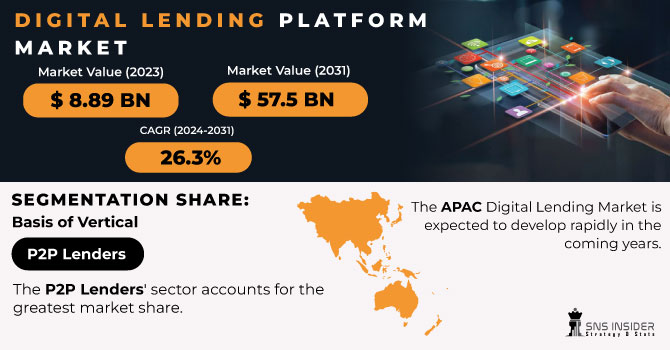

The Digital Lending Platform Market size was valued at USD 10.3 Billion in 2023. It is expected to grow to USD 50.7 Billion by 2032 and grow at a CAGR of 22% over the forecast period of 2024-2032.

The increasing adoption of digital banking is a key driver behind the growth of digital lending platforms. With digital banking and fintech solutions becoming mainstream, consumers and enterprises are also switching over to these solutions because they provide, efficient and convenient ways. The platforms also offer personalized loan offerings per individual needs using data analytics and artificial intelligence for fast credit assessment. As a result of the global shift to cashless economies and the rise in mobile banking, digital lending has been adopted faster than ever, especially in emerging markets. Elsewhere, in places that typically do not have widespread banking infrastructure, digital platforms are bridging the gap with the use of mobile phones to make this a lot easier creating more financial inclusion and allowing individuals and small businesses with quick access to credit. This change is changing the monetary scene, giving chances to both lenders and borrowers individually.

Get more information on Digital Lending Platform Market - Request Sample Report

According to the Bank for International Settlements (BIS), global mobile payment transactions reached over USD 1.1 trillion in 2023, highlighting the rise of cashless economies and the growing trust in digital financial systems. Digital lending allows for faster loan processing, reducing the traditional delays associated with paper-based or in-person procedures.

Increasing smartphone penetration is a significant driver for digital lending platforms, particularly in developing economies. Smartphones have evolved into primary tools for providing financial services, providing a convenient and easy method of interacting with mobile banks and digital lending platforms. Smartphones (and the mobile data network that allows them to be used) have become the most accessible form of banking in many developing regions, where people now rely on their phones to perform a range of transactions from sending money to applying for loans. With 80% of mobile phone ownership in low- and middle-income countries of the world as of 2023, according to the International Telecommunication Union (ITU), access to digital financial services has become easier. These smartphone ownership booms have been most efficient across areas such as Sub-Saharan Africa and South Asia, the trends to be extremely minimal or no conventional banking facilities. In Kenya, for instance, according to the Central Bank of Kenya mobile money services such as M-Pesa have allowed millions of low-income people with no commercial bank account to access mobile credit. With increasingly cheaper smartphones and the expansion of internet connectivity, more people in emerging markets can access digital lending services that allow them to bypass traditional banks and increase financial inclusion. It’s easier access to smartphones for loan applications, complemented by real-time processing, approval, and disbursal of loans on digital lending platforms, makes it especially attractive for under-served populations in the case of these regions.

Drivers

Smartphone proliferation and increased digitization.

SME demand for digital financing platforms is increasing which drives the market growth.

The surge in demand for digital financing platforms from Small and Medium Enterprises (SME) is one of the main factors for the rising growth of the digital lending platform market. Traditional financial services often prove to be a challenge for SMEs, with restrictive credit access and protracted processing times. The digital lending platforms fill the gap of the above issues by providing fast, short-term, and easily accessible roll-out loans, customized to the needs of SMEs. These platforms utilize technology, including artificial intelligence and machine learning, to optimize the loan application process and approval process to be more efficient. Digital platforms also enable SMEs to access financing without the need to visit banks and at a lower operational cost and time. The increasing trend of digital transformation in SMEs, growing internet penetration, and smartphone usage also aid in the adoption of these platforms as well. Furthermore, governments and financial institutions are also noticing how digital lending can energize economic growth granting SMEs with the financial resources they need to expand and innovate thus, driving market growth.

Restraint

Increased reliance on traditional lending techniques which hamper the market growth.

The dependency on traditional lending methods however still plays a major factor in restraining the growth of the market although digital lending platforms are developing at a fast pace. For numerous of these borrowers specifically, in areas of reduced internet gain access to, or places of reduced electronic proficiency traditional banking strategies are still the favored technique due to familiarity and also automatic trust. Moreover, the institutions is another reason why some businesses and individuals believe (especially in larger or complex loans) that they can build a relationship at a trust level. Moreover, established relationships make it easier for seasoned customers to borrow from traditional lenders. In addition, many countries are still in the process of figuring out how to regulate digital lending so businesses may be reluctant to go fully online due to fears of data privacy and security or just general fraud risk on digital platforms. Consequently, the ubiquitousness of seeing spending habits and an element of trusting in traditional methods of lending via banks has meant that, at times, the growth of the traditional method has inhibited the bigger nature of market growth for operators of digital methods.

Opportunities

Adoption of AI, machine learning, and blockchain-based digital lending platforms and solutions is increasing.

Demand for innovative digital lending solutions for retail banking is increasing.

By Solution

Loan Origination held the largest market share around 46% in 2023. It is mainly because loan origination is the first and the most important step of the lending process where a borrower applies for loans and lenders determine whether they qualify for a loan. Moreover, digital lending has greatly eased this process as it automates processes to a good extent, minimizes human intervention, and provides an enhanced experience. A digital loan origination platform helps in faster application, approval, and disbursement for loans, and eliminates quite a few hassles created for borrowers and lenders. So, the response of most financial institutions/lenders is in the form of adopting digital loan origination systems for better customer experience, operational efficiency, and lower costs.

By Service

Support and Maintenance held the largest market share around 38% in 2023. Because digital lending platforms need to evolve sustainably to keep functioning smoothly, safely, and seamlessly within changing regulations. With the heavy dependency on sophisticated technology like AI, machine learning, and cloud computing integrated into these platforms, constant updates, bug fixes, and system upgrades become crucial to ensure performance, security, and scalability. In addition, an evolving digital lending environment means keeping the financial institution financial institution platform current with the latest features, and regulatory needs. Support and maintenance services involve not only debugging but also making sure it plays nicely with the rest of your financial systems and continual support for users.

By Deployment

On-Premises held the largest market share around 62% in 2023. It is mainly due to the ability to control the digital lending process at each stage, both securing and streamlining the processes and system into the overall organization by establishing a compliant environment. On-premises has a natural appeal for financial institutions (particularly socialized camps with a GFC-like background), if only because it provides them with a greater level of control over their data and infrastructure. This is especially true for lenders who process sensitive customer data that is subject to strict data privacy laws. On-prem enables these institutions to have an iron grip over their systems and know their data security meets their internal requirements and compliance requirements directly instead of secondhand. Also, the on-premises deployment can provide better performance and customization because organizations can easily customize these systems to their requirements. Install-based platforms continue to account for the biggest share, as institutions that carry strict mandates around data sovereignty and strong compliance and security needs such as finance, healthcare, and education, still prefer to maintain environments on-site even as more cloud-based solutions become available that can be sized up against them based both on cost and feature set.

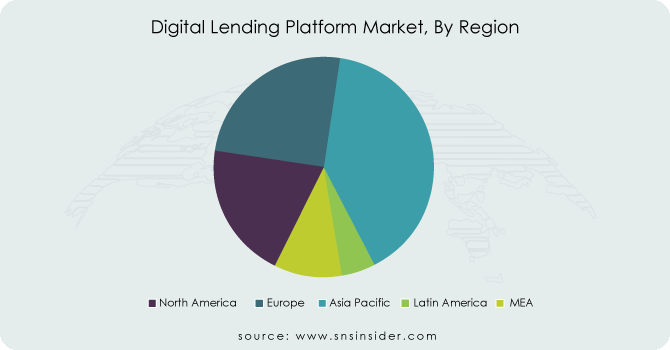

The Asia Pacific region held the largest revenue share around 46%. Government actions to develop digital infrastructure for promoting the region's adoption of Digital Lending solutions. Because of rapid economic development, globalization, digitization, and the rising ubiquity of smartphones, APAC is likely to be the fastest-growing market. Furthermore, Asia Pacific is undergoing a remarkable digital transformation, including rising internet penetration rates, smartphone prevalence, and population familiarity with technology, all of which facilitate the adoption of digital financial services. Meanwhile, government initiatives and regulatory frameworks for encouraging digital lending and financial inclusion are creating a conducive environment in nations such as China, India, and Southeast Asian countries. The expanding middle class and rising consumer appetite for personal loans and credit only add to the urgency for digital lending solutions. Leading digital lending suppliers like as Newgen Software, Nucleus Software, and Intellect Design Arena are concentrating on building cutting-edge lending solutions and technology to help automate, streamline, and manage the whole loan processing life cycle. The suppliers have also begun building AI, machine learning, analytics, and blockchain-based technologies in order to provide a full digital lending platform.

Need any customization research on Digital Lending Platform Market - Enquiry Now

Clariant AG

The Dow Chemical Company

Solvay

Bayer AG

Huntsman International LLC

Helena Agri-Enterprises LLC

Ashland, Inc.

Land O’Lakes, Inc.

FMC Corp.

Croda International Plc

BASF SE

Finastra

Temenos AG

Oracle Corporation

Fiserv, Inc.

Kony, Inc. (Now part of Temenos)

LendingClub Corporation

Prosper Marketplace, Inc.

Upstart Network, Inc.

Zopa

Black knight Inc - Company Financial Analysis

In 2023, Finastra launched its Fusion Digital Lending platform, a comprehensive solution designed to provide banks and financial institutions with end-to-end capabilities for origination, servicing, and loan management.

In 2023, Temenos partnered with SIX Group to enhance the capabilities of its Temenos Transact platform, offering more advanced digital banking and lending solutions. This collaboration aims to strengthen digital transformation efforts for financial institutions across Europe and globally, offering improved digital loan origination and management tools.

In 2023, Oracle launched new cloud-based lending solutions to help financial institutions streamline loan origination and underwriting. These solutions integrate AI and data analytics, enabling faster loan processing and enhanced risk management.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 10.3 Bn |

|

Market Size by 2032 |

US$ 50.7 Bn |

|

CAGR |

CAGR of 22% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2031 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• by Solution (Business Process Management, Lending Analytics, Loan Management, Loan Origination, Risk & Compliance Management, Others) |

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

Black knight, Inc., Ellie Mae, Inc., Finastra, FIS, Fiserv, Inc., Intellect design arena ltd, Nucleus software exports ltd, Tavant, Temenos, Wipro limited |

|

Key Drivers |

• Smartphone proliferation and increased digitization |

|

Market Opportunities |

• Adoption of AI, machine learning, and blockchain-based digital lending platforms and solutions is increasing |

Ans: - The forecast period of the Digital Lending Platform market is 2024-2032.

Ans: - Increased reliance on traditional lending techniques.

Ans: - The segments covered in the Digital Lending Platform study are on the basis of the solution, Services, Deployment Model, and Vertical.

Ans: - The major key players are Clariant AG, The Dow Chemical Company, Solvay, Bayer AG, Huntsman International LLC, Helena Agri-Enterprises LLC, Ashland, Inc., Land O’Lakes, Inc., FMC Corp., Croda International Plc, BASF SE, Finastra, Temenos AG, Oracle Corporation, Fiserv, Inc., Kony, Inc. (Now part of Temenos), LendingClub Corporation, Prosper Marketplace, Inc., Upstart Network, Inc., Zopa.

Ans: - The study includes a comprehensive analysis of Digital Printing Market trends, as well as present and future market forecasts. DROC analysis, as well as impact analysis for the projected period. Porter's five forces analysis aids in the study of buyer and supplier potential as well as the competitive landscape etc.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Type

3.2 Bottom-up Type

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Digital Lending Platform Market Segmentation, By Solution

7.1 Chapter Overview

7.2 Business Process Management

7.2.1 Business Process Management Market Trends Analysis (2020-2032)

7.2.2 Business Process Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Lending Analytics

7.3.1 Lending Analytics Market Trends Analysis (2020-2032)

7.3.2 Lending Analytics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Loan Management

7.4.1 Loan Management Market Trends Analysis (2020-2032)

7.4.2 Loan Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Loan Origination

7.5.1 Loan Origination Market Trends Analysis (2020-2032)

7.5.2 Loan Origination Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Risk & Compliance Management

7.6.1 Risk & Compliance Management Market Trends Analysis (2020-2032)

7.6.2 Risk & Compliance Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Digital Lending Platform Market Segmentation, By Service

8.1 Chapter Overview

8.2 Design and Implementation

8.2.1 Design and Implementation Market Trends Analysis (2020-2032)

8.2.2 Design and Implementation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Training and Education

8.3.1 Training and Education Market Trends Analysis (2020-2032)

8.3.2 Training and Education Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Risk Assessment

8.4.1 Risk Assessment Market Trends Analysis (2020-2032)

8.4.2 Risk Assessment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Consulting

8.5.1 Consulting Market Trends Analysis (2020-2032)

8.5.2 Consulting Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Support and Maintenance

8.6.1 Support and Maintenance Market Trends Analysis (2020-2032)

8.6.2 Support and Maintenance Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Digital Lending Platform Market Segmentation, By Deployment Mode

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 On-premises

9.3.1 On-premises Market Trends Analysis (2020-2032)

9.3.2 On-premises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Digital Lending Platform Market Segmentation, By Vertical

10.1 Chapter Overview

10.2 Banking

10.2.1 Banking Market Trends Analysis (2020-2032)

10.2.2 Banking Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Financial Services

10.3.1 Financial Services Market Trends Analysis (2020-2032)

10.3.2 Financial Services Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Insurance

10.4.1 Insurance Market Trends Analysis (2020-2032)

10.4.2 Insurance Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Credit Unions

10.5.1 Credit Unions Market Trends Analysis (2020-2032)

10.5.2 Credit Unions Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Retail Banking

10.6.1 Retail Banking Market Trends Analysis (2020-2032)

10.6.2 Retail Banking Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 P2P Lenders

10.7.1 P2P Lenders Market Trends Analysis (2020-2032)

10.7.2 P2P Lenders Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Digital Lending Platform Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.2.4 North America Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.5 North America Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.6 North America Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.2.7.2 USA Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.7.3 USA Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.7.4 USA Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.2.8.2 Canada Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.8.3 Canada Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.8.4 Canada Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.2.9.2 Mexico Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.9.3 Mexico Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.9.4 Mexico Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Digital Lending Platform Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.7.2 Poland Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.7.3 Poland Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.7.4 Poland Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.8.2 Romania Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.8.3 Romania Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.8.4 Romania Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turke Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Digital Lending Platform Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.4 Western Europe Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.5 Western Europe Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.6 Western Europe Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.7.2 Germany Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.7.3 Germany Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.7.4 Germany Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.8.2 France Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.8.3 France Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.8.4 France Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.9.2 UK Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.9.3 UK Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.9.4 UK Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.10.2 Italy Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.10.3 Italy Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.10.4 Italy Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.11.2 Spain Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.11.3 Spain Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.11.4 Spain Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.14.2 Austria Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.14.3 Austria Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.14.4 Austria Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Digital Lending Platform Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.4 Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.5 Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.6 Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.7.2 China Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.7.3 China Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.7.4 China Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.8.2 India Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.8.3 India Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.8.4 India Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.9.2 Japan Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.9.3 Japan Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.9.4 Japan Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.10.2 South Korea Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.10.3 South Korea Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.10.4 South Korea Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.11.2 Vietnam Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.11.3 Vietnam Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.11.4 Vietnam Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.12.2 Singapore Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.12.3 Singapore Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.12.4 Singapore Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.13.2 Australia Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.13.3 Australia Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.13.4 Australia Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Digital Lending Platform Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.4 Middle East Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.5 Middle East Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.6 Middle East Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.7.2 UAE Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.7.3 UAE Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.7.4 UAE Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Digital Lending Platform Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2.4 Africa Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.5 Africa Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.6 Africa Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Afric Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Digital Lending Platform Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.4 Latin America Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.5 Latin America Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.6 Latin America Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.7.2 Brazil Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.7.3 Brazil Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.7.4 Brazil Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.8.2 Argentina Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.8.3 Argentina Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.8.4 Argentina Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.9.2 Colombia Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.9.3 Colombia Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.9.4 Colombia Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Digital Lending Platform Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Digital Lending Platform Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Digital Lending Platform Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Digital Lending Platform Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

12. Company Profiles

12.1 Black knight, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Ellie Mae, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 Finastra

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Fis

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 Fiserv, Inc.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 Intellect design arena ltd

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 Nucleus Software Exports Ltd

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Temenos

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Tavant

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Wipro Limited

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Solution

Business Process Management

Lending Analytics

Loan Management

Loan Origination

Risk & Compliance Management

Others

By Service

Design and Implementation

Training and Education

Risk Assessment

Consulting

Support and Maintenance

By Deployment Mode

Cloud

On-premises

By Vertical

Banking

Financial Services

Insurance

Credit Unions

Retail Banking

P2P Lenders

Request for Segment Customization as per your Business Requirement: Segment Customization Request

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Automation Testing Market was valued at USD 29.4 billion in 2023 and is expected to reach USD 118.6 billion by 2032, growing at a CAGR of 16.80% over 2024-2032.

The Outsourced GCC Market Size was USD 20.14 billion in 2023 and is expected to reach USD 78.71 billion by 2032 and growing at a CAGR of 14.79% by 2024-2032.

The Casino Management system Market size was valued at USD 7.7 Billion in 2023 and will grow to USD 29.09 Billion and CAGR of 15.8% by 2032.

The Digital Signature Market size was valued at USD 5.6 Billion in 2023 and will grow to USD 107.1 Billion by 2032 and grow at a CAGR of 38.9 % by 2032.

STEM Education In K-12 Market was valued at USD 51.42 billion in 2023 and is expected to reach USD 168.63 billion by 2032, growing at a CAGR of 14.17% from 2024-2032.

The Predictive Analytics Market size was valued at USD 13.5 billion in 2023 and will grow to USD 82.9 billion by 2032 and grow at a CAGR of 22.4 % by 2032.

Hi! Click one of our member below to chat on Phone