Get More Information on Dermatology Imaging Devices Market - Request Sample Report

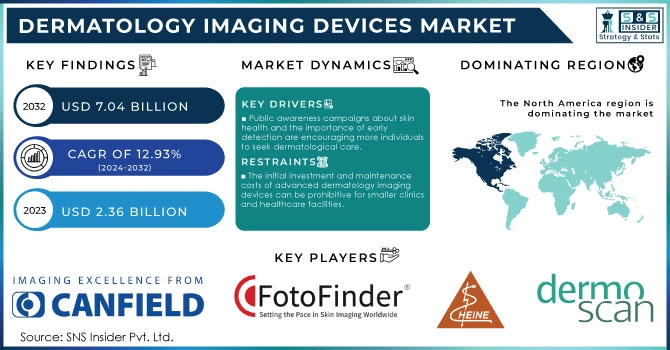

The Dermatology Imaging Devices Market size was valued at USD 2.36 billion in 2023 and is expected to reach USD 7.04 Billion by 2032, growing at a CAGR of 12.93% from 2024-2032.

The dermatology imaging devices market is projected to grow at a rapid pace owing to factors like technological developments, rise in awareness about skin disorders, and increase in number of patients with skin diseases. The increased diagnostic utility to dermatologists under the name of innovations in imaging technology, high resolution digital imaging, dermatoscopy, and 3D imaging systems are all contributing to improved detection of skin conditions like melanoma and other skin cancers. To illustrate, there has been an increasing focus on the role of AI-powered imaging technologies, such as actinic keratosis detection solutions developed by companies such as DermTech, that are improving skin lesion analyses and clinical outcomes. Apart from advancements in technology, the increase of skin diseases among patients is an important factor that drives the market growth. Skin diseases affect nearly 900 million people worldwide, making the development of portable and efficient diagnostic tools highly important according to a report by World Health Organization (WHO). In addition, the rising geriatric population is increasing the prevalence of skin-related diseases and hence propelling the need for dermatology imaging devices. According to a recent report, almost 40% of older adults had at least one skin disorder, creating a need for advanced imaging technologies to treat these disorders. Additionally, Factors driving the growth of telehealth include an escalating need for accessible healthcare, particularly in rural communities, and the increasing prevalence of chronic diseases that necessitate continuous management. Technological improvements, such as better internet access and the development of mobile health applications, enable remote consultations. The COVID-19 pandemic has also played a significant role in advancing telehealth, enhancing comfort levels among patients and providers regarding virtual care. Additionally, expanding insurance coverage for telehealth services supports its growth, alongside the ongoing emphasis on cost reduction and improved patient outcomes.

Market growth is additionally driven by several government initiatives that emphasize skin health awareness and provide improved access to dermatology care. Campaigns to promote awareness about skin cancer and regular skin assessment are motivating a larger population to consult dermatologists, which in turn increases use of imaging devices. These trends have been manifesting recently in market developments. For Instance, In 2023, Siemens Healthineers released its new AI-powered dermatology imaging solution to quickly assess skin conditions while providing actionable information to clinicians, bridging the gap between an evolving technological landscape and traditional dermatological practices.

In conclusion, the dermatology imaging devices market is anticipated to continue on an upward trajectory owing to favorable factors such as technological developments in the field of dermatology devices, rising prevalence of skin diseases, and efforts for creating awareness about these medical conditions.

Drivers

Public awareness campaigns about skin health and the importance of early detection are encouraging more individuals to seek dermatological care.

Enhancements and services in both developed and developing regions are improving access to advanced dermatology imaging technologies.

Supportive government policies and improving skin disease management and access to dermatological services are positively impacting market growth.

The rise of the dermatology imaging devices market is driven by favorable government policies to advance skin disease management and access to dermatological services. Around the world, governments are waking up to skin health problems and trying their best to encourage developments in dermatology. These efforts frequently comprise financing for research, support for medical devices, and public health campaigns related to skin illness awareness. For instance, potentially one of the best examples is replacement national skin cancer prevention programs that document early detection from screening. These programs incentivize the use of advanced imaging technologies (for example, dermatoscopes and high-resolution imaging devices), allowing health care providers to diagnose skin conditions with more precision and efficiency. These initiatives also make certain that the medical community is prepared to use the newest imaging technologies by stimulating training and education of health care providers, improving patient care even more.

And if that's not enough, governments often give a hand to developing healthcare infrastructure in many underserved areas. Dermatology with telemedicine and remote diagnostics can allow patients to reach natural dermatological services, such as if they are in a blessed rural spot or somewhere further out of urban regions. Facilitating such rapid uptake is essential to early diagnosis and treatment, thereby benefiting patient outcomes considerably. Additionally, governments are also implementing policies to improve the quality of healthcare system and it will grow market by raising demand for innovative dermatology imaging devices. The introduction of imaging technologies into EHR systems enhances the capture and follow up of data on patients and their outcomes, leading to increased adoption by more healthcare facilities.

By implementing such supportive government policies and initiatives to reduce the impact of skin diseases, the overall dermatology imaging devices market will grow due to improved management of such diseases and increased access to dermatological services. They aid in the dissemination of better imaging technology and ultimately lead to improved health outcomes for patients with dermatologic disease.

Restraints

The initial investment and maintenance costs of advanced dermatology imaging devices can be prohibitive for smaller clinics and healthcare facilities.

Certain imaging devices may have limitations in accuracy and sensitivity, impacting their adoption in clinical settings.

There is a lack of trained dermatologists and technicians skilled in using advanced imaging technology, which can hinder effective implementation.

The dermatology imaging devices market encounters notable challenges due to a shortage of trained dermatologists and technicians skilled in advanced imaging technologies. As practices increasingly incorporate sophisticated tools such as high-resolution digital cameras, dermatoscopes, and confocal microscopes, the demand for qualified personnel intensifies. However, many healthcare facilities struggle to find professionals capable of effectively operating and interpreting the results generated by these complex devices. This skills gap stems from several issues, primarily the rapid pace of technological advancement that often outstrips the training programs available. Traditional dermatology education frequently does not cover the latest imaging techniques, leading to a workforce that is knowledgeable in fundamental dermatological practices but lacks the expertise needed for advanced imaging. According to a report from the American Academy of Dermatology, many residency programs are inadequate in preparing dermatologists for contemporary practices, including digital imaging and teledermatology.

Moreover, the lack of ongoing professional development opportunities in this domain exacerbates the issue. As imaging technology evolves, continuous education and training become essential for dermatologists and technicians to stay updated with best practices and new tools. Without adequate training programs, many practitioners may hesitate to adopt new technologies, fearing they lack the skills to utilize them effectively.

The consequences of this skills deficit are significant. It limits the successful integration of advanced imaging devices in clinical settings and jeopardizes the quality of patient care. Misuse of imaging technologies can lead to incorrect diagnoses, delayed treatments, and ultimately poorer patient outcomes. To address this training shortfall, enhancing educational offerings through specialized workshops and fostering collaborations with technology manufacturers is crucial. Such initiatives could lead to substantial improvements, benefiting both practitioners and patients in the dermatology imaging devices market. In conclusion, bridging the skills gap in dermatology imaging is vital for effectively incorporating advanced technologies into clinical practice. This focus is crucial for ensuring improved patient care and maximizing the benefits of innovative imaging solutions.

By Modality

In 2023, the dermatoscope segment led the market with a significant revenue share of 41.42%. These specialized instruments are essential in dermatology for examining the skin and detecting anomalies or changes in growth patterns. Dermatoscopes enhance visibility of the skin's surface, allowing for detailed assessments. Their non-invasive nature, painless functionality, and diagnostic precision in identifying skin conditions, along with their ease of use for monitoring skin lesions over time, have driven their widespread acceptance among healthcare professionals. They are instrumental in the early detection of skin cancer and other dermatological disorders. Key features such as polarized and non-polarized lighting options, adjustable magnification, and capabilities for capturing images for further analysis are expected to keep these devices at the forefront in the upcoming forecast period.

The digital photographic imaging segment is projected to achieve the fastest growth rate during the forecast period. This technology leverages digital cameras to capture and electronically store images, becoming indispensable for diagnosing and monitoring skin conditions globally. High-resolution digital cameras empower dermatologists to identify and track skin changes over time. Noteworthy products in this segment include MoleScope, FotoFinder, and Canfield VISIA. Additionally, the rise of total body photographic imaging systems, which capture high-resolution images of the entire body, is likely to boost market expansion. Prominent examples of such systems include VECTRA WB360, IntelliStudio, and DermaGraphix, created by Canfield Scientific, Inc. The DermaGraphix body mapping solution offers dermatologists a comprehensive view of a patient's skin condition through detailed, high-resolution imaging of the whole body.

By Application

In 2023, the skin cancers segment led the market with a notable revenue share of 48.63%, driven largely by the high incidence of skin cancers globally. In 2023, approximately 97,610 new cases of melanoma are expected to be diagnosed in the United States, making melanoma represent 5% of all new cancer diagnoses, This indicates a continued rise in the incidence of skin cancers, emphasizing the importance of early diagnosis and treatment. For instance, Derma Medical Systems' MoleMax HD system uses digital dermoscopy to capture high-resolution skin images, assisting dermatologists in detecting early signs of skin cancer. Similarly, the Vivascope 1500 from Caliber Imaging and Diagnosis employs confocal microscopy to produce cellular-level images, allowing for the identification of abnormal cells indicative of skin cancer.

The plastic and reconstructive surgery segment is expected to witness the highest CAGR in the upcoming forecast period. This growth is fueled by the rising adoption of minimally invasive surgical techniques and technological advancements in relevant devices. As cosmetic surgeries gain popularity, the necessity for precise imaging to achieve optimal surgical results is increasingly critical. Moreover, the launch of specialized products designed specifically for plastic and reconstructive procedures is likely to further enhance market growth in this segment throughout the forecast period.

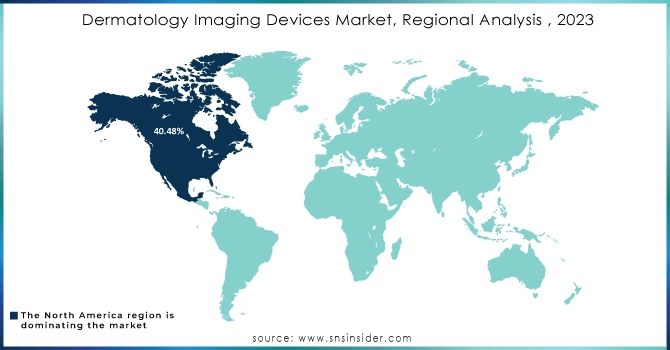

North America dominated the dermatology imaging devices market with a revenue share of 40.48% in 2023 The growth of the dermatoscopes market can be attributed to the factors such as growing prevalence of skin disorders and skin cancer, increasing awareness regarding early diagnosis and treatment along with high availability advanced technologies such as Dermatoscope products that enhance dermatologists diagnostic efficiency. Combined, these factors have led to a huge increase in demand for dermatology imaging devices throughout the region.

The dermatology imaging devices market in Asia Pacific is expected to record the highest compound annual growth rate (CAGR) of 13.97% during 2024–2032. The growth is mainly due to the increasing prevalence of skin diseases and rising awareness regarding skincare coupled with technological advancements in dermatological imaging. Moreover, the increasing disposable income of consumers in this region is anticipated to fuel the demand for these devices. Furthermore, the booming medical tourism sector in this region, especially in India, Singapore and Thailand is expected to offer lucrative growth opportunities to the market players over the forecast period. Market dynamics supporting growth of dermatology imaging devices in China are driven by technological breakthroughs and enhancement traditional healthcare infrastructure as well. The continuous advancements in imaging systems, combined with increasing healthcare costs have enabled easier investigational dermatology services to patients. Additionally, a burgeoning middle class and an increasing awareness of skin health will fuel demand for these services.

Japan dermatology imaging devices market is anticipated to grow with the fastest CAGR throughout the forecast period, owing to factors such as rise in geriatric population, rise in skin diseases coupled with technological advancement. Along with rising awareness for skin cancer, the minimised diagnostic need is further fuelling the demand for non-invasive diagnostics. The market is also being aided by government healthcare policies to support these products and an increase in dermatology clinics and hospitals.

Need Any Customization Research On Dermatology Imaging Devices Market - Inquiry Now

The major key players are

Dermatology Medical Systems - MoleMax HD

Caliber Imaging and Diagnosis - Vivascope 1500

Canfield Scientific, Inc. - Canfield VISIA

FotoFinder Systems GmbH - FotoFinder ATBM (Advanced Total Body Mapping)

Heine Optotechnik GmbH - Heine Delta 20 Dermatoscope

DermoScan - DermoScan C-20

3Derm Systems, Inc. - 3Derm Imaging System

Brigham and Women's Hospital - Brigham Dermatology Imaging System

Genesis Medical Imaging - Genesis Medical Imaging Solutions

MoleScope (by MelaFind) - MelaFind Imaging Device

Nikon Corporation - Nikon Digital Dermatoscope

MedX Health Corp. - DermSecure

Stratasys Ltd. - Stratasys 3D Printing for Medical Applications

Hologic, Inc. - AquaScan Ultrasound Imaging System

Olympus Corporation - Olympus Evis Exera III

Siemens Healthineers - Acuson Sequoia Ultrasound System

GE Healthcare - LOGIQ E10 Ultrasound System

Thermo Fisher Scientific - Thermo Scientific Apreo

Canon Medical Systems - Aplio i-series Ultrasound System

Ricoh Company, Ltd. - Ricoh IM C Series Multifunction Printers

OEMs

Germitec

Zeiss

Schneider Kreuznach

Leica Microsystems

Schott AG

Fujifilm

Keyence

Medtronic

Panasonic

Hoya Corporation

Canon Inc.

Ametek

BASF

Covalent Materials Corporation

Nikon Corporation

Rohde & Schwarz

Honeywell

Merck Group

Nippon Electric Glass Co.

Fujifilm

In February 2024, GE HealthCare and the European Society of Radiology (ESR) renewed their collaboration for the upcoming European Congress of Radiology (ECR), which will take place from February 28 to March 3 in Vienna, focusing on the theme "Next Generation Radiology."

In January 2024, GE HealthCare revealed its acquisition of MIM Software, a leading provider of AI-powered solutions for medical imaging analysis. MIM Software is known for its expertise in radiation oncology, molecular radiotherapy, diagnostic imaging, and urology across various healthcare environments. GE HealthCare plans to utilize MIM Software's cutting-edge imaging analytics and digital workflows to enhance innovation and patient care in multiple healthcare sectors worldwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.36 Billion |

| Market Size by 2032 | USD 7.04 Billion |

| CAGR | CAGR of 12.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (Digital Photographic Imaging, Optical Coherence Tomography (OCT), Dermatoscope, High Frequency Ultrasound, Others) • By Application (Skin Cancers, Plastic and Reconstructive Surgery, Others) • By End-Use (Hospitals, Dermatology Centers, Specialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dermatology Medical Systems, Caliber Imaging and Diagnosis, Canfield Scientific, Inc., FotoFinder Systems GmbH, Heine Optotechnik GmbH, DermoScan, 3Derm Systems, Inc., Brigham and Women's Hospital, Genesis Medical Imaging, MoleScope (by MelaFind), Nikon Corporation |

| Key Drivers | • Public awareness campaigns about skin health and the importance of early detection are encouraging more individuals to seek dermatological care. • Enhancements and services in both developed and developing regions are improving access to advanced dermatology imaging technologies. |

| RESTRAINTS | • The initial investment and maintenance costs of advanced dermatology imaging devices can be prohibitive for smaller clinics and healthcare facilities. • Certain imaging devices may have limitations in accuracy and sensitivity, impacting their adoption in clinical settings. |

Ans: Dermatology Imaging Devices Market was valued at USD 2.36 billion in 2023 and is expected to reach USD 7.04 Billion by 2032, growing at a CAGR of 12.93% from 2024-2032.

Ans: the CAGR of Dermatology Imaging Devices Market during the forecast period is of 12.93% from 2024-2032.

Ans: In 2023, North America dominated the global market, securing the largest share of 40.48% of total revenue

Ans: one main growth factor for the Dermatology Imaging Devices Market is

Ans- Challenges in Dermatology Imaging Devices Market

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Dermatology Imaging Device Market Segmentation, By Modality

7.1 Chapter Overview

7.2 Digital Photographic Imaging

7.2.1 Digital Photographic Imaging Market Trends Analysis (2020-2032)

7.2.2 Digital Photographic Imaging Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Optical Coherence Tomography (OCT)

7.3.1 Optical Coherence Tomography (OCT) Market Trends Analysis (2020-2032)

7.3.2 Optical Coherence Tomography (OCT) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Dermatoscope

7.4.1 Dermatoscope Market Trends Analysis (2020-2032)

7.4.2 Dermatoscope Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 High Frequency Ultrasound

7.5.1 High Frequency Ultrasound Market Trends Analysis (2020-2032)

7.5.2 High Frequency Ultrasound Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Dermatology Imaging Device Market Segmentation, by End-Use

8.1 Chapter Overview

8.2 Hospitals

8.2.1 Hospitals Market Trends Analysis (2020-2032)

8.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Dermatology Centers

8.3.1 Dermatology Centers Market Trends Analysis (2020-2032)

8.3.2 Dermatology Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4Specialty Clinics

8.4.1Specialty Clinics Market Trends Analysis (2020-2032)

8.4.2Specialty Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Dermatology Imaging Device Market Segmentation, by Application

9.1 Chapter Overview

9.2 Skin Cancers

9.2.1 Skin Cancers Market Trends Analysis (2020-2032)

9.2.2 Skin Cancers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Inflammatory Dermatoses

9.3.1 Inflammatory Dermatoses Market Trends Analysis (2020-2032)

9.3.2 Inflammatory Dermatoses Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.3 Skin psoriasis

9.3.3.1 Skin psoriasis Market Trends Analysis (2020-2032)

9.3.3.2 Skin psoriasis Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.4 Eczema (Atopic dermatitis)

9.3.4.1 Eczema (Atopic dermatitis) Market Trends Analysis (2020-2032)

9.3.4.2 Eczema (Atopic dermatitis) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.5 Others

9.3.5.1 Others Market Trends Analysis (2020-2032)

9.3.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Plastic and Reconstructive Surgery

9.4.1 Plastic and Reconstructive Surgery Market Trends Analysis (2020-2032)

9.4.2 Plastic and Reconstructive Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Dermatology Imaging Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.2.4 North America Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.2.5 North America Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.2.6.2 USA Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.2.6.3 USA Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.2.7.2 Canada Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.2.7.3 Canada Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.2.8.2 Mexico Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.2.8.3 Mexico Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Dermatology Imaging Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.1.6.2 Poland Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.6.3 Poland Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.1.7.2 Romania Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.7.3 Romania Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Dermatology Imaging Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.4 Western Europe Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.5 Western Europe Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.6.2 Germany Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.6.3 Germany Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.7.2 France Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.7.3 France Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.8.2 UK Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.8.3 UK Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.9.2 Italy Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.9.3 Italy Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.10.2 Spain Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.10.3 Spain Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.13.2 Austria Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.13.3 Austria Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Dermatology Imaging Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.4 Asia Pacific Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.5 Asia Pacific Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.6.2 China Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.6.3 China Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.7.2 India Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.7.3 India Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.8.2 Japan Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.8.3 Japan Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.9.2 South Korea Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.9.3 South Korea Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.10.2 Vietnam Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.10.3 Vietnam Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.11.2 Singapore Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.11.3 Singapore Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.12.2 Australia Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.12.3 Australia Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Dermatology Imaging Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.1.4 Middle East Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.5 Middle East Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.1.6.2 UAE Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.6.3 UAE Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Dermatology Imaging Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.2.4 Africa Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2.5 Africa Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Dermatology Imaging Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.6.4 Latin America Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.5 Latin America Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.6.6.2 Brazil Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.6.3 Brazil Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.6.7.2 Argentina Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.7.3 Argentina Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.6.8.2 Colombia Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.8.3 Colombia Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Dermatology Imaging Device Market Estimates and Forecasts, Modality (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Dermatology Imaging Device Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Dermatology Imaging Device Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Dermatology Medical Systems

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Caliber Imaging and Diagnosis

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Canfield Scientific, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 FotoFinder Systems GmbH

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Heine Optotechnik GmbH

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 DermoScan

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Derm Systems, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Brigham and Women's Hospital

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Genesis Medical Imaging

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 MoleScope (by MelaFind)

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Modality

Digital Photographic Imaging

Optical Coherence Tomography (OCT)

Dermatoscope

High Frequency Ultrasound

Others

By Application

Skin Cancers

Inflammatory Dermatoses

Skin psoriasis

Eczema (Atopic dermatitis)

Others

Plastic and Reconstructive Surgery

Others

By End-Use

Hospitals

Dermatology Centers

Specialty Clinics

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Research-grade Proteins Market was valued at USD 827.94 million in 2023 and is expected to reach USD 2647.51 million by 2032, growing at a CAGR of 13.60% from 2024-2032.

The global Polyclonal Antibodies Market, valued at USD 1.52 Billion in 2023, is projected to reach USD 2.39 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.36% during the forecast period.

The Home Infusion Therapy Market Size was valued at USD 35.98 Billion in 2023 and is expected to reach USD 71.82 Billion by 2032 and grow at a CAGR of 8.36% over the forecast period 2024-2032

The Single-Use Bioreactors Market Size was valued at USD 3872.40 million in 2023 and is expected to reach USD 13784.83 million by 2031 and grow at a CAGR of 17.2% over the forecast period 2024-2031.

The Smart Fertility Tracker Market was valued at USD 0.17 billion in 2023, and is expected to reach USD 0.42 billion by 2032, and grow at a CAGR of 10.59% over the forecast period 2024-2032.

The Hospital Capacity Management Solutions Market Size was valued at USD 4.17 billion in 2023 and expected to reach USD 14.85 billion by 2031 and grow at a CAGR of 17.2% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone