Dental Sterilization Market Overview:

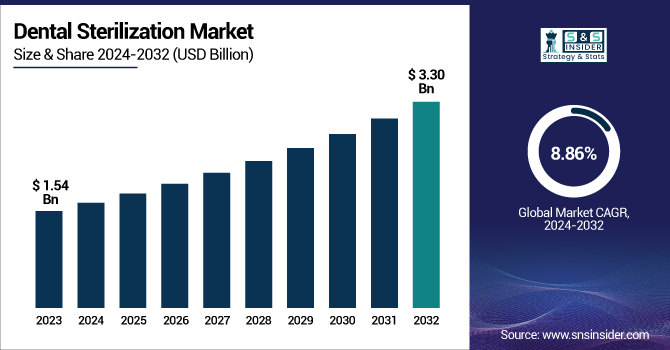

The Dental Sterilization Market was valued at USD 1.54 billion in 2023 and is expected to reach USD 3.30 billion by 2032, growing at a CAGR of 8.86% over the forecast period of 2024-2032.

To Get more information on Dental Sterilization Market - Request Free Sample Report

This report highlights the increasing frequency of dental procedures that require sterilization, thereby driving up demand for advanced infection control solutions. The study looks at installed base and procurement trends of sterilization equipment, as well as the growing adoption of automated systems to improve workflow efficiency and compliance. It also assesses regional compliance with infection control guidelines, which significantly influences equipment usage and standardization across practices. Healthcare expenditure on dental facilities—categorized by government, private, and out-of-pocket sources—is also examined to comprehend funding trends that affect market growth. The report also covers average replacement cycles for equipment and maintenance expenses, both of which affect purchase decisions and long-term clinic budgeting. Automation of sterilization solutions also highlights the market's move toward precision, safety, and operational efficiency.

U.S. Dental Sterilization Market Size & Trends:

The U.S. Dental Sterilization Market was valued at USD 0.44 billion in 2023 and is expected to reach USD 0.90 billion by 2032, growing at a CAGR of 8.23% over the forecast period of 2024-2032. In the United States, the dental sterilization industry is increasing progressively as a result of strict infection control regulations, high levels of dental procedures, and growing investments in updating dental facilities in both private and government sectors.

Dental Sterilization Market Dynamics

Drivers

-

The rising demand for infection control and safety protocols in dental practices is propelling market growth.

The increased focus on infection control and prevention among dental practices remains the primary motive behind the market for dental sterilization. Growing awareness of risks involved in transmitting diseases, particularly in the post-COVID-19 era, has prompted regulation authorities such as the CDC, OSHA, and WHO to standardize sterilization processes to the extent of making them compulsory within dental practices. This has resulted in an upsurge in the need for high-efficiency sterilization devices like autoclaves, ultrasonic cleaners, and dry-heat sterilizers. The American Dental Association (ADA) states that more than 85% of dental practices in the U.S. implemented sophisticated sterilization procedures in 2023, up from 68% in 2018. In addition, the growth in dental treatments—fueled by growing cosmetic dentistry, orthodontics, and implant procedures—has boosted the number of equipment sterilizations. This has a direct relationship with increased equipment utilization and replacement. Moreover, the increasing number of dental professionals worldwide, along with tighter audits and infection control checks, is pushing clinics towards spending on high-end, automated sterilization systems. Technological improvements that enable quicker, safer, and more energy-efficient sterilization cycles are also driving the market as clinics look for solutions that provide high throughput at low downtime.

Restraints

-

High initial costs and maintenance expenses of dental sterilization equipment hinder adoption, especially in smaller setups.

Despite the urgent necessity for sterilization, the excessive capital outlay for sophisticated dental sterilization units is a principal market deterrent. Autoclaves and Class B sterilizers, though favored due to their efficacy, can run between USD 3,000 and USD 10,000 per unit. For small, new, or small-scale dental clinics, particularly in low- to middle-income countries, this economic barrier most often results in delayed or curtailed use. Further, the recurring operation and maintenance charges—like occasional calibration, repair work, and compliance testing—contribute to the cost of ownership. Such systems also demand trained staff for their operation and maintenance, increasing labor and training expenses. In developing markets, the absence of subsidies or state support further suppresses the readiness of practitioners to invest in up-to-date sterilization equipment. Furthermore, the likelihood of equipment becoming outdated because of speedy technology change and changing regulations inhibits long-term investment in costly sterilization equipment. Therefore, a high percentage of small clinics may keep on depending upon obsolete or sub-optimal methods of sterilization, reducing aggregate market penetration due to increasing consciousness.

Opportunities

-

Technological innovation and digital integration in sterilization solutions present strong growth potential.

The dental sterilization industry is seeing huge opportunity through the adoption of automation, IoT (Internet of Things), and digital monitoring systems. Advanced dental practices are now increasingly implementing smart sterilization solutions that give real-time data, cycle validation, automated reporting, and remote diagnostics. For instance, products such as Midmark's M11 Steam Sterilizer now include features like touchscreen operation, pre-programmed cycles, and Wi-Fi connectivity, improving user efficiency and compliance tracking. These technologies are most appealing to group dental practices and DSOs (Dental Support Organizations) that work on scalable and standardized models. Furthermore, there's a growing demand for small and compact sterilization units specific to small to mid-size dental operations or mobile dentistry clinics. This product diversification broadens the market base. Government-supported dental health programs and rising dental tourism in India, Mexico, and Turkey are also creating new market opportunities for sterilization product makers. Also, growing green awareness is forcing the creation of environmentally friendly sterilization solutions with lower water and energy usage—a new niche area that companies can capitalize on. Strategic collaborations, product innovation, and regulation assistance provide companies an opportunity to expand into new markets and cover unmet sterilization requirements with an efficient means.

Challenges

-

Ensuring compliance with evolving international sterilization standards poses a persistent challenge.

One of the biggest challenges for manufacturers and end users of the dental sterilization market is remaining in sync with changing global regulatory requirements and compliance mandates. Organizations like the CDC, FDA, OSHA, and EU MDR continually revise sterilization and infection control guidelines, requiring constant revision or revision of equipment design and practice management. For example, the EU's Medical Device Regulation (MDR), which came into effect in 2021, included stricter performance verification and traceability standards for sterilization equipment. This heightened the regulatory burden on manufacturers to gain approval and retain extensive compliance records. For dental clinics, particularly non-metropolitan or small clinics, complying with intricate sterilization protocols, cycle validation, and record-keeping can be daunting. Non-compliance not only threatens fines but also compromises patient safety and clinic standing. Additionally, worldwide disparity in standard enforcement causes uneven adoption—industrialized nations may strictly follow standards, while developing nations may have issues with enforcement and education. The absence of standard training and education in sterilization best practices further complicates the issue. Therefore, synchronizing equipment functionality with existing and impending regulatory requirements—while remaining accessible and within budgets—remains a difficult challenge for the sector.

Dental Sterilization Market Segmentation Analysis

By Product

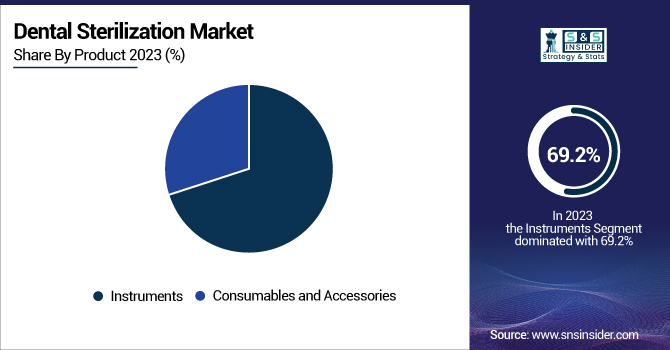

In 2023, the instruments segment led the dental sterilization market with the highest revenue share of 69.2%. This is due to the extensive application of high-cost sterilization equipment, including autoclaves, sterilizers, and ultrasonic cleaners in dental practices for infection control and regulatory purposes. The growing emphasis on proper sterilization procedures and growing procedural volumes in dental clinics also contributed to the segment's dominance.

The accessories and consumables segment will likely be the most rapidly growing category. Single-use product surge, heightened demand for sterilization wraps, pouches, and indicator strips, as well as escalating awareness regarding the risk of cross-contamination, are driving the segment's swift growth across dental environments.

By End Use

Among the end users, dental clinics commanded the market in 2023 with a commanding revenue share of 64.9%. This dominance is mostly because of the large patient turnout in private dental clinics, the frequent requirement of sterilization in between procedures, and the extensive use of advanced sterilizing systems to comply with regulatory requirements.

The hospital segment is expected to record strong growth during the forecast period due to the rising number of dental departments in hospitals as well as expanding investments in hospital-based dental care infrastructure. The dental clinics, however, are also expected to grow at the highest rate helped by the expansion of dental practice networks at a fast pace as well as improving demand for dental procedures in outpatients.

Dental Sterilization Market Regional Outlook

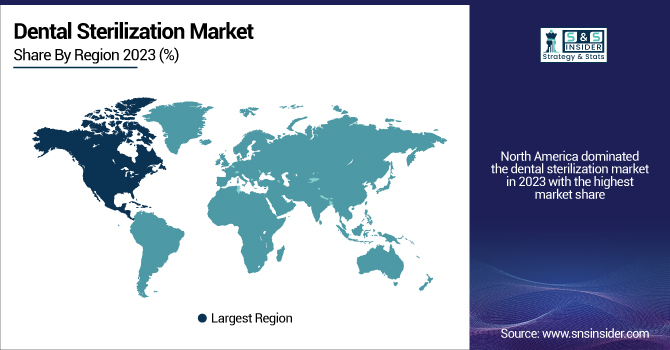

North America dominated the dental sterilization market in 2023 with the highest market share, driven by a well-established dental care infrastructure, high patient volumes, and strict regulatory adherence mandated by organizations such as the CDC and OSHA. Technologically advanced clinics and a high penetration rate of high-end sterilization equipment drive consistent market leadership. The U.S. also experiences robust demand for effective sterilization systems owing to the growing number of complex dental procedures.

Simultaneously, Europe is witnessing tremendous growth, driven by strong public health measures, mounting awareness of oral health, and strict EU-wide sterilization protocols under MDR. Germany, the UK, and France are embracing state-of-the-art sterilization technologies in both public and private dental clinics. There is also a growing demand for cosmetic dentistry and cross-border healthcare services, fuelling regional market growth.

Asia Pacific is expected to be the fastest-growing region, fueled by increasing access to dental care, increased awareness of infection control, and a burgeoning population of dental practitioners in nations like China, India, and South Korea. The region is also being helped by increasing dental tourism and rising government investments in healthcare infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Leading Players in the Dental Sterilization Market

-

Hu-Friedy Mfg. Co., LLC – IMS Cassette System, Ultrasonic Cleaner, Sterilization Wraps

-

Dentsply Sirona – DAC Universal, DAC Professional, Intego Sterilization Center

-

Midmark Corporation – M11 Steam Sterilizer, M9 Sterilizer, Sterilizer Data Logger

-

MATACHANA – S100 Series Sterilizers, 21E Series Steam Sterilizers

-

W&H Dentalwerk – Lisa Sterilizer, Lara Sterilizer, Lexa Plus Sterilizer

-

Nakanishi Inc. – iClave mini, iClave plus

-

SciCan Ltd. – STATIM Cassette Autoclave, BRAVO Chamber Autoclave

-

Getinge – Quadro Sterilizer, GSS67H Steam Sterilizer

-

Tuttnauer U.S.A. Co., Ltd. – EZ9Plus, T-Edge Autoclave, 3870EA Autoclave

-

Mocom (part of Cefla Group) – B Classic Autoclave, B Futura Autoclave, Millennium B+

Recent Developments in the Dental Sterilization Market

-

In Feb 2024, Kerr Dental introduced its new SimpliCut line of pre-sterilized, single-patient use diamond burs. This launch aims to enhance clinical efficiency by eliminating the need for post-use cleaning and sterilization processes.

-

In November 2023, W&H expanded its hygiene portfolio in North America with the launch of the Lexa Plus Class B sterilizer and the Assistina One maintenance device. These innovations enhance infection prevention, offering faster sterilization cycles, improved traceability, and the fastest handpiece maintenance in its class.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.54 billion |

| Market Size by 2032 | USD 3.30 billion |

| CAGR | CAGR of 8.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Instruments, Consumables, and Accessories] • By End Use [Hospitals, Dental Clinics, Dental Laboratories] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hu-Friedy Mfg. Co., LLC, Dentsply Sirona, Midmark Corporation, MATACHANA, W&H Dentalwerk, Nakanishi Inc., SciCan Ltd., Getinge, Tuttnauer U.S.A. Co., Ltd., Mocom (part of Cefla Group). |