Digital Signal Processors Market Report Scope and Overview:

The Digital Signal Processors Market Size was valued at USD 1.40 billion in 2025E and is expected to reach USD 5.29 billion by 2033 and grow at a CAGR of 18.02% over the forecast period 2026-2033.

The digital signal processors market has rapidly expanded in recent years due to the surge in technological development coupled with the subsequent increase in the demand for high-performance computing applications. The telecommunications, automotive, and consumer electronics industries are in desperate need of digital signal processing that can efficiently process the vast amount of data present within the sectors. The digital signal processors market benefits from the new opportunity of integrating deep learning and artificial intelligence, increasing the DSP's efficiency at processing real-time data and complex algorithms.

Digital Signal Processors Market Size and Forecast:

-

Market Size in 2025E: USD 1.19 Billion

-

Market Size by 2033: USD 4.48 Billion

-

CAGR: 18.02% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Digital Signal Processors Market - Request Sample Report

Digital Signal Processors Market Highlights:

-

Rising adoption of 4K and 8K ultra-HD displays for sharper and more engaging visual experiences.

-

Integration of AI and machine learning for personalized and targeted content delivery.

-

Increasing use of cloud-based digital signage solutions for remote content management and scalability.

-

Growing demand for interactive touchscreens and gesture-based displays in retail and hospitality.

-

Expansion of digital-out-of-home (DOOH) advertising networks for real-time, programmatic ad placements.

-

Integration with IoT devices and sensors to deliver context-aware and dynamic content.

-

Shift toward energy-efficient and eco-friendly display technologies, such as LED and OLED.

-

Rising use of digital signage in smart cities for wayfinding, public information, and emergency alerts.

Digital Signal Processors Market Drivers:

-

The automobile industry's growing demand for digital signal processors

The need for digital signal processors is constantly growing in the automotive sector due to its versatile application fields and substantial contribution to expanding vehicles’ capabilities. One of the most common applications is seen in Advanced Driver-Assistance Systems, where DSP is responsible for processing the signals from sensors, cameras, and radar. It allows vehicles to be equipped with an adaptive cruise control, system for collision detection, and lane departure warning systems, they all in turn provide a safer and more comfortable experience of driving. Besides, this processor is heavily used in the audio field, being one of the key components of the in-car sound system and providing a significant level of sound quality. Currently, the digital technologies used in vehicles, such as the aforementioned audio system and onboard navigation, are not the only ones to be rapidly adopted in cars infotainment systems as well as various connectivity and network capabilities are becoming relatively common. Therefore, due to the growing interest and ability of the automotive industry to accommodate these electronic systems, the necessity for DSP is bound to increase even more. Therefore, it can be concluded that the automotive industry is reliant on DSP to be able to respond to the needs of a rapidly changing world where more sophisticated and integrated vehicles are being introduced to consumers.

-

The growing need for DSP chips in the consumer electronics sector.

A growing demand for digital signal processor chips is observed in the sphere of the consumer electronics industry. Firstly, the ongoing complexity and advancements in various electronic devices, including smartphones, smart TVs, wearables, home theatres, and more, make them require more advanced signal processing abilities. Such chips can be used in these devices to help them complete tasks including, but not limited to, audio and video processing, voice, and speech recognition, image upgrading and compression, data transformations, and more. Secondly, a growing number of Internet of Things devices and the progressing implementation of smart home devices make such chips more in demand. They are used by devices to process sensor data and provide the simplest connection between units.

Digital Signal Processors Market Restraints:

-

The intricacies involved in designing and programming digital signal processor architectures pose challenges that hinder market growth

Digital signal processor architectures’ design and programming impose complexities, and it involves significant challenges that hinder their present in the market. Designing of these chips involves the balance of factors such as low costs, power minimization, performance maximization, and computing optimization, a concept that is difficult to meet for the chip designers. Besides, the manufacturing of these processors requires a high level of precision and accuracy which might not be ascertained by a green workforce. Thus, the cost of production increases for the semiconductor manufacturers as it depends on a highly competent workforce.

Digital Signal Processors Market Segment Overview:

By Type, General-Purpose DSPs Dominate with Versatile Applications Across Industries

The general-purpose DSP segment dominated with a market share of over 40% in 2025. These systems are adaptable, which aids their usage in a majority of the applications. Their applications include audio and video processing, telecommunications, and industrial automation. Further, they are multi-tasking and thus, can perform simultaneous tasks, which increases their application in different industries. For instance, the general-purpose DSP used in smartphones and tablets to process video and audio is Snapdragon DSP designed by Qualcomm. This DSP is also applied in such devices to recognize images and voice.

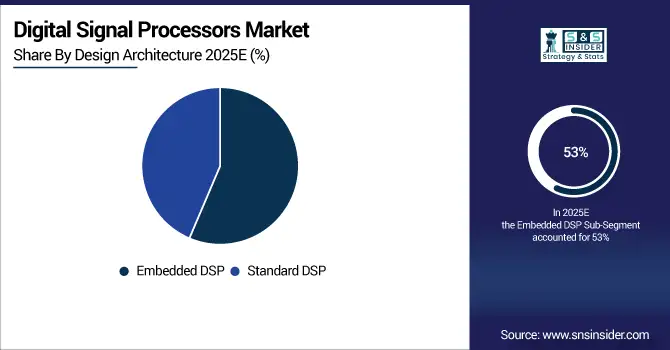

By Design Architecture, Embedded DSPs Lead the Market with Over 53% Share in 2025

The embedded DSP segment held a major market share in 2025 with over 53% market share. Embedded Digital Signal Processors represent one of the main building blocks of modern digital electronics. Boasting exceptional performance, DSPs find their application in signal processing, particularly in telecommunications, audio and image processing, etc. Embedded DSPs are designed to perform various complex mathematical operations and processes, thus enabling the real-time processing of digital signals. In other words, processing is embedded in the device itself, not requiring a separate processing unit. In this way, embedded DSPs changed the way processing of electrical signals has traditionally been performed and allowed for data processing at higher speeds, greater accuracy, and efficiency, and broader functionality.

By Application, Audio and Video Compression Segment Drives Market Growth with 32% Share

The audio and video compression segment led the market in 2025 with over 32%, as it is an important technology that greatly reduces data size while keeping the relevant quality. The main way audio is compressed in the DSP is through the use of mathematical methods allowing the masking of the sounds. For example, a CD Quality audio track is usually around 1.4 megabits per second, a similar bitrate for an MP3 is 128 kilobits per second. Video compression, in turn, is the process of reducing the data amount required to present a sequence of video and keep its acceptable quality level. There are DSPs with implemented complex algorithms H.264 and H.265, which use different tools, such as motion estimation, and transforms like discrete cosine ones to compress the video data. For instance, the H.264 algorithm is widely used in streaming and broadcasting and provides up to a 50:1 compression ratio.

Digital Signal Processors Market Regional Analysis

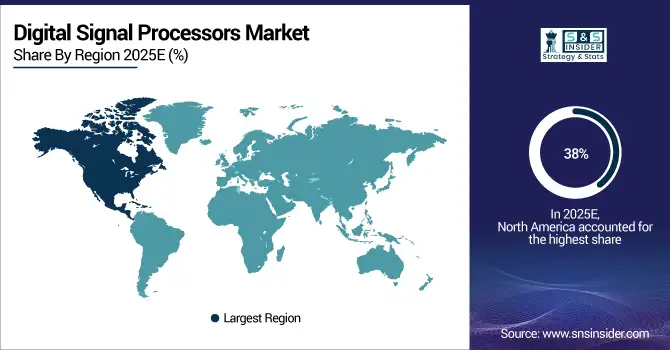

North America Dominates the Digital Signal Processors Market in 2025

In 2025, North America commands an estimated 38% share of the Digital Signal Processors Market, solidifying its leadership position. The region’s dominance is fueled by strong adoption of advanced consumer electronics, rapid 5G rollout, and a mature semiconductor ecosystem. Significant R&D investments in AI-enabled processors, widespread IoT integration, and growing demand across automotive, defense, and healthcare applications further strengthen the market. With continuous innovation and early adoption of high-performance processors, North America remains the largest hub for DSP development and deployment globally.

Get Customized Report as per your Business Requirement - Request For Customized Report

United States Leads North America’s Digital Signal Processors Market

The United States dominates due to its leadership in semiconductor R&D, advanced electronics manufacturing, and widespread DSP integration across industries. Home to global technology giants such as Qualcomm, Texas Instruments, and Intel, the country spearheads innovations in AI-enabled DSPs for telecommunications, multimedia, and automotive solutions. Strong demand for smartphones, IoT devices, and defense applications accelerates DSP utilization. Moreover, the U.S. benefits from robust funding for semiconductor startups, large-scale 5G infrastructure, and a growing EV and autonomous vehicle ecosystem, making it the primary driver of North America’s DSP market leadership in 2025.

Asia Pacific is the Fastest-Growing Region in the Digital Signal Processors Market in 2025

The Asia Pacific DSP Market is projected to grow at a robust 20% CAGR from 2026 to 2033. This growth is fueled by massive consumer electronics demand, rapid expansion of semiconductor manufacturing, and increasing adoption of AI, IoT, and automotive technologies. Rising investments in 5G infrastructure, coupled with government-backed digital initiatives, further accelerate DSP deployment. Countries like China, Japan, and South Korea lead in electronics innovation, positioning Asia Pacific as the fastest-growing hub for digital signal processing solutions worldwide.

China Leads Asia Pacific’s Digital Signal Processors Market

China dominates due to its vast consumer electronics base, strong 5G adoption, and large-scale investments in semiconductor self-reliance. With global leadership in smartphone production and IoT deployment, DSP demand has surged across telecom, multimedia, and automotive industries. Government policies supporting chip innovation, combined with the presence of domestic DSP developers, boost local manufacturing capabilities. Furthermore, Chinese tech companies are integrating DSPs into AI-driven applications, cloud computing, and smart city projects, solidifying China’s role as the leading market for DSPs in the Asia Pacific region in 2024.

Europe Digital Signal Processors Market Insights, 2025

Europe shows steady growth in 2025, driven by strong adoption of DSPs in the automotive, industrial automation, and consumer electronics sectors. The region’s focus on electric vehicles, ADAS, and Industry 4.0 technologies is fueling demand for high-performance processors.

Germany Leads Europe’s Digital Signal Processors Market

Germany dominates due to its advanced automotive engineering, semiconductor R&D, and strong push toward digital transformation in manufacturing. German automakers are integrating DSPs for infotainment, ADAS, and EV systems, while its industrial sector leverages DSPs for automation and robotics. With government support for semiconductor innovation, strict quality standards, and a highly developed engineering ecosystem, Germany remains the primary driver of Europe’s DSP market in 2025.

Middle East & Africa and Latin America Digital Signal Processors Market Insights, 2025

The Digital Signal Processors Market in the Middle East & Africa and Latin America is witnessing steady growth in 2025, supported by rising telecom infrastructure, expanding consumer electronics usage, and smart city initiatives. In the Middle East, Saudi Arabia and the UAE are leading with strong investments in 5G, defense technologies, and IoT adoption. In Latin America, Brazil and Mexico drive growth with increasing demand for smartphones, automotive electronics, and telecom expansion. Rapid urbanization, government-backed digitalization programs, and foreign investments further boost DSP adoption across both regions.

Competitive Landscape for the Digital Signal Processors Market:

Analog Devices, Inc.

Analog Devices, Inc. is a U.S.-based leader in high-performance analog, mixed-signal, and digital signal processing (DSP) solutions. The company designs, develops, and markets DSPs for audio, video, telecommunications, industrial automation, and automotive applications. With decades of experience, Analog Devices integrates precision engineering with advanced signal processing technology, delivering high-performance, reliable solutions. Its role in the DSP market is significant, providing scalable, multi-purpose processors that enable real-time processing, high-speed computation, and efficient data handling across diverse applications.

-

In April 2024, Analog Devices launched enhanced DSPs for 5G infrastructure and industrial automation, boosting performance and energy efficiency for high-demand applications.

Texas Instruments Incorporated

Texas Instruments (TI) is a U.S.-based DSP and semiconductor leader, offering a broad portfolio of processors, microcontrollers, and analog ICs. TI’s DSP solutions cater to automotive, communications, consumer electronics, and industrial automation sectors, emphasizing high integration, low power, and real-time processing capabilities. Its direct-to-customer and distributor networks enable rapid deployment of advanced processors across global markets. TI’s role in the DSP market is pivotal, as it supports innovation in AI, robotics, audio/video processing, and mobile devices.

-

In March 2024, TI unveiled its next-generation C6000 DSP platform, featuring enhanced AI processing and energy-efficient architecture for embedded applications.

NXP Semiconductors N.V.

NXP Semiconductors is a Netherlands-based semiconductor company specializing in DSPs, microcontrollers, and communication processors for automotive, industrial, and consumer electronics. NXP DSPs provide high-speed processing, audio/video compression, and signal integrity for applications like ADAS, IoT, and wireless communication. The company emphasizes integration, performance, and security in its DSP solutions, strengthening its position in automotive electronics and mobile devices. Its role in the market highlights DSP adoption in connected devices and real-time processing systems.

-

In May 2024, NXP launched its advanced DSP series for automotive ADAS systems, enabling real-time sensor fusion and enhanced driver safety features.

Qualcomm Technologies, Inc.

Qualcomm Technologies, Inc. is a U.S.-based leader in mobile and wireless DSP solutions, known for Snapdragon DSPs integrated into smartphones, tablets, and IoT devices. Qualcomm leverages AI, multimedia, and image/audio processing capabilities to deliver high-performance, low-latency DSPs. Its processors enable real-time voice recognition, image processing, and 5G communications, enhancing user experiences across mobile and consumer electronics. Qualcomm’s role in the DSP market is crucial for enabling next-generation mobile computing and connected technologies.

-

In June 2024, Qualcomm introduced Snapdragon DSP enhancements for AI-powered mobile applications, boosting efficiency, multimedia processing, and real-time analytics.

Digital Signal Processors Market Key Players:

-

Analog Devices, Inc.

-

Texas Instruments Incorporated

-

NXP Semiconductors N.V.

-

Qualcomm Technologies, Inc.

-

Marvell Technology, Inc.

-

Broadcom Inc.

-

Infineon Technologies AG

-

STMicroelectronics N.V.

-

Microchip Technology Inc.

-

Renesas Electronics Corporation

-

MediaTek Inc.

-

Intel Corporation

-

Cirrus Logic, Inc.

-

Toshiba Electronic Devices & Storage Corporation

-

Asahi Kasei Microdevices Corporation

-

ON Semiconductor Corporation

-

Xilinx, Inc.

-

Lattice Semiconductor Corporation

-

VeriSilicon Holdings Co., Ltd.

-

Silicon Laboratories Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.40 Billion |

| Market Size by 2033 | USD 5.29 Billion |

| CAGR | CAGR of 18.02% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Programmable (FPGA & PLD) DSP IC, Application-Specific DSP IC, General-Purpose DSP IC) • By Design Architecture (Embedded DSP, Standard DSP) • By Application (Speech Processing And Recognition, Digital Image Processing, Audio And Video Compression, Audio Signal Processing, Radar Applications, Others) • By Industry (Military And Defense, Consumer Electronics, Healthcare, Telecommunication, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Analog Devices, Inc., Texas Instruments Incorporated, NXP Semiconductors N.V., Qualcomm Technologies, Inc., Marvell Technology, Inc., Broadcom Inc., Infineon Technologies AG, STMicroelectronics N.V., Microchip Technology Inc., Renesas Electronics Corporation, MediaTek Inc., Intel Corporation, Cirrus Logic, Inc., Toshiba Electronic Devices & Storage Corporation, Asahi Kasei Microdevices Corporation, ON Semiconductor Corporation, Xilinx, Inc., Lattice Semiconductor Corporation, VeriSilicon Holdings Co., Ltd., Silicon Laboratories Inc. |