Desiccant Dehumidifier Market Size & Trends:

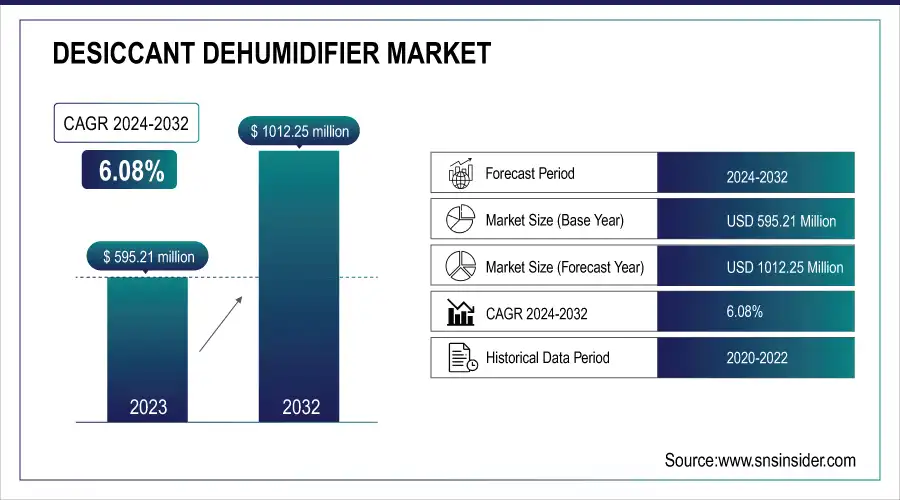

The Desiccant Dehumidifier Market was valued at USD 595.21 Million in 2023 and is projected to reach USD 1012.25 Million by 2032, growing at a CAGR of 6.08% from 2024 to 2032. The Desiccant Dehumidifier Market is experiencing steady growth, primarily driven by key factors such as rising demand for moisture control in critical industries, increasing infrastructure investments, and advancements in dehumidification technology. Industries like pharmaceuticals, food processing, electronics, and data centers require precise humidity regulation to ensure product quality, reduce spoilage, and maintain compliance with safety standards.

To Get more information on Desiccant Dehumidifier Market - Request Free Sample Report

In the U.S. market, which was valued at USD 75.94 million in 2023 and is expected to reach USD 129.34 million by 2032, growing at a CAGR of 6.07%. As a result, companies are significantly investing in high-performance dehumidification systems. One major advantage of desiccant dehumidifiers is their ability to minimize operational downtime by stabilizing humidity-sensitive environments, which improves process efficiency and reduces equipment wear. Additionally, modern units now offer improved humidity control accuracy maintaining relative humidity within ±1–2percentage making them essential for controlled environments such as clean rooms and cold storage.

Desiccant Dehumidifier Market Dynamics:

Drivers:

-

Rising Industry Standards Fuel Demand for Precise Humidity Control in Desiccant Dehumidifier Market

The growing emphasis on precise humidity control is a key driver of the desiccant dehumidifier market, especially in moisture-sensitive industries such as pharmaceuticals, food processing, and electronics. These sectors demand tight environmental conditions to avoid product spoilage, microbial growth, and equipment failure. As per the U.S. FDA, humidity regulation is a mandatory requirement under CGMP to preserve drug efficacy. The USDA and FSIS also stress the need for humidity control in food storage to prevent contamination. In electronics, IPC reports that RH above 60% can corrode PCBs, while optimal storage requires ≤40% RH. Desiccant dehumidifiers excel in maintaining such levels, even in low temperatures. With industrial automation and compliance standards rising, demand for accurate moisture control continues to boost the adoption of desiccant systems across global markets.

Restraints:

-

Energy Efficiency Challenges Impacting Desiccant Dehumidifier Adoption

While desiccant dehumidifiers are effective in low-temperature environments, they often require substantial energy for the regeneration process, particularly during continuous use. This elevated energy demand can lead to higher operational costs compared to refrigerant-based alternatives, making them less appealing for energy-conscious facilities. According to the U.S. Department of Energy (DOE), industrial dehumidification systems can account for up to 30% of total HVAC energy usage in climate-controlled environments. As global energy efficiency regulations tighten, the high energy footprint of desiccant systems becomes a restraint, especially for facilities aiming to meet ISO 50001 standards or reduce greenhouse gas emissions. Manufacturers are investing in advanced rotor materials and hybrid technologies to address this issue, but until such solutions become mainstream, energy consumption remains a critical barrier to wider market adoption.

Opportunities:

-

Quality Standard Compliance Driving Demand for Desiccant Dehumidifiers

The global push for strict quality and safety regulations, such as GMP (Good Manufacturing Practice), HACCP (Hazard Analysis and Critical Control Points), and ISO standards, is significantly boosting the adoption of precise humidity control solutions like desiccant dehumidifiers. Besides, industries like pharmaceuticals, food processing, and electronics are increasingly necessitated to maintain controlled environments to enhance product integrity, minimize susceptibility to contamination, and fulfill regulatory audits. GMP guidance defined by the U.S. FDA, for example, prescribes rigid controls in the environment where pharmaceutical products are fabricated, whereas HACCP systems acknowledged by the FAO and WHO monitor relative humidity to prevent microorganism threats in the food chain. For instance, ISO 14644 standards for cleanroom operation during electronics and semiconductor manufacturing emphasise the need for low-moisture environments. The precise performance of desiccant dehumidifiers to maintain low humidity levels is making them a go-to solution to enable companies to meet these international compliance standards which present a robust opportunity for market expansion.

Challenges:

-

Technical Complexity and Skilled Labor Dependency Hindering Desiccant Dehumidifier Adoption

Desiccant dehumidifiers, while highly effective in maintaining precise humidity levels, often come with complex installation requirements involving customized system integration, ductwork design, and careful calibration. Routine maintenance is also essential to ensure optimal performance, such as replacing or reactivating desiccant materials and inspecting mechanical components. These tasks typically require trained technicians, which may not be readily available in all industrial settings. This reliance on skilled labor increases operational costs and raises the risk of downtime during maintenance or system setup. In industries where continuous operation and environmental consistency are critical, such as pharmaceuticals, food processing, or electronics manufacturing, such interruptions can lead to productivity loss and compliance issues. This challenge may deter smaller businesses or facilities lacking technical expertise, ultimately slowing broader market adoption of desiccant dehumidifiers.

Desiccant Dehumidifier Industry Segmentation Analysis:

By Product Type

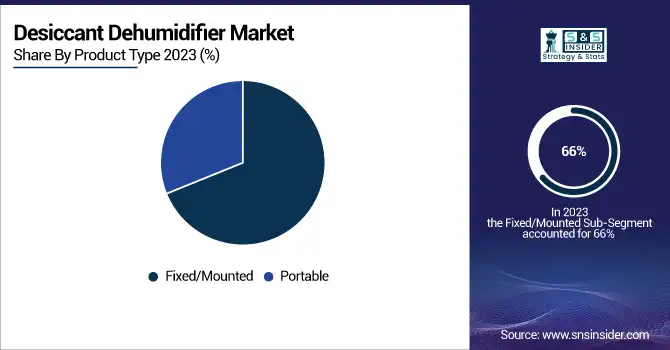

Fixed/mounted desiccant dehumidifiers dominated the market in 2023, accounting for approximately 66% of the total revenue share. These systems are favored in large-scale industrial applications for their ability to provide continuous, high-capacity humidity control in sectors like pharmaceuticals, food processing, and electronics manufacturing. Their stability, energy efficiency, and integration with existing HVAC systems make them ideal for environments requiring precise and reliable moisture removal. Fixed systems are particularly effective in mission-critical facilities, where even slight fluctuations in humidity can lead to product degradation or operational disruptions, solidifying their leading market position.

The portable segment of the desiccant dehumidifier market is expected to experience the fastest growth from 2024 to 2032. Portable dehumidifiers offer flexibility, ease of use, and mobility, making them highly attractive for both residential and commercial applications. They are especially popular in environments where space constraints and mobility are important, such as smaller commercial spaces, temporary setups, or rental properties. As industries like construction, pharmaceuticals, and food processing expand and require temporary or mobile humidity control solutions, the demand for portable units is surging. Furthermore, advancements in energy efficiency and performance are boosting their appeal, while cost-effectiveness compared to larger fixed units adds to their growing adoption across various sectors.

By Application

The Food & Pharmaceutical segment is expected to dominate the desiccant dehumidifier market, accounting for around 30% of the total revenue in 2032. The segment is also poised for the fastest growth between 2024 and 2032; This dominance is driven by the critical need for precise humidity control in these industries to maintain product quality, safety, and regulatory compliance. In pharmaceuticals, controlling humidity is essential for preserving the stability of drugs and preventing microbial growth. Similarly, in food processing, excess moisture can lead to spoilage, mold growth, and compromised texture and taste. As both sectors increasingly focus on maintaining optimal storage and production environments, the demand for reliable and energy-efficient desiccant dehumidifiers is set to grow, driven by expanding production capacities and tightening regulatory standards across these industries.’

By End User

The Industrial segment dominated the desiccant dehumidifier market in 2023, capturing approximately 69% of the total revenue share. This dominance is attributed to the increasing need for precise humidity control in large-scale manufacturing environments, where even minor variations in moisture levels can significantly impact production quality and efficiency. Industries such as pharmaceuticals, food processing, electronics, and chemicals rely heavily on desiccant dehumidifiers to maintain optimal conditions for manufacturing, storage, and packaging. These systems are favored for their high capacity, durability, and ability to perform efficiently in demanding industrial settings. As automation and environmental regulations continue to tighten, the demand for reliable humidity control solutions in industrial sectors is expected to remain strong, solidifying the industrial segment’s leading position in the market.

The Commercial segment of the desiccant dehumidifier market is expected to witness significant growth from 2024 to 2032. As businesses expand and focus on maintaining controlled environments for various applications, the demand for portable and efficient humidity control solutions is increasing. Commercial spaces such as offices, restaurants, retail outlets, and healthcare facilities require reliable dehumidification to maintain air quality, prevent mold growth, and ensure comfort for occupants. Additionally, the growing awareness of energy efficiency and the need for compliance with environmental regulations are driving the adoption of desiccant dehumidifiers. These units, known for their flexibility and cost-effectiveness, are expected to see the fastest growth due to their increasing popularity in small to medium-sized commercial spaces.

Desiccant Dehumidifier Market Regional Overview:

In 2023, the Asia-Pacific region dominated the desiccant dehumidifier market, accounting for around 40% of the total revenue share. This dominance is driven by rapid industrialization, urbanization, and growing manufacturing sectors in countries like China, Japan, and India. Industries such as electronics, pharmaceuticals, and food processing, which require strict humidity control, are expanding in the region. The demand for desiccant dehumidifiers is increasing due to their ability to provide precise humidity regulation, even in challenging environments with high moisture levels. Furthermore, the region's growing focus on energy-efficient and sustainable solutions is encouraging the adoption of these systems.

North America is poised to experience the fastest growth in the desiccant dehumidifier market during the forecast period. This growth is driven by increasing demand across various sectors such as pharmaceuticals, food processing, and electronics, where precise humidity control is critical for product quality and regulatory compliance. In addition, the region’s stringent environmental regulations, such as those set by the U.S. FDA and USDA, are encouraging industries to invest in reliable humidity control systems. The growing trend toward energy-efficient, sustainable solutions in North America further fuels the adoption of desiccant dehumidifiers. Additionally, the expansion of commercial and industrial facilities in the region, along with technological advancements, is expected to drive demand, solidifying North America's position as a key player in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in Desiccant Dehumidifier Market are:

-

Shandong Jiaxin Electric Appliances (China) – Desiccant dehumidifiers, air purifiers, and air conditioners.

-

OKEAN (China) – Industrial dehumidifiers, air dryers, and humidity control systems.

-

Hibar Systems (Canada) – Precision dehumidifiers for industrial applications, primarily for electronics and pharmaceuticals.

-

Aerial (Germany) – Desiccant dehumidifiers for commercial and industrial use, including construction and storage applications.

-

Frigidaire (USA) – Consumer dehumidifiers, portable and fixed units for residential and commercial use.

-

Magic Aire (USA) – Air handling and dehumidification systems for commercial and industrial settings.

-

Condair (Switzerland) – Humidity control solutions, including desiccant dehumidifiers and evaporative cooling systems.

-

Unico System (USA) – HVAC and dehumidification systems, focusing on residential and light commercial applications.

-

Zander (Germany) – Industrial dehumidification and air conditioning systems.

-

Trotec (Germany) – Desiccant dehumidifiers for industrial, commercial, and private use.

-

Mitsubishi Electric (Japan) – HVAC systems, including dehumidifiers for both residential and commercial applications.

-

Munters (Sweden) – Desiccant dehumidifiers, air handling units, and climate control systems for industrial, commercial, and residential use.

-

CTL Group (USA) – Industrial humidity control solutions, including desiccant dehumidifiers for construction and manufacturing.

-

Dantherm (Denmark) – Dehumidification and heating systems for industrial, commercial, and residential applications.

-

DeLonghi (Italy) – Portable dehumidifiers for residential and small commercial applications.

-

Bry-Air (India) – Industrial dehumidifiers, moisture control solutions for manufacturing and commercial applications

-

Munters (Sweden) – Industrial dehumidification systems, air handling units

-

Cotes (Denmark) – Desiccant dehumidifiers for industrial and commercial sectors

-

Seibu Giken DST (Sweden) – Industrial dehumidifiers, moisture control systems

-

Trotec Laser GmbH (Austria) – Industrial dehumidifiers, environmental control systems

-

DehuTech AB (Sweden) – Desiccant dehumidifiers for residential and commercial applications

-

Fisen Corporation (USA) – Industrial dehumidifiers, air filtration solutions

-

KAESER KOMPRESSOREN (Germany) – Compressed air systems, industrial dehumidifiers

-

Atlas Copco AB (Sweden) – Industrial dehumidifiers, compressed air systems

List of companies that provide raw materials and components for the Desiccant Dehumidifier Market:

-

Honeywell International Inc.

-

Cabot Corporation

-

Huntsman Corporation

-

Mitsubishi Chemical Corporation

-

3M Company

-

Desiccant Technologies

-

Chemische Fabrik Budenheim KG

-

Zeolite Suppliers

-

Azelis

-

Munters

-

Koch Industries, Inc.

-

The Dow Chemical Company

-

Taiwan Semiconductor Manufacturing Company (TSMC)

Recent Development:

-

On July 11, 2024, Condair acquired US-based evaporative media manufacturer Kuul, expanding its capabilities in evaporative cooling systems. The acquisition strengthens Condair's product offering with Kuul's glass fibre and cellulose media expertise, enhancing their global distribution network and providing sustainable, reliable solutions. Condair is also investing in a new 400,000ft² production facility in Richmond, Virginia, expected to open in 2025, to better serve the US data center market.

-

28 February, 2025, Atlas Copco is expanding its manufacturing capacity in India with a new factory in Talegaon, investing around MINR 1400 (180 MSEK). The facility will produce air and gas compressor systems for both local and export markets, creating over 200 jobs and improving lead times.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 595.21 Million |

| Market Size by 2032 | USD 1012.25 Million |

| CAGR | CAGR of 6.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Fixed/Mounted, Portable) • By Application(Energy(EV Battery Manufacturing, Power Plants & Wind Turbines), Chemical, Construction, Electronics, Food & Pharmaceutical) • By End User (Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shandong Jiaxin Electric Appliances (China), OKEAN (China), Hibar Systems (Canada), Aerial (Germany), Frigidaire (USA), Magic Aire (USA), Condair (Switzerland), Unico System (USA), Zander (Germany), Trotec (Germany), Mitsubishi Electric (Japan), Munters (Sweden), CTL Group (USA), Dantherm (Denmark), DeLonghi (Italy), Bry-Air (India), Cotes (Denmark), Seibu Giken DST (Sweden), Trotec Laser GmbH (Austria), DehuTech AB (Sweden), Fisen Corporation (USA), KAESER KOMPRESSOREN (Germany), and Atlas Copco AB (Sweden) are key global players in the dehumidifier market. |