To Get More Information on Digital Twins in Healthcare Market - Request Sample Report

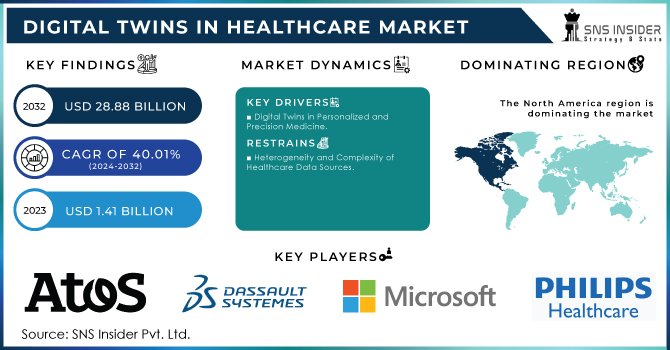

The Digital Twins in Healthcare Market size was valued at USD 1.41 billion in 2023, and is expected to reach USD 28.88 billion by 2032, and grow at a CAGR of 40.01% over the forecast period 2024-2032.

Demand for digital twins in healthcare is escalating rapidly, driven by the need for personalized medicine, improved patient outcomes, and operational efficiency.

The aging population, coupled with rising chronic diseases, necessitate predictive and preventive care models. Digital twins offer a virtual replica of patients, allowing for precise disease modeling, drug simulations, and optimized treatment plans. Furthermore, healthcare institutions are under pressure to reduce costs while enhancing quality. Digital twins can optimize resource allocation, streamline workflows, and minimize errors.

The demand for personalized medicines has surged which is evidenced by the substantial growth in the number of these treatments available on the market, which doubled from 132 to 286 between 2016 and 2020. Furthermore, a notable shift in drug development is highlighted by the FDA's approval data: personalized medicines accounted for a significant 25% of new drug approvals in 2019, a dramatic increase from just 5% in 2005.

The demand for digital twins in healthcare is driven by the need for increasingly sophisticated and granulated patient models. There is a strong desire for digital twins that can represent various levels of biological complexity, from entire body systems to individual cells. This granularity is essential for precision medicine, disease modeling, and drug development. Furthermore, the ability to create composite digital twins, integrating multiple biological systems and disease states, is seen as crucial for addressing complex health conditions.

Real-time data integration and dynamic modeling capabilities are key requirements for digital twins. The demand for high-fidelity digital twins, capable of accurately simulating physiological responses and disease progression, is growing. This necessitates robust data infrastructure and advanced computational power.

Additionally, there is a burgeoning demand for digital twin repositories (DT banks) to facilitate data sharing, clinical trial matching, and drug discovery. The concept of digital twin threads, tracking patient data over time, is gaining traction as it offers potential for longitudinal studies and personalized care pathways.

The supply of digital twin solutions is growing, with a diverse range of players including IT giants, healthcare providers, and specialized startups. The market is characterized by rapid technological advancements in areas like AI, IoT and data analytics, fueling innovation. However, challenges persist in data interoperability, cybersecurity, and the need for skilled professionals to develop and implement these complex systems.

Government initiatives are pivotal in driving the adoption of digital twins in healthcare. Many countries are investing in digital health infrastructure, promoting data sharing and standardization, and supporting research and development in this area. Regulatory frameworks are being established to ensure patient privacy and data security while encouraging innovation. Additionally, government-funded pilot projects and public-private partnerships are accelerating the deployment of digital twin solutions in healthcare delivery. Overall, a supportive regulatory environment and public-private collaboration are essential for the successful growth of the digital twins in healthcare market. Governments are developing regulatory frameworks to support the adoption of digital twins while ensuring patient data privacy and security. The European Union's General Data Protection Regulation (GDPR) is a prominent example of such a framework.

Many governments recognize the potential of digital twins and participating heavily in research and development. For instance, the U.S. has initiatives under the Precision Medicine Initiative and the National Institutes of Health (NIH) focusing on developing digital twins for various diseases.

The healthcare landscape is undergoing a transformative shift with the integration of digital twin technology. Innovations are emerging from that are redefining surgical precision, enhancing patient care, and optimizing treatment outcomes.

One notable advancement is the development of patient-specific 3D maps, which leverage advanced imaging and AI to create highly accurate virtual representations of patients. These digital twins are proving invaluable in surgical planning, execution, and post-operative assessment. By providing detailed anatomical insights and minimizing radiation exposure, this technology is significantly improving surgical outcomes.

In the realm of cardiology, AI-driven platforms are transforming cardiac imaging into actionable insights. By creating digital twins of the heart and combining them with predictive analytics, healthcare providers can gain unprecedented understanding of patient-specific anatomy and device interactions. This knowledge is instrumental in selecting optimal treatment plans and improving the success of procedures like transcatheter aortic valve implantation.

Market Dynamics

Drivers

By creating dynamic, virtual representations of patients, organs or even entire healthcare systems, digital twins offer unprecedented opportunities for improvement.

Enhanced patient care is a primary driver, with digital twins enabling personalized treatment plans, early disease detection and proactive health management. These virtual models facilitate predictive analytics, allowing for the identification of at-risk populations and the optimization of preventive interventions. Moreover, digital twins streamline clinical operations by providing insights into resource allocation, patient flow, and quality improvement initiatives. Lastly, their application in training and simulation enhances healthcare professionals' skills, ultimately improving patient safety and outcomes.

Digital Twins in Personalized and Precision Medicine

The application of digital twin technology in healthcare is a burgeoning field with immense potential. While still in its nascent stages, research has demonstrated promising applications across various medical domains. From creating "virtual twins" that simulate patient responses to treatment options to modeling complex diseases like multiple sclerosis, digital twins are transforming healthcare. Their utility extends to optimizing treatment plans, accelerating drug development, and enhancing overall patient care.

Digital twins are revolutionizing healthcare by offering a comprehensive view of patients. By integrating data from various sources, these virtual representations enable personalized treatment plans, early disease detection, and improved patient outcomes. Digital twins also enhance diagnostic accuracy, facilitate real-time monitoring, and empower patients to actively participate in their care. Predictive analytics and seamless care coordination further strengthen the value of digital twins in modern healthcare.

Restraints

Heterogeneity and Complexity of Healthcare Data Sources

The widespread adoption of digital twins in healthcare is hindered by several challenges. Data integration remains a significant obstacle due to the heterogeneity and complexity of healthcare data sources. Ensuring the privacy and security of sensitive patient information is paramount but poses substantial technical and regulatory hurdles. The demanding computational resources required for complex simulations and model maintenance present another barrier. Furthermore, the accuracy and reliability of digital twin models depend on constant data updates and algorithmic refinement, which can be resource-intensive. Lastly, substantial investments in technology infrastructure and healthcare professional training are necessary for successful digital twin implementation, creating financial and human capital constraints.

By Type

Process and system digital twins dominated the market with 56% share in 2023. These digital representations of healthcare processes and systems leverage advanced technologies like AI, VR, and mixed reality to optimize workflows and improve efficiency. For instance, doctors can interact with holographic representations of patients, accessing real-time data to inform treatment decisions.

On the other hand, product digital twins are gaining traction due to the increasing adoption of IoT sensors and electronic manufacturing devices in healthcare. These digital replicas of medical products enable manufacturers to simulate product performance, identify potential issues, and accelerate development cycles, ultimately leading to higher-quality products.

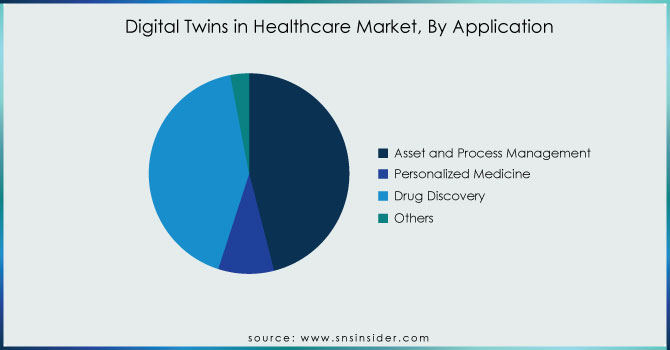

By Application

Asset and process management were the leading segment with 46% in 2023, driven by the need for optimized resource utilization and maintenance planning within healthcare facilities. Digital twins in this area create virtual representations of physical assets, enabling efficient management and predictive maintenance.

The drug discovery segment is experiencing rapid growth due to the potential of digital twins to accelerate drug development processes. By simulating drug interactions and manufacturing processes, pharmaceutical companies can reduce development time, improve efficiency, and enhance product quality.

Do You Need any Customization Research on Digital Twins in Healthcare Market - Enquire Now

By End-use

Hospitals and clinics represented the largest segment with 58% in 2023, driven by the need for operational efficiency, resource optimization, and improved patient care. Digital twins enable healthcare facilities to simulate various scenarios, optimize staffing, and enhance overall performance.

Clinical Research Organizations (CROs) is another key segment experiencing rapid growth. Digital twins are being adopted by CROs to accelerate drug development, reduce costs, and improve trial efficiency. By simulating patient responses and treatment outcomes, CROs can make more informed decisions and accelerate the drug development process.

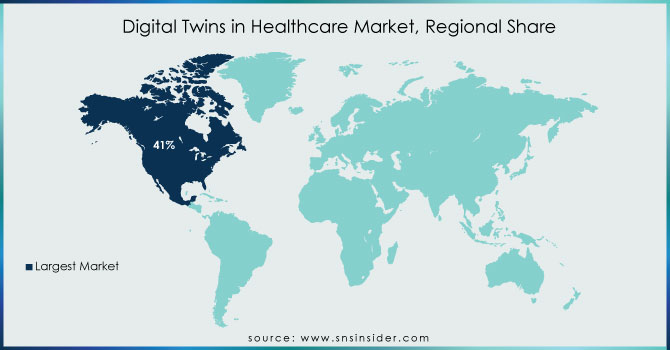

Regional Analysis

North America dominated the digital twins in healthcare market with 41% in 2023, driven by factors such as advanced healthcare infrastructure, early adoption of digital technologies and the presence of key industry players.

The region's robust technological ecosystem and supportive regulatory environment have accelerated the integration of digital twins into healthcare practices.

The Asia Pacific region is emerging as a rapidly growing market for digital twins in healthcare. Fueled by increasing investments in healthcare technology, a burgeoning middle class, and the growing prevalence of chronic diseases, the demand for innovative solutions like digital twins is on the rise. The region's large population and untapped potential present significant opportunities for market expansion.

The Major players are Atos, Dassault Systems (3DS System), Microsoft, Philips Healthcare, Unlearn.AI, Inc., PrediSurge, QiO Technologies, Verto Healthcare, ThoughWire, Fasttream Technologies, Twin Health and others.

Unlearn and QurAlis Corporation joined forces in June 2023 to expedite and enhance ALS clinical trials. Unlearn's cutting-edge artificial intelligence technology, specifically digital twins, will be integrated into QurAlis' research to develop more effective treatments for amyotrophic lateral sclerosis (ALS).

In January 2023, a strategic partnership between Microsoft, Schneider Electric, and Emirates Health Services led to the development of EcoStruxure for Healthcare. This innovative digital twin platform is designed to significantly enhance the efficiency and sustainability of UAE hospitals. By optimizing energy consumption and overall operational performance, the solution aims to achieve a 30% improvement in hospital efficiency.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.41 Bn |

| Market Size by 2032 | US$ 28.88 Bn |

| CAGR | CAGR of 40.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Process & System Digital Twin, Product Digital Twin) • By Application (Asset and Process Management, Personalized Medicine, Drug Discovery, Others) • By End-use (Clinical Research Organizations (CROs), Hospitals and Clinics, Research & Diagnostic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Atos, Dassault Systems (3DS System), Microsoft, Philips Healthcare, Unlearn.AI, Inc., PrediSurge, QiO Technologies, Verto Healthcare, ThoughWire, Fasttream Technologies, Twin Health |

| Key Drivers |

• By creating dynamic, virtual representations of patients, organs or even entire healthcare systems, digital twins offer unprecedented opportunities for improvement

• Digital Twins in Personalized and Precision Medicine |

| Market Restraints | • Heterogeneity and Complexity of Healthcare Data Sources |

Ans: Digital Twins in Healthcare Market is anticipated to expand by 68.0% from 2023 to 2030.

Ans: USD 76.14 billion is expected to grow by 2030.

Ans: Digital Twins in Healthcare Market size was valued at USD 1.2 billion in 2022.

Ans: In healthcare, digital twins are used to create digital representations of healthcare data such as lab findings, hospital environments, and human physiology. The representations aid in cost optimisation, efficiency improvement, and forecasting future demand. These are some of the important reasons that are expected to boost technology demand throughout the projected period.

Ans: Digital Twins can provide a secure environment for evaluating the impact of changes on system performance.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Digital Twins in Healthcare Market Segmentation, by Type

7.1 Introduction

7.2 Process & System Digital Twin

7.3 Product Digital Twin

8. Digital Twins in Healthcare Market Segmentation, by Application

8.1 Introduction

8.2 Asset and Process Management

8.3 Personalized Medicine

8.4 Drug Discovery

8.5 Others

9. Digital Twins in Healthcare Market Segmentation, by End-use

9.1 Introduction

9.2 Clinical Research Organizations (CRO)

9.3 Hospitals and Clinics

9.4 Research & Diagnostic Laboratories

9.5 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Digital Twins in Healthcare Market by Country

10.2.3 North America Digital Twins in Healthcare Market by Type

10.2.4 North America Digital Twins in Healthcare Market by Application

10.2.5 North America Digital Twins in Healthcare Market by End-use

10.2.6 USA

10.2.6.1 USA Digital Twins in Healthcare Market by Type

10.2.6.2 USA Digital Twins in Healthcare Market by Application

10.2.6.3 USA Digital Twins in Healthcare Market by End-use

10.2.7 Canada

10.2.7.1 Canada Digital Twins in Healthcare Market by Type

10.2.7.2 Canada Digital Twins in Healthcare Market by Application

10.2.7.3 Canada Digital Twins in Healthcare Market by End-use

10.2.8 Mexico

10.2.8.1 Mexico Digital Twins in Healthcare Market by Type

10.2.8.2 Mexico Digital Twins in Healthcare Market by Application

10.2.8.3 Mexico Digital Twins in Healthcare Market by End-use

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Digital Twins in Healthcare Market by Country

10.3.2.2 Eastern Europe Digital Twins in Healthcare Market by Type

10.3.2.3 Eastern Europe Digital Twins in Healthcare Market by Application

10.3.2.4 Eastern Europe Digital Twins in Healthcare Market by End-use

10.3.2.5 Poland

10.3.2.5.1 Poland Digital Twins in Healthcare Market by Type

10.3.2.5.2 Poland Digital Twins in Healthcare Market by Application

10.3.2.5.3 Poland Digital Twins in Healthcare Market by End-use

10.3.2.6 Romania

10.3.2.6.1 Romania Digital Twins in Healthcare Market by Type

10.3.2.6.2 Romania Digital Twins in Healthcare Market by Application

10.3.2.6.4 Romania Digital Twins in Healthcare Market by End-use

10.3.2.7 Hungary

10.3.2.7.1 Hungary Digital Twins in Healthcare Market by Type

10.3.2.7.2 Hungary Digital Twins in Healthcare Market by Application

10.3.2.7.3 Hungary Digital Twins in Healthcare Market by End-use

10.3.2.8 Turkey

10.3.2.8.1 Turkey Digital Twins in Healthcare Market by Type

10.3.2.8.2 Turkey Digital Twins in Healthcare Market by Application

10.3.2.8.3 Turkey Digital Twins in Healthcare Market by End-use

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Digital Twins in Healthcare Market by Type

10.3.2.9.2 Rest of Eastern Europe Digital Twins in Healthcare Market by Application

10.3.2.9.3 Rest of Eastern Europe Digital Twins in Healthcare Market by End-use

10.3.3 Western Europe

10.3.3.1 Western Europe Digital Twins in Healthcare Market by Country

10.3.3.2 Western Europe Digital Twins in Healthcare Market by Type

10.3.3.3 Western Europe Digital Twins in Healthcare Market by Application

10.3.3.4 Western Europe Digital Twins in Healthcare Market by End-use

10.3.3.5 Germany

10.3.3.5.1 Germany Digital Twins in Healthcare Market by Type

10.3.3.5.2 Germany Digital Twins in Healthcare Market by Application

10.3.3.5.3 Germany Digital Twins in Healthcare Market by End-use

10.3.3.6 France

10.3.3.6.1 France Digital Twins in Healthcare Market by Type

10.3.3.6.2 France Digital Twins in Healthcare Market by Application

10.3.3.6.3 France Digital Twins in Healthcare Market by End-use

10.3.3.7 UK

10.3.3.7.1 UK Digital Twins in Healthcare Market by Type

10.3.3.7.2 UK Digital Twins in Healthcare Market by Application

10.3.3.7.3 UK Digital Twins in Healthcare Market by End-use

10.3.3.8 Italy

10.3.3.8.1 Italy Digital Twins in Healthcare Market by Type

10.3.3.8.2 Italy Digital Twins in Healthcare Market by Application

10.3.3.8.3 Italy Digital Twins in Healthcare Market by End-use

10.3.3.9 Spain

10.3.3.9.1 Spain Digital Twins in Healthcare Market by Type

10.3.3.9.2 Spain Digital Twins in Healthcare Market by Application

10.3.3.9.3 Spain Digital Twins in Healthcare Market by End-use

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Digital Twins in Healthcare Market by Type

10.3.3.10.2 Netherlands Digital Twins in Healthcare Market by Application

10.3.3.10.3 Netherlands Digital Twins in Healthcare Market by End-use

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Digital Twins in Healthcare Market by Type

10.3.3.11.2 Switzerland Digital Twins in Healthcare Market by Application

10.3.3.11.3 Switzerland Digital Twins in Healthcare Market by End-use

10.3.3.12 Austria

10.3.3.12.1 Austria Digital Twins in Healthcare Market by Type

10.3.3.12.2 Austria Digital Twins in Healthcare Market by Application

10.3.3.12.3 Austria Digital Twins in Healthcare Market by End-use

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Digital Twins in Healthcare Market by Type

10.3.3.13.2 Rest of Western Europe Digital Twins in Healthcare Market by Application

10.3.3.13.3 Rest of Western Europe Digital Twins in Healthcare Market by End-use

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Digital Twins in Healthcare Market by Country

10.4.3 Asia-Pacific Digital Twins in Healthcare Market by Type

10.4.4 Asia-Pacific Digital Twins in Healthcare Market by Application

10.4.5 Asia-Pacific Digital Twins in Healthcare Market by End-use

10.4.6 China

10.4.6.1 China Digital Twins in Healthcare Market by Type

10.4.6.2 China Digital Twins in Healthcare Market by Application

10.4.6.3 China Digital Twins in Healthcare Market by End-use

10.4.7 India

10.4.7.1 India Digital Twins in Healthcare Market by Type

10.4.7.2 India Digital Twins in Healthcare Market by Application

10.4.7.3 India Digital Twins in Healthcare Market by End-use

10.4.8 Japan

10.4.8.1 Japan Digital Twins in Healthcare Market by Type

10.4.8.2 Japan Digital Twins in Healthcare Market by Application

10.4.8.3 Japan Digital Twins in Healthcare Market by End-use

10.4.9 South Korea

10.4.9.1 South Korea Digital Twins in Healthcare Market by Type

10.4.9.2 South Korea Digital Twins in Healthcare Market by Application

10.4.9.3 South Korea Digital Twins in Healthcare Market by End-use

10.4.10 Vietnam

10.4.10.1 Vietnam Digital Twins in Healthcare Market by Type

10.4.10.2 Vietnam Digital Twins in Healthcare Market by Application

10.4.10.3 Vietnam Digital Twins in Healthcare Market by End-use

10.4.11 Singapore

10.4.11.1 Singapore Digital Twins in Healthcare Market by Type

10.4.11.2 Singapore Digital Twins in Healthcare Market by Application

10.4.11.3 Singapore Digital Twins in Healthcare Market by End-use

10.4.12 Australia

10.4.12.1 Australia Digital Twins in Healthcare Market by Type

10.4.12.2 Australia Digital Twins in Healthcare Market by Application

10.4.12.3 Australia Digital Twins in Healthcare Market by End-use

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Digital Twins in Healthcare Market by Type

10.4.13.2 Rest of Asia-Pacific Digital Twins in Healthcare Market by Application

10.4.13.3 Rest of Asia-Pacific Digital Twins in Healthcare Market by End-use

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Digital Twins in Healthcare Market by Country

10.5.2.2 Middle East Digital Twins in Healthcare Market by Type

10.5.2.3 Middle East Digital Twins in Healthcare Market by Application

10.5.2.4 Middle East Digital Twins in Healthcare Market by End-use

10.5.2.5 UAE

10.5.2.5.1 UAE Digital Twins in Healthcare Market by Type

10.5.2.5.2 UAE Digital Twins in Healthcare Market by Application

10.5.2.5.3 UAE Digital Twins in Healthcare Market by End-use

10.5.2.6 Egypt

10.5.2.6.1 Egypt Digital Twins in Healthcare Market by Type

10.5.2.6.2 Egypt Digital Twins in Healthcare Market by Application

10.5.2.6.3 Egypt Digital Twins in Healthcare Market by End-use

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Digital Twins in Healthcare Market by Type

10.5.2.7.2 Saudi Arabia Digital Twins in Healthcare Market by Application

10.5.2.7.3 Saudi Arabia Digital Twins in Healthcare Market by End-use

10.5.2.8 Qatar

10.5.2.8.1 Qatar Digital Twins in Healthcare Market by Type

10.5.2.8.2 Qatar Digital Twins in Healthcare Market by Application

10.5.2.8.3 Qatar Digital Twins in Healthcare Market by End-use

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Digital Twins in Healthcare Market by Type

10.5.2.9.2 Rest of Middle East Digital Twins in Healthcare Market by Application

10.5.2.9.3 Rest of Middle East Digital Twins in Healthcare Market by End-use

10.5.3 Africa

10.5.3.1 Africa Digital Twins in Healthcare Market by Country

10.5.3.2 Africa Digital Twins in Healthcare Market by Type

10.5.3.3 Africa Digital Twins in Healthcare Market by Application

10.5.3.4 Africa Digital Twins in Healthcare Market by End-use

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Digital Twins in Healthcare Market by Type

10.5.3.5.2 Nigeria Digital Twins in Healthcare Market by Application

10.5.3.5.3 Nigeria Digital Twins in Healthcare Market by End-use

10.5.3.6 South Africa

10.5.3.6.1 South Africa Digital Twins in Healthcare Market by Type

10.5.3.6.2 South Africa Digital Twins in Healthcare Market by Application

10.5.3.6.3 South Africa Digital Twins in Healthcare Market by End-use

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Digital Twins in Healthcare Market by Type

10.5.3.7.2 Rest of Africa Digital Twins in Healthcare Market by Application

10.5.3.7.3 Rest of Africa Digital Twins in Healthcare Market by End-use

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Digital Twins in Healthcare Market by country

10.6.3 Latin America Digital Twins in Healthcare Market by Type

10.6.4 Latin America Digital Twins in Healthcare Market by Application

10.6.5 Latin America Digital Twins in Healthcare Market by End-use

10.6.6 Brazil

10.6.6.1 Brazil Digital Twins in Healthcare Market by Type

10.6.6.2 Brazil Digital Twins in Healthcare Market by Application

10.6.6.3 Brazil Digital Twins in Healthcare Market by End-use

10.6.7 Argentina

10.6.7.1 Argentina Digital Twins in Healthcare Market by Type

10.6.7.2 Argentina Digital Twins in Healthcare Market by Application

10.6.7.3 Argentina Digital Twins in Healthcare Market by End-use

10.6.8 Colombia

10.6.8.1 Colombia Digital Twins in Healthcare Market by Type

10.6.8.2 Colombia Digital Twins in Healthcare Market by Application

10.6.8.3 Colombia Digital Twins in Healthcare Market by End-use

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Digital Twins in Healthcare Market by Type

10.6.9.2 Rest of Latin America Digital Twins in Healthcare Market by Application

10.6.9.3 Rest of Latin America Digital Twins in Healthcare Market by End-use

11. Company Profiles

11.1 Atos

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Dassault Systems (3DS System)

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Microsoft

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Philips Healthcare

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Unlearn.AI, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 PrediSurge

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 QiO Technologies

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Verto Healthcare

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 ThoughWire,

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Twin Health

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Process & System Digital Twin

Product Digital Twin

By Application

Asset and Process Management

Personalized Medicine

Drug Discovery

Others

By End-use

Clinical Research Organizations (CRO)

Hospitals and Clinics

Research & Diagnostic Laboratories

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Sterilization Wrap Market Size was valued at USD 3.44 Billion in 2023 and is expected to reach USD 14.05 Billion by 2032, growing at a CAGR of 16.94% over the forecast period 2024-2032.

Breathalyzers Market was valued at USD 2.7 billion in 2023 and is expected to reach USD 10.9 billion by 2032, growing at a CAGR of 16.74% from 2024 to 2032.

The Alopecia Treatment Market Size was valued at USD 8.80 Billion in 2023, and is expected to reach USD 20.70 Billion by 2032, and grow at a CAGR of 10.48%.

The Skin Cancer Treatment Market Size was valued at USD 10.98 Billion in 2023 and is expected to reach USD 20.74 Billion by 2032 and grow at a CAGR of 7.66% over the forecast period 2024-2032.

Referral Management Market was valued at USD 3.56 billion in 2023 and is expected to reach USD 11.15 billion by 2032, growing at a CAGR of 13.51% from 2024-2032.

DNA Sequencing Market size was valued at USD 11.5 Billion in 2023 and is expected to reach USD 52.1 Billion by 2032, growing at a CAGR of 17.8% from 2024-2032.

Hi! Click one of our member below to chat on Phone