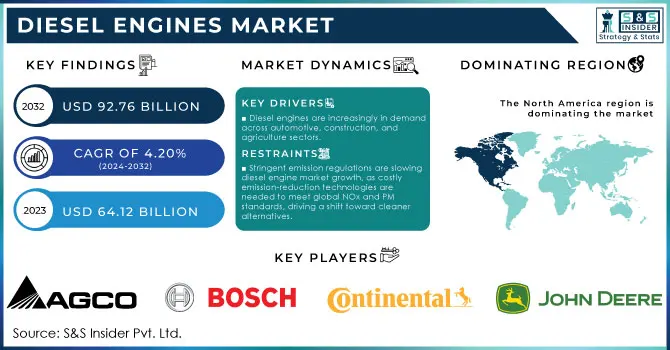

Diesel Engines Market Key Insights:

The Diesel Engines Market size was valued at USD 64.12 billion in 2023 and is expected to reach USD 92.76 billion by 2032 at a CAGR of 4.20% during the forecast period of 2024-2032.

To Get More Information on Diesel Engines Market - Request Sample Report

The diesel engine market is undergoing significant transformation, driven by tighter emission standards and the demand for improved fuel efficiency across a range of sectors, including transportation, agriculture, and heavy-duty machinery. Innovations in emission control technologies such as turbocharging, selective catalytic reduction (SCR), and exhaust gas recirculation (EGR) have become integral to meeting stricter regulations while maintaining engine performance. SCR systems have been particularly effective in reducing nitrogen oxide (NOx) emissions, helping engines comply with the latest environmental standards. Another notable trend is the increasing use of hybrid diesel engines, which combine traditional diesel power with electric motor assistance. This hybridization is becoming more common in sectors like mining, logistics, and construction, where fuel efficiency and reduced emissions are critical. These hybrid systems provide the operational benefits of diesel engines while minimizing environmental impact, making them particularly appealing for businesses seeking to lower their operational costs.

In agriculture and construction, diesel engines remain essential due to their power and durability, especially in demanding environments. Heavy-duty equipment like tractors, excavators, and cranes rely on diesel engines for their high-power output and ability to function reliably in harsh conditions. Additionally, modern fuel injection systems, such as common rail technology, are significantly improving engine efficiency by enhancing fuel atomization, resulting in better performance and reduced fuel consumption. Diesel-powered generators also play a crucial role in providing backup power in critical sectors, including healthcare, data centers, and airports. Their ability to deliver reliable energy in emergency situations, particularly in areas lacking a consistent power supply, makes them indispensable. As renewable energy sources continue to grow, diesel engines are still seen as an essential component in ensuring energy stability during power outages or periods of high demand.

| Type of Diesel Engine | Description | Commercial Products |

|---|---|---|

| Small Diesel Engines | Compact engines typically used for light-duty applications such as small machinery and vehicles. | Yanmar L100N, Kohler KDW 1003 |

| Industrial Diesel Engines | High-power engines designed for heavy-duty applications in construction, mining, and industrial use. | Cummins QSK60, Caterpillar C32 |

| Marine Diesel Engines | Engines specifically engineered for marine applications, offering durability in maritime conditions. | MAN 175D, MTU Series 4000 |

| Automotive Diesel Engines | Diesel engines built for use in vehicles, optimized for fuel efficiency and lower emissions. | Ford 3.0L Power Stroke, Volkswagen EA288 Evo |

| Agricultural Diesel Engines | Designed for tractors, harvesters, and other agricultural equipment, focusing on rugged performance. | John Deere PowerTech, Perkins 1104D-44T |

| Stationary Diesel Engines | Used in fixed installations like generators and pumps, providing reliable power with low maintenance. | Mitsubishi S6R2-Y3PTAW, Caterpillar 3512C |

| Generator Diesel Engines | Engines optimized for power generation, often used in standby or continuous power supply applications. | Cummins QSX15-G8, Perkins 4016-61TRG3 |

| Heavy-Duty Diesel Engines | Engines built to endure demanding environments with high torque and durability for large equipment. | Volvo D13, Scania DC13 |

| Turbocharged Diesel Engines | Equipped with turbochargers for increased power output and fuel efficiency. | Mercedes-Benz OM 654, Fiat Powertrain F1C |

| Eco-Friendly Diesel Engines | Engines that comply with stringent emissions standards and focus on reducing environmental impact. | Volvo D8J Tier 4 Final, Cummins B6.7 Stage V |

| Dual-Fuel Diesel Engines | Diesel engines capable of operating on two types of fuel, enhancing fuel flexibility and efficiency. | Wärtsilä 31DF, MAN V35/44G |

MARKET DYNAMICS

DRIVERS

- Diesel engines are increasingly in demand across automotive, construction, and agriculture sectors.

The demand for diesel engines continues to grow, largely due to their fuel efficiency, durability, and robust torque output, making them ideal for automotive and industrial applications. In the automotive sector, diesel engines power a wide range of vehicles, especially commercial trucks and buses, where they offer greater mileage and lower fuel costs compared to gasoline engines. In Europe, diesel engines power approximately 70% of light commercial vehicles due to their efficiency and lower CO₂ emissions per kilometer, which supports environmental standards. In industrial applications, diesel engines are pivotal in construction, mining, and agriculture due to their ability to handle heavy loads and endure rigorous, prolonged usage. Construction and mining equipment, such as excavators, loaders, and tractors, often rely on diesel engines for their high torque at low speeds, allowing these machines to perform heavy-duty tasks without compromising efficiency. Agriculture machinery, too, such as harvesters and tractors, benefits from diesel engines' extended operational life and lower maintenance requirements, contributing to lower overall costs for farmers.

Additionally, the global shift toward more stringent emissions regulations is fostering technological advancements in diesel engines, such as turbocharging and exhaust treatment, which further improve their efficiency and reduce environmental impact. In emerging markets, where electricity access is limited, diesel engines are essential for power generation, driving continued demand. This combination of high efficiency, durability, and adaptability positions diesel engines as a core technology in both developed and developing regions.

- Technological advancements like turbocharging and direct fuel injection have improved diesel engines' performance, efficiency, and emissions control, making them more appealing and eco-friendly.

Advancements in diesel engine technology, particularly through turbocharging and direct fuel injection, have led to notable improvements in performance, fuel efficiency, and emissions control. Turbocharging technology, which forces more air into the engine's combustion chamber, allows for increased power output without enlarging the engine size. This has made diesel engines more powerful while also improving fuel efficiency, a critical factor for both commercial and consumer diesel applications. Furthermore, direct fuel injection, which precisely controls fuel delivery into the combustion chamber, has improved the combustion process, leading to more efficient fuel use and reduced emissions.

Recent technological strides have also introduced exhaust after-treatment systems, including diesel particulate filters (DPFs) and selective catalytic reduction (SCR) systems. These systems help meet stringent environmental standards by significantly reducing nitrogen oxide (NOx) emissions a major contributor to air pollution. SCR systems can reduce NOx emissions by up to 90%, while DPFs are capable of capturing up to 98% of particulate matter, including soot. Combined, these advancements have transformed diesel engines, making them an eco-friendlier option and aligning them closer to global emission standards, such as Euro 6 in Europe and Tier 4 in the United States. The result is that diesel engines today offer a balanced solution of power, efficiency, and environmental responsibility, keeping them relevant in industries where both performance and reduced emissions are essential. This evolution helps diesel engines remain competitive even as alternative power sources, like electric engines, gain popularity.

RESTRAIN

- Stringent emission regulations are slowing diesel engine market growth, as costly emission-reduction technologies are needed to meet global NOx and PM standards, driving a shift toward cleaner alternatives.

Stringent emission regulations have become a critical factor shaping the diesel engine market, as diesel engines traditionally emit more nitrogen oxides (NOx) and particulate matter (PM) than gasoline engines. Diesel exhaust emissions, including NOx and PM, contribute significantly to air pollution and are linked to respiratory and environmental health issues. As a result, many countries are enforcing stricter emission standards to reduce these pollutants. The European Union’s Euro 6 standards, for instance, have set stringent limits on NOx and PM emissions from vehicles, pressuring manufacturers to reduce emissions or face penalties. Similarly, the United States Environmental Protection Agency (EPA) has enforced rules under the Clean Air Act to limit diesel emissions, including standards for both on-road and off-road engines.

Compliance with these regulations requires automakers and diesel engine producers to invest in advanced emission-reduction technologies, such as selective catalytic reduction (SCR) systems and diesel particulate filters (DPF). However, these technologies increase production costs, which can deter some manufacturers. Many industries, including transportation and construction, are shifting towards alternative power sources, such as electric and hybrid systems, to comply with the stricter emission standards. According to the research, emissions from diesel vehicles are expected to decrease significantly by 2030, as electrification and hybridization gain traction. This regulatory push for cleaner energy solutions places a strain on the growth of the diesel engine market, signaling a shift toward more sustainable alternatives to meet global environmental goals.

KEY SEGMENTATION ANALYSIS

By Speed

The Medium (720–1200 rpm) diesel engine segment dominated the market share over 40.2% in 2023, due to its versatility and widespread use in various sectors, particularly in commercial vehicles, construction machinery, and industrial applications. These engines are renowned for offering an optimal balance between fuel efficiency and power output, making them ideal for heavy-duty operations. Medium-speed engines are commonly found in medium-duty trucks, construction equipment like excavators and bulldozers, and industrial machines. Their efficiency, coupled with a robust torque profile, makes them suitable for both on-road and off-road applications. Moreover, medium-speed diesel engines are generally more fuel-efficient compared to their high-speed counterparts, which is a crucial factor in industries where operational costs are significant.

By Power Rating

The 2.1–5.0 MW power rating segment dominated the market share over 38.09% in 2023, due to its widespread use in various industrial and commercial applications. Medium-power diesel engines in this range are essential for power generation, providing reliable energy in both urban and remote locations. These engines are also employed in the marine industry for vessel propulsion and onboard power supply, as well as in heavy-duty vehicles such as trucks and construction machinery. The versatility of these engines, offering a balance between power and fuel efficiency, has made them a preferred choice. Furthermore, industries requiring uninterrupted operation, such as manufacturing plants, often rely on these engines for backup power, ensuring the continuity of business operations.

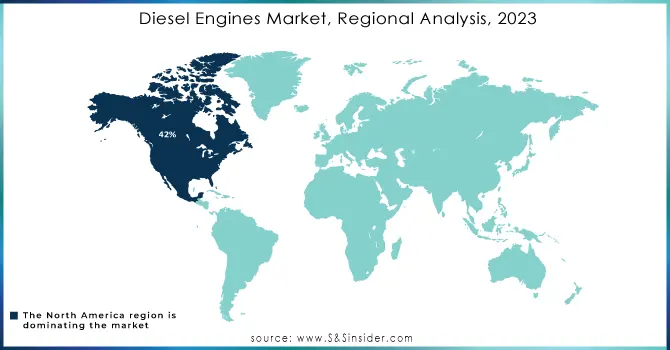

KEY REGIONAL ANALYSIS

North America region dominated the market share over 42% in 2023, to its robust industrial framework and widespread adoption of advanced technologies. The region has a substantial fleet of diesel-powered vehicles, with heavy-duty trucks and construction machinery accounting for a significant share. The U.S. alone has over 3 million heavy-duty trucks on the road, most of which are powered by diesel engines. The agricultural sector in North America also plays a critical role, with a growing number of diesel-powered tractors and harvesters that enhance productivity. In the energy sector, diesel engines are crucial for backup power systems and offshore applications, with thousands of diesel generators used across remote areas and industrial sites.

The Asia Pacific region is set to experience rapid growth in the diesel engines market from 2024 to 2032, driven by key factors such as the surge in maritime activity. The number of boats, crafts, and vessels is rising, which significantly increases the demand for propulsion systems and small marine engines. In countries like China, India, Japan, and South Korea, there is an accelerated expansion of the maritime industry, with a growing number of commercial vessels and fishing boats relying on diesel-powered engines for efficiency and reliability. Additionally, the defense sector is fueling demand for diesel engines, as countries in the region, particularly China and India, expand and modernize their naval fleets in response to territorial disputes.

Do You Need any Customization Research on Diesel Engines Market - Inquire Now

KEY PLAYERS

Some of the major Key Players of Diesel Engines Market

-

AGCO Corporation (Tractors, Combines, Diesel Engines for agricultural machinery)

-

Robert Bosch GmbH (Diesel Fuel Systems, Injectors, Diesel Engine Components)

-

Deere & Company (John Deere Diesel Engines, Agricultural Equipment)

-

Continental AG (Turbochargers, Fuel Systems, Diesel Engine Components)

-

Delphi Automotive System Private Limited (Diesel Fuel Injection Systems, Turbochargers)

-

Mitsubishi Heavy Industries, Ltd (Marine Diesel Engines, Power Generation Engines)

-

Ford Motor Company (Ford Super Duty Diesel Engines, Pickup Trucks)

-

General Motors Company (Duramax Diesel Engines for trucks)

-

MAN SE (Marine Diesel Engines, Commercial Vehicle Engines)

-

Wärtsilä Oyj Abp (Marine Diesel Engines, Power Plant Engines)

-

Cummins, Inc (QSK Series Diesel Engines, Diesel Generators, Heavy-duty Engines)

-

Rolls-Royce Motor Cars Limited (V12 Diesel Engines for luxury vehicles)

-

Caterpillar Inc. (Caterpillar Diesel Engines for construction and mining equipment)

-

Volvo Group (Volvo Diesel Engines for Trucks, Buses, and Construction Equipment)

-

Perkins Engines Company Limited (Industrial Diesel Engines, Agricultural Diesel Engines)

-

Honda Motor Co., Ltd (Honda Diesel Engines for Agricultural and Industrial Applications)

-

Isuzu Motors Ltd (Isuzu Diesel Engines for Commercial Vehicles, Light Duty Trucks)

-

MAN Engines (Marine Diesel Engines, Industrial Diesel Engines)

-

Hyundai Motor Company (Diesel Engines for Commercial Vehicles, Passenger Cars)

-

Kohler Co. (Kohler Diesel Engines for Agricultural, Industrial, and Commercial Applications)

Suppliers for Known for heavy-duty diesel engines for commercial vehicles and industrial applications of Diesel Engines Market:

-

Cummins, Inc.

-

Caterpillar Inc.

-

Perkins Engines Company Limited

-

MAN SE

-

Robert Bosch GmbH

-

Mitsubishi Heavy Industries, Ltd.

-

Deere & Company

-

Volvo Group

-

Isuzu Motors Ltd.

-

Wärtsilä Oyj Abp

RECENT DEVELOPMENTS

-

In March 2023: Caterpillar introduced the CAT C13D, a new 13-liter diesel engine platform engineered to deliver exceptional power density, torque, and fuel efficiency, enhancing heavy-duty off-highway performance. The C13D complies with stringent emissions standards, including EU Stage V, US EPA Tier 4 Final, China Non-road IV, Korea Stage V, and Japan 2014, with variants tailored for less-regulated markets.

-

In April 2023: General Motors Company announced plans to expand its DMAX manufacturing facility in Brookville, Ohio. The Dayton-Montgomery County Board of Trustees approved the expansion, and the new capital lease agreement enables General Motors to move forward with the project.

-

In March 2023: Deere & Company unveiled a new generation of engines, including the JD4, JD14, and JD18, offering power outputs ranging from 36 to 677 kW (48 to 908 hp). The JD4 engine delivers up to 120 kW (161 hp) with a rear gear train for reduced noise and enhanced PTO power.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 64.12 Billion |

| Market Size by 2032 | USD 92.76 Billion |

| CAGR | CAGR of 4.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Speed (Low (Up to 720 rpm), Medium (720-1200 rpm), High (1200-1800 rpm, Above 1800 rpm)) • By power rating (Below 0.5 MW, 0.5-1.0 MW, 1.1-2.0 MW, 2.1-5.0MW, above 5.0 MW) By end user (Power generation, Marines, Locomotives, Oil & Gas, Mining, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGCO Corporation, Robert Bosch GmbH, Deere & Company, Continental AG, Delphi Automotive System Private Limited, Mitsubishi Heavy Industries, Ltd, Ford Motor Company, General Motors Company, MAN SE, Wärtsilä Oyj Abp, Cummins, Inc, Rolls-Royce Motor Cars Limited, Caterpillar Inc., Volvo Group, Perkins Engines Company Limited, Honda Motor Co., Ltd, Isuzu Motors Ltd, MAN Engines, Hyundai Motor Company, Kohler Co. |

| Key Drivers | • Diesel engines are increasingly in demand across automotive, construction, and agriculture sectors due to their fuel efficiency, durability, and reliable power output. • Technological advancements like turbocharging and direct fuel injection have improved diesel engines' performance, efficiency, and emissions control, making them more appealing and eco-friendlier. |

| RESTRAINTS | • Stringent emission regulations are limiting diesel engine market growth due to the need for costly emission-reduction technologies to meet global NOx and PM standards, prompting a shift towards cleaner alternatives. |