Dentures Market Report Scope & Overview:

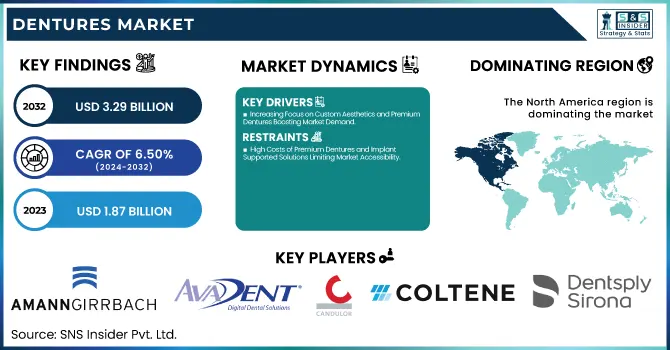

The Dentures Market Size was valued at USD 1.87 Billion in 2023 and is expected to reach USD 3.29 Billion by 2032, growing at a CAGR of 6.50% over the forecast period of 2024-2032.

Get More Information on Dentures Market - Request Sample Report

The Dentures Market is evolving with technological advancements, rising geriatric populations, and growing aesthetic dental needs. Our report provides an in-depth cost structure breakdown for dentures, covering raw material expenses, production costs, and pricing strategies. With strict regulatory standards and compliance requirements, manufacturers must adhere to safety, quality, and reimbursement guidelines. Ongoing clinical trials and research developments focus on improving denture durability, biocompatibility, and patient comfort. Additionally, innovations in denture adhesives and fixatives are enhancing stability and wearability, elevating user experience. As cutting-edge materials and digital manufacturing techniques reshape the industry, our analysis offers exclusive insights into key trends, competitive strategies, and growth opportunities, making it essential for stakeholders navigating this dynamic market.

The US Dentures Market Size was valued at USD 0.52 Billion in 2023 and is expected to reach USD 0.86 Billion by 2032, growing at a CAGR of 5.84% over the forecast period of 2024-2032.

The U.S. Dentures Market is experiencing steady growth, driven by an aging population, increasing prevalence of edentulism, and advancements in dental prosthetics. Organizations like the American College of Prosthodontists (ACP) report that over 36 million Americans are edentulous, fueling demand for high-quality dentures. Technological innovations, such as 3D-printed dentures by companies like Dentsply Sirona and Glidewell Dental, are revolutionizing production, improving customization and affordability. Additionally, government initiatives like Medicare Advantage dental coverage are expanding accessibility. With rising consumer preference for aesthetic and comfortable solutions, alongside evolving material innovations, the market is poised for sustained expansion in the coming years.

Market Dynamics

Drivers

-

Increasing Focus on Custom Aesthetics and Premium Dentures Boosting Market Demand

The demand for high-quality, customized dentures is increasing as patients seek aesthetic and natural-looking prosthetics. Traditional dentures often have a uniform appearance and fit, leading to discomfort and dissatisfaction. However, advancements in high-performance materials such as multi-layered acrylics, zirconia, and nanocomposites are enabling manufacturers to create realistic, lifelike dentures. Companies such as Ivoclar Vivadent and VITA Zahnfabrik offer high-end denture teeth that mimic the natural shade and texture of enamel. The adoption of digital smile design (DSD) software allows patients to preview their dentures before final production, increasing satisfaction rates. The rising influence of cosmetic dentistry and social media trends is also pushing consumers toward personalized, premium dentures. Clinics like DDS Dentures + Implant Solutions offer tailored denture services, including shade-matching consultations and gum contour customization. Additionally, middle-aged and elderly consumers are opting for luxury denture solutions to maintain their facial aesthetics. As innovation in custom denture fabrication progresses, the market is witnessing an increased shift toward premium, patient-specific dental prosthetics, further driving its growth.

Restraints

-

High Costs of Premium Dentures and Implant-Supported Solutions Limiting Market Accessibility

The high costs of premium dentures and implant-supported solutions present a significant restraint, restricting accessibility for a large segment of the population. While basic acrylic dentures are relatively affordable, advanced implant-supported dentures and digitally designed prosthetics come at a premium price. In the United States, implant-supported dentures cost between $5,000 and $25,000 per arch, making them financially unfeasible for many individuals, particularly those without comprehensive dental insurance. Despite the availability of payment plans and financing options, many patients hesitate due to high out-of-pocket expenses and limited insurance coverage. Additionally, customized digital dentures, created using CAD/CAM technology and 3D printing, involve higher material and equipment costs, leading to elevated final prices for consumers. Dental clinics and laboratories also incur training and operational expenses when transitioning to advanced manufacturing techniques, further driving up costs. These financial barriers limit the adoption of superior denture solutions, pushing many patients toward cheaper, less durable alternatives. Addressing this restraint requires more affordable manufacturing processes, increased insurance coverage, and cost-effective material innovations to ensure broader accessibility and market growth.

Opportunities

-

Integration of Artificial Intelligence in Denture Design and Manufacturing Driving Market Innovation

The adoption of artificial intelligence (AI) in denture design and manufacturing is transforming the dentures market, enabling greater precision, efficiency, and customization. Traditional denture production involves manual craftsmanship and multiple patient visits, leading to long turnaround times and inconsistencies in fit. However, AI-driven CAD/CAM technology optimizes denture design by analyzing patient data, predicting fit adjustments, and minimizing human error. Companies such as 3Shape and Exocad are leveraging machine learning algorithms to enhance automated digital modeling and prosthetic adaptation, ensuring better comfort and functionality. Additionally, AI-powered 3D printing and milling systems streamline mass production while maintaining high accuracy, reducing overall production costs. Dental clinics are adopting AI-based intraoral scanning to create precise digital impressions, eliminating the need for physical molds and improving patient experience. With advancements in AI-powered material selection, denture manufacturers can develop stronger, more biocompatible, and aesthetically superior prosthetics. As AI technology evolves, its role in personalized denture fabrication, predictive maintenance, and workflow automation is expected to redefine the dentures market landscape, driving both efficiency and innovation.

Challenge

-

Lack of Skilled Dental Technicians and Denture Specialists Hindering Market Growth

The dentures market is facing a shortage of skilled dental technicians and denture specialists, which is negatively impacting the quality, production capacity, and adoption of advanced denture solutions. Traditional denture fabrication requires highly trained professionals who specialize in prosthetic design, material handling, and fitting adjustments. However, as the industry shifts toward digital workflows, CAD/CAM manufacturing, and 3D printing, there is an increasing demand for technicians proficient in AI-based modeling, digital impression scanning, and computer-aided manufacturing. Unfortunately, training programs for digital dental technology remain limited, leading to a gap between market demand and skilled workforce availability. Many dental laboratories struggle to hire qualified personnel, resulting in delays in production, inconsistent product quality, and increased operational costs. Additionally, the aging workforce in traditional denture craftsmanship is leading to a decline in experienced professionals, further straining the industry. Addressing this challenge requires expanded educational programs, training initiatives, and workforce development efforts to ensure that the next generation of dental professionals can meet the evolving demands of the modern dentures market.

Segmental Analysis

By Type

Complete dentures dominated the dentures market in 2023, holding a 64.5% market share. The rising prevalence of complete tooth loss among the elderly is a key factor driving this dominance. According to the American College of Prosthodontists (ACP), approximately 36 million Americans are completely edentulous, and 90% of them use dentures. Complete dentures are preferred due to their cost-effectiveness, ease of fabrication, and ability to restore full dental function. Technological advancements, such as implant-supported complete dentures, have improved stability and comfort, making them a more viable option for patients seeking long-term solutions. Additionally, Medicare Advantage plans and state-level Medicaid expansions have increased coverage for prosthetic dental solutions, making complete dentures more accessible. The National Institute of Dental and Craniofacial Research (NIDCR) supports research on improving denture durability and fit, further driving market growth. Moreover, a growing awareness of oral health’s impact on overall well-being has encouraged more seniors to seek dentures for better nutrition, speech improvement, and facial structure retention, reinforcing the dominance of complete dentures in the market.

By Material

Acrylic dentures dominated the dentures market in 2023, accounting for 48.2% of the market share. Acrylic remains the preferred material due to its affordability, ease of modification, and lightweight properties compared to alternatives like metal and porcelain. According to the American Dental Association (ADA), acrylic dentures are the most widely used due to their better adaptability and ease of relining, making them suitable for long-term use. Additionally, the rise of digital denture manufacturing technologies has enhanced the production of high-quality acrylic prosthetics with improved fit, comfort, and durability. In 2023, the Centers for Medicare & Medicaid Services (CMS) expanded coverage for removable acrylic dentures, further supporting market growth. Acrylic-based dentures also offer aesthetic advantages, as they can be easily tinted to match natural gum color, providing a more realistic appearance. Leading dental laboratories in the U.S. have been investing in advanced polymer materials to make acrylic dentures more resistant to wear and staining, ensuring their continued preference among both patients and dental professionals.

By Usage

Removable dentures dominated the dentures market in 2023, capturing 71.3% of the market share. The affordability, ease of maintenance, and non-invasive fitting process make removable dentures the preferred option for both complete and partial tooth loss. According to the American College of Prosthodontists (ACP), removable dentures are widely recommended for older adults and low-income patients, as they provide a functional solution without requiring surgical intervention like fixed dentures. The growing adoption of 3D printing and CAD/CAM technologies has also made removable dentures more customizable and comfortable. In 2023, the Centers for Medicare & Medicaid Services (CMS) introduced expanded coverage for removable dentures, particularly for senior citizens, further driving demand. Moreover, educational programs by organizations like the National Institute on Aging (NIA) emphasize the importance of dentures in improving nutrition, speech clarity, and self-confidence, reinforcing their necessity. Advancements in denture adhesives and soft liners have also enhanced removable dentures’ stability and comfort, making them a dominant choice in the market.

By End-use

Dental clinics dominated the dentures market in 2023, holding a 58.6% market share. The dominance of dental clinics is driven by the growing demand for personalized denture fittings, accessibility, and faster treatment turnaround times. According to the American Dental Association (ADA), there are over 201,000 licensed dentists in the U.S., with a significant number specializing in prosthetic dentistry. Unlike large hospitals, private dental clinics provide customized consultations, better patient-dentist interaction, and quicker adjustments, making them the preferred choice for many patients. The integration of digital denture fabrication technologies, including intraoral scanning and 3D printing, has further enhanced the efficiency and accuracy of denture production. Additionally, many clinics partner with insurance providers and government healthcare programs to offer cost-effective denture solutions, increasing accessibility for a broader population. The rise of direct-to-consumer denture solutions and same-day denture services has also contributed to the expansion of the dental clinic segment. With continuous innovation in denture materials and fitting techniques, dental clinics are expected to maintain their leadership in the market.

Regional Analysis

North America dominated the dentures market in 2023, holding a market share of 37.2%. The region's dominance is attributed to the high prevalence of edentulism, growing geriatric population, technological advancements, and increased healthcare expenditure. According to the Centers for Disease Control and Prevention (CDC), nearly one in six U.S. adults aged 65 and older have lost all their teeth, driving demand for dentures. The American Dental Association (ADA) highlights the rapid adoption of digital dentures, CAD/CAM technology, and 3D printing, making denture production more precise and accessible. Government initiatives, such as the Medicare Advantage expansion, have increased coverage for dentures, further propelling market growth. Among North American countries, the United States leads the market, fueled by a well-established dental care infrastructure, private insurance plans, and investments in prosthodontic research. The U.S. prosthetic dentistry market was valued at over USD 4 billion in 2023, showcasing its stronghold in the industry. Canada is the second-largest market, growing due to expanding dental insurance coverage and increasing awareness programs by the Canadian Dental Association (CDA). Meanwhile, Mexico is experiencing significant growth as a hub for dental tourism, attracting patients from the U.S. seeking affordable denture solutions. The presence of leading denture manufacturers and dental laboratories in the region further supports North America’s dominant position in the global dentures market.

However, Asia Pacific emerged as the fastest-growing region in the dentures market with a significant CAGR in the forecast period of 2024 to 2032. The rapid expansion is fueled by the aging population, rising disposable income, increased awareness about oral health, and government-led healthcare reforms. According to the World Health Organization (WHO), edentulism rates are increasing in developing economies such as China and India due to poor oral hygiene, higher sugar consumption, and tobacco use. China leads the market, accounting for a significant share due to strong domestic denture manufacturing, increasing geriatric population, and government-backed dental care programs. The China National Health Commission (NHC) has launched initiatives to improve oral healthcare services for seniors, further supporting market growth. India follows as a high-potential market, where the Indian Dental Association (IDA) reports that over 30% of adults above 60 suffer from partial or complete tooth loss, driving demand for cost-effective denture solutions. Japan, known for its advanced dental technology, is witnessing growth due to robotic-assisted denture production and AI-powered dental care solutions. Additionally, dental tourism in Thailand and South Korea has surged, attracting international patients seeking affordable, high-quality dentures. Increasing foreign investments in digital dentistry and material innovation further accelerate Asia Pacific’s growth in the dentures market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Amann Girrbach AG (Ceramill FDS, Ceramill Motion 2)

-

AvaDent Digital Dental Solutions (Global Dental Science, LLC) (AvaDent Digital Dentures, AvaDent XCL)

-

Candulor AG (PhysioStar NFC+, Condyloform NFC+)

-

COLTENE Holding AG (Acryline Denture Base, Affinis Precious Denture Impression Material)

-

Dentsply Sirona Inc. (Lucitone 199, Lucitone Digital Print Denture)

-

DenMat Holdings, LLC (Snap-On Smile, LumiSmile Dentures)

-

Glidewell Laboratories (BruxZir Esthetic Removables, Simply Natural Dentures)

-

GC Corporation (GC Aadva Denture, Gradia Gum)

-

Heraeus Kulzer GmbH (Mitsui Chemicals Inc.) (Pala Digital Dentures, PalaXpress Ultra)

-

Huge Dental (HUGE PMMA Denture Base, HUGE Heat Cure Denture Acrylic)

-

Ivoclar Vivadent AG (Ivotion Denture System, SR Ivocap)

-

Kulzer GmbH (Mitsui Chemicals Inc.) (Pala Premium Teeth, Pala Mondial Denture Teeth)

-

Merz Dental GmbH (Artic Digital Denture, Merz Dental Lingualized Occlusion)

-

Modern Dental Group Limited (Acry-Tone Dentures, Mondial Teeth)

-

New Stetic S.A. (New Stetic Acropars Denture Base, Vitapan Teeth)

-

SHOFU Inc. (Veracia SA Denture Teeth, SHOFU HC Acrylic Resin)

-

SHERA Werkstoff-Technologie GmbH (SHERAeco Denture, SHERAPOR Acrylics)

-

VITA Zahnfabrik H. Rauter GmbH & Co. KG (VITA Vionic Dentures, VITA Physiodens)

-

Yamahachi Dental MFG., Co. (New Ace Denture Teeth, Yamahachi PMMA Denture Base)

-

Protech Dental Laboratory (Protech Full Dentures, Protech Partial Dentures)

Recent Developments

-

February 2025: Carbon introduced FP3D Resin, a flexible 3D printing material for removable dentures, enhancing comfort, durability, and fit. The innovation aimed to improve digital denture manufacturing, offering high-impact strength and stain resistance. Experts viewed it as a major advancement in dental prosthetics.

-

February 2025: Aspen Dental and Ivoclar introduced Signature Elite Dentures, featuring advanced materials for enhanced durability, aesthetics, and comfort. The launch set a new standard in premium dentures, catering to rising consumer demand and expanding Aspen Dental’s offerings nationwide.

-

January 2025: Stratasys launched TrueDent in Europe, offering monolithic 3D-printed dentures with enhanced precision and efficiency. The technology streamlined denture production, reducing fabrication time and improving fit accuracy, marking a major shift in the European dental market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.87 Billion |

| Market Size by 2032 | USD 3.29 Billion |

| CAGR | CAGR of 6.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Complete, Partial) •By Material (Acrylic, Metal, Porcelain, Others) •By Usage (Removable, Fixed) •By End-use (Dental Clinics, Dental Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dentsply Sirona Inc., Ivoclar Vivadent AG, Modern Dental Group Limited, Mitsui Chemicals Inc. (Kulzer GmbH), VITA Zahnfabrik H. Rauter GmbH & Co. KG, Amann Girrbach AG, GC Corporation, SHOFU Inc., COLTENE Holding AG, AvaDent Digital Dental Solutions (Global Dental Science, LLC) and other key players |