Digital Payments Market Size & Overview:

The Digital Payments Market Size was valued at USD 103.63 Billion in 2023 and is expected to reach USD 409.28 Billion by 2032 and grow at a CAGR of 16.52% over the forecast period 2024-2032.

Get More Information on Digital Payments Market - Request Sample Report

Rapid Growth of the digital Payment market with e-commerce expanding, the use of online shopping through mobile banking, and the demand for contactless payments are driving the rapid growth of digital payments. Over time, with more customers adopting digital wallets, mobile payment applications, and instant payment systems, the demand for payment solutions that are fast, secure, and hassle-free has increased. This is being driven by increased access to the internet, the rise of smartphone users, and the digitalization of financial services. Then, the current global pandemic type that makes the entire population try to limit activities out of doors their homes has catalyzed the carousel from cash to digital payments, due to the fact clients and corporations want contactless and safer methods to transact business. More than 60% of mobile users worldwide are expected to use mobile payments by 2025. With 50% of all digital payment transactions taking place via digital wallets in 2023, this is expected to increase by 5% points to 55% in 2027. Worldwide e-commerce transactions must exceed USD 8 trillion by 2026. In the UK and Australia, mobile payment and contactless cards comprise more than 40% of overall card transactions. As the ownership of smartphones grows, more than 90% of people living in developed markets are projected to use smartphones to make digital payments by 2025.

Growing government and regulatory support is another important catalyst for embracing digital payment systems and promoting their use in boosting economic growth and financial inclusion. The growth of the market will also be driven by advancements in blockchain and digital currency (CBDC). In addition, the emergence of digital payment platforms that facilitate cross-border transactions combined with improvements in security measures has increased the attractiveness of digital payments to consumers and businesses alike. Surely, with more industries including healthcare, retail, and transportation going digital payment solutions. Looking ahead, 134 countries are considering or have already issued Central Bank Digital Currencies (CBDC) roughly 98% of the global economy by 2024. More than 60% of global financial institutions are adopting blockchain technology, and nearly 70% of banks in developed markets are adopting it. The mBridge CBDC initiative has also helped cut cross-border transaction costs by half and reduced settlement time from 2-3 days to a couple of minutes. Combined with AI-driven fraud detection and through the power of the Blockchain, billions in fraudulent activity are being presented annually (estimates of USD 10 billion). Healthcare: 45% of US hospitals currently accept digital payments. Expect 60% by 2025 73% of global retailers have implemented digital payments while 50% of public transportation systems now offer digital payments, which will increase to 70% by 2027, according to him in the retail and consumer area.

Digital Payments Market Dynamics

KEY DRIVERS:

- The Rise of Digital Wallets and P2P Payments Shaping the Future of Global Consumer Transactions

Digital Wallets Digital wallets emerged as the core of daily consumer life, providing a convenient way to pay without the need for cash or cards. Things like mobile payment platforms like Apple Pay, Google Wallet, and PayPal are starting to take off, allowing the consumer to make purchases without ever having cash or a credit card (or sometimes even their phone). The increase of peer-to-peer (P2P) payment apps like Venmo and Zelle to instantly move money is also fuelling this trend. A surge in global smartphone and mobile app penetration is another factor driving the growth of digital wallets. The increasing adoption of these solutions by consumers forces retailers and service providers to use digital payment systems to stay competitive thus contributing to the growth of the market. There are 4.88 billion smartphone users worldwide, resulting in the rise of several digital wallets such as Apple Pay, Google Pay, and PayPal. 51% of consumers now regularly use P2P payment apps in the U.S. while 14% of merchants accept peer-to-peer payments through apps like PayPal, Venmo, Cash App, and Zelle.

- Empowering the Unbanked Through Digital Payments Driving Growth in Global Financial Inclusion and Connectivity

Digital payment systems are moving people without access to traditional banking services into the financial ecosystem. Mobile money services like M-Pesa in Kenya have brought banking services to millions of previously unbanked people in regions such as Sub-Saharan Africa and Southeast Asia. By providing a safe, affordable method for transferring money, purchasing goods and services, and saving, these platforms can help close the financial gap for underbanked communities. The governments and financial institutions of such regions have also been going ahead with the strategies of a cashless economy by providing the necessary infrastructure and incentives for supporting digital payment systems. Increasing internet penetration and mobile network coverage across the globe is anticipated to promote this growing accessibility to digital payments and thus is expected to bring about significant market growth. M-Pesa has 66.2 million users in Kenya (2024) with 20 billion transaction volume Mobile money, which accounted for USD 488 billion in transaction value in Sub-Saharan Africa, and 44% of the population at that time was using mobile payment systems. Mobile payment usage in Southeast Asia exceeded USD 200 billion, and half of U.S. consumers utilize P2P apps such as Venmo and Zelle. All the developing people will migrate from offline to online it is estimated that it will rise between 10- 12% both in terms of Internet penetration, which will, in turn, provide a spur to digital payments.

RESTRAIN:

- Overcoming Cybersecurity and Regulatory Challenges in the Growing Digital Payments Ecosystem for Global Expansion

Security concerns are one of the most common challenges facing the digital payments market. With more and more transactions happening online, there is a greater risk of cyberattacks, fraud, and data breaches. With rising incidents of hacking, phishing, and identity theft, consumers and businesses are more susceptible than ever creating a serious threat to the trust of end users in digital payment systems. It is imperative to build a strong cybersecurity system and protect sensitive financial information to preserve consumer confidence and grow the market. The other issue is the regulatory space. Different regulations Digital payments are under several regulations that may vary widely between a region and country. Such layers of regulation can act as roadblocks for enterprises looking for cross-border expansion. Data protection, AML, and payment security compliance (PSD2 in Europe) can be a heavy burden, especially for smaller companies. Those myriad legal requirements and different rules can make for slow going when it comes to getting to market and innovating.

Digital Payments Market Segments

BY COMPONENT

In 2023, the digital payments market was led by the Solutions segment, which accounted for the majority share of 61.6%. This is primarily due to the rise in demand for software platforms that provide advanced solutions to facilitate the processing of digital transactions. These solutions include payment gateways, mobile payment apps, fraud detection software any number of types of technology. As many businesses are now moving their business practices to digital platforms, the need for secured and easy-to-use solutions for transactions needs to be fulfilled. This has resulted in a strong adoption of these solutions as the world is going digital and contactless in terms of payments, especially in e-commerce and retail. Moreover, the need for scalability and seamless integration with other business systems (including CRM and ERP) only bolsters the demand for end-to-end digital payment solutions.

Services are projected to grow at the highest CAGR from 2024-2032. This is primarily due to the growing demand for professionals specializing in consulting, system integration, and other services needed by companies to implement and maintain digital payment solutions effectively. Vacancy for Digital Payment Professionals: With an increasing number of organizations adapting intricate online payment solutions, the availability of professional services for flawless deployment, customizing, and support is increasing. Furthermore, they meet the growing challenges as a result of shifting regulatory requirements and advances in cybersecurity, which adds to their demand. Increasing adoption of cloud-based digital payment systems along with increasing complexities of payment infrastructures will boost the growth of this segment at a rapid rate due to the growing need for expertise that can help businesses drive these advanced technologies.

BY MODE OF PAYMENT

The digital payments market by method of point of sale (POS) is expected to account for around 34.5% of the overall share in 2023 owing to its extensive use across the globe in physical retail environments. Due to the fact that POS systems are beneficial for providing safe, rapid, and effective transactions, they remain at the top of the list of merchant and customer choices. In addition, the extensive acceptance of contactless payments has boosted the market share for point-of-sale (POS), since businesses are utilizing advanced POS terminals with integrated NFC readers that accept payments through not only physical cards but also digital wallets linked to mobile apps. Retailers, businesses in the hospitality realm, and service providers address the strides in the modern POS systems needed to elevate customer experience, operational efficiency, and security. This market dominance is attributed to the convenience and flexibility that POS systems offer, especially in verticals such as retail, healthcare & hospitality.

Net Banking is projected to witness the highest CAGR (2024-2032) due to the rising number of people preferring net banking transactions. This is causing consumers as well as businesses to drive towards net banking for its convenience of on-the-go payment management. With the expansion of digital payments, net banking services enable people to directly transfer funds, pay bills, and make purchases from their bank accounts without requiring intermediaries. This segment is likely to grow as the adoption of Internet banking increases, especially in emerging markets, where mobile and Internet penetration continues to grow. Net banking provides a high level of security; hence, the consumer is encouraged to use it. The rapid emergence of digital-only banks coupled with heightened attention towards seamless and faster payment will play a vital role in driving net banking growth in the near future.

BY DEPLOYMENT TYPE

On-premise deployment model was the largest segment of the digital payments market, accounting for a 57.4% share in 2023, owing to its security measures and customization in process and workflows. So big enterprises and financial institutions have a pipeline to be on-premise because they can have more control over the data set themselves in local regulations of data security and privacy. On-premise systems give organizations the ability to house their own systems and have total control over how payment information is processed and stored. Industries that have strict requirements regarding data protection and regulations, such as banking and healthcare, are especially fond of these systems. The perception around on-premise solutions is that these on-premise solutions are more reliable and deliver high uptime and operational efficiency, due to which this segment has continued to hold the largest share of the market during this period.

The Cloud deployment model is anticipated to witness the fastest CAGR during the period of 2024-2032, amidst the increased demand for scalability, flexibility, and cost-effectiveness. With businesses moving increasingly towards digital transformation, cloud-based solutions are proving to be more agile and productive compared to on-premise systems. Cloud platforms represent a fantastic opportunity for any company, big or small, given their ease of integration with other business systems, quick update capabilities, and accessibility anywhere. The cloud model also helps in cutting down on investments in hardware and infrastructure, something that serves the purpose of best use for smaller and medium-sized enterprises (SMEs). In addition, the increasing number of worldwide digital payment platforms and the demand for cross-border payment solutions are propelling the deployment of cloud-based systems. This segment will likely grow quickly over the next decades, especially as cloud security improves and more organizations move to cloud-native solutions.

BY ORGANIZATION SIZE

Large Enterprises dominated the digital payments market with a share of 56.3% in 2023. These organizations are able to spend on sophisticated digital payment solutions with robust features such as integrated payment gateways, fraud detection tools, and mobile payment systems to make their operations run smoothly and improve the overall customer experience. Moreover, big enterprises have already been very strong in many industries such as banking, retail, and e-commerce, where they can easily rely on existing customers and their payment systems. Since they can absorb the costs of implementing these advanced solutions because of their larger scale, it guarantees a higher transaction volume which ensures them as the market leader.

Small and Medium-sized Enterprises (SMEs) are anticipated to record the highest CAGR during 2024-2032. The explosion of digital payment accessibility and affordability has further prompted SMEs to start embracing these solutions to keep up with their competitors and evolving consumer demands. This proliferation of cashless and contactless payment systems growth, combined with the increasing number of low-cost payment platforms and mobile payment solutions, is what is feeding this growth. Digital payment solutions provide a way for SMEs to lower operational costs, increase the efficiency of payments, and access a wider client base, including foreign ones. Also, with incentives from the government and financial agencies time now is the key to adopting digital payment systems with SMEs. Small and medium Enterprises (SMEs) are penetrating into the digital age, along with the deep integration and scalability prospects provided by modern payment systems.

BY VERTICAL

Banking, financial services, and Insurance (BFSI) sector accounted for the highest share of 31.3% in 2023. Digital payment technologies have been one of the most utilized technologies in the BFSI sector since they are essential for online banking, credit card transactions, insurance payments, and other financial services. As a result of the large customer base and transaction volume in this sector, there is an ongoing need for digital payment systems that are efficient, secure, and scalable in nature. There is a continuous increase in investment by financial institutions for personalized and intangible digital payment solutions for improving customer experience, regulatory compliance, and innovative financial products. BFSI will always be on top of the digital payments market, just because the need for instant, safe, and convenient payments still remains in need of play in loans, insurance claims, and money transfers.

Retail and E-commerce will register the fastest CAGR during the forecast period from 2024-2032. A boom effect is seen in e-commerce or online retail with a rapid and impulsive consumer movement towards online shopping. Seamless, contactless transactions are an integral part of the retail experience, and digital payments play a crucial role in facilitating such transactions. Mobile shopping, digital wallets, and buy-now-pay-later services are all driving the retail sector toward faster adoption of digital payment systems. Retailers have to ensure that they offer a safe, speedy, and hassle-free experience when it comes to payments, as more consumers turn to online shopping. The growth of the retail and e-commerce sector is slated to continue over the next several years the evolution of e-commerce platforms continues, online marketplaces expand, and omnichannel strategies become more mainstream, all of which are set to drive demand for advanced payment solutions.

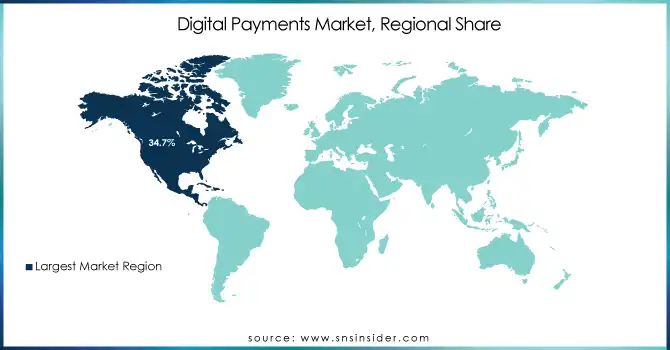

REGIONAL ANALYSIS

North America accounted for a market share of 34.7% of the digital payments market in 2023, thanks to the extremely developed financial infrastructure of the region, coupled with the widespread adoption of digital payment solutions and the presence of major players in this sector. With a high inclination towards contactless payments, mobile wallets, and e-commerce, the U.S. and Canada also lead the way in digital payment penetration. That includes the presence of big fintech companies such as PayPal, Square, or Stripe, that have contributed to the flea-footed growth of digital payment solutions over here. Furthermore, commercial banks in North America have invested a lot in more secure and complex payment systems, in line with the volume of online transactions. The North American region is leading the Digital payment market due to the confidence in the digital payment method among consumers, robust cybersecurity regulations, and government initiatives.

Asia Pacific is anticipated to exhibit the highest CAGR during the years 2024-2032. Digital payments in the region are progressing at a rapid pace, driven by the rapid development of the regional economy, increasing network penetration, and high mobile phone penetration. This is led by countries such as China and India. With the likes of Alipay and WeChat Pay ruling the digital payment market in China, cashless payments have become the new norm both in cities and rural areas. In India, various initiatives by the government in the form of campaigns, like Digital India, and the emergence and popularity of mobile payment solutions, like Paytm, PhonePe, and Google Pay, are promoting the acceptance of digital payments. Asia Pacific has been quickly escalating in terms of digital payments and will play a vital role in shaping the future of global payment systems with the boom of its e-commerce market together with the very recent rise of mobile wallet usage, and the intriguing influx of fintech startups throughout the region.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key players

Some of the major players in the Digital Payments Market are:

-

PayPal (Venmo, PayPal Here)

-

Square (Square Point of Sale, Cash App)

-

Stripe (Stripe Payments, Stripe Atlas)

-

Visa (VisaNet, Visa Direct)

-

Mastercard (Mastercard Payment Gateway, Mastercard Send)

-

FIS (Worldpay, FIS Global Payments)

-

Fiserv (Clover, Carat)

-

Adyen (Adyen Payment Platform, Adyen for Platforms)

-

Alipay (Alipay Wallet, Alipay Merchant Services)

-

Apple Pay (Apple Pay, Apple Card)

-

Google Pay (Google Pay, Google Pay API)

-

Samsung Pay (Samsung Pay, Samsung Pay SDK)

-

Amazon Pay (Amazon Pay, Amazon Pay API)

-

Payoneer (Global Payment Service, Payoneer eWallet)

-

WePay (WePay Payments, WePay for Platforms)

-

Braintree (Braintree Payments, Braintree Marketplace)

-

Worldpay (Worldpay Payment Gateway, Worldpay for Platforms)

-

Klarna (Klarna App, Klarna Merchant Services)

-

Revolut (Revolut App, Revolut Business)

-

Zelle (Zelle App, Zelle Network)

Some of the Raw Material Suppliers for Digital Payments Companies:

-

Intel

-

NVIDIA

-

Qualcomm

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Cisco Systems

-

Broadcom

-

Oracle

-

Verifone

-

F5 Networks

RECENT TRENDS

-

In November 2024, PayPal launched an innovative money pooling feature, allowing users to easily collect and manage funds for group expenses like gifts and travel.

-

In April 2024, Square expanded its offline payment feature to its entire hardware lineup, allowing sellers to process transactions without internet access. This update ensures business continuity during connectivity issues, with customizable transaction limits for greater control.

-

In August 2024, Mastercard launched Pay Local, enabling digital wallet providers in Asia to process payments from over 2 billion Mastercard cardholders. This move expands payment options for consumers across the region at millions of merchants.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 103.63 Billion |

| Market Size by 2032 | USD 409.28 Billion |

| CAGR | CAGR of 16.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Mode of Payment (Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Point of Sales, Others) • By Deployment Type (On-premise, Cloud) • By Organization Size (Small and Medium-sized Enterprises, Large Enterprises) • By Vertical (Banking, Financial Services, And Insurance, Retail and E-commerce, Healthcare, Travel and Hospitality, Transportation and Logistics, Media and Entertainment, Other Verticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PayPal, Square, Stripe, Visa, Mastercard, FIS, Fiserv, Adyen, Alipay, Apple Pay, Google Pay, Samsung Pay, Amazon Pay, Payoneer, WePay, Braintree, Worldpay, Klarna, Revolut, Zelle. |

| Key Drivers | • The Rise of Digital Wallets and P2P Payments Shaping the Future of Global Consumer Transactions • Empowering the Unbanked Through Digital Payments Driving Growth in Global Financial Inclusion and Connectivity |

| RESTRAINTS | • Overcoming Cybersecurity and Regulatory Challenges in the Growing Digital Payments Ecosystem for Global Expansion |