Distributed Fiber Optic Sensor Market Size

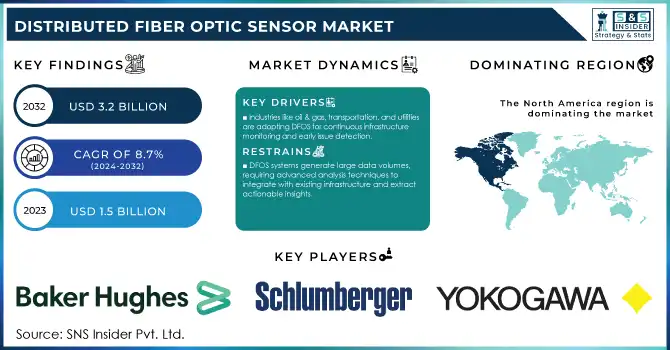

The Distributed Fiber Optic Sensor Market Size was valued at USD 1.5 Billion in 2023 and is expected to reach USD 3.2 Billion by 2032, growing at a CAGR of 8.7% over the forecast period 2024-2032.

To get more Distributed Fiber Optic Sensor Market - Request Free Sample Report

The growth of the Distributed Fiber Optic Sensor market is attributed to various factors, including technological advancements, growing demand for monitoring solutions, & government initiatives to encourage the use of advanced sensor technologies. Rapid industrialization has led to real-time monitoring of the telecommunications and oil & gas industries, which continues to be the key market driver. Fiber optic sensors are becoming increasingly popular for monitoring infrastructure in essential sectors like oil, gas, and utilities, as they can deliver real-time and precise data, states the U.S. Department of Energy. In addition, funding has recently been approved by the U.S. Federal Communications Commission (FCC) to aid infrastructure development with fiber optics to expand into rural areas, further increasing the market opportunity.

Apart from the telecommunications industry, DFOS technology is being adopted for smart grid infrastructure and disaster management applications in many regions led by government agencies. On the other hand, there are several initiatives launched in Europe such as the Horizon 2020 program sponsored by the European Union, to encourage the innovative development of fiber optic technologies (mainly in the context of smart cities), including DFOS. Driven by increasing demand for real-time environmental monitoring and asset management, DFOS is also being used in fields such as transportation, security, and manufacturing. The growing technological advancements in infrastructure and utility monitoring coupled with governments foraying in this direction as well is expected to continuously boost demand for distributed fiber optic sensors, fuelling the long-term growth trend of the market.

Distributed Fiber Optic Sensor Market Dynamics

Drivers

-

Industries such as oil & gas, transportation, and utilities are increasingly adopting DFOS for continuous monitoring of critical infrastructure, ensuring early detection of potential issues.

-

Ongoing innovations in fiber optic technology have enhanced the sensitivity, accuracy, and range of DFOS, making them more suitable for various applications like structural health monitoring and environmental sensing.

The rise in demand for real-time monitoring from various industries including oil & gas, transportation, and utilities is one of the major factors contributing toward the growth of the market. These industries rely heavily on continuous monitoring of critical infrastructure to ensure operational efficiency, reduce maintenance costs, and prevent accidents. DFOS technologies use the special features of optical fibers jointly with materials to sense various changes like the change of temperature, pressure, strain, and vibrations, which help businesses collect real-time data from far-off inaccessible, or remote areas.

For instance, DFOS is widely used in pipeline monitoring, where the technology detects and locates potential leaks or structural failures early, allowing for proactive maintenance and minimizing environmental risks. DFOS is witnessing an increased demand for structural health monitoring (SHM) in civil engineering, especially in 2024 recent reports. DFOS can create a continuous stream of information from sensors placed all over bridges, tunnels, and various other structures to detect small changes in the infrastructure that can lead to big problems. In the oil and gas field, DFOS is also employed for real-time monitoring of wellbore integrity and seismic activities. With growing demand for operational safety, efficiency, and sustainability across industries, DFOS systems are vital as well. This allows for increased reliability and safety of infrastructure and reductions in long-term maintenance costs through improved real-time monitoring capability.

Restraints

-

The vast amount of data generated by DFOS systems can be difficult to integrate with existing infrastructure and systems, requiring advanced data analysis techniques to extract actionable insights.

-

There is a gap in knowledge and expertise regarding DFOS, especially in industries that have not yet adopted these technologies, hindering their widespread implementation

The complexity of integration and data analysis is one of the major restraints for the Distributed Fiber Optic Sensor market. Traditional monitoring systems struggle with the volume of data generated by DFOS systems. Existing infrastructure must be combined with appropriate software and human analysis of the results. For industries breaking ground on this tech, it can be a huge obstacle to adoption. Moreover, the need for specialized knowledge to implement and manage these systems limits their accessibility and scalability for some sectors.

Distributed Fiber Optic Sensor Market Segment Analysis

by Application

In 2023, the temperature sensing segment of the Distributed Fiber Optic Sensor market accounted for the largest share of 44.0% revenue share in the global market. Reasons behind this dominance include the increased demand for accurate temperature measurement in the oil & gas, telecommunications, and energy sectors, wherein even a slight fluctuation in temperature can directly affect the safety and efficiency of operations. According to recent statistics from the U.S. Department of Energy, temperature-related monitoring systems play a crucial role in preventing equipment failures, reducing maintenance costs, and improving overall system reliability. Due to this, companies have been adopting distributed fiber optic sensors as a very reliable approach for long-distance and real-time data acquisition of temperatures.

DFOS are also well-established for continuous, long-range temperature monitoring without physical contact. In industries such as oil and gas, where assets are located far from the city and extreme environmental conditions exist, traditional temperature sensors are often inefficient and unreliable. DFOS technology addresses the above challenges by furnishing high-resolution and real-time measurements over the entire length of the fiber optic cable, enabling a complete representation of the spatial temperature variations in the environmental system under observation. As a result, temperature-sensing DFOS solutions are increasingly relied upon in industrial applications due to their outstanding reliability, flexibility, and cost-effectiveness, and their increasing penetration has further strengthened their market leadership.

by Technology

The Raman Effect technology segment of the Distributed Fiber Optic Sensor market led the industry in 2023 with a notable revenue share of 34%. Based on its merits of unique capabilities of high sensitivity and accuracy distributed sensing, this technology is considerably increasing in popularity. Raman Effect-based sensors are particularly effective at long-range large-scale (km-scale) structural health monitoring applications since they detect changes in temperature, strain, and other environmental factors using light scattering along the length of the optical fiber. The strengths of this technology for applications like pipeline monitoring, structural health monitoring, and environmental monitoring have been identified as parts of government-funded research programs through organizations such as the United States and Japan.

High spatial resolution and accuracy is one of the major factors for the dominance of the Raman Effect technology in the DFOS market. Raman-based sensors can detect even the smallest variations in temperature or strain, making them ideal for monitoring sensitive environments like oil pipelines, energy grids, and aerospace applications. For example, The U.S. Department of Energy has advocated for the implementation of Raman-based fiber optic sensors in vital energy infrastructure, noting their high reliability and operability in extreme and remote settings.

by Vertical

Oil & Gas is the most prominent vertical for the Distributed Fiber Optic Sensor market, with the segment commanding a 35% share of the overall market in 2023. Industries such as oil and gas seek continuous monitoring of their infrastructure due to their harsh and remote environments, concerning rising levels of demand for DFOS in these areas. Considering that fiber optic sensors can inform about temperature, pressure, and strain over the entire length of a pipeline and production facilities, they provide important information that helps maintain the safety, integrity, and operational efficiency of such assets. Specifically, the U.S. Energy Information Administration (EIA) has stated that fiber optic sensors are among the things most used for leak detection, flow metering, and accident prevention of oil and gas pipelines.

The oil & gas industry's increasing focus on automation, predictive maintenance, and asset management has further accelerated the adoption of DFOS technology. Fiber optic sensors allow operators to remotely monitor pipes, wellheads, and offshore platforms, speeding up and increasing the accuracy of decision-making. In addition, the oil and gas sector uses advanced monitoring systems with the help of government regulations in countries such as the U.S. and Canada present in the market, to prevent the installation of environmental hazards and for operational safety. Firstly, The Bureau of Safety and Environmental Enforcement (BSEE) with a focus on significant incidents offers the novel use of distributed fiber optic sensors (DFOS) to monitor offshore wells to help meet safety requirements.

Distributed Fiber Optic Sensor Market Region Outlook

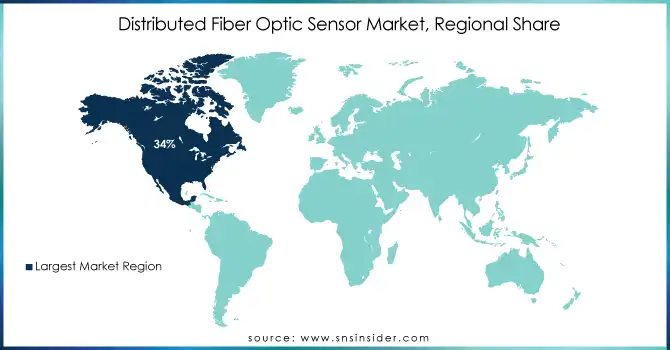

In 2023, North America continued to dominate the Distributed Fiber Optic Sensor market, contributing more than 34% of the global revenue share. This dominance can be attributed to several factors, including significant investments in critical sectors, advanced technological infrastructure in developed regions, and strong government support for innovation in monitoring and sensing technologies, which will continue to dominate the market. In particular, the USA has become one of the most important markets for flow sensors; many sectors like Oil & Gas, telecommunications, and energy are implementing fiber optic sensing technology for better monitoring and to improve operational efficiency. Governments in North America have taken the initiative to increase the adoption of DFOS technology. From its establishment of SCLDs to the first grants and appropriations through DOE and FCC to bolster fiber optic networks there have been cost incentives to upgrade the U.S. infrastructure and energy grid. For example, the U.S. DOE has been awarding grants to energy companies to mutate advanced monitoring systems such as fiber optic sensors to enhance grid reliability and failure avoidance.

The Asia-Pacific (APAC) region is witnessing the fastest-growing Compound Annual Growth Rate (CAGR) in the Distributed Fiber Optic Sensor market. The region held a substantial market share in 2023, and China, Japan, and India have been the major drivers of the growing market. The APAC region's adoption of DFOS technology can be attributed to several factors, including significant infrastructure development, the expansion of the telecommunications sector, and a growing focus on smart city initiatives. The regional demand for distributed fiber optic sensors is expected to increase owing to the government of India's promotion of fiber optic networks as a part of the Digital India initiative, according to the International Trade Administration (ITA).

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Service Providers / Manufacturers

-

Baker Hughes (Optical Fiber Sensing System, Reservoir Monitoring System)

-

Schlumberger (Fiber Optic Sensing Technology, Well Integrity Monitoring System)

-

OFS Fitel LLC (Fiber Optic Sensing System, Distributed Temperature Sensing System)

-

Yokogawa Electric Corporation (FOT-9300, DTSX Fiber Optic Sensing System)

-

OptaSense (DTS (Distributed Temperature Sensing), DAS (Distributed Acoustic Sensing))

-

Halliburton (FOS (Fiber Optic Sensing), Wellbore Monitoring System)

-

Siemens AG (SITRANS FS, Fiber Optic Sensors for Industrial Applications)

-

Luna Innovations (OptaSense Fiber Optic Sensing, Fiber Optic Strain Sensor)

-

Zebco Industries (Distributed Fiber Optic Sensing, Pipeline Monitoring System)

-

NeoPhotonics (Fiber Optic Sensing Solutions, Distributed Strain Sensor)

Users Products/Services

-

ExxonMobil

-

Royal Dutch Shell

-

TotalEnergies

-

Chevron

-

BP

-

ConocoPhillips

-

Enbridge

-

National Grid

-

Pacific Gas and Electric (PG&E)

-

Tesla

Recent News and Developments

-

In January 2024, the U.S. Department of Energy’s investment in fiber optic sensor technology to enhance monitoring capabilities in critical energy infrastructure. The initiative is aimed at improving system reliability and reducing downtime in energy distribution systems.

-

In February 2023, Luna Innovations declared that the Coastal Virginia Offshore Wind Project would use their EN. SURE, long-range power cable detection device. The device will be used to keep an eye on the wind farm's export cable system, which will carry the power to the ground.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.5 Billion |

| Market Size by 2032 | USD 3.2 Billion |

| CAGR | CAGR of 8.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Rayleigh Effect, Brillouin Scattering, Raman Effect, Interferometric, Bragg Grating) • By Application (Temperature Sensing, Acoustic/Vibration Sensing, Other) • By Vertical (Oil & Gas, Power and Utility, Safety & Security, Industrial, Civil Engineering) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Baker Hughes, Schlumberger, OFS Fitel LLC, Yokogawa Electric Corporation, OptaSense, Halliburton, Siemens AG, Luna Innovations, Zebco Industries, NeoPhotonics, Quamma. |

| Key Drivers | • Industries such as oil & gas, transportation, and utilities are increasingly adopting DFOS for continuous monitoring of critical infrastructure, ensuring early detection of potential issues. • Ongoing innovations in fiber optic technology have enhanced the sensitivity, accuracy, and range of DFOS, making them more suitable for various applications like structural health monitoring and environmental sensing. |

| Restraints | • The vast amount of data generated by DFOS systems can be difficult to integrate with existing infrastructure and systems, requiring advanced data analysis techniques to extract actionable insights. |