Digital Banking Platform Market Report Scope & Overview:

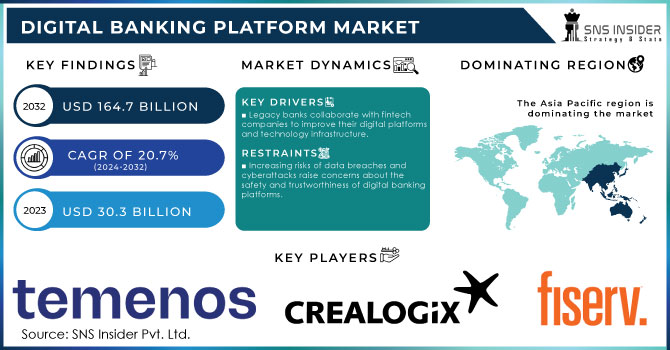

Digital Banking Platform Market was valued at USD 30.3 billion in 2023 and is expected to reach USD 164.7 billion by 2032, growing at a CAGR of 20.7% from 2024-2032.

The digital banking platform market has seen significant growth over the past decade, driven by technological advancements, increasing customer demand for convenience, and shifting from traditional banking services to digital channels.

Get More Information on Digital Banking Platform Market - Request Sample Report

Key growth factors include the rapid rise of smartphones and mobile internet, enabling users to access banking services anytime, anywhere. The increasing adoption of cloud-based solutions and artificial intelligence (AI) is also transforming the banking sector, offering enhanced customer experiences, automation, and personalization. Banks are now focusing on providing end-to-end digital solutions to reduce operational costs and cater to the growing millennial and Gen Z population, who prefer mobile-first banking experiences. Furthermore, the growing demand for secure and seamless transactions has driven investments in advanced technologies like blockchain, AI, and machine learning to enhance fraud detection and compliance.

Regulatory support and government initiatives aimed at promoting digital financial inclusion, particularly in developing countries, have also fueled market growth. For instance, many countries have introduced frameworks to regulate fintech and digital banking operations, providing a more favorable environment for growth. Moreover, the rise of challenger banks and neobanks, which operate solely online, has disrupted traditional banking models and created competitive pressure on established players to enhance their digital offerings. As a result, legacy banks are increasingly partnering with fintech companies to improve their technology infrastructure and offer more comprehensive digital services.

Market Dynamics

Drivers

-

Legacy banks collaborate with fintech companies to improve their digital platforms and technology infrastructure.

-

Government initiatives to promote digital financial inclusion and favorable fintech regulations drive market growth.

-

Widespread smartphone usage and mobile internet access enable on-the-go banking services.

Government initiatives and favorable fintech regulations are key drivers of the digital banking platform market, particularly in developing countries. Governments are increasingly focused on promoting digital financial inclusion, ensuring that underserved populations gain access to banking services through digital platforms. This is crucial, as over 1.4 billion people globally still lack access to traditional banking services, according to the World Bank. To address this gap, many countries have implemented regulatory frameworks that encourage the growth of digital banking. For instance, India's Pradhan Mantri Jan Dhan Yojana (PMJDY), launched in 2014, has opened over 500 million bank accounts as of 2023, significantly boosting financial inclusion through digital means. Similarly, African nations have seen growth in mobile-based banking due to initiatives supporting fintech innovation and digital payments, with mobile money accounts reaching over 562 million in Sub-Saharan Africa. Favorable fintech regulations, such as open banking policies in Europe under PSD2 (Payment Services Directive), have also fostered innovation, allowing third-party providers to offer enhanced financial services via digital platforms. This regulatory support not only improves access to financial services but also drives market growth.

The rise in smartphone usage and mobile internet access has significantly driven the growth of digital banking platforms. As of 2023, there are over 6.9 billion smartphone users globally, providing a massive base for mobile banking adoption. This widespread access allows consumers to manage finances, transfer money, and perform transactions directly from their devices, promoting on-the-go banking services. Mobile internet penetration is also on the rise, with 67% of the global population now having access to mobile internet, making it easier for individuals to use digital banking platforms without the need for traditional bank branches. This convenience has led to the growing popularity of mobile banking apps, with an estimated 3.6 billion people using mobile banking services in 2023.

Restraints

-

Increasing risks of data breaches and cyberattacks raise concerns about the safety and trustworthiness of digital banking platforms.

-

Inadequate internet access and poor infrastructure in some regions restrict the growth of digital banking services.

-

Established banks with strong brand recognition and customer bases may slow the adoption of digital-only platforms.

Established banks with strong brand recognition and large customer bases can slow the adoption of digital-only banking platforms by leveraging their long-standing relationships, trust, and extensive service networks. Traditional banks often offer a combination of physical branches and digital services, giving customers the flexibility of both in-person and online banking. As a result, many customers remain loyal to these institutions, particularly those who value personal interactions and are less comfortable with fully digital platforms.

In 2023, traditional banks still dominate, holding over 85% of global banking market share, despite the rise of digital-only banks, or neobanks. Neobanks, such as Revolut and Chime, attract younger, tech-savvy customers with simplified services and lower fees, but they hold a smaller portion of the market. For example, in the UK, digital-only banks accounted for just 8% of all current accounts in 2022.

Moreover, established banks have significantly invested in upgrading their digital offerings, making it harder for neobanks to differentiate themselves. For instance, JPMorgan Chase and Bank of America have each invested billions in digital transformation to enhance their online services, further solidifying their competitive edge. As a result, while digital-only banks are growing, the dominance of traditional banks remains a barrier to their widespread adoption.

Inadequate internet access and poor infrastructure in certain regions significantly limit the growth of digital banking services. In developing countries, especially in parts of Africa, Asia, and Latin America, large portions of the population lack reliable internet connectivity and access to smartphones. According to the International Telecommunication Union (ITU), about 2.6 billion people globally still do not have access to the internet as of 2023. This digital divide makes it difficult for many individuals to use mobile or online banking platforms, stalling the expansion of digital financial services. Additionally, poor infrastructure, such as unreliable electricity and weak telecommunications networks, further hampers digital banking adoption. For instance, in Sub-Saharan Africa, internet penetration is only 40%, which restricts digital banking platform usage in rural and remote areas. This limited access to technology and infrastructure creates challenges for digital banking providers looking to expand in these regions, slowing overall market growth.

Segment Analysis

By Deployment

The on-premise segment dominated the market and held the largest revenue share of 73.2% in 2023. The on-premise model is preferred by many users due to its enhanced security compared to cloud-based software. Since the software is installed and operated within the user’s network, IT and security teams have direct access and complete control over its configuration, management, and security. Larger, well-established banks, particularly in regions with stringent data storage and security regulations, often favor on-premise solutions, as they have the resources to invest in the necessary infrastructure.

The cloud segment accounted for the second-largest revenue share in 2023 and is projected to achieve the highest CAGR during the forecast period. The adoption of cloud and SaaS solutions will be crucial for the future success of inclusive banking. While the inclusive banking landscape presents challenges, the advantages of cloud and SaaS solutions help address these by providing essential financial services to underserved communities.

By Mode

In 2023, the online banking segment dominated the market, capturing a revenue share of 83.7%, and is expected to maintain its dominance with a projected CAGR of 22.1% during the forecast period. Online banking, the latest approach to delivering retail banking services, encompasses a range of functions including inter-account transfers, balance reporting, and other standard banking tasks. These services allow customers to access information and perform tasks, such as paying bills and using a telecommunication network without having to leave their homes or businesses.

The mobile banking segment is anticipated to grow at a CAGR of around 23.0% during the forecast period. Key drivers of mobile banking's success include lower service fees and rising smartphone penetration.

By Component

In 2023, the platform segment dominated the market and represented over 61.6% revenue share. Since the advent of fintech, tech giants have introduced reforms and new platforms, prompting banks to undergo digital transformation. To address client needs and proactively launch new products, banks are increasingly adopting digital technologies.

The shift of financial services to the cloud enables the development of customer-centric strategies, reduces entry barriers, and broadens access to banking solutions. It also creates opportunities for innovative service packages leveraging scale, data, and technology. This transition allows for quicker and easier access to data, facilitating regulatory reporting, risk management, and the detection of anomalies.

Managed data center services can enhance corporate operations in hybrid IT environments by boosting business automation and improving management. With the rise in cyberattacks, the use of managed security services across various industries is expected to grow. Managed security services are commonly used in business operations to safeguard sensitive data. The increasing complexity of networks presents significant challenges to effective data security management, driving the demand for and adoption of these services.

By Type

In 2023, the retail banking segment captured a revenue share of over 30.4% and is expected to grow at a CAGR of about 22.8% during the forecast period. The rise of digital banking, advancements in technology, integration of industrial ecosystems, and a greater focus on innovation are creating both challenges and opportunities for banking. As customers increasingly turn to digital platforms and fintech solutions, traditional connections for basic financial services such as deposits, loans, payments, and investments are becoming more fragmented.

The investment banking segment dominated the market and held a revenue share of 37.8% in 2023. Many investment banks have resumed office operations and are holding limited in-person client meetings. To revamp deal origination processes, they have adopted hybrid conference methods and the latest technologies.

Regional Analysis

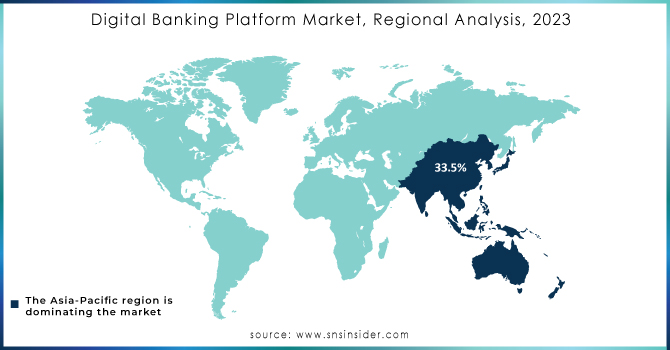

In 2023, the Asia Pacific region led the market with a revenue share of 33.5% and is expected to experience the highest CAGR of 24.2% during the forecast period. The digital banking sector in Asia is set for substantial expansion, driven by new digital firms that are reshaping the industry and revolutionizing banking for both individuals and businesses. As demand for mobile and online banking options rises, there is exceptional potential for both established players and new entrants, especially as regulators increase license allocations and set standards for a new era of banking.

North America was the second-largest regional market, holding a revenue share of 27.2%, and is anticipated to grow at a CAGR of 19.9% during the forecast period. The adoption of cloud-based solutions is rising across various business sectors, including banking and finance. Banks are increasingly implementing cloud-based digital banking platforms, a trend likely to persist due to their low initial costs and rapid update capabilities.

Need any customization research on Digital Banking Platform Market - Enquiry Now

Key Market Players:

The major key players are Fiserv, Inc., Crealogix AG, Temenos, Urban FT Group, Inc., Appway AG, Alkami Technology Inc., Finastra, Urban FT Group, Inc., Q2 Software, Inc., Sopra Banking Software, Tata Consultancy Service and others.

Recent Developments

-

In April 2024, nCino enhanced the omnichannel capabilities of its consumer banking solution for banks and credit unions. This upgrade allows bankers to better engage with customers regarding their preferences and needs in the global financial services sector.

-

In September 2023, Temenos introduced a groundbreaking secure solution for banks that integrates generative artificial intelligence (AI) to automatically classify customers' banking transactions.

| Report Attributes | Details |

| Market Size in 2023 | USD 30.3 Bn |

| Market Size by 2032 | USD 164.7 Bn |

| CAGR | CAGR of 20.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment ( On-Premise, Cloud ) • By Mode (Online Banking, Mobile Banking) • By Type (Retail Banking, Corporate Banking, Investment Banking) • By Component (Platforms, Services, Professional Services, Managed Services ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fiserv, Inc., Crealogix AG, Temenos, Urban FT Group, Inc., Appway AG, Alkami Technology Inc., Finastra, Urban FT Group, Inc., Q2 Software, Inc., Sopra Banking Software, Tata Consultancy Service and others. |

| Key Drivers | • Government initiatives to promote digital financial inclusion and favorable fintech regulations drive market growth.

• Widespread smartphone usage and mobile internet access enable on-the-go banking services. |

| Key Restraints | • Inadequate internet access and poor infrastructure in some regions restrict the growth of digital banking services. • Established banks with strong brand recognition and customer bases may slow the adoption of digital-only platforms. |