Get more information on Digital Diabetes Management Market - Request Free Sample Report

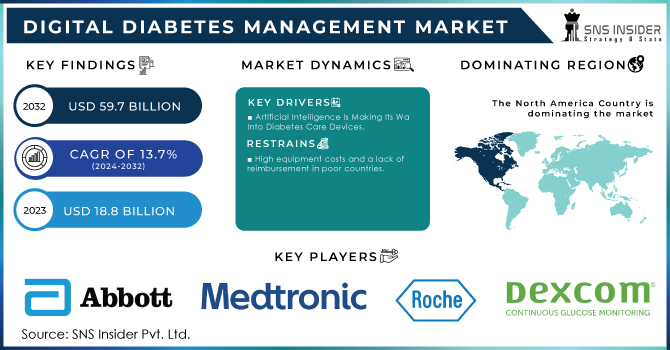

The Digital Diabetes Management Market Size was valued at USD 18.8 billion in 2023, and is expected to reach USD 59.7 billion by 2032, and grow at a CAGR of 13.7% over the forecast period 2024-2032.

The market's rapid rise can be attributed to the rising prevalence of diabetes as well as technical advancement and innovation. As digital technology advances, the diabetes industry is projected to see a wide range of technologies that have the potential to revolutionize the way we manage the condition. Over the last few years, the number of smartphone apps accessible for illness management has expanded, and there are over a hundred apps available on web-based app stores that can help patients monitor their blood glucose levels. Rapidly changing lifestyles, such as smoking and alcohol usage, are contributing to an increase in the number of diabetes patients globally. Furthermore, obesity is one of the key risk factors for diabetes. With an increasing obese population and increased patient awareness, the market for diet and weight control apps is showing great promise.

Diabetes is a medical disorder in which the pancreas' inability to make insulin results in a rise in blood glucose levels. Diabetic patients encounter numerous daily obstacles, such as determining what to eat, comprehending medical advice, and recognizing the influence of food and activities on blood sugar levels. Patients can address their health issues by engaging with the healthcare team and sharing data because digital technology is available at any time and from any location. This is a digital ecosystem of data-driven technologies that will connect patients and their care teams for better diabetes control.

DRIVERS

Artificial Intelligence Is Making Its Way Into Diabetes Care Devices

Artificial intelligence (Al) is a rapidly expanding field, and its applications in diabetes have revolutionized the approach to the diagnosis and management of this chronic condition. Machine learning principles have been utilized to generate algorithms to provide predictive models for the risk of getting diabetes or its complications. Technological advancements have aided in the optimization of diabetes resource consumption. These astute technical modifications have resulted in improved glycemic control, including decreases in fasting and postprandial glucose levels, glucose excursions, and glycosylated hemoglobin.

Al will offer a paradigm shift in diabetes care, moving away from traditional management tactics and toward the development of tailored, data-driven precision care. Livongo Health (United States), for example, is employing a big-data-driven strategy to assist people in managing their health and improving their lifestyles. Many individuals use the company's unique devices, which include blood glucose meters, blood pressure cuffs, and scales that can collect data and communicate it to a larger database. The organization then uses this data to generate complete insights for the benefit of patients.

RESTRAIN

High equipment costs and a lack of reimbursement in poor countries

OPPORTUNITY

Increasing diabetes-related health-care spending

Diabetes-related worldwide health expenditure has increased significantly, rising from USD 236 billion in 2007 to USD 966 billion in 2021 for adults aged 20 to 80 years. This reflects a 318% growth rate over the previous 15 years. A portion of this rise can be attributable to better data quality. Diabetes' direct expenditures are projected to rise further. According to the IDF Atlas 2021, overall diabetes-related health spending will reach USD 1.04 trillion by 2030 and USD 1.07 trillion by 2045. The North America and Caribbean region has the largest diabetes-related health spending per adult diabetic (USD 8,209), followed by Europe (USD 3,088), South and Central America (USD 2,190), the Western Pacific (USD 2,191), and the WP region (1,206 USD). This amount is USD 465 per diabetic person in the Middle East and North Africa region, USD 548 in Africa, and USD 112 in Southeast Asia. Diabetes expenditure has a significant impact on total health expenditure worldwide, accounting for 11.6% of total global health spending. Given the rising cost of diabetes-related health care in developing nations, several digital diabetes management device makers are focusing on growing their presence in these areas in order to capitalize on new opportunities.

CHALLENGES

In emerging economies, penetration is low

Uncertainty in the Market Geopolitical unrest may wreak havoc on financial markets and undermine investor confidence. This could result in lower spending on healthcare and technology, including digital diabetes management. Regulatory Difficulties Following a significant conflict, regulatory frameworks in impacted regions may change, potentially affecting the approval, distribution, and use of medical devices, including digital diabetes management solutions. Economic Impact Wars and conflicts can cause economic downturns in the countries involved and abroad. Reduced purchasing power and higher healthcare expenditures as a result of the war's aftermath may affect both demand for and affordability of digital diabetes control options. Prioritize Immediate needs. During a crisis, healthcare resources may be diverted to more pressing issues, such as treating war-related injuries and providing emergency medical care. This may divert attention away from the development and implementation of digital diabetes management systems.

IMPACT OF ONGOING RECESSION

During the study period, 680 individuals had their blood pressure measured at least once a year, and 274 had their HbA1c measured at least once a year. Because only 58 patients had a recorded BMI at least once a year, the cohort was confined to all patients with at least one recorded BMI per time period (pre-recession, recession, and post-recession), resulting in a BMI trend sample of 1,021 individuals. Mean changes in HbA1c and BP from one year to the next, as well as mean changes in BMI between time periods, were investigated while accounting for repeated assessments. HbA1c levels steadily decreased over the whole study period. Prior to the recession, blood pressure had been declining on a yearly basis.

By Product

Smart Glucose Meter

Continuous Blood Glucose Monitoring System

Smart Insulin Pens

Smart Insulin Pumps

Apps

Digital Diabetes Management Apps

Weight & Diet Management Apps

By Type

Wearable Devices

Handheld Devices

By End Use

Hospitals

Home settings

Diagnostic Centers

REGIONAL ANALYSES

North America will have the greatest CAGR in the digital diabetes management market in 2023, followed by Europe, Asia Pacific, Latin America, the Middle East, and Africa. The region's highest CAGR can be attributed to rising adoption of connected diabetes management devices, rising adoption of diabetes management and obesity apps, rising demand for technologically advanced solutions, payer acceptance of digital diabetes solutions, government initiatives to promote digital health, and rising awareness of self-diabetes management.

Need any customization research on Digital Diabetes Management Market - Enquiry Now

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Abbott Laboratories, Medtronic plc, F. Hoffmann-La Roche Ltd., Bayer AG, Lifescan, Inc, Dexcom, Inc, Sanofi, Insulet Corporation, Ascensia Diabetes Care Holdings Ag, B Braun Melsungen AG and others.

Dexcom: In February 2023,Dexcom announced the Dexcom G7 CGM device in the United States and plans to market it in Europe and Asia Pacific in the first quarter of 2024.

Abbott Laboratories: In October2022, Abbott Laboratories has released the Freestyle Libre 3 CGM gadget on a global scale.

| Report Attributes | Details |

| Market Size in 2023 | US$ 18.8 Bn |

| Market Size by 2032 | US$ 59.7 Bn |

| CAGR | CAGR of 13.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Smart Glucose Meter, Continuous Blood Glucose Monitoring System, Smart Insulin Pens, Smart Insulin Pumps, Apps (Digital Diabetes Management Apps, Weight & Diet Management Apps)) • By Type (Wearable Devices, Handheld Devices) • By End Use (Hospitals, Home settings, Diagnostic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Medtronic plc, F. Hoffmann-La Roche Ltd., Bayer AG, Lifescan, Inc, Dexcom, Inc, Sanofi, Insulet Corporation, Ascensia Diabetes Care Holdings Ag, B Braun Melsungen AG |

| Key Drivers | • Artificial Intelligence Is Making Its Way Into Diabetes Care Devices |

| Market Restraints | • High equipment costs and a lack of reimbursement in poor countries. |

Ans: The Digital Diabetes Management Market is expected to grow at 13.7% CAGR from 2024 to 2032.

Ans: According to our analysis, the Digital Diabetes Management Market is anticipated to reach USD 59.7 billion By 2032.

Ans: The leading participants in the,Abbott Laboratories, Medtronic plc, F. Hoffmann-La Roche Ltd., Bayer AG, Lifescan, Inc, Dexcom, Inc, Sanofi, Insulet Corporation, Ascensia Diabetes Care Holdings Ag, B Braun Melsungen AG.

Ans: Growing technical improvements and rising FDA approval for innovative solutions are key factors driving the digital diabetes management market's expansion.

Ans: Yes, you may request customization based on your company's needs.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Ukraine- Russia war

4.2 Impact of ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Digital Diabetes Management Market, By Product

8.1 Smart Glucose Meter

8.2 Continuous Blood Glucose Monitoring System

8.3 Smart Insulin Pens

8.4 Smart Insulin Pumps

8.5 Apps

8.5.1 Digital Diabetes Management Apps

8.5.2 Weight & Diet Management Apps

9. Digital Diabetes Management Market,By Type

9.1 Wearable Devices

9.2 Handheld Devices

10. Digital Diabetes Management Market, By End Use

10.1 Hospitals

10.2 Home settings

10.3 Diagnostic Centers

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Digital Diabetes Management Market by country

11.2.2North America Digital Diabetes Management Market by Product

11.2.3 North America Digital Diabetes Management Market by Type

11.2.4 North America Digital Diabetes Management Market by End-user

11.2.5 USA

11.2.5.1 USA Digital Diabetes Management Market by Product

11.2.5.2 USA Digital Diabetes Management Market by Type

11.2.5.3 USA Digital Diabetes Management Market by End-user

11.2.6 Canada

11.2.6.1 Canada Digital Diabetes Management Market by Product

11.2.6.2 Canada Digital Diabetes Management Market by Type

11.2.6.3 Canada Digital Diabetes Management Market by End-user

11.2.7 Mexico

11.2.7.1 Mexico Digital Diabetes Management Market by Product

11.2.7.2 Mexico Digital Diabetes Management Market by Type

11.2.7.3 Mexico Digital Diabetes Management Market by End-user

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Digital Diabetes Management Market by country

11.3.1.2 Eastern Europe Digital Diabetes Management Market by Product

11.3.1.3 Eastern Europe Digital Diabetes Management Market by Type

11.3.1.4 Eastern Europe Digital Diabetes Management Market by End-user

11.3.1.5 Poland

11.3.1.5.1 Poland Digital Diabetes Management Market by Product

11.3.1.5.2 Poland Digital Diabetes Management Market by Type

11.3.1.5.3 Poland Digital Diabetes Management Market by End-user

11.3.1.6 Romania

11.3.1.6.1 Romania Digital Diabetes Management Market by Product

11.3.1.6.2 Romania Digital Diabetes Management Market by Type

11.3.1.6.4 Romania Digital Diabetes Management Market by End-user

11.3.1.7 Turkey

11.3.1.7.1 Turkey Digital Diabetes Management Market by Product

11.3.1.7.2 Turkey Digital Diabetes Management Market by Type

11.3.1.7.3 Turkey Digital Diabetes Management Market by End-user

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Digital Diabetes Management Market by Product

11.3.1.8.2 Rest of Eastern Europe Digital Diabetes Management Market by Type

11.3.1.8.3 Rest of Eastern Europe Digital Diabetes Management Market by End-user

11.3.2 Western Europe

11.3.2.1 Western Europe Digital Diabetes Management Market by Product

11.3.2.2 Western Europe Digital Diabetes Management Market by Type

11.3.2.3 Western Europe Digital Diabetes Management Market by End-user

11.3.2.4 Germany

11.3.2.4.1 Germany Digital Diabetes Management Market by Product

11.3.2.4.2 Germany Digital Diabetes Management Market by Type

11.3.2.4.3 Germany Digital Diabetes Management Market by End-user

11.3.2.5 France

11.3.2.5.1 France Digital Diabetes Management Market by Product

11.3.2.5.2 France Digital Diabetes Management Market by Type

11.3.2.5.3 France Digital Diabetes Management Market by End-user

11.3.2.6 UK

11.3.2.6.1 UK Digital Diabetes Management Market by Product

11.3.2.6.2 UK Digital Diabetes Management Market by Type

11.3.2.6.3 UK Digital Diabetes Management Market by End-user

11.3.2.7 Italy

11.3.2.7.1 Italy Digital Diabetes Management Market by Product

11.3.2.7.2 Italy Digital Diabetes Management Market by Type

11.3.2.7.3 Italy Digital Diabetes Management Market by End-user

11.3.2.8 Spain

11.3.2.8.1 Spain Digital Diabetes Management Market by Product

11.3.2.8.2 Spain Digital Diabetes Management Market by Type

11.3.2.8.3 Spain Digital Diabetes Management Market by End-user

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands Digital Diabetes Management Market by Product

11.3.2.9.2 Netherlands Digital Diabetes Management Market by Type

11.3.2.9.3 Netherlands Digital Diabetes Management Market by End-user

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland Digital Diabetes Management Market by Product

11.3.2.10.2 Switzerland Digital Diabetes Management Market by Type

11.3.2.10.3 Switzerland Digital Diabetes Management Market by End-user

11.3.2.11.1 Austria

11.3.2.11.2 Austria Digital Diabetes Management Market by Product

11.3.2.11.3 Austria Digital Diabetes Management Market by Type

11.3.2.11.4 Austria Digital Diabetes Management Market by End-user

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe Digital Diabetes Management Market by Product

11.3.2.12.2 Rest of Western Europe Digital Diabetes Management Market by Type

11.3.2.12.3 Rest of Western Europe Digital Diabetes Management Market by End-user

11.4 Asia-Pacific

11.4.1 Asia-Pacific Digital Diabetes Management Market by country

11.4.2 Asia-Pacific Digital Diabetes Management Market by Product

11.4.3 Asia-Pacific Digital Diabetes Management Market by Type

11.4.4 Asia-Pacific Digital Diabetes Management Market by End-user

11.4.5 China

11.4.5.1 China Digital Diabetes Management Market by Product

11.4.5.2 China Digital Diabetes Management Market by Type

11.4.5.3 China Digital Diabetes Management Market End-user

11.4.6 India

11.4.6.1 India Digital Diabetes Management Market by Product

11.4.6.2 India Digital Diabetes Management Market by Type

11.4.6.3 India Digital Diabetes Management Market by End-user

11.4.7 Japan

11.4.7.1 Japan Digital Diabetes Management Market by Product

11.4.7.2 Japan Digital Diabetes Management Market by Type

11.4.7.3 Japan Digital Diabetes Management Market by End-user

11.4.8 South Korea

11.4.8.1 South Korea Digital Diabetes Management Market by Product

11.4.8.2 South Korea Digital Diabetes Management Market by Type

11.4.8.3 South Korea Digital Diabetes Management Market by End-user

11.4.9 Vietnam

11.4.9.1 Vietnam Digital Diabetes Management Market by Product

11.4.9.2 Vietnam Digital Diabetes Management Market by Type

11.4.9.3 Vietnam Digital Diabetes Management Market by End-user

11.4.10 Singapore

11.4.10.1 Singapore Digital Diabetes Management Market by Product

11.4.10.2 Singapore Digital Diabetes Management Market by Type

11.4.10.3 Singapore Digital Diabetes Management Market by End-user

11.4.11 Australia

11.4.11.1 Australia Digital Diabetes Management Market by Product

11.4.11.2 Australia Digital Diabetes Management Market by Type

11.4.11.3 Australia Digital Diabetes Management Market by End-user

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Digital Diabetes Management Market by Product

11.4.12.2 Rest of Asia-Pacific Digital Diabetes Management Market by Type

11.4.12.3 Rest of Asia-Pacific Digital Diabetes Management Market by End-user

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Digital Diabetes Management Market by country

11.5.1.2 Middle East Digital Diabetes Management Market by Product

11.5.1.3 Middle East Digital Diabetes Management Market by Type

11.5.1.4 Middle East Digital Diabetes Management Market by End-user

11.5.1.5 UAE

11.5.1.5.1 UAE Digital Diabetes Management Market by Product

11.5.1.5.2 UAE Digital Diabetes Management Market by Type

11.5.1.5.3 UAE Digital Diabetes Management Market by End-user

11.5.1.6 Egypt

11.5.1.6.1 Egypt Digital Diabetes Management Market by Product

11.5.1.6.2 Egypt Digital Diabetes Management Market by Type

11.5.1.6.3 Egypt Digital Diabetes Management Market by End-user

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Digital Diabetes Management Market by Product

11.5.1.7.2 Saudi Arabia Digital Diabetes Management Market by Type

11.5.1.7.3 Saudi Arabia Digital Diabetes Management Market by End-user

11.5.1.8 Qatar

11.5.1.8.1 Qatar Digital Diabetes Management Market by Product

11.5.1.8.2 Qatar Digital Diabetes Management Market by Type

11.5.1.8.3 Qatar Digital Diabetes Management Market by End-user

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Digital Diabetes Management Market by Product

11.5.1.9.2 Rest of Middle East Digital Diabetes Management Market by Type

11.5.1.9.3 Rest of Middle East Digital Diabetes Management Market by End-user

11.5.2 Africa

11.5.2.1 Africa Digital Diabetes Management Market by country

11.5.2.2 Africa Digital Diabetes Management Market by Product

11.5.2.3 Africa Digital Diabetes Management Market by Type

11.5.2.4 Africa Digital Diabetes Management Market by End-user

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Digital Diabetes Management Market by Product

11.5.2.5.2 Nigeria Digital Diabetes Management Market by Type

11.5.2.5.3 Nigeria Digital Diabetes Management Market by End-user

11.5.2.6 South Africa

11.5.2.6.1 South Africa Digital Diabetes Management Market by Product

11.5.2.6.2 South Africa Digital Diabetes Management Market by Type

11.5.2.6.3 South Africa Digital Diabetes Management Market by End-user

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Digital Diabetes Management Market by Product

11.5.2.7.2 Rest of Africa Digital Diabetes Management Market by Type

11.5.2.7.3 Rest of Africa Digital Diabetes Management Market by End-user

11.6 Latin America

11.6.1 Latin America Digital Diabetes Management Market by country

11.6.2 Latin America Digital Diabetes Management Market by Product

11.6.3 Latin America Digital Diabetes Management Market by Type

11.6.4 Latin America Digital Diabetes Management Market by End-user

11.6.5 Brazil

11.6.5.1 Brazil America Wheelchair by Product

11.6.5.2 Brazil America Wheelchair by Type

11.6.5.3 Brazil America Wheelchair by End-user

11.6.6 Argentina

11.6.6.1 Argentina America Wheelchair by Product

11.6.6.2 Argentina America Wheelchair by Type

11.6.6.3 Argentina America Wheelchair by End-user

11.6.7 Colombia

11.6.7.1 Colombia America Wheelchair by Product

11.6.7.2 Colombia America Wheelchair by Type

11.6.7.3 Colombia America Wheelchair by End-user

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Wheelchair by Product

11.6.8.2 Rest of Latin America Wheelchair by Type

11.6.8.3 Rest of Latin America Wheelchair by End-user

12 Company profile

12.1 Abbott Laboratories

12.1.1 Company Overview

12.1.2 Financials

12.1.3 Product/Services/Offerings

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Medtronic plc.

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services/Offerings

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 F. Hoffmann-La Roche Ltd.,

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services/Offerings

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Bayer AG,

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services/Offerings

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Lifescan, Inc

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services/Offerings

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Dexcom, Inc.

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services/Offerings

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Sanofi

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services/Offerings

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Insulet Corporation.

12.8.2 Financials

12.8.3 Product/Services/Offerings

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Ascensia Diabetes Care Holdings Ag.

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services/Offerings

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 B Braun Melsungen AG

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services/Offerings

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Antisense and RNAi therapeutics Market size is projected to reach USD 18.48 billion by 2032, growing at a CAGR of 18.05% over 2024-2032. The market was valued at USD 4.15 billion in 2023.

The Nuclear Magnetic Resonance Spectroscopy Market size was USD 1.31 billion in 2023, expected to reach USD 2.08 billion by 2032 and grow at a CAGR of 5.26%.

The Anxiety Disorders and Depression Treatment Market size was USD 11.89 Billion in 2023 and is expected to Reach USD 16.50 Billion by 2032 and grow at a CAGR of 3.5% over the forecast period of 2024-2032.

Dermatology CRO Market was valued at USD 4.8 Billion in 2023 and is expected to reach USD 8.6 Billion by 2032, growing at a CAGR of 6.7% over the forecast period 2024-2032.

The Intensive Care Unit Market size was valued at $7.3 Bn in 2023 and is expected to reach $27.7 Bn by 2032 with a growing CAGR of 16% by 2024-2032.

The Pancreatic and Biliary Stents Market was valued at USD 354.2 Mn in 2023 and is expected to reach 511.47 Mn in 2031, and grow at a CAGR of 4.7% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone