The Diabetes Drug Market Size was valued at USD 79.4 billion in 2023 and is expected to reach USD 145.0 billion by 2032, growing at a CAGR of 6.9% over the forecast period 2024-2032.

Get more information on Diabetes Drug Market - Request Sample Report

This comprehensive report offers in-depth insights into the diabetes drug market. We analyze trends in the existing and future market, explore pricing strategies and drivers of drug pricing, and provide an overview of key patents governing the industry landscape. Our report provides an integrated picture of the diabetes drug market, by highlighting the latest updates and numbers in this fast-evolving field and providing stakeholders with all the tools to make the best strategic decision. There is an increasing incidence of diabetes due to changing lifestyles towards more sedentary behavior, urbanization, and increasing obesity, which is a major driver of the global diabetes drug market. Diabetes is directly associated with 284,049 deaths per year. According to the World Health Organization (WHO), more than 537 million adults around the world had diabetes in 2021, and the number is expected to skyrocket to 783 million by 2045. According to a recent study in India known as the "diabetes capital", more than 212 crore people were affected in 2024.

Drivers

The growing global incidence of particularly type 2, is fueling demand for effective treatments.

The increasing incidence of diabetes remains one of the dominant factors fuelling growth in the diabetes drug market. A recent study states that 90% of people who are suffering from diabetes are having Type 2 diabetes. The rise is compounded by the fact that treatment remains scarce, especially in low- and middle-income countries. From August 2021 to August 2023, the overall prevalence of total diabetes was 15.8% among US adults, with diagnosed diabetes at 11.3% and undiagnosed diabetes at 4.5%. The prevalence was higher in men (18.0%) than in women (13.7%), and it increased with age and weight status. This data highlights the increasing global need for effective diabetes treatments. The burgeoning incidence, particularly in areas with impractical access to care, illustrates the urgent necessity for accessible, and radical diabetes medications to control this growing medical crisis.

Restraints

The expense of newer medications can limit accessibility, especially in low-income populations.

High treatment cost is one of the significant restraining factors affecting the market as it limits patient accessibility in the diabetes drug market. Most of the new, better diabetes drugs, like the GLP-1 receptor agonists or the SGLT2 inhibitors, are expensive, and too often out of reach for much of the population. The cost of diabetes treatment is not limited to the price of the medication itself accompanying expenses include device and regular monitoring and insulin delivery devices and doctor consultations.

Patients in low- and middle-income countries often struggle to afford these treatments, leading to poor disease management and increased complications. Moreover, the insurance coverage is highly variable as well and many plans do not cover the full cost of advanced diabetes drug, driving patients to less effective but cheaper options. The economic hurdle constrains market reach and widens gaps in the standard-of-care delivery for Diabetes management, hence impacting patients' long-term prognosis and increasing the chances of diabetes-related complications.

Opportunities

Growing diabetic populations in emerging markets present significant opportunities for pharmaceutical companies to expand their reach.

As global diabetes cases climb above 800 million, unprecedented opportunities await pharmaceutical companies and arise out of their reach with emerging market populations containing 90% of the untreated adult cases. Meanwhile, Glenmark Pharmaceuticals took the lead in India with a liraglutide biosimilar at 70% cost reduction of existing therapies, and firms like Hangzhou Jiuyuan Gene Engineering are also progressing on Semaglutide biosimilars ahead of the 2026 patent expiry. Governments are incentivizing production the PLI scheme in India is propping up generic GLP-1 drugs that would launch in 2026, and Eli Lilly has already planned to render Tirzepatide (Mounjaro) available in India by 2025 This diversification of therapeutics is underscored by new innovations such as Innovent Biologics’ Mazdutide near China’s 2025 approval as a dual-target obesity/diabetes drug. As diabetes prevalence exceeds 20% in parts of Latin America and the Middle East, companies are making affordability, screening integration, and partnerships a priority to address systemic shortfalls in detection and care.

Challenges

The expiration of patents for key diabetes drugs is leading to increased competition from generic drug manufacturers, potentially impacting market share and profitability.

The expiration of patents for drugs used to treat diabetes indicates the beginning of a competitive and economically challenging transformation period in the pharmaceutical market. This provides the opportunity for generic manufacturers to make their bioequivalent alternatives, typically priced 80-85% lower than branded versions, eroding the market dominance of originator companies. Innovators like Sanofi and Novo Nordisk face huge drops in revenue, forcing drastic strategic shifts to create next-generation formulations or find additional indications. Generics lower costs and provide access, but the path to entry is fraught. Patent thickets are commonly deployed by originators, which see secondary patents filed on delivery devices or formulations with a view to ensure competitors are delayed from entering the market. This slows generic market entry even more due to regulatory complexities and litigation risk. Meanwhile, quality issues such as NDMA contamination of metformin generics necessitate strict bioequivalence requirements. These dynamics strain profitability for innovators but drive systemic cost savings, reshaping diabetes care accessibility while challenging firms to innovate beyond patent-dependent models.

By Drug Class

In 2023, the GLP-1 Receptor Agonists segment dominated the market, as a result of their dual action of glycemic control and subcutaneous help. According to the UK National Diabetes Audit (2024), there had been a 22% rise in the number of people with type 1 diabetes receiving GLP-1 therapies, given evidence of their benefits in the prevention of cardiovascular disease. The WHO’s 2024 guidelines endorsing GLP-1 agonists like semaglutide for obesity management have expanded their adoption.

Insulin is poised for substantial growth, driven by rising type 1 diabetes cases and accessibility initiatives. In response to rising demand in lower-income regions, approvals for biosimilar insulins received a fast track from India's Central Drugs Standard Control Organization (CDSCO) in 2024. Insulin is so expensive that worldwide it leaves over 100 million patients dependent on life-sustaining therapy suffering, as per the International Diabetes Federation (2024).

By Diabetes Type

The Type 2 diabetes segment dominated the market with the highest revenue share in 2023, According to the WHO, more than 90% of cases in 2023 are attributed to type 2 diabetes, and it was encouraged as a result of obesity and metabolic syndrome. According to the 2024 National Diabetes Statistics Report, 38.4 million adults in the U.S. had type 2 diabetes, of which 8.7 million were undiagnosed, the CDC said. The National Family Health Survey in 2023 exemplified this- some form of urban sedentary lifestyle was associated with a 15% increase in prevalence in metros. Governments have driven campaigns to reduce type 2 ultimately through lifestyle changes such as the EU 2025 Diabetes Prevention Pact campaign that indirectly increases the demand for oral antidiabetics and GLP-1 agonists.

By Route of Administration

The subcutaneous route held the largest revenue share in 2023, as it is the primary route of administration for diabetes medications, especially insulin, and is broadly accepted by patients because of its safety and convenience. Subcutaneous injections consist of injecting medication into the fatty tissue of the skin, usually resulting in slow absorption into the bloodstream. The constant release is essential to keep the blood glucose levels unchanged, particularly with slow-acting insulins. Subcutaneous injections are relatively easy for the patient to self-administer, allowing them to become their own doctor to a degree by controlling their diabetes with minimal clinical visits. Authorities in health have identified that with the proper care of diabetes, we can conclude the value of being below the skin. The U.S. Food and Drug Administration (FDA), for example, has authorized the use of numerous insulin products for subcutaneous (under-the-skin) delivery, simply reinforcing their effectiveness and safety.

By Distribution Channel

In 2023, the market was dominated by retail pharmacies due to convenience and availability at most pharmacies. Recent data in 2024, revealed that 63% of diabetes drugs were dispensed via retail channels, supported by generic affordability. The Inflation Reduction Act (2022) capped insulin copays at USD 35/month in the U.S. and raised retail procurement by Medicare beneficiaries. American Pharmacists Association (2020–2023) data indicate a 12% increment in SGLT2 inhibitor and DPP-4 retail prescriptions.

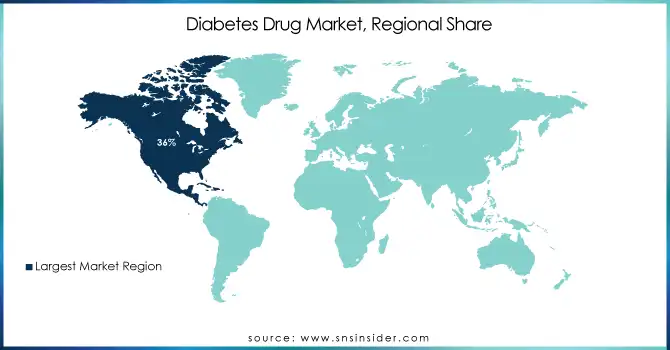

In 2023, the North American region dominated the market with a 36% market share. This leadership position is primarily attributed to the region's high obesity rates, with 42.4% of U.S. adults classified as obese. The advanced healthcare infrastructure in North America, particularly in the United States, further supports this market dominance. In 2024, the Centers for Disease Control and Prevention (CDC) reported a diabetes prevalence of 11.6% which represents a significant patient population. The economic impact is evident in the $12 billion annual Medicare spending on antidiabetic medications, reflecting both the high cost of treatment and the extensive coverage provided.

Asia-Pacific is projected to grow the fastest CAGR during the forecast period. This growth is primarily propelled by gigantic diabetic figures of India and China stand at around 21 crores and 14 crores respectively. These figures highlight the vast market potential in the region. The expansion of the market is a key role played by government initiatives. As an example of this, the National Health Mission of India set aside ₹2,500 crore in 2024 for screening of diabetes, a clear stance towards early detection intervention. At the same time, the State Council of China has integrated AI-based diagnostics into rural healthcare systems, addressing the challenge of healthcare access in remote areas. These initiatives help provide better therapy to patients as well as drive the market upwards through increased diagnosis and availability of treatment.

Need any customization research on Diabetes Drug Market - Enquiry Now

Key Service Providers/Manufacturers

Novo Nordisk A/S (Ozempic, Rybelsus)

Eli Lilly and Company (Mounjaro, Trulicity)

Sanofi (Lantus, Toujeo)

Merck & Co., Inc. (Januvia, Janumet)

AstraZeneca (Farxiga, Bydureon)

Boehringer Ingelheim (Jardiance, Trajenta)

Bayer AG (Glucobay, Acarbose)

Takeda Pharmaceutical Company Limited (Actos, Nesina)

Pfizer Inc. (Exubera, Ertugliflozin)

MannKind Corporation (Afrezza, Technosphere Insulin)

Key Users

Mayo Clinic

Cleveland Clinic

Johns Hopkins Medicine

UnitedHealth Group

Kaiser Permanente

CVS Health (Aetna)

Cigna Corporation

Anthem, Inc.

Humana Inc.

Blue Cross Blue Shield Association

Eli Lilly’s Mounjaro in India December 2024, approved for obesity and diabetes, targeting 11% of India’s projected obese population by 2035.

Novo Nordisk’s Wegovy EU Expansion January 2025, EMA-approved GLP-1 agonist entering 10 markets to address 32 million obese adults.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 79.4 Billion |

| Market Size by 2032 | USD 145.0 Billion |

| CAGR | CAGR of 6.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Insulin, SGLT2 Inhibitors, DPP-4 Inhibitors, GLP-1 Receptor Agonists, Others) • By Route of Administration (Oral, Intravenous, Subcutaneous) • By Diabetes Type (Type 1, Type 2) • By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novo Nordisk A/S, Eli Lilly and Company, Sanofi, Merck & Co., Inc., AstraZeneca, Boehringer Ingelheim, Bayer AG, Takeda Pharmaceutical Company Limited, Pfizer Inc., MannKind Corporation |

Ans. The projected market size for the Diabetes Drug Market is USD 145 Billion by 2032.

Ans: The North American region dominated the Diabetes Drug Market in 2023.

Ans. The CAGR of the Diabetes Drug Market is 6.9% During the forecast period of 2024-2032.

Ans: The key trends and statistical insights we providing are,

Prescription Trends by Region

Drug Volume

Healthcare Spending on Diabetes

Key Diabetes Drug Categories by Market Share

Regulatory Trends

Ans: The Type 2 diabetes type segment dominated the Diabetes Drug Market

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Prescription Trends by Region (2023)

5.2 Drug Volume (2023-2032)

5.3 Healthcare Spending on Diabetes (2023)

5.4 Key Diabetes Drug Categories by Market Share (2023)

5.5 Regulatory Trends (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Diabetes Drug Market Segmentation, By Drug Class

7.1 Chapter Overview

7.2 Insulin

7.2.1 Insulin Market Trends Analysis (2020-2032)

7.2.2 Insulin Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 SGLT2 Inhibitors

7.3.1 SGLT2 Inhibitors Market Trends Analysis (2020-2032)

7.3.2 SGLT2 Inhibitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 DPP-4 Inhibitors

7.4.1 DPP-4 Inhibitors Market Trends Analysis (2020-2032)

7.4.2 DPP-4 Inhibitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 GLP-1 Receptor Agonists

7.5.1 GLP-1 Receptor Agonists Market Trends Analysis (2020-2032)

7.5.2 GLP-1 Receptor Agonists Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Diabetes Drug Market Segmentation, By Route of Administration

8.1 Chapter Overview

8.2 Oral

8.2.1 Oral Market Trends Analysis (2020-2032)

8.2.2 Oral Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Intravenous

8.3.1 Intravenous Market Trends Analysis (2020-2032)

8.3.2 Intravenous Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Subcutaneous

8.4.1 Subcutaneous Market Trends Analysis (2020-2032)

8.4.2 Subcutaneous Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Diabetes Drug Market Segmentation, By Diabetes Type

9.1 Chapter Overview

9.2 Type 1

9.2.1 Type 1 Market Trends Analysis (2020-2032)

9.2.2 Type 1 Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Type 2

9.3.1 Type 2 Market Trends Analysis (2020-2032)

9.3.2 Type 2 Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Diabetes Drug Market Segmentation, By Distribution Channel

10.1 Chapter Overview

10.2 Hospital Pharmacies

10.2.1 Hospital Pharmacies Market Trends Analysis (2020-2032)

10.2.2 Hospital Pharmacies Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Online Pharmacies

10.3.1 Online Pharmacies Market Trends Analysis (2020-2032)

10.3.2 Online Pharmacies Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Retail Pharmacies

10.4.1 Retail Pharmacies Market Trends Analysis (2020-2032)

10.4.2 Retail Pharmacies Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Diabetes Drug Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.2.4 North America Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.2.5 North America Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.2.6 North America Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.2.7.2 USA Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.2.7.3 USA Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.2.7.4 USA Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.2.7 Canada

11.2.7.1 Canada Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.2.7.2 Canada Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.2.7.3 Canada Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.2.7.3 Canada Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.2.8 Mexico

11.2.8.1 Mexico Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.2.8.2 Mexico Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.2.8.3 Mexico Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.2.8.3 Mexico Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Diabetes Drug Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.1.6 Poland

11.3.1.6.1 Poland Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.1.6.2 Poland Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.1.6.3 Poland Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.1.6.3 Poland Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.1.7 Romania

11.3.1.7.1 Romania Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.1.7.2 Romania Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.1.7.3 Romania Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.1.7.3 Romania Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.1.8 Hungary

11.3.1.8.1 Hungary Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.1.8.2 Hungary Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.1.9 Turkey

11.3.1.9.1 Turkey Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.1.9.2 Turkey Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Diabetes Drug Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.4 Western Europe Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.5 Western Europe Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.6 Germany

11.3.2.6.1 Germany Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.6.2 Germany Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.6.3 Germany Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.6.3 Germany Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.7 France

11.3.2.7.1 France Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.7.2 France Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.7.3 France Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.7.3 France Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.8 UK

11.3.2.8.1 UK Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.8.2 UK Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.8.3 UK Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.8.3 UK Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.9 Italy

11.3.2.9.1 Italy Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.9.2 Italy Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.9.3 Italy Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.9.3 Italy Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.11.2 Spain Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.11.3 Spain Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.11 Netherlands

11.3.2.11.1 Netherlands Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.11.2 Netherlands Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.12 Switzerland

11.3.2.12.1 Switzerland Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.12.2 Switzerland Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.13 Austria

11.3.2.13.1 Austria Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.13.2 Austria Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.13.3 Austria Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.13.3 Austria Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.3.2.14 Rest of Western Europe

11.3.2.14.1 Rest of Western Europe Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.3.2.14.2 Rest of Western Europe Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Diabetes Drug Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.4 Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.5 Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.6 China

11.4.6.1 China Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.6.2 China Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.6.3 China Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.6.3 China Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.7 India

11.4.7.1 India Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.7.2 India Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.7.3 India Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.7.3 India Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.8 Japan

11.4.8.1 Japan Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.8.2 Japan Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.8.3 Japan Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.8.3 Japan Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.9 South Korea

11.4.9.1 South Korea Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.9.2 South Korea Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.9.3 South Korea Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.9.3 South Korea Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.11.2 Vietnam Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.11.3 Vietnam Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.11 Singapore

11.4.11.1 Singapore Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.11.2 Singapore Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.11.3 Singapore Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.11.3 Singapore Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.12 Australia

11.4.12.1 Australia Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.12.2 Australia Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.12.3 Australia Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.12.3 Australia Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.4.13.2 Rest of Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Diabetes Drug Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.1.4 Middle East Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.1.5 Middle East Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.1.6 UAE

11.5.1.6.1 UAE Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.1.6.2 UAE Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.1.6.3 UAE Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.1.6.3 UAE Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.1.7 Egypt

11.5.1.7.1 Egypt Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.1.7.2 Egypt Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.1.8 Saudi Arabia

11.5.1.8.1 Saudi Arabia Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.1.8.2 Saudi Arabia Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.1.9 Qatar

11.5.1.9.1 Qatar Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.1.9.2 Qatar Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Diabetes Drug Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.2.4 Africa Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.2.5 Africa Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.2.8.3 Africa Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.2.6 South Africa

11.5.2.6.1 South Africa Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.2.6.2 South Africa Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.2.6.3 South Africa Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.2.8.3 South Africa Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.2.7 Nigeria

11.5.2.7.1 Nigeria Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.2.7.2 Nigeria Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.2.7.3 Nigeria Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.5.2.8 Rest of Africa

11.5.2.8.1 Rest of Africa Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.5.2.8.2 Rest of Africa Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Diabetes Drug Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.6.4 Latin America Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.6.5 Latin America Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.6.5 Latin America Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.6.6 Brazil

11.6.6.1 Brazil Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.6.6.2 Brazil Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.6.6.3 Brazil Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.6.6.3 Brazil Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.6.7 Argentina

11.6.7.1 Argentina Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.6.7.2 Argentina Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.6.7.3 Argentina Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.6.7.3 Argentina Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.6.8 Colombia

11.6.8.1 Colombia Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.6.8.2 Colombia Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.6.8.3 Colombia Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.6.8.3 Colombia Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Diabetes Drug Market Estimates and Forecasts, By Drug Class (2020-2032) (USD Billion)

11.6.9.2 Rest of Latin America Diabetes Drug Market Estimates and Forecasts, By Route of Administration (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Diabetes Drug Market Estimates and Forecasts, By Diabetes Type (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Diabetes Drug Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12. Company Profiles

12.1 Novo Nordisk A/S

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Eli Lilly and Company

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Sanofi

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 AstraZeneca

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Merck & Co., Inc.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Boehringer Ingelheim

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Bayer AG

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Takeda Pharmaceutical Company Limited

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Pfizer Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 MannKind Corporation

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Drug Class

Insulin

SGLT2 Inhibitors

DPP-4 Inhibitors

GLP-1 Receptor Agonists

Others

By Route of Administration

Oral

Intravenous

Subcutaneous

By Diabetes Type

Type 1

Type 2

By Distribution Channel

Hospital Pharmacies

Online Pharmacies

Retail Pharmacies

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Soft Contact Lenses Market size was valued at USD 9.05 billion in 2023, projected to reach USD 17.39 billion by 2032, with a 7.55% CAGR from 2024 to 2032.

The Capnography Devices Market size was valued at USD 605.37 million in 2023 and is expected to reach USD 1460.84 million by 2032 and grow at a CAGR of 10.28% over the forecast period 2024-2032.

Animal Disinfectant Market Size was valued at USD 3.64 Billion in 2023 and is expected to reach USD 6.95 billion by 2032, growing at a CAGR of 7.46% over the forecast period 2024-2032.

The Gene Synthesis Market size was valued at USD 2.28 billion in 2023 and is expected to grow to USD 9.64 billion by 2032 and grow at a CAGR of 17.41% over the forecast period of 2024-2032.

Toxicity Testing Outsourcing Market Size was valued at USD 3.76 Billion in 2023 and is expected to reach USD 8.28 Billion by 2032, growing at a CAGR of 9.2%.

Cardiovascular Information System Market Size was valued at USD 1.24 Billion in 2023 and is expected to reach USD 2.8 Billion by 2032, growing at a CAGR of 9.4% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone