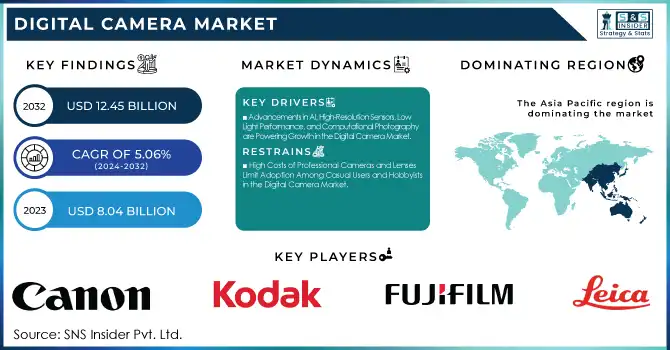

Digital Camera Market Report Scope & Overview:

The Digital Camera Market was valued at USD 8.04 billion in 2023 and is expected to reach USD 12.45 billion by 2032, growing at a CAGR of 5.06% from 2024-2032. This report includes an analysis of demand & adoption trends, highlighting the shift towards mirrorless and high-resolution cameras driven by content creators and professionals. A price breakdown explores affordability across different segments, while technology & feature trends emphasize AI-powered enhancements and connectivity features. Additionally, consumer demographics reveal strong demand from photography enthusiasts and vloggers, alongside steady professional adoption. These factors collectively shape the market's expansion.

To get more information on Digital Camera Market - Request Free Sample Report

Digital Camera Market Dynamics

Drivers

-

Advancements in AI, High-Resolution Sensors, Low-Light Performance, and Computational Photography are Powering Growth in the Digital Camera Market.

New developments in imaging technology are profoundly influencing the digital camera industry. AI-driven innovations, including sophisticated autofocus capabilities and real-time scene detection, give consumers quicker, more precise shots in various settings. Greater-resolution sensors guarantee that each picture takes in subtle details, while low-light capability enhancements enable photography in difficult conditions with greater ease and dependability. In addition, the incorporation of computational photography enables advanced image processing, combining several photographs into a single perfectly exposed image, providing unprecedented flexibility and creativity. Such advances in technology render digital cameras more appealing to professional photographers as well as common users, fueling the rapid growth of the market and the need for next-generation imaging technologies.

Restraints

-

High Costs of Professional Cameras and Lenses Limit Adoption Among Casual Users and Hobbyists in the Digital Camera Market

The high cost of professional-quality digital cameras and lenses poses an insurmountable hurdle to most potential purchasers. Though top-of-the-line cameras are higher in features and image quality, their price may be extremely costly for part-time users and amateur photographers, making them unavailable for purchase. Most consumers end up choosing the alternatives, such as smartphones that offer high-level cameras, for which a suitable level of performance compared to the cost is found. Second, the requirement of buying specialized lenses increases the entire cost, reducing it as a more attractive alternative for non-professionals. This cost concern hinders larger digital camera take-up, specifically within the starter and mid-segment of the market.

Opportunities

-

Rising Demand for High-Quality Content on Social Media Boosts Adoption of Mirrorless and DSLR Cameras in Digital Camera Market

The growing need for good-quality content on online media sites such as YouTube, Instagram, and TikTok is developing a sizeable market for digital cameras. Influencers, vloggers, and content creators are looking for cameras that deliver higher image and video quality, and this has caused the adoption of mirrorless and DSLR cameras to rise. These cameras provide improved features like 4K video, quick autofocus, and professional lenses, catering to the requirements of those who want to create interesting, high-definition content. With more people opting for digital media creation as a profession or a hobby, the requirement for specialized gear keeps increasing, offering plenty of growth opportunities for the digital camera industry, particularly in the consumer and professional markets.

Challenges

-

Smartphone Camera Advancements Offer High-Quality Alternatives, Challenging the Standalone Digital Camera Market, Especially in Entry-Level Segments

The growing innovations in smartphone cameras pose a formidable challenge for the digital camera industry. High-quality image sensors, AI features, and friendly interfaces make smartphones more convenient, affordable, and functional, posing challenges that are difficult for consumers to resist. The ability to take professional-grade photographs and videos using a device that is already utilized for communication, web browsing, and entertainment has established smartphones as the go-to option for amateur photographers and even some professionals. With smartphone cameras becoming more advanced, point-and-shoot digital cameras, particularly in the lower end and middle ranges, are finding it hard to compete, with most consumers settling for the convenience of their mobile devices.

Digital Camera Market Segment Analysis

By Lens

The Built-in segment led the Digital Camera Market with the largest revenue share of around 65% in 2023 with increasing demand for convenience and price. Built-in cameras, which are typically used in smartphones, compact digital cameras, and action cameras, provide convenience with built-in features appealing to casual consumers and regular users. Their small size, mobility, and low cost make them the choice of a wide portion of the market, leading to high usage levels.

The Interchangeable segment is anticipated to expand at the highest CAGR of approximately 6.10% during 2024-2032 as a result of the growing need for professional-level cameras among photographers, vloggers, and content creators. Interchangeable lens cameras, including DSLRs and mirrorless cameras, provide better image quality, flexibility, and customization, which makes them extremely desirable for professionals and serious enthusiasts alike. Their capability to support a broad range of shooting situations drives their fast expansion.

By Product

The Mirrorless segment dominated the Digital Camera Market with the highest revenue share of about 55% in 2023 due to its balance of high performance and portability. Mirrorless cameras offer advanced features such as faster autofocus, high-quality video recording, and compact design, making them highly appealing to both professionals and enthusiasts. The absence of a mirror mechanism reduces size and weight, while still maintaining excellent image quality, which has driven widespread adoption, particularly among photographers and content creators.

The Compact Digital Camera segment is expected to grow at the fastest CAGR of about 7.15% from 2024-2032 due to rising demand for portable and user-friendly devices. These cameras are attractive to casual users who want quality images without the complexity of higher-end models. With advancements in sensor technology, compact cameras are offering better low-light performance and higher resolution, making them a more appealing choice for everyday photography, especially among travelers and young users.

By End Use

The Pro Photographers segment dominated the Digital Camera Market with the highest revenue share of about 47% in 2023 due to the high demand for advanced imaging capabilities. Professional photographers require cameras that offer superior image quality, dynamic range, and performance in diverse conditions. High-end models, including DSLRs and mirrorless cameras, with interchangeable lenses and features like 4K video, make them the preferred choice for professionals. Their ability to meet stringent quality requirements drives this segment’s dominance.

The Hobbyists segment is expected to grow at the fastest CAGR of about 6.58% from 2024-2032 due to the increasing number of individuals pursuing photography as a hobby. With the rise of social media, there is a growing interest in personal content creation, driving demand for digital cameras among hobbyists. Affordable and easy-to-use models with advanced features allow amateur photographers to experiment with various styles and techniques, fueling this segment’s rapid growth.

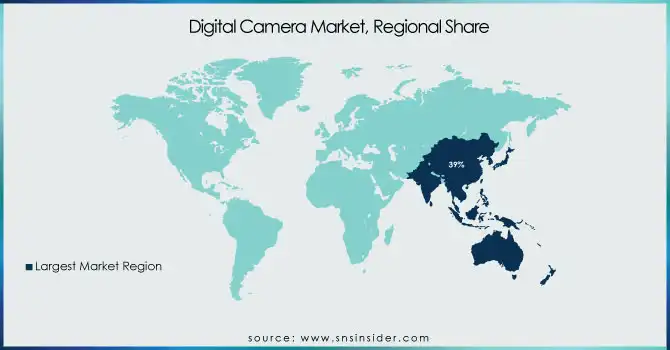

Regional Analysis

Asia Pacific led the Digital Camera Market with the largest revenue share of approximately 39% in 2023 because of its huge consumer base, high pace of technological innovation, and availability of leading camera companies in nations such as Japan and China. Asia Pacific boasts top brands that spearhead innovation, including Sony, Canon, and Nikon, with strong adoption of digital cameras across both professional and consumer markets. The increased interest in content creation, travel, and social media in the region also complements this dominance.

Europe is anticipated to expand at the fastest CAGR of approximately 6.78% during 2024-2032 owing to the rising demand for sophisticated camera gear among content creators, photographers, and the rising popularity of travel and lifestyle photography. The growth of social media influencers, vlogging, and web video content drives the demand for high-quality imaging devices in the region. Furthermore, Europe's rich consumer base and increased disposable incomes facilitate the development of premium camera segments, increasing overall market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Canon Inc. (EOS R5, PowerShot G7 X Mark III)

-

Eastman Kodak Company (Kodak Pixpro AZ421, Kodak FZ152)

-

FUJIFILM Holdings Corporation (X-T4, GFX 100S)

-

Leica Camera AG (Leica M10, Leica Q2)

-

Nikon Corporation (Nikon D850, Nikon Z6 II)

-

Olympus Corporation (OM-D E-M1 Mark III, PEN-F)

-

OM Digital Solutions Corporation (OM-D E-M1 Mark III, OM-5)

-

Panasonic Corporation (Lumix GH5, Lumix S5)

-

Ricoh Imaging Company, Ltd. (Pentax K-1 Mark II, Ricoh GR III)

-

SIGMA Corporation (Sigma fp, Sigma sd Quattro)

-

Sony Corporation (Alpha 7R IV, Cyber-shot RX100 VII)

-

Hasselblad (Hasselblad X1D II 50C, H6D-100c)

-

GoPro, Inc. (GoPro HERO11 Black, GoPro MAX)

-

Panasonic Corporation (Lumix G100, Lumix TZ200)

-

Samsung Electronics (NX500, Samsung WB350F)

-

Vizio Inc. (Vizio 4K UHD Smart TV, Vizio SmartCast)

-

Leica Microsystems (Leica DM6 B, Leica DMi8)

-

Benq Corporation (BenQ GH600, BenQ SW270C)

-

Casio Computer Co., Ltd. (Casio Exilim EX-ZR800, Casio Exilim EX-FH25)

-

Polaroid Corporation (Polaroid Now, Polaroid Snap Touch)

-

Kodak Alaris (Kodak i3400 Scanner, Kodak Alaris DS8200)

Recent Developments:

-

In September 2024, Canon announced the release of the EOS C80, a digital cinema camera featuring a 6K full-frame sensor, aimed at improving mobility and operability for diverse shooting styles. With advanced features like enhanced autofocus and 4K recording at up to 120fps, this new model caters to professionals in industries ranging from filmmaking to live broadcasts.

-

Sony India launched the Alpha 9 III on February 26, 2024, featuring the world's first full-frame image sensor with a global shutter system. This advanced camera offers up to 120 fps high-speed shooting with no distortion or blackout, AI-powered autofocus, and the ability to sync flash at all speeds, making it ideal for professional photographers capturing decisive moments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.04 Billion |

| Market Size by 2032 | USD 12.45 Billion |

| CAGR | CAGR of 5.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Lens (Built-in, Interchangeable) • By Product (Compact Digital Camera, DSLR, Mirrorless) • By End Use (Pro Photographers, Prosumers, Hobbyists) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Canon Inc., Eastman Kodak Company, FUJIFILM Holdings Corporation, Leica Camera AG, Nikon Corporation, Olympus Corporation, OM Digital Solutions Corporation, Panasonic Corporation, Ricoh Imaging Company, Ltd., SIGMA Corporation, Sony Corporation, Hasselblad, GoPro, Inc., Samsung Electronics., Vizio Inc., Leica Microsystems, Benq Corporation, Casio Computer Co., Ltd., Polaroid Corporation, Kodak Alaris. |