Digital Forensics Market Size & Overview:

Get more information on Digital Forensics Market - Request Free Sample Report

The Digital Forensics Market was valued at USD 9.84 Billion in 2023 and is expected to reach USD 30.74 Billion by 2032, growing at a CAGR of 13.51% from 2024-2032.

The Digital Forensics Market is witnessing significant growth due to an increase in cybercrime investigations and regulation compliance. The market is expanding, as recovery, analysis, and presentation of digital evidence play an imperative role in criminal investigations, corporate data protection, and national security. The increasing prevalence of cyberattacks, data breaches, and advanced persistent threats (APTs), especially in industries such as banking, government, healthcare, and retail, is one of the key drivers responsible for the growth of this market.

The growing significance of mobile devices, cloud computing, and the Internet of Things (IoT) over the last few years, has also fueled the demand for digital forensics. These developments have evolved the volume and range of data available to analyze, from the devices we use every day to the infamously nebulous cloud systems and networks that require the tools and expertise of an information forensic scientist to retrieve and analyze evidence.

Digital forensics tools are also being revolutionized by the integration of artificial intelligence (AI) and machine learning (ML) technologies.

This streamlines the identification and classification of the cybercrimes allowing for investigations to happen faster and more accurately. Consequently, the digital forensics market will keep growing, given the increase in the number of cybersecurity professionals as well as the growing demand for cybersecurity training and services

A similar goes for the cloud computing boom, which has increased the demand for cloud forensics. Cyber security firms invested heavily in 2023 on tools to tackle challenges around data stored in Cloud settings. Such tools play a huge role in fighting cybercrimes such as ransomware and data breaches, enabling investigators to request access to relevant information stored on servers hosted by cloud service providers. Network forensics has also gained prominence in recent years due to the rising risk of security breaches over networks. With global cybercrime damages expected to reach USD 10.5 trillion per annum by 2025 (according to Cybersecurity Ventures), there is a growing need for efficient network forensics tools capable of tracing malicious activities.

Digital Forensics Market Dynamics

Drivers

- As organizations move more data to the cloud, the need for cloud forensics grows to address security concerns and retrieve critical data from cloud environments for investigation purposes.

With an increasing number of organizations shifting their data storage to the cloud environment, there has been a significant rise in the demand for cloud forensics in the Digital Forensics Market. There are several benefits of cloud computing including improved flexibility, scalability, cost-effectiveness, etc. Now, this also brings some unique security challenges. Your data may reside in multiple locations, and be encrypted, and even cloud management may be within the third-party environment which can result in challenges of cybercrime or data breach investigations entailing cloud-based data.

Accessing and retrieving data from third-party cloud servers is one of the most common issues in cloud forensics. These might be cloud platforms, they would not be under the same legal roof and also, not a straight access like the ordinary data centers. Further complexities such as multi-tenancy, where data from more than one client is hosted on the same infrastructure, and basic data obfuscation methods, like encryption. As cloud services are increasingly adopted, investigators require essential tools to secure actual evidence as well as to trace and extract data from various platforms. And they need to be compliant with international standards like the General Data Protection Regulation (GDPR) in the European Union. Cyberattacks targeting cloud environments, such as ransomware and data breaches, are becoming increasingly sophisticated, and this is another major factor driving demand for cloud forensics.

Real-time detection, low-cost scalability, and high-speed data analysis are some of the many benefits of cloud forensics. Cloud-stored data allows an investigator to access the data remotely, which means investigators can retrieve data much quicker in a situation where time may be critical. All of these advantages make cloud forensics an essential aspect of the modern cybersecurity and digital investigation process.

Benefits of Cloud Computing in the Digital Forensics Market

|

Benefit |

Description |

|

Scalability |

Cloud forensics tools can scale quickly to accommodate large volumes of data across multiple locations, ensuring efficient investigation. |

|

Cost Efficiency |

Cloud-based digital forensics solutions eliminate the need for expensive on-premise infrastructure, reducing the overall cost of forensics operations. |

|

Enhanced Collaboration |

Cloud platforms allow multiple investigators to access the same data set, facilitating team collaboration and more comprehensive investigations. |

|

Data Integrity and Preservation |

Cloud platforms provide built-in redundancy and backup systems to ensure data is securely stored and preserved throughout the investigative process. |

-

The rising number of cybercrimes, including data breaches and cyberattacks, fuels the demand for digital forensics tools to identify, recover, and analyze digital evidence.

-

The proliferation of smartphones and mobile applications has significantly increased the need for mobile device forensics solutions to analyze data from personal and business communications.

Restraints

- The increasing use of encryption and other obfuscation techniques in data storage and transmission makes forensic investigations more difficult.

Encryption and obfuscation techniques are becoming a major hurdle for digital forensics investigators, and many criminals have discovered the benefits of advanced data protection methods to obstruct investigations. Often used by industries like finance, health care, and government with sensitive data, encryption guarantees that, even if someone intercepted the data, they could not access it without the appropriate decryption key. Not only is this important in securing data but this makes forensic analysis more complicated as investigators require decryption keys/passwords for important information which are not always available. In addition to encryption, there are several methods such as masking, anonymization, and VPN and dark web, which make forensic investigations more challenging. Such techniques conceal the authenticity or location of data and prevent investigators from tracking, recovering, or examining the evidence. Similar anonymity toppers such as VPNs Skype, or even anonymizing networks such as Tor, which conceals users and also directs traffic, where the identity of the cybercriminal or the harmful action is difficult, if not impossible, to be determined.

Such security measures are particularly troublesome in cyber, data breach, or IP theft scenarios where access to encrypted or obfuscated data is essential to identify criminals, assess the extent of damage, and recover stolen valuables. Forensic specialists frequently turn to more complex solutions to address these issues, such as brute-force efforts or proprietary decryption software. However these methods can be very resource-intensive and expensive, and they may become less effective and even ineffective because encryption and obfuscation techniques are constantly being improved. With the rise of these security strategies, the Digital Forensics Market will need to keep adapting and creating better tools and methods to meet these challenges head-on while allowing digital investigators to remain effective in the future.

-

Advanced digital forensics tools require substantial investment, limiting access for smaller organizations and affecting market growth.

-

The rapid growth of data types and sources (e.g., IoT, cloud, mobile) complicates data retrieval, requiring specialized tools and skilled professionals.

Digital Forensics Market Segmentation Analysis

By Component

In 2023, the hardware segment dominated the market and represented a significant revenue share of more than 44.0%. This is due to the importance of specialized hardware in collecting, analyzing, and preserving digital evidence. Hardware is essential for digital forensics investigators as it includes practical tools that allow them to perform extraction, analysis, or running other forensic tools on the target device. Popular examples include forensic workstations, write blockers, and disk images, which are used to extract data from computers, mobile devices, servers, etc. A rising requirement for high-performance and dedicated hardware for processing rapidly expanding and complex digital data (like big data) that is growing at an exponential rate in the modern age is creating a demand for advanced hardware assemblies and segments of this hardware in the market, thus, driving its dominance in the overall market.

The service segment is anticipated to grow at the fastest CAGR during the forecast period. This is due to a rising need for custom digital forensics specialties like incident response, threat intelligence, and expert witness testimony. The increased complexity of the digital forensics case and the need for more specialized services like data recovery, mobile device analysis, or cloud forensics has also accelerated this trend. Moreover, the need for continuous training & assistance for digital forensics professionals to maintain currency with changes in technology & keep up with advances in techniques has propelled the requirement for services. This is expected to fuel segment growth, leading major service providers to diversify their product offerings with managed, consulting and training services.

By Type

In 2023, the computer forensics segment dominated the market and represented a revenue share of more than 42.0%. Since these devices are used for several different critical industries, it's natural they receive almost immediate and lengthy scrutiny as they become a prime portal for collecting and analyzing digital evidence. Today we see the rise of the computer forensics profession, the practice of collecting, discovering, analyzing, and preserving data from computer systems, which plays an important role in digital investigations. Demand for computer forensics solutions has gained significant traction due to the increasing dependence of organizations on computers for storing sensitive data, and the rising threat of cybercrimes such as hacking and data breach. For example, in developing countries, the increase in digitization initiatives from governments is resulting in an explosion in computer use — and, therefore, more opportunities for cybercriminals. It has also established itself as the largest stake in the global digital forensics market.

The cloud forensics segment is anticipated to grow at fastest CAGR during the forecast period. The swift shift to cloud computing technologies has developed a new demand for particular cloud forensics solutions. Data and applications are migrating to cloud environments, and it has become increasingly important to investigate and analyze data stored in the cloud. The end users of cloud forensics solutions are professionals such as DevSecOps practitioners, cybersecurity experts, law enforcement officers, and IT investigators. It enables the collection, analysis, and preservation of all cloud-based data which makes cloud forensics an extremely important part of any digital forensics investigations. The increasing incidence of cloud-based cybercrimes like data breaches, and unauthorized access has increased the requirement of these solutions.

By End-Use

In 2023, the government and defense segment dominated the market and represented a significant revenue share. This is due to the pressing requirement of state-of-the-art digital forensics tools for cyber threat investigation and cybercrime digital evidence analysis in forensic criminal investigation and intelligence gathering. Due to the nature of the information that the sector has to deal with along with the critical infrastructure, there exists a strong demand for high-quality digital forensics solutions that can protect the sector from cyberattacks, data breaches, and other malicious acts. In addition, stringent regulatory requirements and compliance standards further drive the adoption of digital forensics to ensure the integrity and security of digital evidence.

Healthcare is projected to register the fastest CAGR over the forecast period. This is due to the rise in the adoption of digital technologies in this sector leading to an increase in cyberattacks & data breaches of sensitive patient information. The Identity Theft Resource Center, for example, noted in its Annual Data Breach Report that the healthcare vertical was the most breached industry in the U.S., accounting for 809 data breaches in 2023. The increasing use of electronic health records, medical devices, and connected healthcare systems has left the industry particularly exposed to cyberattacks.

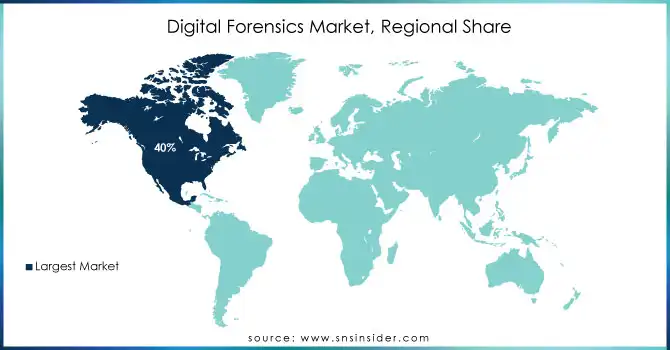

Regional Landscape

The North American digital forensics market accounted for the highest revenue share of 40.0% in 2023 This is because of the early adoption of digital technologies in this part of the world, leading to the high data volume generating and the need for digital forensics solutions. The experimentation of a number of the world’s largest tech companies, and massive investment from Wall Street banks and government agencies in the region, have created a digital forensics innovation and investment hotbed. Additionally, the rising incidence of cyberattacks and data breaches in North America has thrust the requirement for advanced digital forensics functionality to study and address these incidents into the spotlight.

The Asia Pacific digital forensics market is likely to experience the fastest growth rate during the forecast period. This is mainly due to the transformation towards digitalization and the increasing deployment of cloud computing, IoT, and other digital technologies in these regions. This has led the regional economies to be one of the primary targets of cyber enthusiasts and data breaches which is subsequently propelling the demand for digital forensics solutions to counter such incidents in a new way. Moreover, with the increasing emphasis on cybersecurity, data privacy, and regulatory compliance, the region witnessed the need for digital solid forensics capabilities. China, India, and Japan are paving the way by investing heavily in digital forensics technologies, training, and expertise.

Need any customization research on Digital Forensics Market - Enquiry Now

Key Players

The major key players along with their products are

-

AccessData – FTK (Forensic Toolkit)

-

Cellebrite – Cellebrite UFED

-

Magnet Forensics – Magnet AXIOM

-

Guidance Software (Acquired by OpenText) – EnCase

-

OpenText – EnCase Endpoint Investigator

-

Paraben Corporation – E3 Platform

-

MSAB – XRY

-

Belkasoft – Belkasoft Evidence Center

-

BlackBag Technologies (Acquired by Cellebrite) – BlackLight

-

Passware – Passware Kit Forensic

-

X1 Discovery – X1 Social Discovery

-

Kroll – CyberDetectER

-

Oxygen Forensics – Oxygen Forensic Detective

-

Basis Technology – Autopsy

-

Nuix – Nuix Workstation

-

Cisco Systems – SecureX

-

IBM – QRadar Incident Forensics

-

FireEye – Helix

-

LogRhythm – LogRhythm NetMon

-

Rapid7 – InsightIDR

Recent Developments

March 2024: Downstreem launched StreemView, a groundbreaking platform for mobile device analysis that simplifies the investigation of diverse data types across multiple operating systems

April 2024: Magnet Forensics announced upgrades to its Magnet AXIOM tool, incorporating advanced cloud forensics capabilities to support investigations in hybrid environments

| Report Attributes | Details |

| Market Size in 2023 | USD 9.84 Billion |

| Market Size by 2031 | USD 30.74 Billion |

| CAGR | CAGR of 13.51% from 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Service) • By Tool (Data Acquisition & Preservation, Forensic Data Analysis, Data Recovery, Review & Reporting, Forensic Decryption, Others) • By Type (Computer Forensics, Network Forensics, Mobile Device Forensics, Cloud Forensics) • By End-Use (Government, Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

AccessData, Cellebrite, Magnet Forensics, Guidance Software (Acquired by OpenText), OpenText, Paraben Corporation, MSAB, Belkasoft, BlackBag Technologies (Acquired by Cellebrite), Passware, X1 Discovery,Kroll, Oxygen Forensics, Basis Technology, Nuix, Cisco Systems, IBM, FireEye, LogRhythm, Rapid7 |

| Key Drivers | •As organizations move more data to the cloud, the need for cloud forensics grows to address security concerns and retrieve critical data from cloud environments for investigation purposes. •The rising number of cybercrimes, including data breaches and cyberattacks, fuels the demand for digital forensics tools to identify, recover, and analyze digital evidence. •The proliferation of smartphones and mobile applications has significantly increased the need for mobile device forensics solutions to analyze data from personal and business communications. |

| Market Restraints | •The increasing use of encryption and other obfuscation techniques in data storage and transmission makes forensic investigations more difficult. •Advanced digital forensics tools require substantial investment, limiting access for smaller organizations and affecting market growth. •The rapid growth of data types and sources (e.g., IoT, cloud, mobile) complicates data retrieval, requiring specialized tools and skilled professionals. |