Get E-PDF Sample Report on Defoamers Market - Request Sample Report

The Defoamers Market Size was valued at USD 3.6 billion in 2023, and is expected to reach USD 5.6 billion by 2032, and grow at a CAGR of 5.1% over the forecast period 2024-2032.

Advancement of innovations in the defoamers market was caused by a variety of industries trying to establish an effective foam-management solution. Defoamers are important as they support the prevention and control of foam production in the industries and companies that deal with food production and processing, pharmaceuticals, and manufacturing. The technology within the market was also affected principally by the latest technological improvements as numerous companies and industries worked toward developing new for-defoaming solutions to meet the new parameters and demands of their industries. This development underscores the important function of defoaming agents in preserving operational effectiveness and product excellence in various uses.

An important development in the defoamers industry occurred in June 2023 with the introduction of Evonik Industries' innovative wafer-cutting solutions. This advancement signifies a notable improvement in accuracy and productivity for the manufacturing of semiconductor wafers, where managing foam is crucial for achieving top-notch results. Evonik's latest technology includes innovative defoaming agents designed specifically for the difficulties of wafer fabrication. This new development highlights the company's dedication to improving performance in advanced technology uses, addressing the distinct issues with foaming that arise in semiconductor production.

Concentrol has made considerable progress in the food processing sector with its custom defoaming solutions tailored for different food production settings. The defoamers made by the company are specially crafted to address foam-related problems in sectors such as brewing and dairy processing, where excessive foam can negatively impact productivity and uniformity. Concentrol's customized method for defoaming emphasizes the significance of upholding both product quality and operational efficiency in the food sector. Concentrol helps the food industry by offering solutions that adhere to strict standards, aiding in reliable foam control.

The defoamers market is impacted by various important factors, such as the rising complexity of industrial processes and the increasing need for greater efficiency. The requirement for advanced defoaming solutions has become clear as industries aim to enhance both their operations and product quality. Both Evonik's innovations in wafer cutting and Concentrol's emphasis on food-safe defoamers represent an overall shift toward creating specialized and efficient products to meet distinct industry demands.

Sustainable practices and adherence to regulations are also important factors influencing the defoamers market. There is an increasing focus on creating environmentally friendly defoamers that lessen the environmental effect of industrial operations, in line with wider industry trends toward sustainability. Moreover, the need for defoamers that meet strict safety and quality standards is also driven by regulatory requirements in fields such as food processing. Companies such as Concentrol are leading the way in meeting regulations and offering efficient foaming solutions that align with the market's shift towards sustainable and compliant technologies.

Market Dynamics:

Drivers:

Increasing demand for defoamers from various industries

The growing need for defoamers in different sectors is a key factor in the market, highlighting the important function these chemicals serve in improving operational effectiveness and product standards. As sectors like chemicals, pharmaceuticals, textiles, and pulp and paper advance, their demand for efficient foam control solutions increases. In August 2023, BASF launched a new series of defoaming agents tailored for the textile sector, aiming to address the issue of foam interference in dyeing procedures and its impact on color consistency. These new additives were created to fulfill the strict demands of textile producers, emphasizing the industry's necessity for specialized defoaming remedies. In October 2023, Dow Chemical also introduced a specialized defoamer formula designed for the pulp and paper sector. This product deals with usual foaming problems in paper production, which can lead to inefficiencies and impact paper quality. Dow’s statement demonstrates an increasing demand for defoamers in different industries where controlling foam is critical for maintaining excellent production levels as well as performance. Generally, organizations seek advanced and custom defoaming solutions to streamline operations, maintain top quality, and keep in line with stringent standards of different sectors, contributing to the cited trend.

Growing demand for the defoamers in water treatment

The rising need for defoamers in water treatment is a major factor driving the market, indicating a growing necessity for efficient foam regulation in different water management procedures. As water treatment facilities in both industrial and municipal arenas aim to increase their efficiency and maintain high water quality levels, the demand for defoamers is increasing. In March 2024, Solvay introduced a new range of defoamers specifically designed for the treatment of wastewater. The company produced defoamers which are intended to prevent foam in large municipal wastewater treatment facilities. One of the specific problems associated with foam in such plants is that this foam generated can prevent effective water treatment and can significantly decrease the efficiency of various filtration systems. In July of 2024, Clariant introduced a new high-tech product, which is used as a defoamer for industrial water recycling. Foaming is a problem in the recycling of water products, since the foam generated by recycling clogs any water reclamation machines and reduces the efficiency of the water reclamation and reutilization process. This demonstrates the trend that more and more defoamer producing companies are attempting to create defoaming products which would assist both industrial settings and communities by improving the water management processes, reducing operational interruptions and meeting water quality standards. This trend is partially driven by the increasing demand for ecologically sound and resource conserving products.

Restraints:

High cost associated with the production and quality control of the defoamers

The significant barrier in the market is the expensive production and quality control of defoamers, affecting both manufacturers and end-users. In February 2024, Evonik Industries saw an increase in production expenses for their high-tech defoaming agents because of higher prices of raw materials and strict quality control steps. The expenses are caused by the necessity of using high-quality ingredients and strict testing to guarantee that defoamers are efficient and safe for a wide range of uses. Likewise, in April 2024, Huntsman Corporation encountered difficulties due to rising costs associated with the creation and production of their new defoamer formulas for the chemical sector. The overall pricing of their products has been impacted by the expensive upkeep of high-quality standards and compliance with regulatory requirements, which may hinder their market reach. This economic strain is transferred throughout the supply chain, impacting the cost and uptake of specialized defoamers, especially for smaller companies and industries with limited financial resources.

Opportunities:

Increasing demand from the packaging industry for paper-based products Challenges

The increasing demand for paper-based items in the packaging sector creates an excellent opportunity for the defoamers market, as these items require effective foam control during their production processes. The increasing demand for environmentally friendly packaging solutions has resulted in the escalation of the paper production, which, in turn, triggered people’s increased reliance on defoamers as a tool to address the threats of foaming that could expose the final result of the product to possible reduction in efficiency and quality. One such defoamer was presented by AkzoNobel in January 2024, the use of which can be recommended in the production of paper and packaging. AkzoNobel’s defoamer is specifically created to enhance the production of packaging based on paper a material, which, when being exposed to foaming, can become flawed, and the process can be negatively affected. Kemira also put in place a new defoamer in May 2024 to satisfy the demand for environmentally friendly packaging materials, recyclable or biodegradable. This item assists in controlling foam in paper packaging production, leading to smoother processes and improved output quality. The growing emphasis on sustainability in the packaging sector highlights the rising demand for efficient defoaming solutions, as companies aim to comply with environmental laws while improving manufacturing productivity and product quality. This trend allows defoamer manufacturers to create customized products for the changing demands of the packaging industry, presenting a valuable opportunity.

Challenges:

Stringent regulations imposed by environmental agencies regarding the use of defoamers

The strict regulations enforced by environmental agencies on defoamer usage present a major obstacle for manufacturers in the industry, affecting product development and market dynamics. In June 2024, BASF encountered regulatory challenges in the European Union as new limitations on the utilization of specific chemicals in defoamers were implemented based on environmental and health worries. The ECHA imposed stricter restrictions on the level of volatile organic compounds (VOCs) allowed in defoaming agents, forcing BASF to adjust their product formulations to meet these new rules. This change in regulations not only raised the expenses and intricacy of product creation but also required thorough testing and certification procedures. Also, in August 2024, Dow Chemical faced difficulties due to new regulations in the United States that limited the use of certain surfactants in defoamers for industrial purposes. The goal of these rules was to reduce the environmental effects of defoaming agents, necessitating Dow to dedicate resources to developing new formulations that adhere to the updated guidelines. The strict regulatory landscape compels businesses to swiftly adjust, finding a balance between utilizing efficient defoaming strategies and staying in line with regulations to prevent legal consequences and market entry barriers. This challenge highlights the increasing significance of creating environmentally friendly defoamers and successfully navigating intricate regulatory environments to guarantee both environmental safety and market competitiveness.

By Product

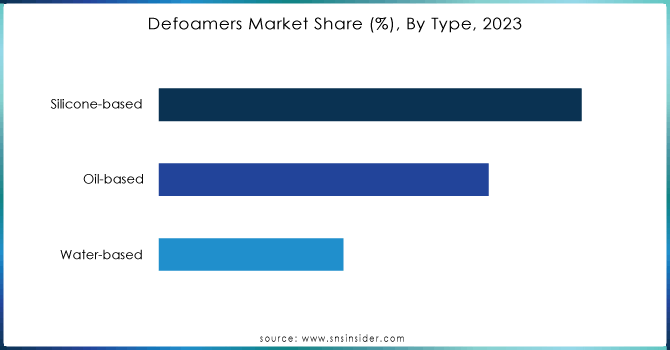

In 2023, the silicone-based defoamers sector was the leading in the defoamers market, showcasing their extensive utility and efficiency in multiple industries. Silicone-based antifoaming agents are recognized for their excellent effectiveness, especially in uses that demand resistance to high temperatures and chemicals, making them well-suited for sectors like automotive, oil and gas, and textiles. In March 2023, Momentive Performance Materials saw a large uptick in the need for silicone-based defoamers, mainly due to their use in high-quality coatings and industrial procedures. This portion's superior position is also backed by its expected market share of around 45%, showing its wide range of uses and the continued favor of silicone-based options because of their improved performance qualities over other varieties. The significant market influence of silicone-based defoamers showcases their crucial importance in addressing the challenging needs of different industrial uses.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

The water treatment sector dominated the defoamers market in 2023, due to the growing demand for efficient foam management in municipal and industrial water treatment plants. Defoamers are necessary for water treatment to avoid foam formation in activities like wastewater treatment and water recycling, which can affect effectiveness and system operation. In February 2023, Solvay noted a significant increase in demand for their defoamers used in water treatment, underscoring their important function in handling foam in municipal water treatment facilities on a large scale. This portion commanded about 40% of the market, showcasing its strong influence from the extensive use of defoamers in ensuring efficiency and meeting regulations in water treatment systems. The importance of the water treatment sector highlights its crucial role in dealing with foam-related issues in key environmental management procedures.

Regional Analysis

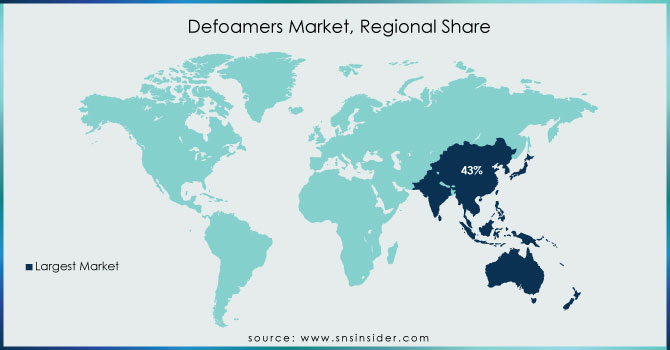

In 2023, Asia Pacific dominated the defoamers market and accounted for around 43% of the revenue share. The chemicals, paints, coatings, food, and beverages sector played a vital role in increasing the need for defoamers. These industries face the problem of foam formation during their manufacturing process, and hence, need defoamers to increase their operational efficiency. Scenario, the high rate of economic development of countries such as China, India, and Japan has also increased the need for defoamers. The rate of industrial development and urban expansion of these countries has increased the need for defoamers in wastewater treatment, pulp and paper production, oil, and gas refining. By increasing the number of research and development activities of major industries, the defoamers market has grown.

Moreover, in 2023, Europe emerged as the second leading region in the defoamers market, mainly because of its strong industrial foundation and strict environmental rules that are increasing the need for more advanced defoaming options. The diverse industrial sectors in Europe, such as automotive, pharmaceuticals, and food and beverages, contribute to its substantial market presence due to the need for efficient foam control. In Germany, BASF increased manufacturing of defoamers in April 2023 because the pharmaceutical and food industries, which are two of the major industries of the country, need these products. Moreover, Europe has sustainability concerns and requires environmentally friendly deforming agents to meet its strict environmental regulations. By 2023, Europe is expected to amount to the defoamers market share of around 30% due to many reasons that contribute to this region’s importance in the global market. These reasons include the strong industrial sector and the need for environmentally friendly deservers that can satisfy the severe regulations of the region.

The major key players are BASF SE, Clariant AG, Merck KGaA, Ashland Inc., Dow Corning Corporation, Evonik Industries AG, Shin-Etsu Chemical Co. Ltd., Kemira Oyj, Baker Hughes, Eastman Chemical Company, Air Products and Chemicals, and other key players mentioned in the final report.

April 2024: Evonik Coating Additives unveiled TEGO Foamex 16 and TEGO Foamex 11 at the American Coatings Show to improve the green credentials and performance of water-based architectural coatings.

November 2023: BASF expanded defoamer production at its Dilovasi plant in Turkey to meet rising demand and improve delivery schedules in Southeast Europe, the Middle East, and Africa.

June 2023: Elementis Plc introduced DAPRO BIO 9910, a bio-derived defoamer made from renewable vegetable oil, serving as a sustainable option to traditional defoamers.

May 2023: BRB International B.V. introduced Akasil Antifoam XP 20, a newly developed alkali-stable silicone-based anti-foam emulsion, suitable for surfactant-rich formulations.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.6 Billion |

| Market Size by 2032 | US$ 5.6 Billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Oil-based, Water-based, Silicone-based, and Others) • By Application (Pulp & Paper, Water Treatment, Oil & gas, Paints & Coatings, Agrochemicals, Pharmaceuticals, Detergents, Food & Beverages, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Clariant AG, Merck KGaA, Ashland Inc., Dow Corning Corporation, Evonik Industries AG, Shin-Etsu Chemical Co. Ltd., Kemira Oyj, Baker Hughes, Eastman Chemical Company, Air Products and Chemicals and other players |

| Key Drivers | • Increasing demand for defoamers from various industries • Growing demand for the defoamers in water treatment |

| RESTRAINTS | • Volatility of raw material prices • High cost associated with the production and quality control of the defoamers |

Ans. The Compound Annual Growth rate for the Defoamers Market over the forecast period is 5.1%.

Ans. The projected market size for the Defoamers Market is USD 5.6 billion by 2032.

Ans: Increasing demand from the packaging industry for paper-based products is one of the opportunities that fuel the demand for the Defoamers market

Ans: Industries such as pulp and paper, oil and gas, and wastewater treatment are witnessing rapid growth, driving the demand for defoamers. These sectors require effective foam control agents to enhance productivity, reduce downtime, and maintain product quality.

Ans: Yes, you can ask for the customization as per your business requirement.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Defoamers Market Segmentation, by Product

7.1 Chapter Overview

7.2 Oil-based

7.2.1 Oil-based Market Trends Analysis (2020-2032)

7.2.2 Oil-based Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Water-based

7.3.1 Water-based Market Trends Analysis (2020-2032)

7.3.2 Water-based Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Silicone-based

7.4.1 Silicone-based Market Trends Analysis (2020-2032)

7.4.2 Silicone-based Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Defoamers Market Segmentation, by Application

8.1 Chapter Overview

8.2 Pulp & Paper

8.2.1 Pulp & Paper Market Trends Analysis (2020-2032)

8.2.2 Pulp & Paper Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Water Treatment

8.3.1 Water Treatment Market Trends Analysis (2020-2032)

8.3.2 Water Treatment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Oil & gas

8.3.1 Oil & gas Market Trends Analysis (2020-2032)

8.3.2 Oil & gas Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Paints & Coatings

8.3.1 Paints & Coatings Market Trends Analysis (2020-2032)

8.3.2 Paints & Coatings Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Agrochemical

8.3.1 Agrochemical Market Trends Analysis (2020-2032)

8.3.2 Agrochemical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pharmaceuticals

8.3.1 Pharmaceuticals Market Trends Analysis (2020-2032)

8.3.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Detergents

8.3.1 Detergents Market Trends Analysis (2020-2032)

8.3.2 Detergents Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Food & Beverages

8.3.1 Food & Beverages Market Trends Analysis (2020-2032)

8.3.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Others

8.3.1 Others Market Trends Analysis (2020-2032)

8.3.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Defoamers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 USA

9.2.6.1 USA Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 USA Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Canada

9.2.7.1 Canada Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Canada Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.8 Mexico

9.2.8.1 Mexico Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.8.2 Mexico Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Defoamers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Poland

9.3.1.6.1 Poland Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Poland Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Romania

9.3.1.7.1 Romania Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Romania Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Hungary

9.3.1.8.1 Hungary Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Hungary Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Turkey

9.3.1.9.1 Turkey Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Turkey Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Defoamers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 Germany

9.3.2.6.1 Germany Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 Germany Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 France

9.3.2.7.1 France Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 France Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 UK

9.3.2.8.1 UK Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 UK Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Italy

9.3.2.9.1 Italy Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Italy Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Switzerland

9.3.2.12.1 Switzerland Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Switzerland Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Austria

9.3.2.13.1 Austria Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Austria Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.14 Rest of Western Europe

9.3.2.14.1 Rest of Western Europe Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.14.2 Rest of Western Europe Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Defoamers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 China

9.4.6.1 China Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 China Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 India

9.4.7.1 India Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.7.2 India Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Japan

9.4.8.1 Japan Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Japan Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 South Korea

9.4.9.1 South Korea Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 South Korea Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Vietnam

9.4.9.1 Vietnam Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Vietnam Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Singapore

9.4.10.1 Singapore Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Singapore Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.12 Australia

9.4.12.1 Australia Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.12.2 Australia Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.13 Rest of Asia Pacific

9.4.13.1 Rest of Asia Pacific Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.13.2 Rest of Asia Pacific Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Defoamers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 UAE

9.5.1.6.1 UAE Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 UAE Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Egypt

9.5.1.7.1 Egypt Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Egypt Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Saudi Arabia

9.5.1.8.1 Saudi Arabia Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Saudi Arabia Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Qatar

9.5.1.9.1 Qatar Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Qatar Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Defoamers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 South Africa

9.5.2.6.1 South Africa Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 South Africa Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Nigeria

9.5.2.7.1 Nigeria Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.7.2 Nigeria Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.8 Rest of Africa

9.5.2.8.1 Rest of Africa Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.8.2 Rest of Africa Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Defoamers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Brazil

9.6.6.1 Brazil Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Brazil Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Argentina

9.6.7.1 Argentina Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Argentina Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Colombia

9.6.8.1 Colombia Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Colombia Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.9 Rest of Latin America

9.6.9.1 Rest of Latin America Defoamers Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.9.2 Rest of Latin America Defoamers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 BASF SE

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Clariant AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Merck KGaA

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Ashland Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Dow Corning Corporation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Evonik Industries AG

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Shin-Etsu Chemical Co. Ltd.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Kemira Oyj

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Baker Hughes

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Eastman Chemical Company

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

10.11 Air Products and Chemicals

10.11.1 Company Overview

10.11.2 Financial

10.11.3 Products/ Services Offered

10.11.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Oil-based

Water-based

Silicone-based

Others

By Application

Pulp & Paper

Water Treatment

Oil & gas

Paints & Coatings

Agrochemical

Pharmaceuticals

Detergents

Food & Beverages

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Fire-resistant Coatings Market was valued at USD 1079.4 million in 2023 and is expected to reach USD 1478.8 million by 2032, at a CAGR of 3.6% from 2024-2032.

Furandicarboxylic Acid Market was valued at USD 3.7 Billion in 2023 and is expected to reach USD 50.6 Billion by 2032, at a CAGR of 34.0% from 2024-2032.

The Bio-Polyamide Market Size was valued at USD 224.3 million in 2023 and will reach USD 925.2 million by 2032 and grow at a CAGR of 17.1% by 2024-2032.

The Benzoates Market Size was valued at USD 3.42 Billion in 2023 and is expected to reach USD 5.73 Billion by 2032, growing at a CAGR of 5.89% over the forecast period of 2024-2032.

The Sulfur Bentonite Market size was valued at USD 144.8 million in 2023. It is anticipated to reach USD 224.4 million by the year 2032 with a projected CAGR of 5.0% during the forecast period of 2024-2032.

Organic Chemicals Market was valued at USD 12.75 billion in 2023 and is expected to reach USD 24.25 billion by 2032, growing at a CAGR of 7.40% from 2024-2032.

Hi! Click one of our member below to chat on Phone