Get More Information on Dental regeneration Market - Request Sample Report

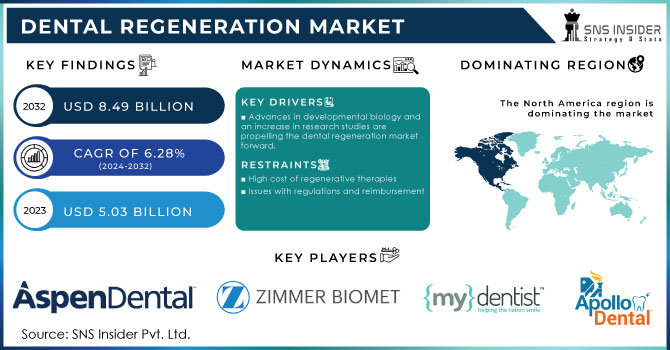

The global dental regeneration market, valued at USD 5.03 Billion in 2023, is projected to reach USD 8.49 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.28% during the forecast period.

Dental regeneration is a stem cell-based regenerative medicine process used to replace damaged or lost teeth by generating them from autologous stem cells in the field of tissue engineering and stem cell biology. The preservation of enamel's integrity is a challenge. It is subject to wear, injury, and decay because it is constantly demineralized and remineralized within the oral environment. It cannot renew since it is made up of cells that are lost following the dental eruption.

DRIVERS

Advances in developmental biology and an increase in research studies are propelling the dental regeneration market forward.

The global dental regeneration market is growing as a result of increased research studies on dental regeneration, developments in developmental biology, an aging population, and new creative technologically enhanced therapies. It is feasible to focus the development of spatial-temporal specific expression and achieve the expected objective of dental regeneration by utilizing biology and bioinformatics to establish the pattern of gene expression during tooth formation. According to additional study, the increased prevalence of tooth deformity or informity is a major reason driving market expansion. These studies on bioengineered teeth show that with focused differentiation and certain stem cell expression patterns, full dental regeneration is conceivable. Rising study and development of new advantageous ways for dental regeneration is assisting in the growth. Rising research and development of novel advantageous approaches for dental regeneration is fueling market growth.

Growing awareness of the benefits of dental regeneration

In recent years, there has been a considerable increase in awareness of the benefits of dental regeneration. This is due to greater media coverage and online information availability. People are becoming more aware of the advantages of dental regeneration, such as enhanced dental health, aesthetics, and the chance to skip intrusive surgeries. This has increased the demand for dental regeneration goods and services.

RESTRAIN

High cost of regenerative therapies

Regenerative therapies are extremely expensive and can be difficult for many people to obtain. This is owing to the high expense of the therapy's supplies as well as the competence necessary to perform it. As a result, many people are unable to obtain these therapies, which can stifle growth in the dental regeneration market.

Issues with regulations and reimbursement

OPPORTUNITY

The rising demand for dental implants and reconstructive surgery

The expansion of healthcare infrastructure in emerging nations, and technical advancements in dentistry are the primary factors driving the global dental regeneration market. The increased frequency of periodontal disorders, as well as the rising demand for cosmetic dentistry, are driving market expansion. The market is very competitive, with several global and regional businesses present. In addition, the market is distinguished by a high degree of product innovation and competitive pricing. The industry is projected to gain traction further as regenerative dentistry methods become more widely used and new products are introduced.

CHALLENGES

Lack of experience and infrastructure

A major impediment to expansion in the dental regeneration market is a lack of expertise and infrastructure required to undertake regenerative therapies. Regenerative therapies necessitate highly specialized skills and expertise that are in short supply. Furthermore, the infrastructure required to administer these therapies is frequently unavailable or inaccessible in many locations, making it difficult for people to obtain these treatments.

Donor funds are in short supply.

Long-term efficacy and safety of regenerative therapies

In dentistry, nitrous oxide is generally utilized for difficult treatments or surgeries. Unfortunately, around 40% of the Ammonium Nitrate required for Nitrous Oxide comes from Russia. Root canal therapy is performed to treat a tooth infection. It entails a dentist removing infected soft tissue known as the pulp from inside the tooth. Because of the invasive aspect of a root canal treatment, as well as the lengthy process time, patients may experience anxiety and concern. Patients who are anxious, agitated, or distressed may be given a sedative such as Nitrous Oxide. However, due to the scarcity, fewer sedatives are projected to be available. This may cause fewer people to seek root canal therapy. As a result, the healthcare sector is worried. It's crucial to remember that dental clinics often have various sedatives on hand, although supplies are usually limited. Regardless of possible shortages, dental clinics will continue to provide root canal and other complicated treatments. This should not detract from the primary goal of providing effective and efficient therapies to patients worldwide.

IMPACT OF ECONOMIC SLOWDOWN

The dentistry market is facing recession due to the COVID-19 epidemic has touched many healthcare sectors, including dental health professionals. Dental health workers are more likely to become infected as a result of blood, saliva, and droplets expelled during the treatment of asymptomatic COVID-19 infected patients. The majority of dental practices are closed due to official closure or restricted functionality orders issued by government organizations in the majority of the world's regions which impacted on the global dentistry economy.

By Type

Hard Tissue

Dentin

Cementum

Enamel

Soft Tissue

Gum

Pulp

In 2023, the hard tissue segment is expected to held the highest market growth rate of 59.3% during the forecast period due to the rising prevalence of enamel hypoplasia, dental caries, and periodontitis is fueling demand for enamel restorative therapies. According to WHO estimates, there are more than 1 billion instances of severe periodontal disease worldwide, affecting over 19% of the adult population. The biggest risk factors for periodontal disease include tobacco use and poor oral hygiene.

By Age Group

Pediatric

Adult

Geriatric

In 2023, the geriatric segment is expected to dominate the market growth of 37.4% during the forecast period owing to the loss in the senior population, which reduces nutrient intake and is expected to contribute to systemic health difficulties. According to the CDC's 2022 report, one-fifth of persons 67 and older had lost all of their teeth. Complete tooth loss was twice as likely in aged 77 and older (27% vs. 15% in those 67 to 76). It is anticipated that 98 million Americans, or 25% of the population, will be 67 or older by 2060.

By End Use

Hospitals

Dental Clinics

Others

In 2023, the hospitals & diagnostic laboratories segment is expected to dominate the market growth of 56.5% during the forecast period due to the majority of individuals visit privately run dental clinics because they are more economical, have access to specialists, and use cutting-edge technology. Globally, there are more independent practices.

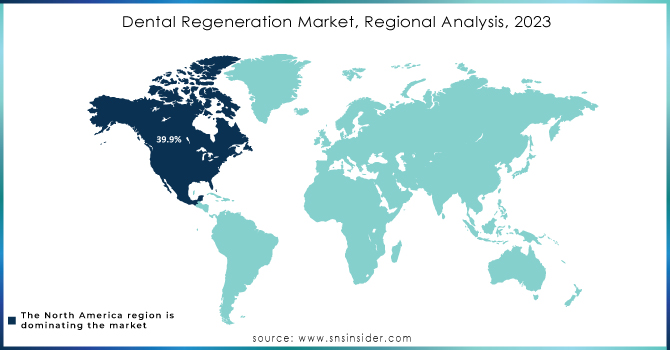

North America held a significant market share of 39.9% in 2023. This is due to an increase in tooth loss and the prevalence of diseases such as periodontal disease, dental caries, pupal periapical disorders, and enamel hypoplasia. These are the primary drivers fueling the region's market growth. Furthermore, advances in dentistry regeneration therapies and a growing geriatric population are fueling market expansion.

Asia-Pacific is witness to expand fastest CAGR rate of 6.8% during the forecast period The region's primary drivers include an aging population, an increase in the prevalence of dental disorders such as dentin hypersensitivity, dental caries, and periodontal diseases, and an increase in disposable income. For example, according to an NIH report, the frequency of dental caries in India will be 56.3% in 2022. According to reports, 62% of patients are above the age of 18 and 52% are between the ages of 3 and 18. Furthermore, 29% of early childhood caries cases were detected utilizing missing, decayed, or filled teeth as diagnostic criteria.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major players are Smile Dental Care, Apollo White Dental, Integrated Dental Holdings, My Dentist, Zimmer Biomet, Floss Dental Clinic, Axiss Dental, VideaHealth, Aspen Dental Clinic, Heartland Dental, Dentsply Sirona, Delta Dental, Clove Dental, and Others.

In June 2022, VideaHealth, a leading provider of dental artificial intelligence solutions, announced that Health Canada has given it a Medical Device Establishment License for their AI-powered dental caries detection system, Video Caries Assist. VideaHealth's AI and software solutions were designed with efficiency and ethics in mind. They enable dentists to examine patient X-rays more successfully, get paid faster, and make more precise treatment suggestions.

According to an announcement by Zimmer Biomet Holdings, a global pioneer in medical technology, ZimVie, formerly known as Zimmer Biomet's Dental and Spine business, successfully spun out in March 2022. This transaction is expected to accelerate growth and offer superior value for all stakeholders by sharpening Zimmer Biomet and ZimVie's emphasis on patient and customer needs.

In July 2022, my doctor joined with a dental clinic to strengthen their leadership in the medical business and deliver a high-quality experience to their clientele.

Dentsply Sirona completed the acquisition of Datum Dental, Ltd. and its OSSIX biomaterial portfolio in January 2021. A well-known manufacturer of innovative dental regeneration solutions based on GLYMATRIX technology. This acquisition has expanded the company's product line. Datum Dental's robust R&D pipeline has also increased the firm's capabilities for future development.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 5.03 billion |

|

Market Size by 2031 |

US$ 8.49 billion |

|

CAGR |

CAGR of 6.28% From 2024 to 2031 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2031 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

By Type (Hard Tissue, Soft Tissue), By Age Group (Pediatric, Adult, Geriatric), By End User (Hospitals, Dental Clinics, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Smile Dental Care, Apollo White Dental, Integrated Dental Holdings, My Dentist, Zimmer Biomet, Floss Dental Clinic, Axiss Dental, VideaHealth, Aspen Dental Clinic, Heartland Dental, Dentsply Sirona, Delta Dental, Clove Dental |

|

Key Drivers |

•Advances in developmental biology and an increase in research studies are propelling the dental regeneration market forward. •Growing awareness of the benefits of dental regeneration |

|

Market Challenges |

•Donor funds are in short supply |

Dental regeneration market size was valued at USD 5.03 billion in 2023.

The growth rate of Dental Regeneration market is expected to grow USD 8.49 billion by 2032.

Dental regeneration market is anticipated to expand by 6.28% from 2024 to 2032.

The U.S held the significant CAGR of 39.9% and will expand significantly during the forecast period due to advances in dentistry regeneration therapies and a growing geriatric population.

Donor funds are in short supply and long-term efficacy and safety of regenerative therapies.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Ukraine- Russia war

4.2 Impact of ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Dental Regeneration Market Segmentation, By Type

8.1 Hard Tissue

8.1.1 Dentin

8.1.2 Cementum

8.1.3 Enamel

8.2 Soft Tissue

8.2.1 Gum

8.2.2 Pulp

9. Dental Regeneration Market Segmentation, By Age Group

9.1 Pediatric

9.2 Adult

9.3 Geriatric

10. Dental Regeneration Market Segmentation, By End User

10.1 Hospitals

10.2 Dental Clinics

10.3 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Dental Regeneration Market by Country

11.2.2North America Dental Regeneration Market by Type

11.2.3 North America Dental Regeneration Market by Age Group

11.2.4 North America Dental Regeneration Market by End User

11.2.5 USA

11.2.5.1 USA Dental Regeneration Market by Type

11.2.5.2 USA Dental Regeneration Market by Age Group

11.2.5.3 USA Dental Regeneration Market by End User

11.2.6 Canada

11.2.6.1 Canada Dental Regeneration Market by Type

11.2.6.2 Canada Dental Regeneration Market by Age Group

11.2.6.3 Canada Dental Regeneration Market by End User

11.2.7 Mexico

11.2.7.1 Mexico Dental Regeneration Market by Type

11.2.7.2 Mexico Dental Regeneration Market by Age Group

11.2.7.3 Mexico Dental Regeneration Market by End User

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Dental Regeneration Market by Country

11.3.1.2 Eastern Europe Dental Regeneration Market by Type

11.3.1.3 Eastern Europe Dental Regeneration Market by Age Group

11.3.1.4 Eastern Europe Dental Regeneration Market by End User

11.3.1.5 Poland

11.3.1.5.1 Poland Dental Regeneration Market by Type

11.3.1.5.2 Poland Dental Regeneration Market by Age Group

11.3.1.5.3 Poland Dental Regeneration Market by End User

11.3.1.6 Romania

11.3.1.6.1 Romania Dental Regeneration Market by Type

11.3.1.6.2 Romania Dental Regeneration Market by Age Group

11.3.1.6.4 Romania Dental Regeneration Market by End User

11.3.1.7 Turkey

11.3.1.7.1 Turkey Dental Regeneration Market by Type

11.3.1.7.2 Turkey Dental Regeneration Market by Age Group

11.3.1.7.3 Turkey Dental Regeneration Market by End User

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Dental Regeneration Market by Type

11.3.1.8.2 Rest of Eastern Europe Dental Regeneration Market by Age Group

11.3.1.8.3 Rest of Eastern Europe Dental Regeneration Market by End User

11.3.2 Western Europe

11.3.2.1 Western Europe Dental Regeneration Market by Type

11.3.2.2 Western Europe Dental Regeneration Market by Age Group

11.3.2.3 Western Europe Dental Regeneration Market by End User

11.3.2.4 Germany

11.3.2.4.1 Germany Dental Regeneration Market by Type

11.3.2.4.2 Germany Dental Regeneration Market by Age Group

11.3.2.4.3 Germany Dental Regeneration Market by End User

11.3.2.5 France

11.3.2.5.1 France Dental Regeneration Market by Type

11.3.2.5.2 France Dental Regeneration Market by Age Group

11.3.2.5.3 France Dental Regeneration Market by End User

11.3.2.6 UK

11.3.2.6.1 UK Dental Regeneration Market by Type

11.3.2.6.2 UK Dental Regeneration Market by Age Group

11.3.2.6.3 UK Dental Regeneration Market by End User

11.3.2.7 Italy

11.3.2.7.1 Italy Dental Regeneration Market by Type

11.3.2.7.2 Italy Dental Regeneration Market by Age Group

11.3.2.7.3 Italy Dental Regeneration Market by End User

11.3.2.8 Spain

11.3.2.8.1 Spain Dental Regeneration Market by Type

11.3.2.8.2 Spain Dental Regeneration Market by Age Group

11.3.2.8.3 Spain Dental Regeneration Market by End User

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands Dental Regeneration Market by Type

11.3.2.9.2 Netherlands Dental Regeneration Market by Age Group

11.3.2.9.3 Netherlands Dental Regeneration Market by End User

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland Dental Regeneration Market by Type

11.3.2.10.2 Switzerland Dental Regeneration Market by Age Group

11.3.2.10.3 Switzerland Dental Regeneration Market by End User

11.3.2.11. Austria

11.3.2.11.1 Austria Dental Regeneration Market by Type

11.3.2.11.2 Austria Dental Regeneration Market by Age Group

11.3.2.11.3 Austria Dental Regeneration Market by End User

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe Dental Regeneration Market by Type

11.3.2.12.2 Rest of Western Europe Dental Regeneration Market by Age Group

11.3.2.12.3 Rest of Western Europe Dental Regeneration Market by End User

11.4 Asia-Pacific

11.4.1 Asia-Pacific Dental Regeneration Market by Country

11.4.2 Asia-Pacific Dental Regeneration Market by Type

11.4.3 Asia-Pacific Dental Regeneration Market by Age Group

11.4.4 Asia-Pacific Dental Regeneration Market by End User

11.4.5 China

11.4.5.1 China Dental Regeneration Market by Type

11.4.5.2 China Dental Regeneration Market by Age Group

11.4.5.3 China Dental Regeneration Market by End User

11.4.6 India

11.4.6.1 India Dental Regeneration Market by Type

11.4.6.2 India Dental Regeneration Market by Age Group

11.4.6.3 India Dental Regeneration Market by End User

11.4.7 Japan

11.4.7.1 Japan Dental Regeneration Market by Type

11.4.7.2 Japan Dental Regeneration Market by Age Group

11.4.7.3 Japan Dental Regeneration Market by End User

11.4.8 South Korea

11.4.8.1 South Korea Dental Regeneration Market by Type

11.4.8.2 South Korea Dental Regeneration Market by Age Group

11.4.8.3 South Korea Dental Regeneration Market by End User

11.4.9 Vietnam

11.4.9.1 Vietnam Dental Regeneration Market by Type

11.4.9.2 Vietnam Dental Regeneration Market by Age Group

11.4.9.3 Vietnam Dental Regeneration Market by End User

11.4.10 Singapore

11.4.10.1 Singapore Dental Regeneration Market by Type

11.4.10.2 Singapore Dental Regeneration Market by Age Group

11.4.10.3 Singapore Dental Regeneration Market by End User

11.4.11 Australia

11.4.11.1 Australia Dental Regeneration Market by Type

11.4.11.2 Australia Dental Regeneration Market by Age Group

11.4.11.3 Australia Dental Regeneration Market by End User

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Dental Regeneration Market by Type

11.4.12.2 Rest of Asia-Pacific Dental Regeneration Market by Age Group

11.4.12.3 Rest of Asia-Pacific Dental Regeneration Market by End User

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Dental Regeneration Market by Country

11.5.1.2 Middle East Dental Regeneration Market by Type

11.5.1.3 Middle East Dental Regeneration Market by Age Group

11.5.1.4 Middle East Dental Regeneration Market by End User

11.5.1.5 UAE

11.5.1.5.1 UAE Dental Regeneration Market by Type

11.5.1.5.2 UAE Dental Regeneration Market by Age Group

11.5.1.5.3 UAE Dental Regeneration Market by End User

11.5.1.6 Egypt

11.5.1.6.1 Egypt Dental Regeneration Market by Type

11.5.1.6.2 Egypt Dental Regeneration Market by Age Group

11.5.1.6.3 Egypt Dental Regeneration Market by End User

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Dental Regeneration Market by Type

11.5.1.7.2 Saudi Arabia Dental Regeneration Market by Age Group

11.5.1.7.3 Saudi Arabia Dental Regeneration Market by End User

11.5.1.8 Qatar

11.5.1.8.1 Qatar Dental Regeneration Market by Type

11.5.1.8.2 Qatar Dental Regeneration Market by Age Group

11.5.1.8.3 Qatar Dental Regeneration Market by End User

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Dental Regeneration Market by Type

11.5.1.9.2 Rest of Middle East Dental Regeneration Market by Age Group

11.5.1.9.3 Rest of Middle East Dental Regeneration Market by End User

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by Country

11.5.2.2 Africa Dental Regeneration Market by Type

11.5.2.3 Africa Dental Regeneration Market by Age Group

11.5.2.4 Africa Dental Regeneration Market by End User

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Dental Regeneration Market by Type

11.5.2.5.2 Nigeria Dental Regeneration Market by Age Group

11.5.2.5.3 Nigeria Dental Regeneration Market by End User

11.5.2.6 South Africa

11.5.2.6.1 South Africa Dental Regeneration Market by Type

11.5.2.6.2 South Africa Dental Regeneration Market by Age Group

11.5.2.6.3 South Africa Dental Regeneration Market by End User

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Dental Regeneration Market by Type

11.5.2.7.2 Rest of Africa Dental Regeneration Market by Age Group

11.5.2.7.3 Rest of Africa Dental Regeneration Market by End User

11.6 Latin America

11.6.1 Latin America Dental Regeneration Market by Country

11.6.2 Latin America Dental Regeneration Market by Type

11.6.3 Latin America Dental Regeneration Market by Age Group

11.6.4 Latin America Dental Regeneration Market by End User

11.6.5 Brazil

11.6.5.1 Brazil Dental Regeneration Market by Type

11.6.5.2 Brazil Dental Regeneration Market by Age Group

11.6.5.3 Brazil Dental Regeneration Market by End User

11.6.6 Argentina

11.6.6.1 Argentina Dental Regeneration Market by Type

11.6.6.2 Argentina Dental Regeneration Market by Age Group

11.6.6.3 Argentina Dental Regeneration Market by End User

11.6.7 Colombia

11.6.7.1 Colombia Dental Regeneration Market by Type

11.6.7.2 Colombia Dental Regeneration Market by Age Group

11.6.7.3 Colombia Dental Regeneration Market by End User

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Dental Regeneration Market by Type

11.6.8.2 Rest of Latin America Dental Regeneration Market by Age Group

11.6.8.3 Rest of Latin America Dental Regeneration Market by End User

12. Company profile

12.1 Smile Dental Care

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Apollo White Dental

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Integrated Dental Holdings

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 My Dentist

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Zimmer Biomet

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Floss Dental Clinic

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Axiss Dental

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 VideaHealth

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Aspen Dental Clinic

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Heartland Dental

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Dentsply Sirona

12.11.1 Company Overview

12.11.2 Financials

12.11.3 Product/ Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 Delta Dental

12.12.1 Company Overview

12.12.2 Financials

12.12.3 Product/ Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

12.13 Clove Dental

12.13.1 Company Overview

12.13.2 Financials

12.13.3 Product/ Services Offered

12.13.4 SWOT Analysis

12.13.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Hepatitis B Vaccine market size was USD 8.27 billion in 2023 and is expected to reach USD 13.02 billion by 2032 and grow at a CAGR of 5.17% over the forecast period of 2024-2032.

The Cell Separation Market Size was valued at USD 9.55 Billion in 2023 and is expected to reach USD 30.15 Billion by 2032, growing at a CAGR of 13.63% over the forecast period of 2024-2032.

The Carrier Screening Market Size was valued at USD 2.26 Billion in 2023 and is expected to reach USD 11.44 Billion by 2032 and grow at a CAGR of 19.76% over the forecast period 2024-2032.

The Antibody Drug Conjugates [ADC] Market was valued at USD 10.28 billion in 2023 and is expected to reach USD 29.10 billion by 2032, growing at a CAGR of 12.29% from 2024-2032.

The Healthcare Data Storage Market Size was valued at USD 4.7 Bn in 2023 and will reach to USD 15.54 Bn by 2032 and grow at a CAGR of 14.23% by 2024-2032.

The CyberKnife Market was valued at USD 542.14 million in 2023 and is expected to reach USD 2340.47 million by 2032, growing at a CAGR of 17.67% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone