Get more information on Digital Pathology Market - Request Sample Report

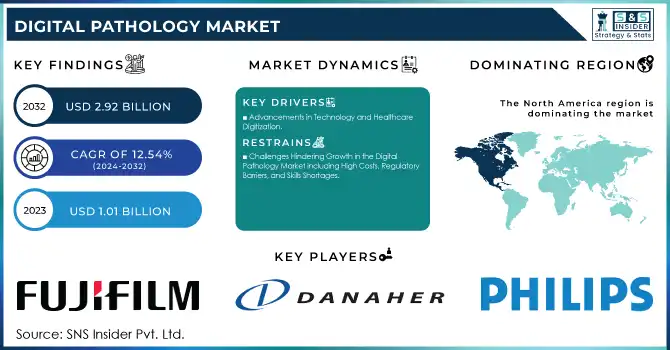

The Digital Pathology Market size is expected to reach USD 2.92 billion by 2032 from USD 1.01 billion in 2023, and grow at CAGR of 12.54% over the forecast period 2024-2032.

The Digital Pathology Market is revolutionizing diagnostic processes by digitizing traditional pathology workflows, enabling enhanced precision, efficiency, and collaboration. This innovation has been critical in addressing the increasing burden of chronic diseases such as cancer and cardiovascular disorders, which require accurate and timely diagnostics. Studies indicate that digital pathology systems can reduce diagnostic turnaround times by up to 50%, significantly improving patient outcomes.

Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), are major contributors to this transformation. AI-powered algorithms are now capable of automating the detection of abnormalities in histopathology slides with remarkable accuracy. For example, a 2023 study published in Modern Pathology highlighted an AI-based tool that achieved a sensitivity rate of over 92% in identifying lymph node metastases in breast cancer. Similarly, digital pathology has enabled the early detection of prostate cancer, with AI systems demonstrating consistent diagnostic performance comparable to expert pathologists.

The adoption of digital pathology has also been accelerated by the COVID-19 pandemic, which highlighted the need for remote diagnostics and telemedicine. Research published in Diagnostic Pathology showed that remote digital pathology reduced the time for second-opinion consultations by 40%, ensuring timely and effective patient management during global lockdowns. The technology also supported continuity in pathology education and training, allowing students and professionals to access high-quality digital slides remotely. However, the path toward widespread adoption is not without challenges. Regulatory frameworks, such as compliance with the Health Insurance Portability and Accountability Act (HIPAA) and General Data Protection Regulation (GDPR), require robust data security measures to safeguard patient information. Additionally, the high initial costs of implementing digital pathology systems pose a barrier, particularly for smaller healthcare providers.

Despite these hurdles, digital pathology continues to gain traction due to its proven benefits. With advancements in imaging technologies, AI integration, and supportive regulatory initiatives, the field is set to redefine diagnostic accuracy and efficiency, transforming healthcare delivery worldwide.

Drivers

Advancements in Technology and Healthcare Digitization

A key factor is the rising demand for high-throughput diagnostic solutions to address the global increase in chronic and lifestyle-related diseases. Pathologists face increasing pressure to process large volumes of samples quickly and accurately, and digital pathology systems, with their automated workflows, significantly enhance productivity. Another critical driver is the ongoing digitization of healthcare. As hospitals and laboratories implement electronic health records (EHRs) and other digital systems, integrating digital pathology becomes vital for seamless data sharing and collaboration. This interoperability encourages multidisciplinary teamwork, allowing pathologists, oncologists, and other specialists to provide efficient and comprehensive care.

Advances in digital imaging technologies have also played a significant role, improving the resolution and quality of virtual slides for more reliable diagnostics. These innovations, combined with artificial intelligence (AI) integration for automated image analysis, are reshaping pathology by reducing errors and standardizing diagnostic results. For example, digital pathology is becoming essential in personalized medicine research, where molecular insights rely on accurate histopathological data. Additionally, regulatory support and strategic partnerships between healthcare organizations, technology providers, and research institutions are further driving market expansion. Government initiatives that promote telemedicine and remote diagnostics, particularly during public health crises like the COVID-19 pandemic, have highlighted the crucial role of digital pathology in ensuring continuous and effective diagnostics.

Restraints

Challenges Hindering Growth in the Digital Pathology Market including High Costs, Regulatory Barriers, and Skills Shortages

A significant challenge in the digital pathology market is the high upfront cost associated with the systems, which include advanced imaging equipment, software, and storage solutions. This substantial initial investment may discourage smaller healthcare providers and laboratories from adopting the technology, limiting its broader implementation. Additionally, regulatory obstacles pose a considerable barrier to market growth. Strict data privacy regulations, such as HIPAA in the U.S. and GDPR in Europe, make it difficult to integrate digital pathology systems into clinical environments. Meeting these compliance requirements can cause delays in adoption as organizations strive to ensure data security and storage standards are met. Moreover, the lack of standardized protocols across different regions and healthcare systems results in interoperability challenges, hindering the seamless integration of digital pathology systems with existing medical infrastructure. Lastly, the shortage of trained professionals capable of operating digital pathology systems and analyzing digital slides remains a key issue, especially in areas with limited healthcare resources, impeding the widespread adoption and effective use of digital pathology technologies.

By Product

In 2023, the Software segment dominated the digital pathology market, accounting for 45% of the total market share. This dominance is driven by the increasing demand for advanced image analysis and management solutions in pathology. Software plays a critical role in processing, managing, and analyzing digital pathology images, enabling pathologists to interpret large volumes of data more efficiently and accurately. The integration of artificial intelligence (AI) and machine learning into pathology software has further enhanced diagnostic precision and workflow efficiency, making it indispensable in modern healthcare settings. The growing focus on automating pathology workflows and improving diagnostic accuracy has fueled the dominance of this segment.

The Storage Systems segment is emerging as the fastest-growing in the digital pathology market. With the continuous generation of large volumes of digital data through high-resolution imaging, the demand for efficient, scalable, and secure storage solutions is rapidly increasing. Cloud-based storage, in particular, has gained significant traction due to its ability to provide remote access, data sharing, and seamless integration into digital workflows. As more healthcare organizations adopt digital pathology systems, the need for robust storage systems to manage vast amounts of image data is expected to rise, driving growth in this segment.

By Application

In 2023, the Drug Discovery & Development segment led the market, representing 55% of the share. Digital pathology has become an essential tool in drug discovery by providing high-resolution imaging and detailed analysis of tissue samples. It supports the identification of biomarkers, understanding of disease mechanisms, and evaluating therapeutic efficacy. The growing use of digital pathology to accelerate research and reduce the time and costs associated with drug development has driven this dominance, particularly in pharmaceutical and biotech companies.

The Disease Diagnosis segment is the fastest-growing area in the digital pathology market. The increasing global burden of chronic diseases, such as cancer, along with advancements in diagnostic technologies, has led to a surge in the adoption of digital pathology systems for clinical diagnostics. These systems enhance diagnostic accuracy, enable remote consultations, and facilitate collaboration among medical professionals. The integration of AI-powered tools to assist with diagnostics further fuels this growth, positioning disease diagnosis as a key driver for the expansion of digital pathology applications in the coming years.

North America held the largest market share, primarily due to the early adoption of digital pathology technologies and the presence of leading healthcare providers and research institutions. The U.S., in particular, is at the forefront of integrating digital pathology systems into clinical settings, fueled by strong government initiatives, investments in healthcare digitization, and a growing emphasis on precision medicine. Furthermore, the high incidence of chronic diseases like cancer is driving the adoption of digital pathology in diagnostic and research applications.

Europe is another key region, with substantial growth in countries like Germany, the UK, and France. The European market benefits from supportive regulatory frameworks, increased healthcare digitization, and a strong focus on medical research and drug discovery. In particular, the growing need for personalized medicine and advancements in AI-based diagnostics are contributing to the rapid adoption of digital pathology solutions.

The Asia-Pacific region is expected to see the fastest growth in the coming years, driven by expanding healthcare infrastructure, rising healthcare awareness, and increasing investments in technological innovation. Countries like China, Japan, and India are witnessing a surge in digital pathology adoption in both clinical and research sectors. The growing healthcare burden due to an aging population and increasing incidence of chronic diseases is also propelling the market in this region.

Need any customization research on Digital Pathology Market - Enquiry Now

1. Fujifilm Holdings Corporation

Fujifilm Virtual Slide System

2. Danaher Corporation

Aperio Digital Pathology Systems (Leica Biosystems)

Philips IntelliSite Pathology Solution

4. Mikroscan Technologies, Inc.

Mikroscan Digital Slide Scanners

5. PathAI

PathAI Diagnostic Solutions

6. Hamamatsu Photonics K.K.

NanoZoomer Digital Slide Scanners

7. F. Hoffmann-La Roche Ltd.

Ventana Digital Pathology Systems

8. 3DHISTECH

Pannoramic Digital Slide Scanners

CaseViewer Software

9. Apollo Enterprise Imaging

Apollo Enterprise Imaging Platform

10. XIFIN, Inc.

XIFIN Pathology Solutions

11. Proscia Inc.

Proscia Concentriq Digital Pathology Platform

12. KONFOONG BIOTECH INTERNATIONAL

KONFOONG Digital Pathology Solutions

13. Sectra AB

Sectra Digital Pathology Solution

14. Hamamatsu Photonics, Inc.

NanoZoomer Digital Slide Scanners

15. Olympus Corporation

Olympus Digital Pathology Systems

16. Inspirata, Inc.

Inspirata Digital Pathology Solutions

17. Epredia (3DHISTECH Ltd.)

Pannoramic Digital Slide Scanners

18. Visiopharm A/S

Visiopharm Digital Pathology Solutions

19. Huron Technologies International Inc.

Huron Digital Pathology Solutions

20. ContextVision AB

ContextVision Pathology Imaging Software

21. CellaVision

CellaVision Digital Pathology Solutions

22. HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO)

Morphogo Digital Pathology Systems

23. West Medica Produktions- und Handels-GmbH (West Medica)

West Medica Digital Pathology Solutions

24. aetherAI

aetherAI Digital Pathology Solutions

25. IBEX (IBEX MEDICAL ANALYTICS)

IBEX AI Pathology Solutions

26. SigTuple Technologies Private Limited

SigTuple AI-based Pathology Solutions

27. Morphle Labs, Inc.

Morphle Labs Digital Pathology Solutions

28. Bionovation Biotech, Inc.

Bionovation Digital Pathology Solutions

In Dec 2024, OptraSCAN raised USD 30 million in Series B funding to advance its mission of democratizing digital pathology and improving diagnostic accuracy worldwide. The funding round, led by Molbio Diagnostics, highlights the increasing significance of digital pathology in transforming healthcare and patient outcomes.

In Oct 2024, Central Maine Healthcare (CMH) partnered with Spectrum Healthcare Partners (SHCP) to enhance its pathology services by adopting Pramana's AI-enabled autonomous scanners. This collaboration aims to improve operational efficiency and provide pathologists with a more detailed view, boosting diagnostic confidence.

In Sept 2024, Roche expanded its digital pathology open environment by integrating over 20 advanced AI algorithms from eight new collaborators. This initiative aims to enhance cancer research and diagnostics, supporting pathologists and scientists with innovative AI technology.

In Sept 2024, Mindpeak raised USD 15.3M in Series A funding to accelerate the development of its AI-driven digital pathology solutions. This investment will enhance its AI-powered histopathological assessments, benefiting clinical labs and biopharma companies globally.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.01 billion |

| Market Size by 2032 | USD 2.92 billion |

| CAGR | CAGR of 12.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Software, Device (Scanners, Slide Management System), Storage System] • By Application [Drug Discovery & Development, Academic Research, Disease Diagnosis (Cancer Cell Detection, Others)] • By End-use [Hospitals, Biotech & Pharma Companies, Diagnostic Labs, Academic & Research Institutes] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fujifilm Holdings Corporation, Danaher Corporation, Koninklijke Philips N.V., Mikroscan Technologies, Inc., PathAI, Hamamatsu Photonics K.K., F. Hoffmann-La Roche Ltd., 3DHISTECH, Apollo Enterprise Imaging, XIFIN, Inc., Proscia Inc., KONFOONG BIOTECH INTERNATIONAL, Sectra AB, Leica Biosystems Nussloch GmbH (Danaher), Olympus Corporation, Inspirata, Inc., Epredia (3DHISTECH Ltd.), Visiopharm A/S, Huron Technologies International Inc., ContextVision AB, CellaVision, HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO), West Medica Produktions- und Handels-GmbH (West Medica), aetherAI, IBEX (IBEX MEDICAL ANALYTICS), SigTuple Technologies Private Limited, Morphle Labs, Inc., Bionovation Biotech, Inc. |

| Key Drivers | • Advancements in Technology and Healthcare Digitization |

| Restraints | • Challenges Hindering Growth in the Digital Pathology Market including High Costs, Regulatory Barriers, and Skills Shortages |

Ans: The estimated compound annual growth rate is 12.54% during the forecast period for the Digital Pathology market.

Ans: The projected market value of the Digital Pathology market is USD 1.01 billion in 2023 and is expected to reach USD 2.92 billion by 2032.

Ans: A key factor is the rising demand for high-throughput diagnostic solutions to address the global increase in chronic and lifestyle-related diseases.

Ans: A key factor is the rising demand for high-throughput diagnostic solutions to address the global increase in chronic and lifestyle-related diseases.

Ans: North America is the dominant region in the Digital Pathology market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates and Penetration (2023)

5.2 Workflow Digitization Trends (2023), by Region

5.3 System Installations and Usage, by Region (2020-2032)

5.4 Healthcare IT Spending on Digital Pathology, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

5.5 Research and Diagnostic Usage Statistics (2023)

5.6 Artificial Intelligence (AI) Integration Metrics (2023)

5.7 Image Data Volume Growth, by Region (2020–2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Digital Pathology Market Segmentation, by Product

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Device

7.3.1 Device Market Trends Analysis (2020-2032)

7.3.2 Device Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Scanners

7.3.3.1 Scanners Market Trends Analysis (2020-2032)

7.3.3.2 Scanners Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Slide Management System

7.3.4.1 Slide Management System Market Trends Analysis (2020-2032)

7.3.4.2 Slide Management System Market Size Estimates and Forecasts to 2032 (USD Billion

7.4 Storage System

7.4.1 Storage System Market Trends Analysis (2020-2032)

7.4.2 Storage System Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Digital Pathology Market Segmentation, by Application

8.1 Chapter Overview

8.2 Drug Discovery & Development

8.2.1 Drug Discovery & Development Market Trends Analysis (2020-2032)

8.2.2 Drug Discovery & Development Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Academic Research

8.3.1 Academic Research Market Trends Analysis (2020-2032)

8.3.2 Academic Research Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Disease Diagnosis

8.4.1 Disease Diagnosis Market Trends Analysis (2020-2032)

8.4.2 Disease Diagnosis Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4.3 Cancer Cell Detection

8.4.3.1 Cancer Cell Detection Market Trends Analysis (2020-2032)

8.4.3.2 Cancer Cell Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4.4 Others

8.4.4.1 Others Market Trends Analysis (2020-2032)

8.4.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Digital Pathology Market Segmentation, by End-use

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Biotech & Pharma Companies

9.3.1 Biotech & Pharma Companies Market Trends Analysis (2020-2032)

9.3.2 Biotech & Pharma Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Diagnostic Labs

9.4.1 Diagnostic Labs Market Trends Analysis (2020-2032)

9.4.2 Diagnostic Labs Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Academic & Research Institutes

9.5.1 Academic & Research Institutes Market Trends Analysis (2020-2032)

9.5.2 Academic & Research Institutes Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Digital Pathology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Digital Pathology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.1.9 turkey

10.3.1.9.1 Turkey Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Digital Pathology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Digital Pathology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Digital Pathology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Digital Pathology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Digital Pathology Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Digital Pathology Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Digital Pathology Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Digital Pathology Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Fujifilm Holdings Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product Types/ Services Offered

11.1.4 SWOT Analysis

11.2 Danaher Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product Types/ Services Offered

11.2.4 SWOT Analysis

11.3 Mikroscan Technologies, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product Types/ Services Offered

11.3.4 SWOT Analysis

11.4 Hamamatsu Photonics K.K.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product Types/ Services Offered

11.4.4 SWOT Analysis

11.5 F. Hoffmann-La Roche Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product Types/ Services Offered

11.5.4 SWOT Analysis

11.6 KONFOONG BIOTECH INTERNATIONAL

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product Types/ Services Offered

11.6.4 SWOT Analysis

11.7 Olympus Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product Types/ Services Offered

11.7.4 SWOT Analysis

11.8 Huron Technologies International Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product Types/ Services Offered

11.8.4 SWOT Analysis

11.9 West Medica Produktions- und Handels-GmbH (West Medica)

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product Types/ Services Offered

11.9.4 SWOT Analysis

11.10 ContextVision AB

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product Types/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Software

Device

Scanners

Slide Management System

Storage System

By Application

Drug Discovery & Development

Academic Research

Disease Diagnosis

Cancer Cell Detection

Others

By End-use

Hospitals

Biotech & Pharma Companies

Diagnostic Labs

Academic & Research Institutes

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Multiplex Assay Market size is projected to reach USD 8.84 billion by 2032 and was valued at USD 3.05 billion in 2023, with a CAGR growing CAGR of 11.24% during 2024-2032.

The Opioid Use Disorder Market Size was valued at USD 3.7 Billion in 2023 and is expected to reach USD 9.02 Billion by 2032, growing at a CAGR of 10.4%.

Patient Safety and Risk Management Software Market Size was valued at $2.25 Bn in 2023 & will reach $6.07 Bn by 2032 & grow at a CAGR of 11.69% by 2024-2032.

The global 3D Cell Culture Market, valued at USD 1.4 billion in 2023 and projected to reach USD 4.0 billion by 2032, growing at a CAGR of 12.4% by 2032.

The Weight Loss Devices Market Size was valued at USD 5.30 Billion in 2023 and is expected to reach USD 8.50 Billion by 2032 and grow at a CAGR of 6.60% over the forecast period 2024-2032.

Sepsis Diagnostics Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.5 billion by 2032, growing at a CAGR of 8.6% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone