032)

8.2.2 Benchtop DNA Synthesizers Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Large-scale DNA Synthesizers

8.3.1 Large-scale DNA Synthesizers Market Trends Analysis (2020-2032)

8.3.2 Large-scale DNA Synthesizers Market Size Estimates and Forecasts to 2032 (USD Million)

9. DNA Synthesizer Market Segmentation, by End-use

9.1 Chapter Overview

9.2 Academic & Research Institutes

9.2.1 Academic & Research Institutes Market Trends Analysis (2020-2032)

9.2.2 Academic & Research Institutes Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Pharmaceutical & Biotechnology Companies

9.3.1 Pharmaceutical & Biotechnology Companies Market Trends Analysis (2020-2032)

9.3.2 Pharmaceutical & Biotechnology Companies Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Clinical Laboratories

9.4.1 Clinical Laboratories Market Trends Analysis (2020-2032)

9.4.2 Clinical Laboratories Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America DNA Synthesizer Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.4 North America DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.5 North America DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.2 USA DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.3 USA DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.2 Canada DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.3 Canada DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.2 Mexico DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.3 Mexico DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe DNA Synthesizer Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.4 Eastern Europe DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.2 Poland DNA Synthesizer Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.6.3 Poland DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.2 Romania DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.3 Romania DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.2 Hungary DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.9 turkey

10.3.1.9.1 Turkey DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.2 Turkey DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe DNA Synthesizer Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.4 Western Europe DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.5 Western Europe DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.2 Germany DNA Synthesizer Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.6.3 Germany DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.2 France DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.3 France DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.2 UK DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.3 UK DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.2 Italy DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.3 Italy DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.2 Spain DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.3 Spain DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.2 Netherlands DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.2 Switzerland DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.2 Austria DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.3 Austria DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific DNA Synthesizer Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.4 Asia Pacific DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.5 Asia Pacific DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.2 China DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.3 China DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.2 India DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.3 India DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.2 Japan DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.3 Japan DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.2 South Korea DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.3 South Korea DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.2 Vietnam DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.3 Vietnam DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.2 Singapore DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.3 Singapore DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.2 Australia DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.3 Australia DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East DNA Synthesizer Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.4 Middle East DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.5 Middle East DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.2 UAE DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.3 UAE DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.2 Egypt DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.2 Qatar DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa DNA Synthesizer Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.4 Africa DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.5 Africa DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.2 South Africa DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.2 Nigeria DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America DNA Synthesizer Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.4 Latin America DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.5 Latin America DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.2 Brazil DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.3 Brazil DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.2 Argentina DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.3 Argentina DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.2 Colombia DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.3 Colombia DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America DNA Synthesizer Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America DNA Synthesizer Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America DNA Synthesizer Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11. Company Profiles

11.1 Danaher

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Twist Bioscience

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Kilobase

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 LGC Limited

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 K&A Labs GmbH

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 DNA Script

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 OligoMaker ApS

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 PolyGen GmbH

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 CSBio

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Biolytic Lab Performance Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusio

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Application

Drug Discovery & Development

Genetic Engineering

Clinical Diagnostics

By Type

Benchtop DNA Synthesizers

Large-scale DNA Synthesizers

By End-use

Academic & Research Institutes

Pharmaceutical & Biotechnology Companies

Clinical Laboratories

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Medical Image Analysis Software Market Size was valued at USD 3.34 billion in 2023 and is expected to reach USD 6.44 billion by 2032, growing at a CAGR of 7.58% over the forecast period 2024-2032.

The Portable Medical Devices Market Size was USD 63.56 Billion in 2023 and will reach USD 158.22 Billion by 2032 and grow at a CAGR of 10.70% by 2024-2032.

The Flow Cytometry Market was valued at USD 5.34 billion in 2023 and is expected to reach USD 11.41 billion by 2032, growing at a CAGR of 8.82%.

The Medical Equipment Financing market size was USD 157.09 billion in 2023 and is expected to reach USD 305.98 billion by 2032 and grow at a CAGR of 7.69% over the forecast period of 2024-2032.

Hydrotherapy Equipment Market size was valued at USD 61 Billion in 2023, expected to reach USD 89.2 billion by 2032, growing at a CAGR of 4.3% from 2024-2032.

Sepsis Diagnostics Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.5 billion by 2032, growing at a CAGR of 8.6% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone