Digital PCR Market Size & Trends

Get more information on Digital PCR-dPCR Market - Request Sample Report

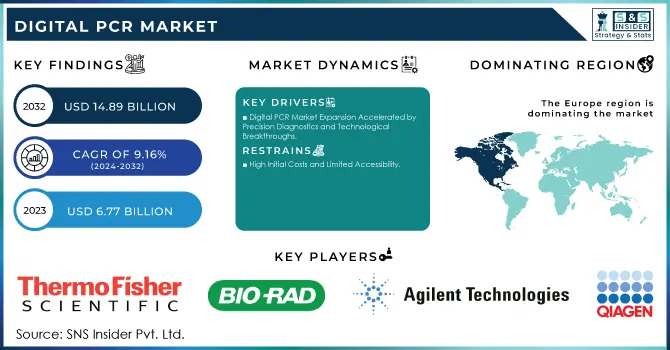

The Digital PCR Market size was valued at USD 6.77 billion in 2023 and is expected to reach USD 14.89 billion by 2032, growing at a CAGR of 9.16% over the forecast period 2024-2032.

The Digital PCR market is experiencing robust growth, driven by its exceptional sensitivity and precision in nucleic acid quantification. Unlike traditional PCR, dPCR provides absolute quantification without standard curves, making it essential in personalized medicine, oncology, infectious disease diagnostics, and genetic research. In cancer diagnostics, dPCR has shown remarkable efficiency, detecting circulating tumor DNA (ctDNA) at concentrations as low as 0.01% of total DNA. With sensitivity rates exceeding 95%, it plays a pivotal role in monitoring minimal residual disease (MRD) and tracking tumor-specific mutations. These capabilities enable oncologists to detect early cancer recurrence and assess therapeutic responses, significantly improving patient outcomes. In infectious disease diagnostics, dPCR demonstrated unparalleled utility during the COVID-19 pandemic by detecting viral RNA at lower concentrations than qPCR, especially in cases with high Ct (Cycle threshold) values. This made it instrumental in identifying asymptomatic carriers and monitoring emerging viral mutations. Beyond COVID-19, dPCR’s sensitivity of over 98% for low-level HIV reservoirs aids in effective disease management and epidemiological studies. Innovations like Qiagen’s QIAcuity Digital PCR assays have enhanced microbial DNA quantification, improving surveillance of infectious disease and food safety and environmental microbiology applications. For genetic disorder detection, dPCR has achieved a 99.9% accuracy rate in identifying rare mutations, such as those linked to Duchenne Muscular Dystrophy (DMD) and Fragile X Syndrome, making it a critical tool in prenatal and postnatal diagnostics. Automated platforms like Bio-Rad QX200 and Thermo Fisher QuantStudio Absolute Q are reducing operational costs by 25-30%, enabling high-throughput testing and expanding access to this technology.

Moreover, government investments exceeding USD 1 billion globally in genomic research and rare disease programs are accelerating dPCR adoption. Industrial applications are also on the rise, with dPCR demonstrating 99% specificity in detecting foodborne pathogens like Salmonella and E. coli and quantifying environmental contaminants at levels as low as 1 part per trillion. The versatility, precision, and growing affordability of dPCR are driving its adoption across healthcare, research, and industrial sectors, positioning it as a cornerstone in molecular diagnostics and genomic advancements.

Market Dynamics

Drivers

-

Digital PCR Market Expansion Accelerated by Precision Diagnostics and Technological Breakthroughs

The growth of the Digital PCR market is driven by several pivotal factors, including advancements in technology, the rising prevalence of chronic diseases, and an increasing emphasis on precision diagnostics. Innovations in dPCR technology, such as automated and high-throughput platforms, have significantly improved its accuracy, sensitivity, and usability. These advancements have established dPCR as a preferred solution for applications that require precise quantification of low-abundance nucleic acids, especially in areas like cancer diagnostics and infectious disease management.

The growing burden of chronic and genetic diseases further propels market expansion. dPCR’s exceptional ability to detect rare genetic mutations, monitor minimal residual disease, and accurately quantify genetic variations has positioned it as a critical tool in personalized medicine. As the demand for targeted and individualized therapies continues to rise, dPCR’s role in tracking genetic mutations and enabling precise treatment decisions becomes increasingly crucial.

Additionally, the surge in infectious disease outbreaks and the focus on epidemiological surveillance have accelerated the adoption of dPCR in clinical and research settings. Its unmatched sensitivity for detecting low-level pathogens and viral loads is pivotal in enhancing public health initiatives and outbreak management.

Government investments and funding in genomic research have also provided substantial momentum to the market. Initiatives supporting precision medicine and rare disease research are encouraging the integration of dPCR into healthcare and research systems. Furthermore, the expanding use of dPCR in industrial applications, including food safety testing and environmental monitoring, underscores its versatility and growing significance across multiple sectors.

Restraints

-

High Initial Costs and Limited Accessibility

The advanced technology and infrastructure required for dPCR systems result in high initial investment costs, making it less accessible for small laboratories and research facilities, particularly in low-resource settings. This financial barrier can hinder market growth and adoption rates.

-

Technical Challenges and Expertise Requirements

Operating dPCR systems demands specialized technical knowledge and training, which can limit their widespread use. Additionally, issues such as sample preparation complexity and potential errors in droplet generation or partitioning pose challenges to achieving consistent and accurate results.

Segmentation Insight

By Product

Consumables & reagents dominated the market and accounted for a 60% share of the dPCR market in 2023. This dominance is attributed to their recurrent use in every dPCR test, ensuring steady demand across clinical, research, and industrial applications. The increased adoption of dPCR for applications like cancer diagnostics, infectious disease monitoring, and genetic studies has further driven the need for high-quality reagents and consumables.

The software & services segment is anticipated to witness the fastest growth due to the increasing need for data analysis and interpretation solutions in dPCR workflows. Advanced software tools that enhance automation and streamline workflows are driving adoption in clinical and research settings. Moreover, the growing trend of outsourcing dPCR services to specialized laboratories is contributing to the segment’s rapid growth.

By Application

Clinical applications emerged as the largest segment in 2023, fueled by the widespread adoption of dPCR in cancer diagnostics, infectious disease testing, and prenatal screening. The ability of dPCR to detect low-abundance biomarkers with exceptional sensitivity has made it a cornerstone in personalized medicine and routine diagnostics.

Forensic applications are poised for rapid growth, supported by the increasing use of dPCR in analyzing trace amounts of DNA from complex crime scene samples. Its ability to accurately quantify degraded or mixed DNA samples is driving its adoption in forensic laboratories worldwide.

Regional Analysis

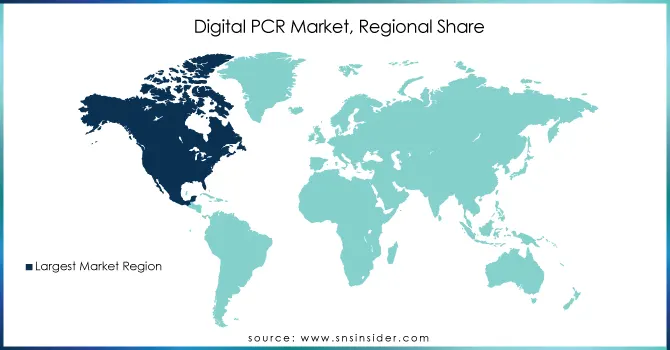

North America led the market in 2023 due to its advanced healthcare infrastructure, high adoption of cutting-edge technologies, and robust investment in research and development. The United States, in particular, accounts for a significant share, driven by the increasing demand for personalized medicine, cancer diagnostics, and infectious disease testing. Furthermore, the presence of major players like Thermo Fisher Scientific and Bio-Rad Laboratories further accelerates market growth in the region.

In Europe, the market is expanding due to rising government investments in genomics and precision medicine initiatives, as well as the growing focus on rare disease research. The United Kingdom, Germany, and France are key contributors to the market, with an emphasis on integrating advanced diagnostic tools into clinical practice.

The Asia-Pacific (APAC) region is experiencing the fastest growth, driven by increased healthcare spending, expanding research facilities, and a rise in chronic disease prevalence. Countries such as China, Japan, and India are witnessing a surge in dPCR adoption due to favorable government policies supporting biotechnology and medical research. The region's rapid development of healthcare infrastructure, alongside growing awareness of advanced diagnostic technologies, further propels market expansion.

Need any customization research on Digital PCR-dPCR Market - Enquiry Now

Key Players

-

QuantStudio 3D Digital PCR System

-

Ion Chef System

-

Applied Biosystems QuantStudio Digital PCR System

-

QX200 Droplet Digital PCR System

-

QX100 Droplet Digital PCR System

-

ddPCR Supermix for Probes

3. QIAGEN

-

QIAcuity Digital PCR System

-

QIAcuity Digital PCR Reagents

4. F. Hoffmann-La Roche Ltd

-

Cobas Digital PCR System (Cobas dPCR)

-

Cobas Digital PCR

5. Fluidigm Corporation

-

Biomark HD System (Digital PCR platform)

-

Digital PCR Reagents

6. Merck KGaA

-

Multi-Analyte dPCR Kits

-

dPCR Assay Kits

7. Agilent Technologies

-

AriaMx Real-Time PCR System (used with dPCR assays)

8. BioMerieux SA

-

BIOFIRE FilmArray (integrated with PCR diagnostics)

9. Takara Bio Inc.

-

TaKaRa dPCR Kit

10. Danaher Corporation

-

Bio-Rad QX200 Droplet Digital PCR System (through subsidiary)

11. JN Medsys

-

dPCR Bio-Chip System

12. Formulatrix, Inc.

-

Digital PCR Consumables and Software

13. Stilla Technologies

-

Naica System for Digital PCR

14. Becton, Dickinson and Company

-

BD Rhapsody Digital PCR System

15. Sysmex Corporation

-

Sysmex Digital PCR Systems (in development)

16. Quantabio

-

qPCR and dPCR Reagents

17. Illumina, Inc.

-

Nextera Digital PCR System

18. Promega Corporation

-

GoTaq Digital PCR System

19. Eppendorf AG

-

Eppendorf Digital PCR System

20. PerkinElmer, Inc.

-

LabChip Digital PCR System

21. LGC Biosearch Technologies

-

dPCR Reagents and Consumables

Recent Developments

-

In Dec 2024, Bio-Rad Laboratories introduced the Vericheck ddPCR Empty-Full Capsid Kit, enabling precise quantification of empty and full adeno-associated virus (AAV) capsids. This kit enhances gene therapy research by offering a reliable method to assess capsid integrity and viral titer across various sample types, ensuring the consistency and effectiveness of AAV-based therapies.

-

In Nov 2024, QIAGEN announced the inclusion of the QIAcuityDx Digital PCR System in the Australian Register of Therapeutic Goods (ARTG), marking a significant expansion of Digital PCR into clinical diagnostics. This IVDR-certified platform will support applications in oncology and infectious diseases across Australia and New Zealand.

-

In June 2024, Stilla Technologies expanded its Nio product line with the addition of two new Digital PCR system configurations. This follows the successful launch of the flagship Nio+ instrument in November 2023, further enhancing their portfolio in multiplex Digital PCR technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.77 billion |

| Market Size by 2032 | USD 14.89 Billion |

| CAGR | CAGR of 9.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Consumables & Reagents, Instruments, Software & Services) •By Type (Droplet Digital PCR, Chip-based Digital PCR, Others) •By Application (Clinical, Research, Forensic) •By Indication (Oncology, Infectious Disease, Genetic Disorders, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Bio-Rad Laboratories, QIAGEN, F. Hoffmann-La Roche Ltd, Fluidigm Corporation, Merck KGaA, Agilent Technologies, BioMerieux SA, Takara Bio Inc., Danaher Corporation, JN Medsys, Formulatrix, Inc., Stilla Technologies, Becton, Dickinson and Company, Sysmex Corporation, Quantabio, Illumina, Inc., Promega Corporation, Eppendorf AG, PerkinElmer, Inc., LGC Biosearch Technologies |

| Key Drivers | • Digital PCR (dPCR) Market Expansion Accelerated by Precision Diagnostics and Technological Breakthroughs |

| Restraints | • High Initial Costs and Limited Accessibility • Technical Challenges and Expertise Requirements |