Get More Information on Diesel Exhaust Fluid Market - Request Sample Report

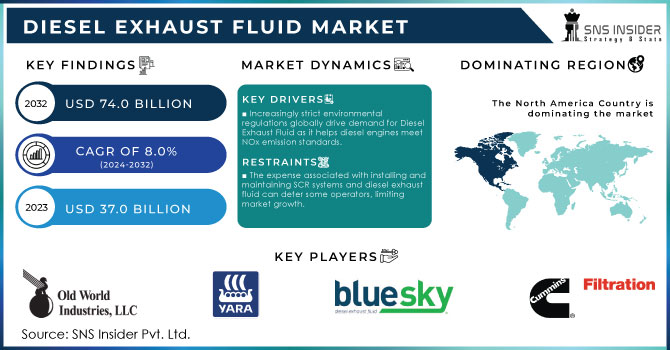

The Diesel Exhaust Fluid Market Size was valued at USD 37.0 billion in 2023, and is expected to reach USD 74.0 Billion by 2032, and grow at a CAGR of 8.0% over the forecast period 2024-2032.

The Diesel Exhaust Fluid market has also faced large shifts due to requirements and technological changes. Large vats of diesel exhaust fluid in the form of very pure liquid solution mainly composed of deionized water and urea play a pivotal role in reducing NOx emissions from diesel engines to stringent environmental standards. With major drivers for vehicular emissions reduction, diesel exhaust fluid experienced increased demand, mainly driven by increasing penetration of SCR systems in the latest diesel engines. This has created a dynamic market landscape, driven by regulatory pressures and technological innovations.

Recent developments have served to bring about rapid progress within the diesel exhaust fluid sector. In May 2024, Rislone announced a new diesel exhaust fluid treatment that boosts the performance and longevity of systems with diesel exhaust fluid. This product spurs research in improving efficiency with diesel exhaust fluid solutions while addressing an ever-growing interest in the automotive industry. Rislone optimizes treatment to address the most prevalent diesel engine operators' challenges, including the degradation of diesel exhaust fluid over time and the challenges related to maintaining the efficiency of the SCR system.

Renewable diesel is increasingly becoming a factor in the diesel exhaust fluid market. In February 2024, an analysis discussed how diesel exhaust fluid and renewable diesel are reshaping the industry. This emerging renewable diesel market originates from bio-based feedstocks, which are considered a serious alternative to traditional diesel: being less carbon-intensive and having better compatibility with the existing engines. Thus, the shift towards renewable diesel has changed the established patterns of diesel exhaust fluid consumption.

Meanwhile, the role of diesel exhaust fluid in diesel engines has been defined and perfected. As recently as February 2024, JLG Industries provided insight into the world of diesel exhaust fluid focusing on its importance in modern machinery. Their analysis brings attention to how the right amount of diesel exhaust fluid makes sure that diesel engines operate at their best and provide efficiency according to defined criteria. An industry-wide effort, by JLG's attempts to educate stakeholders on what diesel exhaust fluid is and what it achieves, provides good evidence.

The development streams found in the diesel exhaust fluid market comment on the general trend-setter affecting the industry through constant shifts in further technological developments and changes in regulatory requirements. Such boosts came about from enhanced treatments of diesel exhaust fluid, renewable diesel effects, and rising educational efforts. Such advancements, as well as changing standards in diesel engines, would continue adapting the diesel exhaust fluid market due to innovations and policy changes in fuel and emissions management policies.

Market Dynamics:

Drivers:

Increasingly strict environmental regulations globally drive demand for Diesel Exhaust Fluid as it helps diesel engines meet NOx emission standards.

The demand for Diesel Exhaust Fluid has increased as a result of the stringent environmental regulations implemented globally, imposing lower NOx emissions from diesel engines. Very strict regulatory standards have been set by the regulatory bodies of different regions to curb the environmental impact of diesel-powered vehicles and machinery and combat air pollution. For instance, the Euro 6 standards of the European Union and the U.S. The Tier 4 regulations of the EPA impose intense cuts in NOx emissions, mandating the automotive and industrial sectors to develop more advanced forms of emission control technologies. Diesel exhaust fluid plays a key role in this by facilitating the efficient conversion of NOx emissions from SCR systems to harmless nitrogen and water. One such example is that of trucks, wherein large truck manufacturers have made considerable investments in SCR technology as well as in the use of diesel exhaust fluid to comply with new emission standards. Similarly, construction and agricultural machines have deployed diesel exhaust fluid to meet the stringently high Tier 4 standards, highlighting how regulatory pressure has had them adopt such large scales of use of diesel exhaust fluid across the industry. Following the greatest focus on low levels of air pollutants, the effectiveness of diesel exhaust fluid increased and is currently known to make steady improvements within the fluid quality and system performance to enable compliance and efficiency in operations.

Innovations in Selective Catalytic Reduction (SCR) technology enhance diesel exhaust fluid efficiency and performance, boosting its market adoption.

Innovations in SCR technology enhanced the efficiency and performance of Diesel Exhaust Fluid, thereby widely gaining its usage in many sectors. NOx emissions of diesel engines have been particularly reduced through the use of diesel exhaust fluid in SCR systems, which, in turn, have been continually improved to become more effective and reliable. Other examples include advanced catalyst formulations and improvements in SCR system designs that have led to a more efficient process of NOx conversion. The engines now can reach emission levels that are well below those of their predecessors and at the same time achieve previous performance levels. Examples of innovations integrated into the SCR technologies include advanced sensors and control systems that improve the dosing of diesel exhaust fluid and work to achieve an overall better performance of the system with reduced consumption of diesel exhaust fluid, thereby reducing running costs. With advancements in SCR technology, compact and lightweight systems could now be used for much wider applications, from heavy-duty trucks to small machinery. The demand for advanced SCR systems from the automotive industry increases because manufacturers have stringent emission regulations and want to improve their fuel efficiency. The use of advanced SCR systems in construction and agriculture has helped meet environmental standards and optimize the performance of diesel-based equipment. Such technological advancements fuel higher usage of diesel exhaust fluid while generally making diesel engine operations more environmentally friendly and sustainable, indicating rising adoption of diesel exhaust fluid among diesel users spurred by technological innovations in SCR systems.

Restraint:

The expense associated with installing and maintaining SCR systems and diesel exhaust fluid can deter some operators, limiting market growth.

Installation and maintenance expenses for SCR systems and diesel exhaust fluid are likely to be very costly and may remain a significant deterrent for operators, hindering the growth prospects for the diesel exhaust fluid market. The SCR systems, which are deemed essential for optimal applications of diesel exhaust fluid, involve high initial costs for installation and integration with diesel engines. Moreover, maintenance costs and the necessity of repeated replenishment of diesel exhaust fluid increase the burdens of the total cost. Once again, this is particularly true in industries that are subject to operating budgets highly restricted or regulated. These include transportation and construction. This discourages some operators from adopting diesel exhaust fluid technology, especially in areas with less severe emissions restrictions or in smaller operators who may find the additional costs problematic. In this regard, the financial considerations against SCR systems and the use of diesel exhaust fluid deter the wider market penetration required for further growth in the diesel exhaust fluid sector.

Opportunity:

The rise of renewable diesel fuels presents an opportunity to integrate diesel exhaust fluid more effectively, potentially expanding market reach.

The advent of renewable diesel fuels provides the opportunity to more readily integrate diesel exhaust fluid into a more vast market. Renewable diesel products are a cleaner alternative to traditional diesel and are produced from bio-based feedstocks, meaning their carbon emissions are lower than their traditional counterparts. Therefore, environmental objectives promoted by diesel exhaust fluid perfectly form part of this trend. A rise in renewable diesel development creates a complementary relationship with diesel exhaust fluid and enhances the overall rationale behind the strategy of improving emissions reduction. For example, adding diesel exhaust fluid to heavy-duty vehicles and equipment that use renewable diesel would further reduce NOx levels, combining the advantages of good air quality with the additional benefit of regulatory compliance. In this manner, the promotion of the use of diesel exhaust fluid with renewable fuels expands the market for application, opening new niches and markets that deploy both technologies side by side. Consequently, the rise in the consumption of renewable diesel thus presents an emerging market opportunity for the integration of diesel exhaust fluid across sectors and contributes to broader objectives of environmental and sustainability goals.

Challenge:

Supply chain disruptions and variability in diesel exhaust fluid production can impact availability and pricing, posing challenges for consistent market supply.

Supply chain disruptions and variability in diesel exhaust fluid production create trouble in consistent supply chain availability in the market. Fluctuations in availability and transportation delays of raw materials also influence inconsistent production and can lead to shortages of diesel exhaust fluid by affecting those industries that depend on it for their business to comply with the need of emission regulations. For example, disruption in the supply chain of urea that is used in the production of diesel exhaust fluid can be a critical production bottleneck that pushes the cost in the hands of the end-users. This instability leads to then-probabilistic diesel exhaust fluid shortages as well as the resultant price rises which have come to discourage the operators from maintaining adequate levels of diesel exhaust fluid or even investing in SCR technology. This unpredictability can thus go against the market stability and growth of diesel exhaust fluid in some respects, ultimately affecting businesses' ability to maintain good control over their operational costs as well as adhere to the proper emission standards in place.

KEY MARKET SEGMENTS

By Component

In 2023, the SCR Catalysts segment dominated the Diesel Exhaust Fluid market accounting for a market share of about 40%. SCR Catalysts are crucial components of Selective Catalytic Reduction systems, without them, the effective reduction of nitrogen oxide (NOx) emission from diesel engines would not be possible. A higher market share reveals more significance in the emissions process, as SCR systems rely on catalysts of this type to convert harmful NOx into harmless nitrogen and water. For example, the wide acceptance of SCR technology in heavy-duty trucks and industrial machinery indicates dependence on high-performance SCR Catalysts because those are mostly applied for strictly stringent emission regulations. It underlines the integral nature of SCR Catalysts to improve the efficiency of the diesel exhaust fluid system and enables diesel-powered applications to meet respective regulations.

By Vehicle Type

In 2023, the Heavy Commercial Vehicles (HCVs) segment dominated and accounted for approximately 50% of the market share in the diesel exhaust fluid market. HCVs, which include trucks and buses, are a major diesel exhaust fluid consumer because of the higher emissions from their diesel engines and the strict emission standards to which they are subjected. These are vehicles that, based on the level of their technology, are supposed to be equipped with the most advanced Selective Catalytic Reduction systems that are capable of even higher levels of nitrogen oxide reduction, mainly dependent on diesel exhaust fluid. The more stringent the emission standards increase, the higher the usage of diesel exhaust fluid in, for example, logistics and transportation companies that increasingly rely on HCVs. The HCV segment's dominance depicts its critical role in the diesel exhaust fluid market and impacts the overall demand for diesel exhaust fluid solutions in the transportation sector.

By Application

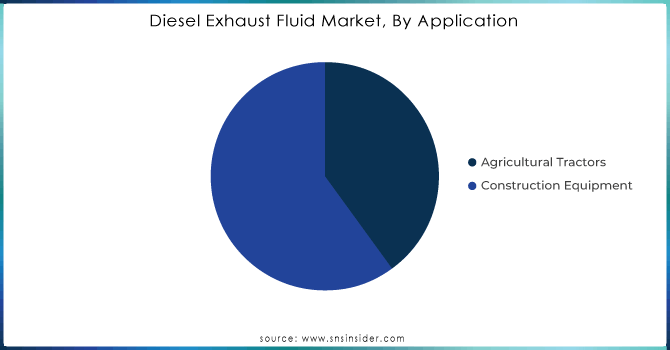

In 2023, the Construction Equipment segment dominated the Diesel Exhaust Fluid market, with an estimated market share of approximately 60%. Construction equipment, such as excavators, bulldozers, and loaders, often operates under demanding conditions and is subject to stringent emission regulations. These machines typically use diesel exhaust fluid in their Selective Catalytic Reduction (SCR) systems to manage NOx emissions effectively. For example, large-scale construction projects and infrastructure developments require heavy machinery that adheres to environmental standards, driving higher diesel exhaust fluid consumption in this sector. The dominance of the Construction Equipment segment reflects the critical role of diesel exhaust fluid in meeting regulatory requirements and maintaining the performance of diesel-powered construction machinery.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Supply Mode

In 2023, the bulk market segment dominated the Diesel Exhaust Fluid market with a market share of around 55%. Bulk diesel exhaust fluid is in great demand among large users such as fleets, construction companies, and agricultural operations primarily because of its cost-effectiveness and convenience. For instance, large logistics companies and construction firms generally consume large amounts of diesel exhaust fluid for heavy-duty vehicles and machinery. Hence, bulk supply is more efficient than cans and bottles which, in return, is a cost-efficient practice for large consumers of large volumes that also saves handling costs and simplifies refueling processes for them.

By Distribution Channel

The OEM segment dominated the Diesel Exhaust Fluid market accounting for a revenue share of at least 65%. OEMs refer to automobile and equipment makers who promote the application mainly through their new diesel engines, wherein they build systems that utilize diesel exhaust fluid. For instance, large truck manufacturers and construction equipment manufacturers install diesel exhaust fluid in their standard components in their SCR systems to ensure the attainment of regulatory emission standards. Therefore, the infusion will entail that the customers receive it through new equipment sales to further increase market penetration. The OEM segment is perceived as a dominant one, meaning that conformity with emission standards at the outset largely accounts for the OEM share of the diesel exhaust fluid market.

Regional Analysis

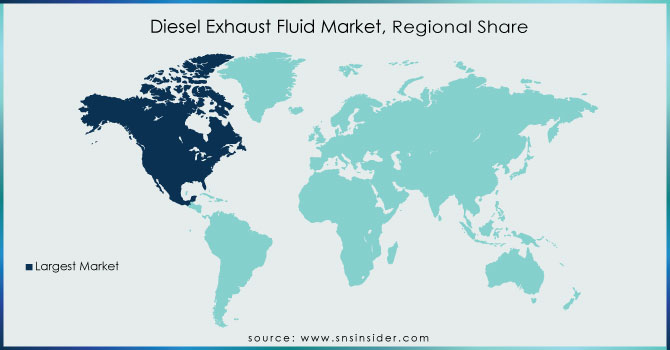

In 2023, North America dominated the Diesel Exhaust Fluid market, with an estimated market share of approximately 45%. Strict emission regulations have made it the leading region, with SCR technology now being highly adopted in the transportation and construction sectors across the area. For instance, the U.S. and Canada have set stringent standards with the emissions rules set by EPA's Tier 4 and Euro VI requiring the use of diesel exhaust fluid in diesel engines to cut down NOx emissions drastically. With a large population of heavy-duty trucks and construction machinery, North America is facing high consumption of diesel exhaust fluid, and this is the biggest market share in the world.

Moreover, Asia-Pacific emerged as the fastest-growing region in the Diesel Exhaust Fluid market in 2023, with an estimated CAGR of around 8%. The prime reason behind this rapid growth is the swift industrialization and urbanization occurring in countries such as China and India, as well as stricter emission standards to counteract air pollution. For instance, China adopts the China VI emission standard, and India adopts Bharat Stage VI regulations for the better adoption and deployment of diesel-engine-running machinery and more advanced vehicles for emission control, the market for diesel exhaust fluid has seen surging demand. Increased growth in the automotive and construction sector of the Asia-Pacific region is increasing uptake and thus boosting the growth rate in the global market.

AdBlue (AdBlue DEF, AdBlue Premium)

Blue Sky Diesel Exhaust Fluid (Blue Sky DEF, Blue Sky Premium DEF)

CF Industries Holdings, Inc. (DEF, DEF Plus)

Cummins Filtration (Fleetguard DFS, Fleetguard Diesel Exhaust Fluid)

Diesel Exhaust Fluid (DEF) (Standard DEF, Premium DEF)

Dyno Nobel (DEF, Dyno DEF)

KOST USA, Inc. (KOST DEF, KOST Pure DEF)

Old World Industries, LLC (PEAK Blue DEF, Final Charge DEF)

STOCKMEIER Group (STOCKMEIER DEF, STOCKMEIER SCR Fluid)

The Potash Corporation of Saskatchewan (PCS DEF, PCS Premium DEF)

Yara International ASA (Yara Vita DEF, Yara DEF)

BASF SE (BASF DEF, BASF Blue DEF)

Chevron (Chevron DEF, Chevron Diesel Exhaust Fluid)

ENI S.p.A. (ENI DEF, ENI Blue DEF)

Fluid Energy Group Ltd. (Fluid Energy DEF, Fluid Energy SCR Fluid)

Groupe Renault (Renault DEF, Renault Premium DEF)

GS Caltex (GS Caltex DEF, GS Caltex SCR Fluid)

JX Nippon Oil & Energy (JX DEF, JX SCR Fluid)

LyondellBasell Industries (LyondellBasell DEF, LyondellBasell SCR Fluid)

TotalEnergies (TotalEnergies DEF, TotalEnergies Blue DEF)

Recent Developments

May 2024: Rislone introduced a new product called diesel exhaust fluid Crystal Clean to upgrade diesel exhaust fluid systems and enhance SCR emissions by cleaning deposits while improving engine performance.

October 2023: Monomoy Capital Partners sold Shaw Development, the leading manufacturer of diesel exhaust fluid to Madison Dearborn Partners; this is a successful exit from the investment by Monomoy in Shaw Development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 37.0 Billion |

| Market Size by 2032 | US$ 74.0 Billion |

| CAGR | CAGR of 8.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (SCR Catalysts, DEF Tanks, DEF Injectors, DEF Supply Modules, DEF Sensors, NOx Sensors) •By Vehicle Type (Passenger Cars, LCVs, HCVs) •By Application (Agricultural Tractors, Construction Equipment) •By Supply Mode (Cans & Bottles, IBCs, Bulk, Pumps) •By Distribution Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Old World Industries, LLC, Yara International ASA, Blue Sky Diesel Exhaust Fluid, Cummins Filtration, KOST USA, Inc., STOCKMEIER Group, The Potash Corporation of Saskatchewan, CF Industries Holdings, Inc., Dyno Nobel and other key players |

| Key Drivers | • Increasingly strict environmental regulations globally drive demand for Diesel Exhaust Fluid (DEF) as it helps diesel engines meet NOx emission standards • Innovations in Selective Catalytic Reduction (SCR) technology enhance DEF efficiency and performance, boosting its market adoption |

| RESTRAINTS | • The expense associated with installing and maintaining SCR systems and DEF can deter some operators, limiting market growth |

Ans: Key stakeholders considered in the study:

Raw material vendors

distributors/traders/wholesalers/suppliers

regulatory authorities, including government agencies and ngo

commercial research & development (r&d) institutions

importers and exporters

government organizations, research organizations, and consulting firms

trade/industrial associations

end-use industries are the stake holder of this report

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: The Diesel Exhaust Fluid Market is expected to grow at a CAGR of 6.5%.

Ans: Supply chain disruptions and variability in diesel exhaust fluid production can impact availability and pricing, posing challenges for consistent market supply

Ans: The Diesel Exhaust Fluid Market Size was valued at USD 37.0 billion in 2023, and is expected to reach USD 74.0 Billion by 2032

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Typeion Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Vehicle Type Benchmarking

6.3.1 Vehicle Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Vehicle Type launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Diesel Exhaust Fluid Market Segmentation, by Component

7.1 Chapter Overview

7.2 SCR Catalysts

7.2.1 SCR Catalysts Market Trends Analysis (2020-2032)

7.2.2 SCR Catalysts Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 DEF Tanks

7.3.1 DEF Tanks Market Trends Analysis (2020-2032)

7.3.2 DEF Tanks Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 DEF Injectors

7.3.1 DEF Injectors Market Trends Analysis (2020-2032)

7.3.2 DEF Injectors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 DEF Supply Modules

7.4.1 DEF Supply Modules Market Trends Analysis (2020-2032)

7.4.2 DEF Supply Modules Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2 DEF Sensors

7.2.1 DEF Sensors Market Trends Analysis (2020-2032)

7.2.2 DEF Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 NOx Sensors

7.3.1 NOx Sensors Market Trends Analysis (2020-2032)

7.3.2 NOx Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Diesel Exhaust Fluid Market Segmentation, by Vehicle Type

8.1 Chapter Overview

8.2 Passenger Cars

8.2.1 Passenger Cars Market Trends Analysis (2020-2032)

8.2.2 Passenger Cars Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2 LCVs

8.2.1 LCVs Market Trends Analysis (2020-2032)

8.2.2 LCVs Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2 HCVs

8.2.1 HCVs Market Trends Analysis (2020-2032)

8.2.2 HCVs Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Diesel Exhaust Fluid Market Segmentation, By Application

9.1 Chapter Overview

9.2 Agricultural Tractors

9.2.1 Agricultural Tractors Market Trends Analysis (2020-2032)

9.2.2 Agricultural Tractors Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Construction Equipment

9.3.1 Construction Equipment Market Trends Analysis (2020-2032)

9.3.2 Construction Equipment Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Diesel Exhaust Fluid Market Segmentation, By Supply Mode

10.1 Chapter Overview

10.2 Cans & Bottles

10.2.1 Cans & Bottles Market Trends Analysis (2020-2032)

10.2.2 Cans & Bottles Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 IBCs

10.3.1 IBCs Market Trends Analysis (2020-2032)

10.3.2 IBCs Market Size Estimates And Forecasts To 2032 (USD Billion)

10.4 Bulk

10.4.1 Bulk Market Trends Analysis (2020-2032)

10.4.2 Bulk Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 Pumps

10.5.1 Pumps Market Trends Analysis (2020-2032)

10.5.2 Pumps Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Diesel Exhaust Fluid Market Segmentation, By Distribution Channel

11.1 Chapter Overview

11.2 OEM

11.2.1 OEM Market Trends Analysis (2020-2032)

11.2.2 OEM Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Aftermarket

11.3.1 Aftermarket Market Trends Analysis (2020-2032)

11.3.2 Aftermarket Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Diesel Exhaust Fluid Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.4 North America Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.5 North America Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.6 North America Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.2.7 North America Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.8.2 USA Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.8.3 USA Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.8.4 USA Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.2.8.5 USA Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.9.2 Canada Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.9.3 Canada Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.9.4 Canada Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.2.9.5 Canada Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.10.2 Mexico Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.10.4 Mexico Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.2.10.5 Mexico Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.8.2 Poland Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8.4 Poland Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.1.8.5 Poland Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.9.2 Romania Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9.4 Romania Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.1.9.5 Romania Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.4 Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.6 Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.7 Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.8.2 Germany Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8.4 Germany Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.8.5 Germany Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.9.2 France Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.3 France Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9.4 France Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.9.5 France Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.10.2 UK Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10.4 UK Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.10.5 UK Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.11.2 Italy Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11.4 Italy Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.11.5 Italy Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.12.2 Spain Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.4 Spain Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.12.5 Spain Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.15.2 Austria Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15.4 Austria Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.15.5 Austria Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.4 Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.6 Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.7 Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.8.2 China Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.8.3 China Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.8.4 China Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.8.5 China Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.9.2 India Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.9.3 India Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.9.4 India Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.9.5 India Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.10.2 Japan Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.10.3 Japan Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.10.4 Japan Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.10.5 Japan Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.11.2 South Korea Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.11.4 South Korea Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.11.5 South Korea Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.12.2 Vietnam Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.12.4 Vietnam Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.12.5 Vietnam Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.13.2 Singapore Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.13.4 Singapore Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.13.5 Singapore Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.14.2 Australia Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.14.3 Australia Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.14.4 Australia Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.14.5 Australia Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.4 Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.6 Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.1.7 Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.8.2 UAE Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.4 UAE Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.1.8.5 UAE Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.4 Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.5 Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.6 Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.2.7 Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.4 Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.5 Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.6 Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.6.7 Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.8.2 Brazil Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.8.4 Brazil Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.6.8.5 Brazil Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.9.2 Argentina Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.9.4 Argentina Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.6.9.5 Argentina Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.10.2 Colombia Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.10.4 Colombia Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.6.10.5 Colombia Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Supply Mode (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Diesel Exhaust Fluid Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

13. Company Profiles

13.1 Old World Industries, LLC

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Vehicle Types/ Services Offered

13.1.4 SWOT Analysis

13.2 Yara International ASA

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Vehicle Types/ Services Offered

13.2.4 SWOT Analysis

13.3 Blue Sky Diesel Exhaust Fluid.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Vehicle Types/ Services Offered

13.3.4 SWOT Analysis

13.4 Cummins Filtration

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Vehicle Types/ Services Offered

13.4.4 SWOT Analysis

13.5 KOST USA, Inc.

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Vehicle Types/ Services Offered

13.5.4 SWOT Analysis

13.6 STOCKMEIER Group

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Vehicle Types/ Services Offered

13.6.4 SWOT Analysis

13.7 The Potash Corporation of Saskatchewan

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Vehicle Types/ Services Offered

13.7.4 SWOT Analysis

13.8 CF Industries Holdings, Inc.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Vehicle Types/ Services Offered

13.8.4 SWOT Analysis

13.9 Dyno Nobel

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Vehicle Types/ Services Offered

13.9.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle Type

Passenger Cars

LCVs

HCVs

By Application

Agricultural Tractors

Construction Equipment

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

By Distribution Channel

OEM

Aftermarket

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Marine Lubricants Market Size was valued at USD 6.5 Billion in 2023 and is expected to reach USD 7.8 Billion by 2032 and grow at a CAGR of 2.07% over the forecast period 2024-2032.

The Consumer Foam Market Size was USD 43.5 billion in 2023 and is expected to reach USD 66.9 billion by 2032 and grow at a CAGR of 4.8% by 2024-2032.

The Sulfur Fertilizer Market size was USD 4.49 Billion in 2023 and is expected to reach USD 6.08 Billion by 2032, growing at a CAGR of 3.42% from 2024 to 2032.

The Specialty Gas Market size was valued at USD 13.15 billion in 2023. It is projected to reach USD 25.21 billion by 2032 and grow at a CAGR of 8.62% over the forecast period of 2024-2032.

The Wax Market size was USD 10.41 billion in 2023 and is expected to reach USD 14.80 billion by 2032 and grow at a CAGR of 3.99% over the forecast period of 2024-2032.

The Flexible Foam Market was valued at USD 45.52 Billion in 2023 and is expected to reach USD 71.75 Billion by 2032, growing at a CAGR of 5.19% from 2024-2032.

Hi! Click one of our member below to chat on Phone