Get E-PDF Sample Report on Demulsifier Market - Request Sample Report

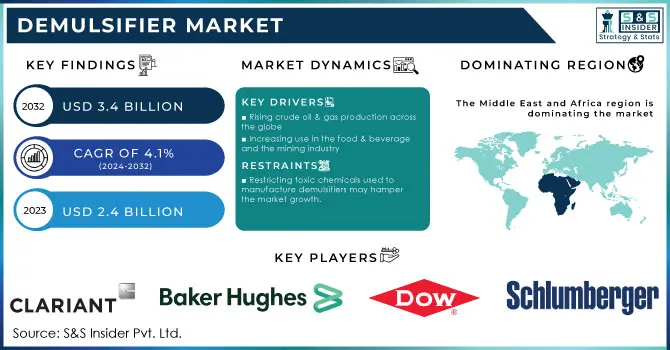

The Demulsifier Market size was valued at USD 2.4 Billion in 2023. It is expected to grow to USD 3.4 Billion by 2032 and grow at a CAGR of 4.1% over the forecast period of 2024-2032.

The surge in global demand for oil and gas has prompted a significant rise in exploration and production activities across the industry. As operators seek to maximize output from existing fields and explore new reserves, the necessity for effective separation processes becomes paramount. Demulsifiers play a crucial role in this context, as they facilitate the efficient separation of water from crude oil, thereby enhancing oil recovery rates and processing efficiency.

According to the U.S. Energy Information Administration (EIA), global oil production reached an average of 95 million barrels per day in 2023, a significant increase driven by expanded exploration activities and production in key regions, including the Middle East, the United States, and offshore fields worldwide.

Growing realization regarding environmental sustainability, along with the adverse impact of conventional chemical products is resulting in significant movement toward non-hazardous and bio-degradable demulsifiers. With the increasing urgency of climate and environmental concerns, industries are being more mindful of their ecological footprint and choosing products that have a lower impact but would still get the job done. Due to this trend manufacturers are shifting their focus towards formulation and development of efficient, eco-friendly demulsifiers these influence product development and innovation within the global demulsifier market.

However, recent developments in the formulation of demulsifiers are making new technology a reality and further improving oilfield operations by being economic and ecological while meeting ever-stricter regulatory demands. Newly developed demulsifiers are made to work at a wide range of pressures and temperatures, which is important in offshore and deep-water drilling where extraction can be difficult. This includes biodegradable and environmentally sound formulations that are capable of reducing the oilfield chemical environmental footprint as an aid to solving regulations about eco-centric issues in oil production. Also, the developed demulsifiers focus on enhanced water-oil separation speed for efficient lowering of the processing time and cost. These latest demulsifiers are considered an industry-standard practice that satisfies environmental requirements without compromising operational performance, leading to reduced interface levels making significant contributions to sustainable operational practices, and lowering external environmental risk in oilfield operations.

According to the U.S. Environmental Protection Agency (EPA), regulations on oil and gas operations led to a 30% reduction in chemical discharge limits for offshore drilling by 2023, prompting the industry to adopt environmentally friendly solutions. This shift has accelerated the development and use of advanced, low-impact demulsifiers that meet both efficiency and environmental standards, supporting sustainable practices in oilfield operations

Drivers:

Rising crude oil & gas production across the globe

Increasing use in the food & beverage and the mining industry

The rising utilization of demulsifiers in food & beverage and mining industries is a major growth driver. Demulsifiers are essential for separating unwanted water from oils and fats in the food & beverage sector, maintaining product purity and quality in key products such as vegetable oils & other food-grade oils. Such an application is necessary because the demand for high-quality, refined food oils increases due to both consumer behavior focusing on healthy foods and stricter safety regulations surrounding these food products. Like the oil industry, where emulsions are formed when water and oil are mixed during mineral processing and extraction, there is a need for demulsifiers in the mining industry. The decomposition of such emulsions reduces extraction efficiency and increases processing costs therefore the demulsifiers fulfill a wide variety of demands in chemical sciences where cheap, effective, eco-friendly solutions for industrial problems are needed.

According to data from the U.S. Department of Agriculture (USDA), the global vegetable oil market reached approximately 213 million metric tons in 2022, with demand projected to grow by 4% annually due to increased food processing activities. This trend highlights the growing need for efficient demulsifiers in the food sector to maintain oil purity and meet quality standards. In mining, the International Council on Mining and Metals (ICMM) reports that over 75% of mining operations globally are implementing chemical solutions like demulsifiers to enhance mineral separation processes, driven by industry standards for cost-efficiency and environmental safety.

Restricting toxic chemicals used to manufacture demulsifiers may hamper the market growth.

The restriction on toxic chemicals commonly used in the manufacturing of demulsifiers is a significant factor that could hamper market growth. Many traditional demulsifiers contain compounds that, while effective, pose environmental and health risks, leading regulatory bodies worldwide to impose strict guidelines and limitations on their usage. For instance, chemicals that are non-biodegradable or have high toxicity levels are now subject to tighter scrutiny and, in some cases, outright bans. As a result, manufacturers face increased pressure to develop alternative, eco-friendly demulsifier formulations, which can be costly and time-intensive. This shift not only raises production costs but may also impact the availability of effective demulsification solutions in the short term, potentially slowing market growth as companies adapt to these evolving regulations.

Rising applications in end-user sectors create the opportunity for the market

Raising demand for bio-based demulsifier

A bio-based demulsifier is produced using renewable resources including sugar cane, vegetable oils, and animal fats. Compared to conventional chemical-based demulsifiers, bio-based demulsifiers are more environmentally friendly and biodegradable. As people become more conscious of the need to preserve the environment, there is an increasing demand for bio-based emulsifiers. Demulsifiers made from biological sources are a more environmentally friendly alternative.

By Type

Oil-soluble demulsifiers held the largest market share around 68% in 2023. As they are extremely effective in the separation of water from crude oil especially heavy oil and complex emulsion systems. These demulsifiers are formulated to dissolve directly in the oil phase and break water-in-oil emulsions effectively immediately. The ability to separate oil from gas after extraction is an essential capability in the oil and gas industry, which internally drives quality–conditioning oil to maintain it at a desired standard. For example, they are highly effective under harsh conditions (high temperature and pressure) which often take place in offshore drilling and unconventional oil extraction. Producers often opt for them due to their reliability coupled with excellent performance across diverse oil kinds and extraction conditions, hence dominating the market.

By Application

Crude oil processing held the largest market share 32% in 2023. This is due to separating water and impurities from crude oil is one of the most vital steps in refining operations. Since the extraction of crude oil usually leads to the formation of stable water-in-oil emulsions, demulsifiers are an important tool for breaking those emulsions enabling the delivery of high-grade crude to refineries. As world energy consumption is projected to keep a rising trend, the need for effective crude oil treatment becomes more pressing since higher loads of crude and unconventional sources tend to yield complex emulsions. With more stringent crude oil quality and environmental regulations, the dependence on efficient demulsification technologies is essential for these producers. The strong demulsifier market for crude oil processing drives their share and more importantly, continues to attract innovations in formulation and application techniques improving separation efficiency.

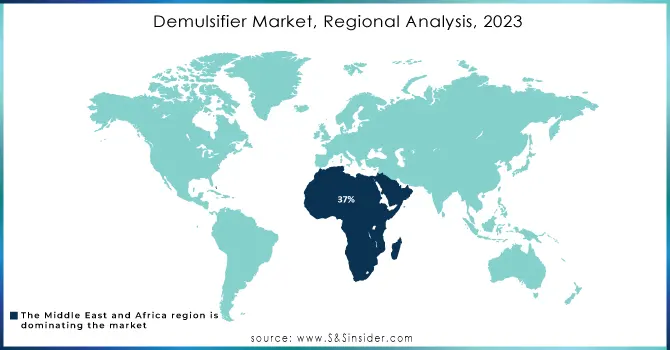

Middle East and Africa held the largest market share around 37% in 2023. It is because of its large oil and gas production capacity. The two biggest oil reserves lie within the Middle East with Saudi Arabia, The United Arab Emirates, and Iraq showing the way in production. In light of the current investments in oil exploration and extraction projects, especially under harsh conditions like off-shore and deep-water fields, there is an increasing requirement for effective demulsification technologies to treat water-in-oil emulsions. Moreover, an increase in emphasis on the betterment of the refining process and strict environmental regulation is driving the growth of demulsifiers. Furthermore, a growing number of newer oil and gas markets in Africa such as Nigeria and Angola have been increasingly explored, which is expected to bolster the potential domestic demand for demulsifiers used in crude oil processing. The MEA region is characterized by a large reserve base as well as production increase and tight regulations, which makes it the favourite market for demulsifiers.

According to the U.S. Energy Information Administration (EIA), the Middle East accounted for approximately 33% of the world's total crude oil production in 2022, with the region producing around 27.4 million barrels per day. Additionally, the African Petroleum Producers Organization (APPO) reported that oil production in Africa is expected to grow by approximately 2.2 million barrels per day by 2025, driven by new exploration and production projects in countries like Nigeria and Angola. This substantial oil output and the anticipated growth in production underscore the increasing demand for demulsifiers in crude oil processing within the Middle East and Africa, reinforcing their dominant market share in the sector.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Clariant International Ltd. (Emulsogen, Lutensol)

Baker Hughes Company (AquaShift, K-OIL)

The Dow Chemical Company (DOWSIL, VERSIFY)

Schlumberger Limited (Demi-Sep, Hydroclear)

Halliburton Company (Demi-Rem, LCM)

Clariant AG (Sustainol, Defoamer)

Ecolab Inc. (AquaDri, EcoClear)

BASF SE (Ludox, Emulsogen)

Nova Star LP (NovaDemul, NovaClear)

Croda International (Crodamide, Crodafos)

SI Group (DemiCide, SI Demulsifier)

Baker Hughes (Separator, Demulsifier)

Evonik Industries AG (TEGO, DYNASYLAN)

Huntsman Corporation (Amines, TDI)

SABIC (SABIC LLDPE, SABIC HDPE)

Fuchs Petrolub SE (Fuchs Demulsifiers, Fuchs Emulsifiers)

Afton Chemical (Afton 3000, Afton 5000)

Lubrizol Corporation (Lubrizol 596, Lubrizol 607)

M-I SWACO (M-I Gel, M-I Clear)

Kraton Corporation (Kraton D, Kraton G)

In 2023, Clariant launched a new range of eco-friendly demulsifiers designed to enhance oil-water separation processes while reducing environmental impact, specifically tailored for offshore applications.

In 2023, Dow expanded its portfolio with the introduction of DOWSIL, a new line of demulsifiers that offer superior performance in high-temperature conditions, catering to the needs of deep-water drilling operations.

In 2023, Schlumberger launched Hydroclear, an innovative demulsifier that enhances water removal rates in crude oil processing, particularly for high-viscosity oils.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.4 Billion |

| Market Size by 2032 | US$ 3.4 Billion |

| CAGR | CAGR of 4.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Water Soluble and Oil Soluble) • By Application (Petro Refineries, Sludge Oil Treatment, Crude Oil Processing, Lubricant Manufacturing, Oil-based Power Plants, and Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Clariant International Ltd., Baker Hughes Company, The Dow Chemical Company., Schlumberger Limited, Halliburton Company, Clariant AG, Ecolab Inc., BASF SE, Nova Star LP, Croda International, SI Group |

| Key Drivers | • Increasing use in the food & beverage and the mining industry • crude oil & gas production across the globe |

| Market Opportunity | • Rising applications in end-user sectors • Raising demand for bio-based demulsifier |

Ans. The CAGR of the Demulsifier Market over the forecast period is 4.15%.

Ans. USD 2.4 billion is the projected value in 2023 for Demulsifier Market.

Ans. USD 3.31 billion is the projected Demulsifier Market size of the market by 2031.

Ans. Drivers are Increasing use in the food & beverage and the mining industry and crude oil & gas production across the globe

Ans. Middle East & Africa is the fastest-growing region of the Demulsifier Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Demulsifier Market Segmentation, by Type

7.1 Chapter Overview

7.2 Oil Soluble

7.2.1 Oil Soluble Market Trends Analysis (2020-2032)

7.2.2 Oil Soluble Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Water Soluble

7.3.1 Water Soluble Market Trends Analysis (2020-2032)

7.3.2 Water Soluble Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Demulsifier Market Segmentation, by Application

8.1 Chapter Overview

8.2 Petro Refineries

8.2.1 Petro Refineries Market Trends Analysis (2020-2032)

8.2.2 Petro Refineries Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Sludge Oil Treatment

8.3. Sludge Oil Treatment Market Trends Analysis (2020-2032)

8.3.2 Sludge Oil Treatment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Crude Oil Processing

8.4.1 Crude Oil Processing Market Trends Analysis (2020-2032)

8.4.2 Crude Oil Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Lubricant Manufacturing

8.5.1 Lubricant Manufacturing Market Trends Analysis (2020-2032)

8.5.2 Lubricant Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Oil-based Power Plants

8.6.1 Oil-based Power Plants Market Trends Analysis (2020-2032)

8.6.2 Oil-based Power Plants Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Other

8.7.1 Other Market Trends Analysis (2020-2032)

8.7.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Demulsifier Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Demulsifier Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Demulsifier Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Demulsifier Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Demulsifier Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Demulsifier Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Demulsifier Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Demulsifier Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Demulsifier Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Clariant International Ltd.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Baker Hughes Company

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 The Dow Chemical Company

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Schlumberger Limited

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Halliburton Company

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Clariant AG

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Ecolab Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 BASF SE

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Nova Star LP

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 SI Group

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Oil Soluble

Water Soluble

By Application

Petro Refineries

Sludge Oil Treatment

Crude Oil Processing

Lubricant Manufacturing

Oil-based Power Plants

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Polycarbonate Market size was valued at USD 20.13 billion in 2023 and is expected to reach USD 32.61 billion by 2032, at a CAGR of 5.51% from 2024-2032.

The Acrylic Polymer Market Size was valued at USD 610 million in 2023, and is expected to reach USD 883.4 million by 2032, and grow at a CAGR of 4.2% over the forecast period 2024-2032.

Fire-resistant Coatings Market was valued at USD 1079.4 million in 2023 and is expected to reach USD 1478.8 million by 2032, at a CAGR of 3.6% from 2024-2032.

The Sodium Nitrate Market size was USD 136.22 Million in 2023 and is expected to reach USD 231.47 Million by 2032, growing at a CAGR of 6.07% from 2024-2032.

Antimicrobial Plastics Market was valued at USD 44.01 billion in 2023 and is expected to reach USD 85.06 billion by 2032, at a CAGR of 7.63% from 2024-2032.

The Catalyst Carrier Market size was valued at USD 413 Million in 2023. It is expected to grow to USD 770.1 Million by 2032 and grow at a CAGR of 7.2% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone