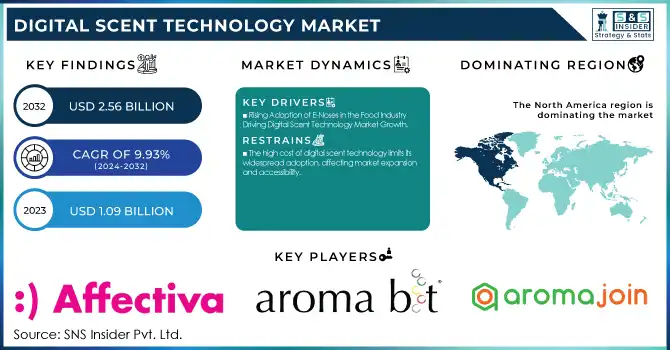

The Digital Scent Technology Market size was valued at USD 1.09 Billion in 2023 and expected to reach USD 2.56 Billion by 2032, growing at a CAGR of 9.93% during 2024-2032.

This growth is driven by increasing adoption across industries such Gaming, healthcare, retail, and virtual reality sectors, where scent integration enhances the user experience, are helping the industry grow. The increasing application of AI-assisted olfaction, custom scent marketing, and electronic nose (E-Nose) technology for diagnostics and security is, in turn, driving the market growth.

To get more information on Digital Scent Technology Market - Request Free Sample Report

Adoption rates across technologies, for example, are tracking differently, with electronic noses, scent diffusion systems, and olfactory sensors paving the way. He cites operational costs as an important factor, which affect market penetration and pricing. This is led to the importance of regulatory compliance particularly in the healthcare, food safety, and other consumer electronics which play a pivotal role in determining product approval and market entry barriers. According to consumer surveys, there is an increasing demand for incredibly immersive and multi-sensory experiences and that is resulting in strong demand for digital scent solutions. As industries prioritize realism and engagement, digital scent technology continues to evolve, driving widespread adoption and technological advancements.

Drivers:

Rising Adoption of E-Noses in the Food Industry Driving Digital Scent Technology Market Growth

The increasing use of electronic noses (e-noses) in the food industry is a major driver of the digital scent technology market, as they enable rapid, objective, and non-destructive analysis of volatile compounds for process monitoring, freshness evaluation, and authenticity assessment. Research has demonstrated their effectiveness in applications such as monitoring aroma compounds during wine fermentation, detecting spoilage markers like ammonia and sulfur compounds in meat with over 90% accuracy, and differentiating pure extra virgin olive oils from adulterated ones with an accuracy exceeding 95%. Additionally, e-noses are proving valuable in detecting foodborne pathogens and spoilage bacteria, significantly enhancing food safety measures. As food manufacturers increasingly emphasize quality assurance and regulatory compliance, the demand for digital scent technology is expected to surge, fueling market expansion over the coming years.

Restraints:

The high cost of digital scent technology limits its widespread adoption, affecting market expansion and accessibility.

The high cost of production stems from considerable research and development costs associated with developing and producing electronic noses (e-noses) and scent synthesizers, as well as the need for specialized materials and components. As a result, the price of these technologies tends to be somewhat high, making it difficult for small and medium-sized enterprises to adopt them. This financial challenge restricts the adoption of digital aroma solutions, especially in price-sensitive areas. As the market continues to evolve, efforts to reduce production costs and enhance affordability will be crucial in promoting broader adoption of digital scent technologies.

Opportunities:

Advancements in Explosive Detection Present Opportunities for Digital Scent Technology in Airport Security

Recent technological advancements in explosive trace detection (ETD) are enhancing airport security and efficiency. The Transportation Security Administration (TSA) has implemented computed tomography (CT) checkpoint scanners that provide 3D imaging, enabling automatic detection of explosives, including liquids, and reducing the need for manual bag checks. These CT systems produce detailed images, enabling identification of potential threats with a high level of accuracy. Moreover, micro-sensor-based ETDs capable of detecting explosives, including RDX and ammonium nitrate, at the nanogram level have also been developed, allowing for fast and accurate threat identification. AI-based ETDs can identify different explosive materials, which strengthen the security measures. These advancements highlight significant opportunities for digital scent technology to contribute to more effective and efficient security solutions in the aviation sector.

Challenges:

The Absence of Standardization Limits Interoperability and Growth in Digital Scent Technology.

The lack of universal standards in digital scent technology creates significant challenges in interoperability, data consistency, and cross-platform compatibility. The proprietary nature of the algorithms and sensor designs makes it difficult to integrate systems across different industries including healthcare, security, and food safety. In the absence of standardized protocols, the accuracy of scent recognition varies, thereby affecting the reliability and global acceptance of the technology. Defining standard protocols and methodologies for odor detection, classification, and data processing is crucial for interworking, building trust in the users, and speeding up market penetration. Industry collaboration and regulatory frameworks are crucial to overcoming this barrier.

By Hardware

E-noses segment is dominated the largest share revenue in Digital Scent Technology Market of around 55% in 2023, driven by the widespread use of e-noses in various sectors, such as food & beverage, healthcare and security. In the food industry, the e-noses are used to enhance quality control by determining spoilage, verifying the authenticity of products, and following the progress of fermentation. In the medical field, they help with the discovery of disease through the analysis of breath biomarkers, which can enhance early diagnosis of diseases including lung cancer and metabolic disorders such as diabetes. Applications are also growing in security, with e-noses deployed in airport screening in a quest to detect explosives. Growing demand for powered olfactory sensors, advancement in miniaturization, and increasing requirement of real-time odor analysis are promoting the growth of this segment. E-noses will likely remain the lead and pioneer of digital scent implementations across different industries with more investments improving sensitivity and response time.

The scent synthesizers segment is projected to be the fastest-growing in the Digital Scent Technology Market from 2024 to 2032. Driven by growing need in entertainment, virtual reality (VR), and immersible experiences, scent synthesis doesn't only heighten human engagement by reproducing all associated smells from the real world; this segment is expected to see strong adoption over the next few years. Adding to the tech-factory experience, gaming, cinema, and retail industries are filtering digital scent systems to create more immersive environments. Moreover, the medical field is also looking into utilizing scent synthesizers for therapeutic purposes, such as relieving stress or stimulating cognitive function. Moreover, the integration of artificial olfactory technology and machine learning will ensure greater accuracy and customization in scent creation. Growing consumer demand for multi-sensory experiences, increased investment in digital olfaction research, and broader applications in advertising and smart home devices are driving growth in the scent synthesizers segment in the forecast period.

By Application

The Medical Diagnostic Products segment accounted for the largest share, around 26%, of the Digital Scent Technology Market in 2023. Due to the increasing utilization of electronic noses (e-noses) for non-invasive disease diagnosis, especially in respiratory and metabolic disorders. Owing to the presence of volatile organic compounds (VOCs) in the breath, advanced olfactory sensors are being used for the early-stage diagnosis of conditions such as lung cancer, diabetes, and bacterial infection. The growing burden of chronic diseases along with the need for faster and accurate diagnostic methods is driving market growth. Moreover, advances in artificial olfaction and machine learning are constantly being developed, aiding the accuracy and efficiency of digital scent-based diagnostics. Additionally, ongoing research and development in artificial olfaction and machine learning have enhanced the accuracy and efficiency of digital scent-based diagnostics. With regulatory support for non-invasive medical technologies and expanding healthcare applications, the segment is expected to maintain its leading position in the forecast period, further driving the adoption of digital scent solutions in the medical field.

The Smartphones segment is projected to experience substantial growth in the Digital Scent Technology Market over the forecast period (2024-2032). The growth is propelled by the rapid research and development of mobile-based olfactory sensors to provide scent-based applications for health monitoring, personalized user experience, and improved digital interaction. Different companies are adding digital scent capabilities to smartphones — for sensing air quality, for checking food freshness or even for analyzing your breath for possible health alerts. Growing consumer need for engaging, multi-sensory experiences in mobile devices is also boosting market growth. In addition, partnerships between technology companies and healthcare organizations are paving the way for mobile-compatible osmatic detection technologies, encouraging their use in diagnostics and well-being.

By End Use

The Medical segment accounted for the largest revenue share in the Digital Scent Technology Market, contributing approximately 34% in 2023. This dominance is attributed to the rising use of e-noses and scent detection systems in medical diagnostics, disease detection, and patient monitoring. The considerable developments made in electronic nose technology have apprehended the attention of medical experts for non-invasive breath analysis of various Instantaneous diseases, such as respiratory diseases, diabetes, lung cancer, and a variety of other pathological conditions. Increasing need for early disease diagnosis and real-time monitoring of health conditions has led to investments in Ai-powered olfactory sensors for various medical applications. In addition, R&D in the field of biomarker based scent detection has further bolstered the segment’s growth. Existing use cases, such as in telemedicine and remote healthcare solutions, also open up new areas of market potential for digital scent technology. As the healthcare industry embraces advanced diagnostic tools, the Medical segment is expected to maintain its leading position, driving continuous innovation and adoption in the coming years.

The Environmental Monitoring segment is projected to be the fastest-growing in the Digital Scent Technology Market during the forecast period 2024-2032. The increasing need for air quality assessment, pollution control, and hazardous gas detection is driving the demand for advanced olfactory sensors. Digital scent technology is being deployed to monitor industrial emissions, detect volatile organic compounds (VOCs), and ensure compliance with environmental regulations. Governments and regulatory bodies worldwide are implementing stricter air quality standards, boosting the adoption of electronic noses (e-noses) for real-time environmental analysis. Additionally, the integration of AI and IoT in scent detection systems enhances their accuracy and efficiency, making them essential for smart city initiatives and sustainable development.

North America dominated the Digital Scent Technology Market in 2023, accounting for approximately 36% of the total revenue. The region's leadership is driven by strong technological advancements, high R&D investments, and the presence of key industry players such as Aryballe Technologies, Sensigent LLC, and Smiths Detection Group. The United States holds the largest market share, with extensive adoption of digital scent technology in medical diagnostics, security, and environmental monitoring. Government initiatives supporting advanced sensory technologies, particularly for homeland security and healthcare applications, further bolster market growth. Canada is also emerging as a key contributor, leveraging AI-driven olfactory systems for air quality monitoring and industrial applications. Additionally, the demand for digital scent solutions in consumer electronics and automotive industries is rising, with companies integrating olfaction sensors into smart devices and luxury vehicles. The region's well-established infrastructure, strong regulatory framework, and increasing adoption of digital scent applications across multiple industries ensure its continued dominance in the forecast period.

Europe is the fastest-growing region in the Digital Scent Technology Market, due to increasing AI-driven olfaction enhancements, growing acceptance of digital scent solutions across the healthcare sector, and support given by the government for research and development. Germany, France, and the UK are among the leading nations that have forwarded their development of e-nose technology for diagnostics in medicine, food safety, and environmental monitoring. These strict quality and safety regulations by the European Union compel the industries to maintain such elevated standards which have been key drivers in the adoption of advanced scent detection solutions in the region, especially in pharmaceuticals and security. Germany is at the fore of industrial applications of this technology, notably in automation and robotics. While France follows innovations in the luxury and fragrance industry thanks to digital scent, the UK is exploring health care use and using electronic noses for early disease detection. Also, increasing collaboration between universities, research institutes and tech companies is speeding up innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the Major Players in Digital Scent Technology Market along with their product:

Affectiva (United States) [Emotion AI & Scent Detection]

Aroma Bit, Inc. (Japan) [Electronic Olfaction Sensors]

Aromajoin Corporation (Japan) [Digital Scent Technology]

Fraunhofer IIS (Germany) [Sensory & Electronic Nose Technology]

Kiwa Bio-Tech Products Group Corporation (China) [Bio-Tech & Environmental Solutions]

Owlstone Inc. (United Kingdom) [Chemical Sensing & Breath Analysis]

Scentsy, Inc. (United States) [Fragrance & Home Scent Solutions]

Sensigent LLC (United States) [Gas & Odor Detection Systems]

Smiths Detection Group Ltd. (United Kingdom) [Security & Threat Detection]

The eNose Company (Netherlands) [Artificial Olfaction & Medical Diagnostics]

Vapor Communications (United States) [Digital Scent Communication]

Aryballe Technologies (United States) [Digital Olfaction & Scent Recognition]

Adamant Technologies (United States) [AI-Based Scent & Taste Analysis]

ScentAir Technologies LLC (United States) [Scent Marketing & Diffusion Systems]

Aromax (Mexico) [Fragrance & Air Care Solutions]

List of Suppliers of Raw Materials & Components for Digital Scent Technology

Scent Detection Sensors & Electronic Noses

Figaro Engineering Inc. (Japan)

Alpha MOS (France)

Sensirion AG (Switzerland)

Aroma Bit, Inc. (Japan)

Microfluidic & Scent Diffusion Components

Dolomite Microfluidics (United Kingdom)

Cellix Ltd. (Ireland)

Parker Hannifin Corporation (United States)

Scent Encapsulation & Fragrance Ingredients

Firmenich SA (Switzerland)

International Flavors & Fragrances Inc. (United States)

Symrise AG (Germany)

AI & Software for Scent Recognition

Aryballe Technologies (United States)

Adamant Technologies (United States)

Fraunhofer IIS (Germany)

In June 2024 – Aroma Bit have developed e-Nose type odor imaging sensor based on CMOS semiconductors, Among the smallest in the world with highly integrated 1.2mm × 1.2mm sensor element with 100 odor-receptor membranes making it easy to integrate with all types of devices.

11 Nov 2024– The e-Nose created by the University of Hertfordshire researchers can sample 60 times a second to imitate a mouse's sense of smell, which allows real-time detection of odor patterns for following the source of scent through swampy environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.09 Billion |

| Market Size by 2032 | USD 2.56 Billion |

| CAGR | CAGR of 9.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Hardware (E-noses, Scent Synthesizers, Others) • By Application(Smart Phones, Smelling Screens, Music and Video Games, Explosive Detectors, Quality Control Products, Medical Diagnostic Products, Others) • By End Use(Food & Beverages, Military & Defence, Medical, Marketing, Environment Monitoring, Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Affectiva (United States), Aroma Bit, Inc. (Japan), Aromajoin Corporation (Japan), Fraunhofer IIS (Germany), Kiwa Bio-Tech Products Group Corporation (China), Owlstone Inc. (United Kingdom), Scentsy, Inc. (United States), Sensigent LLC (United States), Smiths Detection Group Ltd. (United Kingdom), The eNose Company (Netherlands), Vapor Communications (United States), Aryballe Technologies (United States), Adamant Technologies (United States), ScentAir Technologies LLC (United States), Aromax (Mexico). |

Ans: The Digital Scent Technology Market is expected to grow at a CAGR of 9.93% during 2024-2032.

Ans: The Digital Scent Technology Market was USD 1.09 billion in 2023 and is expected to Reach USD 2.56 billion by 2032.

Ans: The key drivers of the Digital Scent Technology Market include advancements in AI and sensor technology, increasing demand for multisensory user experiences, and growing applications in healthcare, entertainment, and marketing.

Ans: The “E-noses” segment dominated the Digital Scent Technology Market.

Ans: North America dominated the Digital Scent Technology Market in 2023

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rate by Technology

5.2 Operational Costs

5.3 Regulatory Compliance Data

5.4 Consumer Surveys & Demand Analysis

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Digital Scent Technology Market Segmentation, by Hardware

7.1 Chapter Overview

7.2 E-noses

7.2.1 E-noses Market Trends Analysis (2020-2032)

7.2.2 E-noses Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Scent Synthesizers

7.3.1 Scent Synthesizers Market Trends Analysis (2020-2032)

7.3.2 Scent Synthesizers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Digital Scent Technology Market Segmentation, by Application

8.1 Chapter Overview

8.2 Smart Phones

8.2.1 Smart Phones Market Trends Analysis (2020-2032)

8.2.2 Smart Phones Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Smelling Screens

8.3.1 Smelling Screens Market Trends Analysis (2020-2032)

8.3.2 Smelling Screens Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Music and Video Games

8.4.1 Music and Video Games Market Trends Analysis (2020-2032)

8.4.2 Music and Video Games Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Explosive Detectors

8.5.1 Explosive Detectors Market Trends Analysis (2020-2032)

8.5.2 Explosive Detectors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Quality Control Products

8.6.1 Quality Control Products Market Trends Analysis (2020-2032)

8.6.2 Quality Control Products Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Medical Diagnostic Products

8.7.1 Medical Diagnostic Products Market Trends Analysis (2020-2032)

8.7.2 Medical Diagnostic Products Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Digital Scent Technology Market Segmentation, by End Use

9.1 Chapter Overview

9.2 Food & Beverages

9.2.1 Food & Beverages Market Trends Analysis (2020-2032)

9.2.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Military & Defence

9.3.1 Military & Defence Market Trends Analysis (2020-2032)

9.3.2 Military & Defence Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Medical

9.4.1 Medical Market Trends Analysis (2020-2032)

9.4.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Marketing

9.5.1 Marketing Market Trends Analysis (2020-2032)

9.5.2 Marketing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Environment Monitoring

9.6.1 Environment Monitoring Market Trends Analysis (2020-2032)

9.6.2 Environment Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Entertainment

9.7.1 Entertainment Market Trends Analysis (2020-2032)

9.7.2 Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Digital Scent Technology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.2.4 North America Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.2.6.2 USA Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.2.7.2 Canada Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.2.8.2 Mexico Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Digital Scent Technology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.1.6.2 Poland Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.1.7.2 Romania Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Digital Scent Technology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.4 Western Europe Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.6.2 Germany Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.7.2 France Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.8.2 UK Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.9.2 Italy Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.10.2 Spain Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.13.2 Austria Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Digital Scent Technology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.6.2 China Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.7.2 India Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.8.2 Japan Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.9.2 South Korea Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.10.2 Vietnam Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.11.2 Singapore Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.12.2 Australia Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Digital Scent Technology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.1.4 Middle East Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.1.6.2 UAE Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Digital Scent Technology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.2.4 Africa Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Digital Scent Technology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.6.4 Latin America Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.6.6.2 Brazil Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.6.7.2 Argentina Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.6.8.2 Colombia Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Digital Scent Technology Market Estimates and Forecasts, by Hardware (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Digital Scent Technology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Digital Scent Technology Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Affectiva

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Aroma Bit, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Aromajoin Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Fraunhofer IIS

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Kiwa Bio-Tech Products Group Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Owlstone Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Scentsy, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Sensigent LLC

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Smiths Detection Group Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 The eNose Company

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Hardware

E-noses

Scent Synthesizers

Others

By Application

Smart Phones

Smelling Screens

Music and Video Games

Explosive Detectors

Quality Control Products

Medical Diagnostic Products

Others

By End Use

Food & Beverages

Military & Defence

Medical

Marketing

Environment Monitoring

Entertainment

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Thin-Film Encapsulation Market size was valued at USD 110.53 million in 2023 and is expected to grow to USD 549.27 million by 2032 and grow at a CAGR Of 19.5% over the forecast period of 2024-2032.

The Frequency Converter Market Size was valued at USD 27.15 billion in 2023 and is expected to grow at a CAGR of 9.36% to reach USD 60.60 billion by 2032.

The DRAM Module and Component Market Size was valued at $96.91 Billion in 2023 and is expected to grow at a CAGR of 1.75% to reach $113.26 Billion by 2032

The Consumer Electronics Market size was valued at USD 956.12 Billion in 2023 & will reach USD 1775.27 Billion by 2032, with a CAGR of 7.14% by 2024-2032.

The SiC Device Market size was valued at USD 2.35 billion in 2023 and is expected to reach USD 15.82 billion by 2032 and grow at a CAGR of 23.6% over the forecast period 2024-2032.

The Image Intensifier Market was valued at USD 1.54 billion in 2023 and is expected to reach USD 2.98 billion by 2032, growing at a CAGR of 7.70% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone