Digital Identity Solution Market Report Scope & Overview:

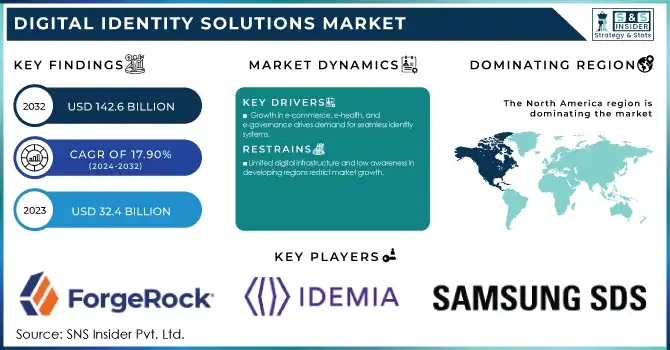

The Digital Identity Solutions Market was valued at USD 32.4 Billion in 2023 and is expected to reach USD 142.6 Billion by 2032, growing at a CAGR of 17.90% from 2024-2032.

Get more information on Digital Identity Solution Market - Request Free Sample Report

Digital Identity Solutions Market is experiencing significant growth due to the increasing need for secure, efficient, user-friendly identity verification solutions across multiple sectors. They use innovative technologies like biometrics, blockchain, artificial intelligence, and multi-factor authentication to provide safe access to services and safeguard sensitive information. With the rising number of cyber threats, identity theft, and data breaches, there is a growing demand for trustworthy identity solutions. Moreover, the growing rapid digital transformation in financial services, healthcare, e-commerce, and the government sector has also accelerated the need to integrate seamless identity management systems. The market growth trend is evident in the recent data. For example, reports from the industry claim that in 2024, around 3.6 billion people worldwide used digital identity verification at least once, thanks to the increase in online transactions and remote work. Further, the use of biometric authentication is rapidly on the uprising, as more than 70% of banking and financial services have incorporated biometric systems to bolster security and improve customer experience. Nation digital ID programs also play a leading role in driving adoption from the gov side. By 2024, more than 1.4 billion citizens had enrolled under India's Aadhaar initiative, showcasing a growing trend reliant on digital identity for public service delivery.

Digital identity solutions are more widely available due to smartphones and internet connection being an integral part of our lives. European regulatory frameworks like GDPR and PSD2 have driven much of the need for targeted advanced identity solutions to comply and manage risks. Moreover, advances in AI and machine learning allow for more precise and instant identity verification, eliminating fraud and improving user experience. Identity management is another sector where blockchain technology is witnessing adoption, providing decentralized and tamper-proof verification systems.

The market is moving towards customer-centric solutions as investments in identity-as-a-service platforms are growing driven by scalability and cost optimization. Additionally, its growing applications in e-voting, digital wallets, and decentralized finance products echo its transformative potential. The technological advancements accompanied by the changing regulatory environment are expected to lead to promising growth opportunities for the Digital Identity Solutions Market as organizations and governments give priority to secure, compliant, and seamless digital transactions & interactions.

Digital Identity Solutions Market Dynamics

Drivers

-

Growth in e-commerce, e-health, and e-governance drives demand for seamless identity systems.

Increasing use of e-commerce, e-health, and e-governance increases the demand for smooth and uninterrupted digital identity systems as these sectors rely extensively on secure and effective digital interactions. E-commerce: With more people buying online than ever before, identity verification needs to be more robust to help counter fraud, protect transactions, and build trust with customers. Authenticated users can benefit from appropriate security measures such as biometric authentication and multi-factor authentication to safeguard access and alleviate any risk for sensitive financial data. The growth of e-health services like telemedicine, EHRs, and virtual consultations treats the necessity of ensuring secure access to sensitive patient information. To safeguard patient privacy while complying with regulations such as HIPAA, digital identity systems guarantee the access of confidential medical data solely by authorized parties. In health organizations, biometrics and blockchain-based identity management technology are used extensively that add more security and facilitate patient identification and verification. In e-governance, the digital identity solution plays a prior role by granting access to secure electronic government services — including tax filing, welfare distribution, and digital voting. Initiatives such as India’s Aadhaar and Estonia’s e-Residency underscore the potential of digital identity to improve service delivery, decrease fraud, and support citizen participation. With continued growth across these sectors and their adaptations to digital transformation, the requirement for secure, seamless, and easy-to-use identity verification systems also increases, thus establishing digital identity solutions as a critical enabler of success and a driver of market growth.

-

Increasing cyberattacks and identity theft incidents drive the need for robust digital identity solutions.

-

Innovations in AI, ML, and blockchain enhance the accuracy and security of identity management.

Restraints

-

Limited digital infrastructure and low awareness in developing regions restrict market growth.

Continues Low Digital Infrastructure and Awareness in Developing Regions are the Key Constraints for the growth of digital identity solutions market. Several rising economies face poor internet availability, immature technology structure as well as low-performing digital transformation investments, which amplify the difficulty of using digital identity systems. These solutions are further hampered by challenges such as low penetration of smartphones, limited access to safe devices, and an unreliable power supply. Additionally, the problem is compounded by businesses and people who are unaware of the advantages of digital identity systems. Risk-friendly organizations in these regions are still using conventional ways of identity verification as they know little about advanced techniques like biometrics, blockchain, and multi-factor authentication. Similarly, end-users can be reluctant to use digital identity solutions over issues of their data privacy, security, and low familiarity with these innovations.

In developing economies, national digital identity programs face additional challenges from limited financing and a dearth of technical capacity in governments. It delays the implementation of digital identity systems into critical public services like welfare distribution, tax administration, and access to healthcare systems, consequently hindering market expansion. Tackling these hurdles will need the combined actions of governments, technology providers, and global bodies to improve digital infrastructure, build awareness, and offer affordable, accessible digital identity solutions to communities around the world, appropriate for their regions. Overcoming these obstacles can help developing nations realize immense potential and take part in the expanding Digital Identity Solutions Market globally.

-

Growing apprehensions about data misuse and unauthorized access hinder user adoption of digital identity systems.

-

Compliance with diverse and evolving global regulations complicates implementation and scalability.

Digital Identity Solutions Market Segment Analysis

By Type

In 2023, the centralized segment dominated the market and represented a significant revenue share of 65%, because of their wide adoption by both governments and large enterprises. This characteristic makes these systems ideal for applications such as national ID programs and for organizations as a robust single source of identity verification, especially for banking and enterprise access management. Easy to deploy, cost-effective, and integration with existing infrastructure are the key growth drivers. However, the challenges still toggle under them as susceptibility to leakages of crucial information or reliance on the single point of failure. However, in the future, centralized solutions are here to stay, especially for industries where strict regulatory compliance and centralized governance must be implemented. Continuous improvement in encryption and cyber security technologies will enhance their reliability, creating more stable growth in fields like finance, healthcare, and public services.

The decentralization segment is expected to register the fastest CAGR during the forecast period due to the inherent benefits of privacy, security, and user ownership. By utilizing blockchain technology, these systems facilitate self-sovereign identities that cannot be tampered with — and this is extremely tempting for players in e-commerce, DeFi, and cross-border service domains. Drivers: None, growth drivers, increasing importance of data privacy, higher blockchain adoption, regulatory winds blowing in favor of user-centric identity solutions. Decentralized systems will finally disrupt identity management, enabling people to take charge of their online identity. The rapid development of blockchain technology and interoperability will propel adoption, especially where digital infrastructure is well-developed and privacy is highly valued, driving strong market growth as the decade progresses.

By Deployment

The cloud segment dominated the market and accounted for a revenue share of more than 52% in 2023 due to scalability, ease of implementation, and low-cost benefits. Identity Cloud solutions allow organizations to remotely maintain and host identity data without the hassles of on-premise infrastructure and maintenance. The key growth drivers are the increased adoption of cloud computing, lowering IT expenses, and boosting access to remote workforces. In addition, Cloud solutions connect with other digital services very well which makes them fit best for the sectors of eCommerce, finance, and government. Cloud-based identity solutions are expected to experience massive growth in the future owing to the digital transformation taking place across every industry. The trend will gain even more momentum with the introduction of more innovative cloud security and compliance solutions, especially in large-scale identity management-dependent sectors.

On-premise segment is expected to register the fastest CAGR during the forecast period, owing to their user interest from organizations with high security, compliance, and data privacy requirements. They feature complete control of identity data, an important point for banking, government, and defense sectors. Data privacy concerns, regulatory compliance, and the need for a secure environment are some of the key growth factors. Looking out to the future, on-site solutions are slated to continue their growth trajectory in industries that emphasize data control and security quite a bit. On-premises will always be a requirement due to ever more stringent regulatory demands and data protection laws put forth by regulators in many geographies such as the EU, positioning the on-premises solution as an essential offering for any organization that needs full ownership and control over their digital identity infrastructure, especially within privacy-forward regions.

By Enterprise Size

In 2023, The large enterprises segment dominated the market and accounted for a revenue share of more than 71%, as they require the security of their complex systems, a wide reach with a vast customer base, and durable identity management systems. These organizations emphasize secure, scalable solutions for high data volume management and regulatory standards compliance. The major growth drivers are rising cases of data breaches, the need for secure access to corporate networks, and the growing use of cloud and hybrid cloud technology. In the coming years, large enterprises will continue to drive market growth through increased focus on security, user experience, and regulatory compliance. For many industries, especially the financial, healthcare, and government sectors, the IOC will just be the beginning as the digital transformation timeline continues to shorten and the demand for next-gen identity solutions will grow.

The Small and Medium Enterprises segment is expected to register the fastest CAGR during the forecast period, driven by the need for affordable and scalable identity management systems. SMEs are gradually moving towards these solutions to protect customer data, secure transactions, and enhance operational efficiency. Growth drivers: Increasing demand for cloud-based solutions, rise in need for secure work-from-home environments, and increasing cybersecurity risk awareness. The adoption of digital identity systems will follow this trend at speed, with SMEs standing on the cusp of further digital transformation. Low cloud-based solutions and increased focus on data protection will help SMEs further ensure growth and resilience in the digital economy scale securely.

Regional Analysis

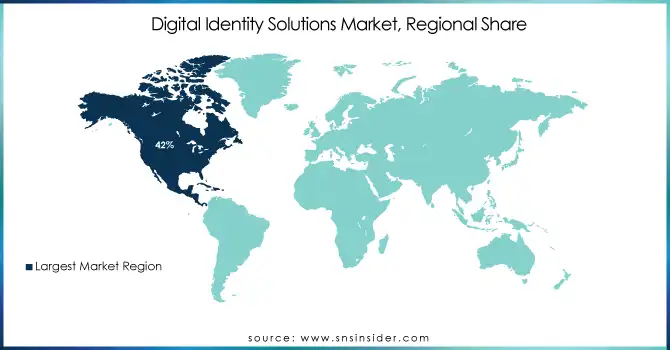

North America dominated the digital identity solutions market and accounted for a revenue share of more than 42% in 2023, owing to its well-established technological infrastructure, high digital services penetration, and rigorous regulations in the region. Increased awareness around cybersecurity threats, along with major technology providers in the region, further support the dominance of the market in this part of the world. Core factors contributing to revenue growth include the increasing prevalence of data breaches, rising demand for secure connectivity to corporate networks, and adoption of cloud and hybrid cloud solutions.

North America continues to be the leader in the Digital Twin market and will continue to grow with the ongoing digital transformation in many industries. With changing regulatory needs and growing security concerns, the need for sophisticated identity solutions is relentless, especially in financial, healthcare, and government functions.

The Asia-Pacific is registering the fastest CAGR during the forecast period, due to the proliferation of digitalization, increasing internet penetration, and focus on security stretching beyond physical borders. A massive and diverse population, combined with an explosive rise in mobile internet, underscores the need for a reliable, secure identity verification system in the region. And the growth factors can be attributed to the increasing trends of e-commerce, digital payments, and government initiatives for improving digital governance. Asia-Pacific is set to see continued rapid growth and adoption of digital identity solutions across sectors, including finance, healthcare, and government. The region will emerge as one of the market´s growth regions as it continues to develop its digital infrastructure and awareness of data security will grow, and will need secure and scalable identity management systems.

Need any customization research on Digital Identity Solution Market - Enquiry Now

Key Players

The major key player along with their products are

-

Microsoft – Azure Active Directory

-

IBM – IBM Security Identity Governance and Intelligence

-

Oracle – Oracle Identity Management

-

Ping Identity – PingOne for Enterprise

-

Okta – Okta Identity Cloud

-

Duo Security (Cisco) – Duo Security Multi-Factor Authentication

-

Gemalto (Thales Group) – SafeNet Trusted Access

-

SailPoint Technologies – IdentityNow

-

IDEMIA – IDEMIA Identity Management

-

Auth0 – Auth0 Identity Platform

-

HYPR – HYPR Biometric Authentication

-

ForgeRock – ForgeRock Identity Management

-

OneSpan – OneSpan Identity Verification

Recent Developments

In April 2024, Giesecke+Devrient reported record sales in its Digital Security segment, which includes applications in identity technology and digital infrastructures.

In January 2025, SailPoint, a cybersecurity company owned by Thoma Bravo, filed for a U.S. initial public offering (IPO), reporting a narrower loss attributed to increased subscription revenue.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.4 Billion |

| Market Size by 2032 | USD 142.6 Billion |

| CAGR | CAGR of 12.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Centralized, Decentralized) • By Deployment (Cloud, On-premises, Hybrid) • By Organization Size (Small and Medium Enterprises, Large Enterprises) • By Application (Authentication, Authorization, Access and Lifecycle Management, Others) • By Industry (BFSI, Automotive and Manufacturing, Government and Public Services, Energy and Resources, Healthcare, IT and Telecommunication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, IBM, Oracle, Ping Identity, Okta, Duo Security (Cisco), Gemalto (Thales Group), SailPoint Technologies, IDEMIA, Auth0, HYPR, ForgeRock, OneSpan. |

| Key Drivers | • Increasing cyberattacks and identity theft incidents drive the need for robust digital identity solutions. • Innovations in AI, ML, and blockchain enhance the accuracy and security of identity management. |

| RESTRAINTS | • Growing apprehensions about data misuse and unauthorized access hinder user adoption of digital identity systems. • Compliance with diverse and evolving global regulations complicates implementation and scalability. |