The Digital Vault Market was valued at USD 813.5 Million in 2023 and is expected to reach USD 2118.2 Million by 2032, growing at a CAGR of 12.89% from 2024-2032.

Get more information on Digital Vault Market - Request Free Sample Report

The Digital Vault Market is witnessing phenomenal growth, primarily due to the increasing need for secure and efficient storage of data. Digital vault is an advanced system for the protection of sensitive information like financial records, legal documents, and personal data, digital vault is a must for every organization that is experiencing the rise in data breach risks and the establishment of strict data protection regulations. Recent industry reports show the rapid adoption across major verticals including banking, financial services, healthcare, and government where data security is a critical goal. Blockchain, artificial intelligence, and machine learning are just a few of the new technologies enabling innovative new features in digital vaults to ensure that they become more and more intelligent and find new ways to defend themselves from new types of attacks.

The increasing volume and sophistication of cyberattacks is one of the key factors fueling this growth, as a result of which demand for enterprise-grade data security solutions has increased. More and more businesses are leveraging digital vaults to shield sensitive information against unauthorized access and cyber-attacks. Additionally, the scalability and economical base for deploying digital vaults created by the wide range of cloud-based services has enabled the market to grow further. The changes brought on by the pandemic coupled with the digital transformation that every industry went through, have proven the fluidity of a remote work style and the need for secure digital storage systems needed to remain efficient. Furthermore, regulatory mandates such as the General Data Protection Regulation and the California Consumer Privacy Act force organizations to adopt secure data storage solutions like digital vaults. Such regulations mandate stringent data security, so enterprises are now forced to invest in cutting-edge technology to remain compliant. Finally, the increasing adoption of digital payment systems and e-commerce platforms that process a large volume of data around customer information that must be securely stored and managed to avoid damaging penalties and customer trust will also play a big role.

Drivers

Growth in remote work and cloud adoption amplifies the need for scalable and secure digital vaults.

The rising trend of remote working and the adoption of cloud technologies have measurably increased the need for scalable and secured digital vault solutions. With more organizations transitioning to remote and hybrid work environments, employees are typically accessing sensitive corporate data from anywhere using different devices that often connect over unsecured networks. As more sensitive and transactional data has moved to these applications, the threat of data breaches, unauthorized access, and cyberattacks has only increased, forcing companies to implement strong data security practices. Digital vaults serve as a highly secure platform for storing and managing critical information, keeping it accessible only to the right users — wherever they may be.

Increased dependence on cloud services has intensified the requirement for scalable digital vaults. Instead, businesses using cloud-based vault solutions would be able to quickly scale their storage needs with changing demands for data, avoiding any capital investments needing to be made into physical infrastructure systems. The solutions also integrate well with other cloud solutions that enable the smooth movement of data while ensuring stringent security protocols. In addition, cloud-based digital vaults use high-end encryption techniques, live monitoring, and multi-factor authentication so that complex security threats cannot compromise sensitive data. With remote work deepening its roots as a long-lasting trend and cloud platforms fueling the digital transformation yet further, many organizations are recognizing the need to adopt digital vaults to protect their assets. These solutions are an effective means of addressing the security concerns posed by remote access, but they are also a necessary component of a modern security framework for complying with rigorous data protection laws.

Use of blockchain, AI, and ML enhances digital vault functionality and threat detection.

Small and medium-sized enterprises increasingly seek cost-effective solutions to protect sensitive data.

Restraints

Cloud-based digital vaults rely heavily on stable internet connections, posing challenges in regions with poor connectivity.

While cloud-based digital vaults provide an easily scalable and high-security solution for data storage, their excessive dependence on stable internet connection makes them unfeasible in areas where network infrastructure is unstable or unreliable. These solutions rely on an uninterrupted and strong internet connection for essential operations such as data synchronization, instantaneous updates, and remote accessibility. This can delay users, make them inaccessible, or in even some cases, disrupt access to critical data, slowing down the adoption of cloud-based digital vaults in these areas.

Poor internet infrastructure can disrupt operations for businesses in remote or underdeveloped regions, reducing the effectiveness of digital vault systems. Regular connection problems could give rise to security holes too because it exposes a gap in sending data, meaning it could result in incomplete data transfers or failed updates that leave sensitive information open to risks. As a result, organizations may experience difficulty reaping the full advantages of cloud-native digital vaults, which include things like scalability and easy integration into the rest of the cloud services. As a result, many providers are increasingly creating hybrid solutions utilizing both cloud and on-premises storage to maintain data access even during connectivity outages. In addition, new edge computing and offline synchronization technology allow users in regions such as rural areas to be less affected by poor internet connectivity. This said, despite those innovations, reliance on a stable internet connection continues to pose a substantial obstacle to the availability of cloud-based digital vaults for emerging economies characterized by low or unreliable network infrastructure, underscoring the enduring necessity of technological evolutions and better connectivity in these regions.

The significant upfront investment required for deploying digital vault solutions can deter adoption, especially for SMEs.

Lack of awareness about digital vault benefits among small businesses hinders market growth.

By Type

In 2023, the solution segment dominated the market and represented a significant revenue share of more than 61%, driven by the increasing requirement for platforms that not only provide security but also ensure the safety of sensitive data through strong and locked storage facilities. Since data breaches are one of the foremost threats today, organizations in various domains like banking, healthcare, and government sectors are investing in digital vault solutions to secure sensitive data and meet the requirements of strict regulations like GDPR, CCPA, etc. These provided solutions that incorporate the latest technologies, such as encryption, artificial intelligence, or blockchain technology, to increase security and improve operational efficiency. The type of platform that enterprises increasingly adopt, for ease of integration with existing IT systems and scalability. Looking ahead, the solution component is expected to remain dominant as the demand for secure, centralized information storage continues to grow alongside innovation in the increasingly digital and connected world.

The services segment is expected to have the highest growth rate during 2024–2032, due to the increasing demand for implementation, integration, and maintenance support for digital vault systems. The implementation of digital vaults will require professional services such as consulting and customization facilitating increased demand within this segment. Also, managed services are becoming popular especially in SMEs due to cost-effectiveness as well as in-house experience absence. As these products become more entrenched, the services segment will expand, driven by more complex cyber threats and evolving compliance requirements, fueling the need for expert guidance on how to keep up with constantly changing security and regulatory technologies.

By Deployment

In 2023, the on-premise segment dominated the market and represented a revenue share of more than 75%, with on-premise as the largest deployment type used in digital vaults for organizations that are more invested in keeping control of their data. Such deployment enables organizations to keep sensitive data in-house, minimizing the threat of data security breaches and complying with stringent data protection laws. Some industries such as government and finance prefer on-premise systems for keeping critical data because it provide better control and organizations that operate offline can also need on-premise systems within their respective environments, to reduce data exposure from network vulnerabilities. Over the forecast period, the on-premise segment will continue to hold its dominant position in the markets where data security is of utmost importance and where entities prefer to minimize reliance on external networks.

The cloud segment is expected and estimated to exhibit the highest CAGR during the forecast period, owing to scalable, flexible, and lower initial cost-based pricing environments. Digital vaults offered in the cloud provide easy storage and retrieval of data from any place with network access, which fits the needs of organizations as they undergo digital transformation and adopt remote working practices. Increased acceptance of cloud-based applications and the availability of secure cloud technologies such as encrypted storage and multi-factor authentication also augments this segment. More SMEs are expected to adopt cloud-based digital vaults due to their low cost and ease of use, which will drive growth in the upcoming years. Moreover, the coupling of cloud platforms with futuristic technologies will render such systems appealing to a broader spectrum of industries.

By End-Use

In 2023, The BFSI segment dominated the market and represented a significant revenue share, owing to a critical demand for safe storage of data and protection of sensitive financial information. Amidst escalating cyber threats and tough regulatory requirements including but not limited to GDPR and the Sarbanes-Oxley Act, financial institutions value secure data storage solutions to avoid data breaches and stay in compliance with applicable regulations. Digital vaults are encrypted high-line, and scalable storage solutions for financial records, transactional data, customer data, and other information. The BFSI sector will remain dominant in the market in the coming years as financial institutions continue to adopt more complex technologies such as AI and blockchain to improve security and regulatory compliance in an increasingly digital world.

The telecommunication segment is estimated to witness the fastest CAGR. This industry experiences a fast digital transformation and generates a lot of data requiring advanced storage solutions that protect sensitive data, including internal data, customer information, intellectual property, etc. As cloud computing, 5G networks, and IoT technologies continue to gain traction, the need for secure, scalable digital vaults is on the rise. Furthermore, the growing dependency of the sector on service and application data amplifies the need for strong data security. The continuous innovation and advancement in the IT and telecommunication industry will propel the need for high-end digital vaults, and it will be the fastest-growing segment during the forecast period.

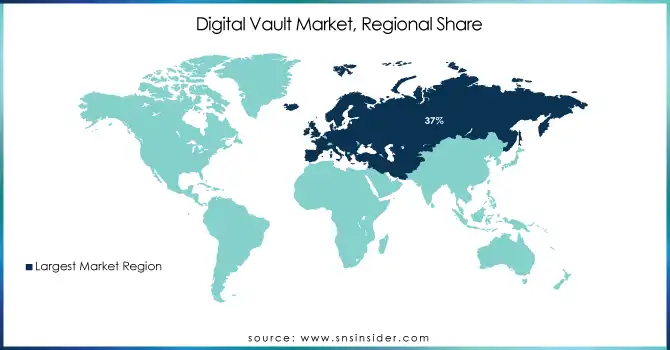

In 2023, Europe dominated the digital vault market and accounted for a revenue share of more than 37%, supported by strict data protection regulations like the General Data Protection Regulation and high demand for secure digital data storage across many industries. Market growth has primarily been attributed to the strong infrastructure network in the region, increased adoption of cloud technologies, and the requirement of various key verticals such as finance, healthcare, and government In addition, the increased focus on cybersecurity in Europe and regulation compliance has also encouraged organizations to store data safely to avoid the consequences. Soon, Europe will remain the frontrunner due to regulatory pressures and the increasing need across industries for secure, scalable digital storage solutions.

Asia Pacific is estimated to witness the fastest CAGR during the forecast period due to rapid digital transformation coupled with increasing data generation and surging security threats. The growing incidence of accessing cloud computing, IoT, and mobile technologies in the region is driving the requirement for secured data storage facilities. Moreover, the growth of sectors such as e-commerce, fintech, and healthcare in emerging markets like India and China is also driving the demand for digital vaults. The uptrend of digital vaults in the Asia Pacific is anticipated to grow on the back of a growing focus on data security, compliance with changing regulations improved IT infrastructure, and increasing investment in cyber security as companies in the region are expected to evolve their vault strategies to meet the growing demand for more effective protection of their ever-growing data assets.

Need any customization research on Digital Vault Market - Enquiry Now

The major key players along with their products are

Vormetric – Data Security Platform

Commvault – Commvault Complete Backup & Recovery

Thales – Thales CipherTrust Cloud Key Manager

Iron Mountain – Iron Mountain Digital Vault

Dell Technologies – Dell PowerProtect Cyber Recovery

Microsoft – Azure Key Vault

Amazon Web Services (AWS) – AWS Key Management Service

IBM – IBM Security Guardium

McAfee – McAfee Total Protection for Data Loss Prevention

Forcepoint – Forcepoint Data Loss Prevention

Proofpoint – Proofpoint Enterprise Data Loss Prevention

Gemalto (now part of Thales) – SafeNet Data Protection

Acronis – Acronis Cyber Backup

In July 2024, Commvault reported a 23% increase in stock value following a strong fiscal first quarter, with revenues of $224.7 million and an 18% rise in adjusted earnings per share.

In June 2024, AWS introduced enhanced encryption features for its Key Management Service (KMS), providing customers with more robust data protection options.

In April 2024, IBM launched a new version of its Security Guardium, offering improved real-time data activity monitoring and advanced threat detection.

In March 2024, Microsoft announced the integration of its Azure Key Vault with advanced AI capabilities, enhancing security and compliance for enterprise customers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 813.5 Billion |

| Market Size by 2032 | USD 2118.2 Billion |

| CAGR | CAGR of 12.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solution, Services) • By Deployment (On-premise, Cloud) • By End - User (BFSI, IT and Telecommunication, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vormetric, Commvault, Thales, Iron Mountain, Dell Technologies, Microsoft, Amazon Web Services (AWS), IBM, McAfee, Forcepoint, Proofpoint, Gemalto |

| Key Drivers | • Use of blockchain, AI, and ML enhances digital vault functionality and threat detection. • Small and medium-sized enterprises increasingly seek cost-effective solutions to protect sensitive data. |

| RESTRAINTS | • The significant upfront investment required for deploying digital vault solutions can deter adoption, especially for SMEs. • Lack of awareness about digital vault benefits among small businesses hinders market growth. |

Ans The Digital Vault Market was valued at USD 813.5 Million in 2023 and is expected to reach USD 2118.2 Million by 2032, growing at a CAGR of 12.89% from 2024-2032.

Ans- The CAGR of the Digital Vault Market during the forecast period is 12.89% from 2024-2032.

Ans- Asia-Pacific is expected to register the fastest CAGR during the forecast period.

Ans- Use of blockchain, AI, and ML enhances digital vault functionality and threat detection.

Ans- Lack of awareness about digital vault benefits among small businesses hinders market growth.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Digital Vault Market Segmentation, By Deployment

7.1 Chapter Overview

7.2 On-premise

7.2.1 On-premise Market Trends Analysis (2020-2032)

7.2.2 On-premise Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Cloud

7.3.1 Cloud Market Trends Analysis (2020-2032)

7.3.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Million)

8. Digital Vault Market Segmentation, by Type

8.1 Chapter Overview

8.2 Solutions

8.2.1 Solutions Market Trends Analysis (2020-2032)

8.2.2 Solutions Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Services

8.3.1 Services Market Trends Analysis (2020-2032)

8.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Million)

9. Digital Vault Market Segmentation, by End-User

9.1 Chapter Overview

9.2 BFSI

9.2.1 BFSI Market Trends Analysis (2020-2032)

9.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 IT and Telecommunication

9.3.1 IT and Telecommunication Market Trends Analysis (2020-2032)

9.3.2 IT and Telecommunication Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Government

9.4.1 Government Market Trends Analysis (2020-2032)

9.4.2 Government Market Size Estimates and Forecasts to 2032 (USD Million)

9.5Others

9.5.1Others Market Trends Analysis (2020-2032)

9.5.2Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Digital Vault Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.2.4 North America Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.5 North America Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.2.6.2 USA Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.3 USA Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.2.7.2 Canada Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.3 Canada Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.2.8.2 Mexico Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.3 Mexico Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Digital Vault Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.1.6.2 Poland Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.1.7.2 Romania Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.1.8.2 Hungary Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.1.9.2 Turkey Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Digital Vault Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.4 Western Europe Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.6.2 Germany Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.7.2 France Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.3 France Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.8.2 UK Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.3 UK Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.9.2 Italy Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.10.2 Spain Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.13.2 Austria Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Digital Vault Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.4 Asia Pacific Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.6.2 China Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.3 China Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.7.2 India Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.3 India Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.8.2 Japan Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.3 Japan Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.9.2 South Korea Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.3 South Korea Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.10.2 Vietnam Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.11.2 Singapore Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.3 Singapore Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.12.2 Australia Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.3 Australia Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Digital Vault Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.1.4 Middle East Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.5 Middle East Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.1.6.2 UAE Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.1.7.2 Egypt Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.1.9.2 Qatar Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Digital Vault Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.2.4 Africa Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.5 Africa Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.2.6.2 South Africa Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Digital Vault Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.6.4 Latin America Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.5 Latin America Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.6.6.2 Brazil Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.3 Brazil Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.6.7.2 Argentina Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.3 Argentina Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.6.8.2 Colombia Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.3 Colombia Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Digital Vault Market Estimates and Forecasts, By Deployment (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Digital Vault Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Digital Vault Market Estimates and Forecasts, by End-User (2020-2032) (USD Million)

11. Company Profiles

11.1 Vormetric

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Commvault

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Thales

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Iron Mountain

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Dell Technologies

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Microsoft

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Amazon Web Services

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 IBM

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 McAfee

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Forcepoint

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Solution

Services

By Deployment

On-premise

Cloud

By End - User

BFSI

IT and Telecommunication

Government

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Intrusion Detection System Market Size was USD 5.71 Billion in 2023 and will reach USD 11.43 bn by 2032 and grow at a CAGR of 8.0% by 2024-2032.

The Data Center Infrastructure Management Market was valued at USD 2.8 billion in 2023 and is expected to reach USD 8.8 billion by 2032, growing at a CAGR of 13.51% from 2024-2032.

IoT Energy Management Market was valued at USD 71.23 billion in 2023 and is expected to reach USD 311.86 billion by 2032, growing at a CAGR of 17.89% by 2032.

Data Pipeline Tools Market was valued at USD 9.34 billion in 2023 and is expected to reach USD 56.27 billion by 2032, growing at a CAGR of 22.16% from 2024-2032.

The Driving Simulator Market was valued at USD 2.7 Billion in 2023 and is expected to reach USD 4.7 Billion by 2032, growing at a CAGR of 6.24% by 2032.

The Factoring Services Market was valued at USD 4.01 billion in 2023 and is expected to reach USD 7.76 billion by 2032, growing at a CAGR of 7.67% by 2032.

Hi! Click one of our member below to chat on Phone