Display Driver Integrated Circuit Market Report Scope & Overview:

Get More Information on Display Driver Integrated Circuit Market - Request Sample Report

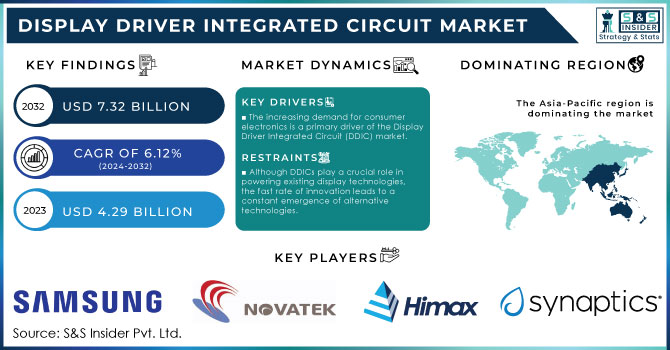

The Display Driver Integrated Circuit Market Size was valued at USD 4.29 billion in 2023 and is expected to reach USD 7.32 billion by 2032 and grow at a CAGR of 6.12% over the forecast period 2024-2032.

The Display Driver Integrated Circuit (DDIC) market is a vital sector within the electronics and semiconductor industry, serving as a cornerstone for visual display technology. With the rapid growth in consumer electronics and expanding automotive display applications, the DDIC market has seen substantial growth. In consumer electronics, where DDICs are widely utilized in smartphones, tablets, and laptops, there's a heightened demand for high-resolution displays that deliver enhanced visual experiences. In 2024, consumer electronics retail sales in the United States reached USD 512 billion, highlighting the growing importance of advanced DDICs. High-definition (HD), ultra-high-definition (UHD), and 4K resolutions are fueling demand for energy-efficient DDICs that can handle increased pixel densities and refresh rates without sacrificing power efficiency. Leading DDIC providers such as Samsung Electronics, Qualcomm, and Synaptics are innovating to meet these requirements, focusing on low-power, high-performance display driver ICs that optimize battery life in portable devices.

In the automotive industry, DDICs are equally crucial as display technology becomes more integrated into modern vehicles. As of October 2024, total vehicle sales in the United States rose to 16 million units, underscoring the rising demand for digital dashboards, infotainment systems, and heads-up displays (HUDs) in vehicles. Automotive DDICs must meet stringent standards for performance, durability, and reliability, as they are expected to endure extreme temperatures and vibrations. Companies like Texas Instruments, Rohm Semiconductor, and STMicroelectronics are at the forefront, delivering automotive-grade DDICs that enhance display quality, optimize control, and support autonomous vehicle technology. With the increasing adoption of high-quality displays in the automotive sector, this application is becoming a critical growth driver for the DDIC market.

Display Driver Integrated Circuit Market Dynamics

Drivers

-

The increasing demand for consumer electronics is a primary driver of the Display Driver Integrated Circuit (DDIC) market.

Consumer electronics manufacturers consistently seek advanced display technologies, such as OLED (Organic Light Emitting Diode), LCD (Liquid Crystal Display), and emerging microLED technologies, which rely heavily on efficient and high-performance display drivers. These integrated circuits are integral in controlling pixel-level data, enabling crisp, vibrant, and high-resolution displays. The consumer electronics industry is witnessing a significant growth phase due to factors like urbanization, an expanding middle class in emerging economies, and the continuous trend of upgrading personal devices. As these devices become more feature-rich, with larger, higher resolution, and more color-accurate displays, the demand for advanced DDICs has risen. Furthermore, the ongoing developments in display technologies like flexible and foldable screens, which are seen in the latest foldable smartphones, have created new opportunities for DDICs, making them essential for the next-generation electronic devices. The growing penetration of the Internet of Things (IoT) and smart home devices, many of which feature touch screens, is contributing to the market expansion for DDICs.

-

The automotive industry has seen a significant transformation in recent years, with the adoption of advanced in-car entertainment systems, digital dashboards, heads-up displays (HUDs), and autonomous vehicle technologies.

Display Driver Integrated Circuits are crucial in managing and controlling the various display systems found in modern vehicles. These include both traditional infotainment screens and more complex systems, such as digital instrument clusters and 3D HUDs. With the shift towards electric vehicles (EVs), connected cars, and autonomous vehicles, the demand for high-performance displays is expected to grow substantially. Advanced display systems not only enhance the user experience in terms of entertainment and navigation but also provide critical safety features by displaying vital information to the driver. For instance, digital dashboards offer drivers customizable and clearer data, while HUDs provide augmented reality for navigation, making driving safer and more convenient. In this context, DDICs are vital as they ensure the accurate and efficient display of information on various types of screens within the vehicle. The rapid evolution of automotive technology, alongside increasing consumer demand for smart features in vehicles, continues to fuel the demand for advanced display drivers. Additionally, with automotive displays shifting from basic monochrome screens to high-definition color displays, DDICs have become even more indispensable.

Restraints

-

Although DDICs play a crucial role in powering existing display technologies, the fast rate of innovation leads to a constant emergence of alternative technologies.

For example, microLED is gaining popularity in areas such as premium televisions and commercial displays due to its enhanced brightness, color accuracy, and energy efficiency over OLED. Nevertheless, microLED displays need various kinds of display drivers, which may decrease the need for conventional DDICs. Likewise, emerging display technologies could necessitate tailor-made display drivers or might incorporate additional features directly within the display panels, lowering the demand for external display driver ICs. If these trends persist, DDICs might encounter competition from in-display driver technologies or integrated solutions that merge both the display and driver functionalities into one component. The emergence of advanced technologies and the demand for ongoing innovation in the DDIC sector means that businesses in the industry must stay flexible and invest significantly in research and development to remain competitive. Nonetheless, the swift speed of technological progress may present dangers if businesses cannot adapt to these innovations or if emerging technologies disturb the current market.

Display Driver Integrated Circuit Market Segmentation Overview

By Type

The LCD segment led in 2023 with a 45% market share in the display driver integrated circuit (DDIC) market, propelled by its widespread application in consumer electronics such as smartphones, laptops, televisions, and industrial displays. LCD technology is well-developed, economical, and extensively used because of its longevity and dependable performance. In 2023, LCD represented a notable segment of the DDIC market, and its ongoing leadership is driven by the need for both established and new uses, such as automotive displays. Firms such as Samsung and LG produce display drivers for these panels, which are crucial in large consumer electronics products.

The OLED is the fastest-growing segment with a rapid CAGR during 2024-2032, undergoing swift acceptance due to its exceptional image quality, versatility, and energy efficiency. OLED screens provide excellent contrast ratios, vivid colors, and slimmer designs, making them suitable for use in premium smartphones, wearables, and automotive displays. With the decline in OLED manufacturing costs, its application is growing in multiple sectors. Samsung and LG are significant contributors to the OLED driver IC sector, offering products aimed at smartphones, TVs, and automotive displays, highlighting their increasing importance in the display driver IC market.

By Applications

The laptop category led the market with over 35% market share in 2023 because of the rising need for portable computing devices. Laptops need sophisticated graphics processing power, as they serve multiple functions like gaming, multimedia, and business. As high-definition (HD) and 4K displays continue to evolve, laptop producers are more frequently depending on DDICs to deliver clear, crisp, and high-quality visual outputs. Prominent examples include companies such as HP, Dell, and Lenovo, which incorporate DDICs in their laptops to improve user experience.

The mobile phone segment is anticipated to become the fastest-growing market during 2024-2032, propelled by the rising use of smartphones featuring advanced display technologies. The ongoing need for OLED, AMOLED, and foldable screens is driving this expansion. Mobile phones today boast high refresh rates, enhanced resolution displays (including 1080p, 4K, and even 8K), and bigger screens, all of which necessitate advanced DDICs. Firms like Apple, Samsung, and OnePlus are major contributors in this area, featuring advanced display technologies such as OLED and Super AMOLED in their products.

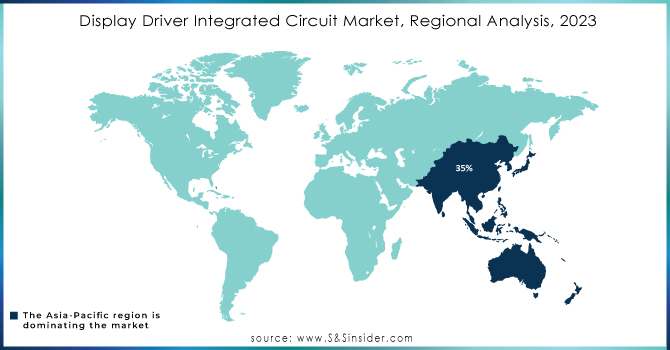

Display Driver Integrated Circuit Market Regional Analysis

Asia-Pacific emerged as the leading region in 2023 with a 35% market share and is expected to have the fastest CAGR from 2024 to 2032. This supremacy is fueled by the existence of leading semiconductor producers and a strong demand for display technologies in multiple industries including consumer electronics, automotive, and industrial uses. Nations such as China, Japan, South Korea, and Taiwan are important participants, with firms like Samsung Electronics, LG Display, and TCL at the forefront. These firms significantly invest in creating advanced display technologies such as OLED and AMOLED, which fuel the need for DDICs. Moreover, the surge of smartphones, televisions, and wearable gadgets in the APAC region drives market expansion, with Taiwan Semiconductor Manufacturing Company (TSMC) and MediaTek significantly contributing by supplying display drivers for these gadgets.

Need Any Customization Research On Display Driver Integrated Circuit Market - Inquiry Now

Key Players in Display Driver Integrated Circuit Market

The major key players in the Display Driver Integrated Circuit Market are:

-

Samsung Electronics (S6E3HA8, S6E3FA9)

-

Novatek Microelectronics (NT36672A, NT37761)

-

Himax Technologies (HX8399C, HX8298A)

-

Synaptics (S9887, S6D7AA)

-

Silicon Works (SW46100, SW66110)

-

ROHM Semiconductor (BU26503, BU9798)

-

Raydium Semiconductor (RM69070, RM69200)

-

Magnachip Semiconductor (OHD083, OHD085)

-

MediaTek (MT8195, MT6737)

-

Texas Instruments (DLPC7540, DLPA100)

-

Parade Technologies (PS8725A, PS8620)

-

Orise Technology (SPFD5408, ST7735)

-

Toshiba (TC358762XBG, TC358860XBG)

-

Sharp (LR0G1060, LR0G2060)

-

Analogix Semiconductor (ANX7530, ANX2402)

-

Sitronix Technology (ST7703, ST7789)

-

Solomon Systech (SSD2020, SSD1963)

-

BOE Technology (BDC16-01, BDC18-05)

-

Richtek Technology (RT4601, RT6213)

-

FocalTech Systems (FT8716, FT8006)

Suppliers of Raw Materials/Components

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

GlobalFoundries

-

Samsung Foundry

-

Shin-Etsu Chemical

-

Sumitomo Chemical

-

TOKYO OHKA KOGYO CO., LTD.

-

Applied Materials

-

ASML

-

KLA Corporation

-

Cadence Design Systems

Recent Development

-

October 2024: Novatek, the top display driver IC (DDI) producer in Taiwan, has revealed intentions to start mass manufacturing its eagerly awaited OLED TDDI technology as soon as the second quarter of 2025.

-

April 2023: ROHM created the 4ch/6ch LED driver ICs, BD83A04EFV-M, BD83A14EFV-M, and BD82A26MUF-M tailored for medium to large automotive displays in-vehicle infotainment systems and instrument clusters.

-

November 2023: ROHM has introduced a gate driver IC - the BD2311NVX-LB. It is tailored for GaN devices and reaches gate drive speeds in the range of nanoseconds (ns) - perfect for rapid GaN switching. This was made possible by a thorough comprehension of GaN technology and an ongoing quest for gate driver performance.

| Report Attribute | Details |

|---|---|

| Market Size in 2023 | USD 4.29 Billion |

| Market Size by 2032 | USD 7.32 Billion |

| CAGR | CAGR of 6.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (LCD, LED, OLED) • By Applications (Laptops, Mobile Phones, Smart Watches, Tablets, Televisions) • By End User (Entertainment, Retail, Education, Banking, Medical, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe [Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, Novatek Microelectronics, Himax Technologies, Synaptics, Silicon Works, ROHM Semiconductor, Raydium Semiconductor, Magnachip Semiconductor, MediaTek, Texas Instruments, Parade Technologies, Orise Technology, Toshiba, Sharp, Analogix Semiconductor, Sitronix Technology, Solomon Systech, BOE Technology, Richtek Technology, FocalTech Systems |

| Key Drivers | • The increasing demand for consumer electronics is a primary driver of the Display Driver Integrated Circuit (DDIC) market. • The automotive industry has seen a significant transformation in recent years, with the adoption of advanced in-car entertainment systems, digital dashboards, heads-up displays (HUDs), and autonomous vehicle technologies. |

| RESTRAINTS | • Although DDICs play a crucial role in powering existing display technologies, the fast rate of innovation leads to a constant emergence of alternative technologies. |