Direct-to-Consumer Genetic Testing Market Overview:

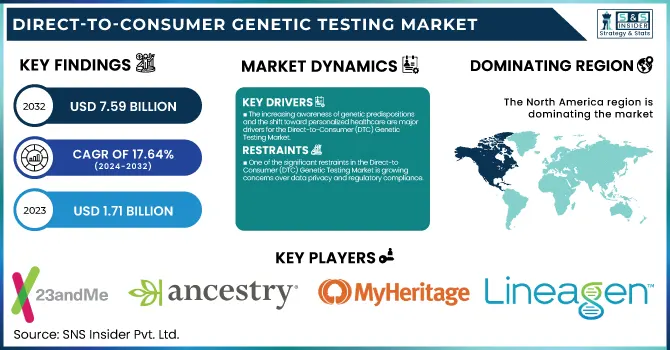

The Direct-to-Consumer Genetic Testing Market was valued at USD 1.71 billion in 2023 and is expected to reach USD 7.59 billion by 2032, growing at a CAGR of 17.64% from 2024-2032. Our Direct-to-Consumer Genetic Testing Market report provides consumer adoption and market penetration data, including the percentage of people utilizing genetic test kits and the level of awareness. It also includes test kit sales and distribution patterns region-wise, which includes the retail vs. online sales ratio and regional buying patterns. The report also includes market growth forecasts region-wise, which examines adoption patterns and technology trends. Further, consumer spending and pricing trends by region are analyzed, providing insights into the pricing differences, spending habits, and premium versus budget testing services in major markets.

To Get more information on Direct-to-Consumer Genetic Testing Market - Request Free Sample Report

U.S. Direct-to-Consumer Genetic Testing Market Size & Forecast

The U.S. Direct-to-Consumer Genetic Testing Market size was USD 0.79 billion in 2023 and is expected to reach USD 3.53 billion by 2032, growing at a CAGR of 17.7% over the forecast period of 2024-2032.

The market is expanding due to increasing consumer interest in personalized healthcare, ancestry tracing, and disease risk assessment. Advances in genetic research and declining sequencing costs are making these tests more accessible. Additionally, rising awareness about genetic predispositions and preventive health measures is fueling demand. Companies are focusing on innovation, data privacy, and regulatory compliance to enhance market growth.

Direct-to-Consumer Genetic Testing Market Dynamics

Drivers

-

The increasing awareness of genetic predispositions and the shift toward personalized healthcare are major drivers for the Direct-to-Consumer (DTC) Genetic Testing Market.

The growing awareness of genetic susceptibilities and the movement toward personalized medicine are key drivers for the Direct-to-Consumer (DTC) Genetic Testing Market. There is growing consumer interest in learning about their genetic susceptibility to diseases, lifestyle attributes, and heritage. Over 60% of North American consumers were interested in home-based genetic testing for health information, as indicated by a survey in 2023. The low cost of genetic testing kits, combined with intense promotional efforts by major players such as 23andMe and AncestryDNA, has driven market growth. Moreover, advances in whole genome sequencing and artificial intelligence-based genetic analysis have enhanced test precision and affordability. MyHeritage launched an upgraded ancestry DNA test with AI-based trait analysis in March 2023, reflecting ongoing innovation in the industry. The increasing need for preventive care also contributes to market expansion.

-

Expansion of Digital Health and E-commerce Platforms propelling the market growth.

The swift growth of digital health platforms and online channels has greatly facilitated the accessibility and uptake of DTC genetic testing. The ease of buying genetic testing kits online and obtaining digital reports has drawn a wider consumer base. In 2023, more than 75% of genetic test kits were sold online, which indicates a change in consumer buying behavior. Firms such as LetsGetChecked and Nebula Genomics have deepened their online presence, providing subscription-based genetic information and health advice. Additionally, innovation in telehealth integration has made it possible for consumers to remotely consult genetic counselors, enhancing the user experience. An innovation in September 2023 involved Color Health partnering with a leading telehealth provider to provide genetic counseling together with test results, boosting consumer trust in at-home genetic testing products.

Restraint

-

One of the significant restraints in the Direct-to-Consumer (DTC) Genetic Testing Market is growing concerns over data privacy and regulatory compliance.

One of the major restraints in the Direct-to-Consumer (DTC) Genetic Testing Market is increasing data protection and regulatory concerns. Since genetic testing constitutes extremely sensitive personal data, consumers are now more cautious about how their data is stored, used, and shared. A 2023 survey revealed that more than 50% of prospective users are reluctant to undergo genetic tests for fear of privacy threats. Regulatory agencies like the European Union's General Data Protection Regulation (GDPR) and the U.S. Federal Trade Commission (FTC) have imposed stricter controls on genetic data treatment, providing additional compliance hurdles for businesses. The FTC, in June 2023, settled a data breach with Vitagene (1Health.io), mandating tighter protection practices. Such breaches emphasize the potential for unauthorized access to data, possibly discouraging consumers and hindering market growth despite the increase in demand for genetic information.

Opportunities

-

The integration of artificial intelligence (AI) and advanced genomic technologies presents a significant growth opportunity in the Direct-to-Consumer (DTC) Genetic Testing Market.

The convergence of artificial intelligence (AI) and sophisticated genomic technologies offers a large growth opportunity in the Direct-to-Consumer (DTC) Genetic Testing Market. AI-powered data analytics has the potential to increase the accuracy of genetic reports, giving greater depth and more tailored information about ancestry, health risks, and lifestyle advice. Organizations such as Nebula Genomics and Veritas Genetics are utilizing whole genome sequencing (WGS) and AI-driven interpretation tools to provide richer genetic information in addition to routine single nucleotide polymorphism (SNP) analysis. Also, the emerging use of predictive modeling with AI can enable consumers to know likely disease risks with more accuracy. In 2023, Helix launched an AI-driven predictive health platform, reflecting the expanding use of technology in consumer genomics. As AI improves, DTC genetic testing firms can extend their services, further fueling market penetration.

Challenges

-

Variability in Test Accuracy and Interpretation challenges the market to grow.

One of the challenges in the Direct-to-Consumer (DTC) Genetic Testing Market is inconsistency in test precision and interpretation of results between providers. In contrast to clinical genetic testing, which is governed by rigorous regulatory and scientific validation, DTC tests are frequently based on proprietary databases and algorithms that can produce variable results. Research shows that many consumers who took tests from more than one vendor were given different interpretations of their genetic information. This variability can cause confusion and suspicion among consumers, curtailing mass adoption. Moreover, minimal regulatory scrutiny in some markets increases disparities in reporting requirements, leading to challenges for users in distinguishing between clinically approved and strictly entertainment-based tests. Firms need to invest in standardized practices and transparent reporting to increase credibility and stimulate long-term market expansion.

Direct-to-Consumer Genetic Testing Market Segmentation Analysis

By Test Type

The predictive testing segment dominated the market with a 37.61% market share in 2023 on account of growing consumer interest in early disease risk evaluation and preventative healthcare management. As consumers develop greater awareness regarding genetic susceptibility to diseases like cancer, cardiovascular illnesses, and neurodegenerative disorders, people are increasingly preferring predictive genetic testing to make knowledgeable health decisions. As of 2023, predictive genetic tests had the greatest percentage of overall DTC test sales, an indication of the trend toward preventive care and precision medicine.

This dominance was further boosted by the acceleration of genomic research, the use of AI-based data interpretation, and enhanced test affordability. Other organizations such as Color Health, Helix, and Veritas Genetics have developed enhanced predictive testing options, which provide consumers with accurate risk reports of hereditary disorders. The market adoption has been further encouraged through regulatory endorsements, especially in the North American and European regions. An instance worth mentioning is that of FDA clearance for augmented genetic health risk reports for specific DTC test operators, which supported consumer confidence toward predictive testing platforms.

By Type of Technology

The whole genome sequencing (WGS) segment dominated the direct-to-consumer (DTC) genetic testing market in 2023 with a 40.13% market share because it can generate complete genetic information as opposed to other tests available. WGS unlike Single Nucleotide Polymorphism (SNP) chips and targeted testing reads a person's entire DNA sequence, providing a high-resolution picture of genetic differences associated with disease risk, ancestry, and traits. The popularity of WGS-based genetic analysis soared in 2023, with more than 40% of premium DTC genetic tests featuring WGS technology, as customers craved more accurate and comprehensive health evaluations.

Technological advancements and declining prices also contributed to WGS's dominance. Over the past few years, the price of sequencing a complete genome plummeted, and WGS became even more appealing to consumers. Firms such as Nebula Genomics, Dante Labs, and Veritas Genetics have capitalized on this cost to provide competitive pricing for direct-to-consumer whole genome sequencing. Furthermore, the employment of AI-based genomic interpretation has improved the precision and applicability of WGS outcomes, which are more actionable to consumers interested in personalized health information.

Another reason for WGS' dominance is that it has been used beyond ancestry and health risk screening. Several companies have also begun to offer lifetime genomic data storage, regular updates of health, and integration with digital health platforms, enhancing the long-term value of WGS-based tests. Additionally, increased uptake of personalized medicine and preventive health strategies has made WGS the most sophisticated and extensive genetic testing technology, cementing its position at the top of the 2023 direct-to-consumer genetic testing market.

By Distribution Channel

The Online Platform segment dominated the direct-to-consumer (DTC) genetic testing market in 2023 with 65.20%, because of convenience, accessibility, and direct consumer involvement. The advent of e-commerce platforms, company websites, and digital marketplaces has simplified consumers' ability to shop, compare, and buy genetic tests without a prescription from a healthcare provider. More than 70% of DTC genetic test sales in 2023 were through online channels, demonstrating robust consumer demand for home health solutions. Large players such as 23andMe, AncestryDNA, and MyHeritage have utilized digital marketing, subscription-based offerings, and tailored health dashboards to improve customer experience. Also, the increasing use of telemedicine and AI-based genetic counseling services has further supported the dominance of the online channel, and it has become the major distribution method for genetic testing services.

The Over-the-Counter (OTC) segment is expected to witness the fastest growth in the forecast years because of the growing retail availability of genetic test kits and growing consumer demand for immediate access. Pharmacies, supermarkets, and health stores now carry DTC genetic testing kits, increasing visibility and availability to more people. Over the past few years, retailers such as LetsGetChecked and EverlyWell have grown their retail partnerships, enabling consumers to buy test kits at neighborhood pharmacies and retail stores. The growing demand for wellness and lifestyle genetic testing, especially for nutrigenomics, fitness, and ancestry, will continue to fuel growth. Also, increasing regulatory clearances for OTC genetic tests with clinically confirmed results will boost consumer confidence, further driving the growth of this segment during the forecast period.

Direct-to-Consumer Genetic Testing Market Regional Insights

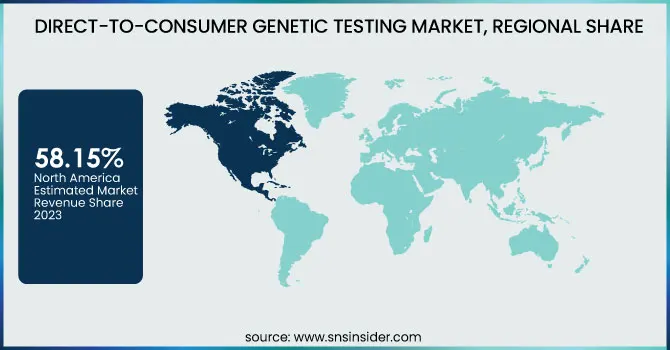

North America dominated the direct-to-consumer genetic testing market with a 58.15% market share in 2023, because of its strong healthcare infrastructure, high consumer education, and robust presence of leading market players like 23andMe, AncestryDNA, and MyHeritage. The region is aided by a conducive regulatory scenario for the direct selling of genetic tests, in addition to high disposable income levels, which allow consumers to spend on personalized health and ancestry services. In addition, the universal use of e-commerce and digital health platforms has driven the use of at-home genetic testing kits, making America the highest revenue-generating market in this segment. The availability of cutting-edge genomic research labs, partnerships among biotech companies and healthcare professionals, and ongoing innovation in genetic testing technology also support North America's leadership position in the market. Additionally, aggressive promotional campaigns and marketing efforts by major players have contributed considerably to consumer interaction in the region.

Europe is the fastest-growing region in the direct-to-consumer genetic testing market with 18.95% CAGR throughout the forecast period, as a result of growing consumer interest in personalized healthcare and wellness. The region has witnessed a growing awareness of genetic susceptibility, fueled by government support for genomic research and precision medicine. Markets such as the UK, Germany, and France are experiencing a boost in demand, driven by enhanced digital health infrastructure and growing distribution channels. In addition, regulatory developments, including GDPR-compliant genetic data protection regulations, are creating increased consumer confidence, leading more people to try at-home genetic testing options. Greater availability of multilingual genetic testing services and region-specific ancestry information is also driving higher adoption. In addition, increasing partnerships between European healthcare systems and private genetic testing companies are further propelling market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Direct-to-Consumer Genetic Testing Market

-

23andMe (Health + Ancestry Service, VIP Health + Ancestry Service)

-

AncestryDNA (AncestryDNA Test, Traits + All Access Membership)

-

MyHeritage (MyHeritage DNA Test, Health + Ancestry Kit)

-

FamilyTreeDNA (Family Finder, Y-DNA Testing)

-

Living DNA (Ancestry Kit, Wellbeing Kit)

-

Color Health (Hereditary Cancer Test, Heart Health Test)

-

Helix (DNA Discovery Kit, Wellness + Ancestry Kit)

-

Veritas Genetics (myGenome Standard, myGenome Premium)

-

International Biosciences (Natera Panorama Prenatal Test, Ancestry DNA Test)

-

Lineagen (FirstStepDx PLUS, GeneDose)

-

Genomic Prediction (Preimplantation Genetic Testing, Expanded Carrier Screening)

-

Orig3n (Nutrition DNA Test, Fitness DNA Test)

-

Nebula Genomics (30x Whole Genome Sequencing, Deep Ancestry Report)

-

Dante Labs (Whole Genome Sequencing, Health Screening Tests)

-

Vitagene (Health + Ancestry Report, Premium Health Report)

-

Futura Genetics (Genetic Health Test, Wellness + Lifestyle Test)

-

EasyDNA (Ancestry DNA Test, Health DNA Test)

-

HomeDNA (Healthy Weight Test, Skin Care DNA Test)

-

LetsGetChecked (Colon Cancer Screening Test, Diabetes Test)

-

EverlyWell (Food Sensitivity Test, Metabolism Test)

Suppliers (These suppliers commonly provide reagents and equipment such as PCR enzymes, sequencing kits, and analytical instruments, which are fundamental components in the workflows of DTC genetic testing companies.) in the Direct-to-Consumer Genetic Testing Market

-

Thermo Fisher Scientific

-

Illumina, Inc.

-

New England Biolabs (NEB)

-

LGC Biosearch Technologies

-

Sigma-Aldrich

-

Bio-Rad Laboratories

-

Qiagen

-

Agilent Technologies

-

Roche Diagnostics

-

PerkinElmer

Recent Developments

-

June 2023 – The Federal Trade Commission (FTC) has settled with Vitagene, or 1Health.io, after a data breach. Through the agreement, the firm was compelled to better secure genetic information and remit USD 75,000 in consumer refunds.

-

September 8, 2022—Morgan Health, a JPMorgan Chase & Co. business unit, has made a strategic investment of USD 20 million in LetsGetChecked. The investment will help increase access to affordable and convenient at-home healthcare services by backing LetsGetChecked's clinical solutions for remote patient health monitoring.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.71 billion |

| Market Size by 2032 | US$ 7.59 billion |

| CAGR | CAGR of 17.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Nutrigenomics Testing, Predictive Testing, Carrier Testing, Others) • By Type of Technology (Whole Genome Sequencing, Single Nucleotide Polymorphism Chips, Targeted Analysis, Others) • By Distribution Channel (Online Platform, OTC) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 23andMe, AncestryDNA, MyHeritage, FamilyTreeDNA, Living DNA, Color Health, Helix, Veritas Genetics, International Biosciences, Lineagen, Genomic Prediction, Orig3n, Nebula Genomics, Dante Labs, Vitagene, Futura Genetics, EasyDNA, HomeDNA, LetsGetChecked, Everlywell, and other players. |