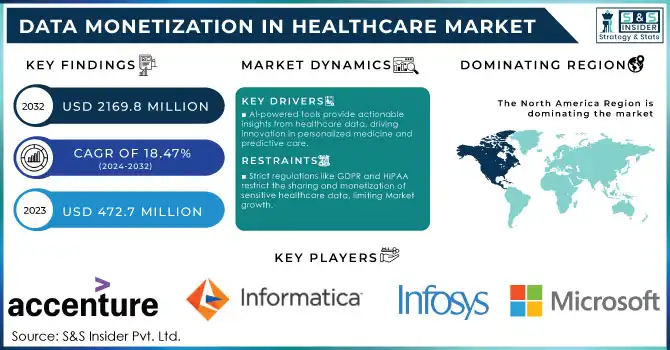

Data Monetization in Healthcare Market Key Insights:

The Data Monetization in Healthcare Market Size was valued at USD 472.7 Million in 2023 and will reach $2169.8 Mn by 2032, with a CAGR of 18.47% over the forecast period of 2024-2032. The Data Monetization in Healthcare Market is growing rapidly, fueled by the increasing integration of digital technologies like electronic health records (EHRs), big data analytics, and artificial intelligence. In 2024, it is estimated that over 85% of large healthcare organizations worldwide actively use data monetization strategies to improve operational efficiency and patient outcomes. This Market growth is underpinned by several key factors, including the drive to lower healthcare costs and the potential for data to optimize resource allocation and enhance clinical decision-making.

Get More Information on Data Monetization in Healthcare Market - Request Sample Report

For instance, the digitization of patient data enables predictive analytics that can identify at-risk populations, thereby reducing hospital readmissions by 15-20% on average. Initiatives such as the UK National Health Service's (NHS) implementation of EHRs across all hospitals by 2025, with a USD 2.15 billion investment, underscore the commitment to utilizing data for healthcare transformation. Similarly, in December 2023, OMNY Health raised USD 17 million to develop solutions for real-world data monetization, indicating strong investor confidence in the sector. Cloud-based solutions are a significant enabler, with 70% of healthcare organizations now utilizing cloud infrastructure to securely store and analyze vast data volumes. These platforms help organizations harness data to create insights for research and development, targeted interventions, and patient engagement strategies. Furthermore, the use of AI in healthcare data monetization, such as Google’s Vertex AI Search, launched in March 2024, illustrates the technological advancements driving innovation in the sector.

The increasing prevalence of chronic diseases has also amplified the need for data monetization. Data analytics help in personalizing treatments and streamlining healthcare delivery. Despite challenges like data standardization and security concerns, the market’s growth trajectory is propelled by continuous technological advancements, rising investments, and favorable regulatory frameworks aimed at improving data interoperability and utilization.

Data Monetization in Healthcare Market Dynamics

Drivers

-

AI-powered tools provide actionable insights from healthcare data, driving innovation in personalized medicine and predictive care.

-

Data monetization helps organizations reduce operational expenses by optimizing resource allocation and identifying inefficiencies.

-

Cloud infrastructure supports secure storage and easy access to massive healthcare datasets, facilitating data-driven strategies.

Cloud infrastructure plays a pivotal role in the Data Monetization in Healthcare Market, offering secure and scalable solutions for storing and accessing vast healthcare datasets. With the exponential growth of digital health records, clinical data, and IoT-driven real-time health monitoring, traditional on premise storage systems often fall short in capacity and accessibility. Cloud platforms overcome these challenges by providing a flexible, cost-effective, and secure environment for healthcare organizations to store, analyze, and monetize their data.

In healthcare, cloud infrastructure enables the aggregation of diverse data types, such as patient records, medical imaging, and genomic information, into unified databases. This consolidation not only enhances operational efficiency but also facilitates advanced analytics and real-time insights. For instance, by leveraging cloud-based AI tools, organizations can predict disease outbreaks, personalize patient care, and optimize resource allocation. The ability to access data seamlessly from multiple locations also supports collaborative research and development, especially in global clinical trials. Security is a critical factor, as healthcare data often contains sensitive personal information. Cloud providers implement advanced encryption, multi-factor authentication, and compliance with stringent regulations like HIPAA and GDPR to safeguard data integrity and privacy. For example, leading cloud platforms like AWS and Microsoft Azure offer specialized healthcare solutions that ensure secure data sharing among stakeholders while maintaining compliance. The adoption of cloud-based solutions has also significantly reduced infrastructure costs for healthcare organizations, enabling them to channel savings into innovation. Start-ups and smaller institutions benefit from the cloud's pay-as-you-go model, allowing them to leverage powerful analytics tools without hefty upfront investments. A notable example is the use of Google Cloud in genomic data processing, which accelerates research by providing rapid, scalable data analysis capabilities.

Overall, cloud infrastructure serves as the backbone for healthcare data monetization by enabling efficient data management, enhancing security, and supporting advanced analytics. As more healthcare organizations transition to digital ecosystems, the role of cloud platforms in facilitating data-driven strategies will continue to expand, driving innovation and improving patient outcomes.

Restraints

-

Strict regulations like GDPR and HIPAA restrict the sharing and monetization of sensitive healthcare data, limiting Market growth.

-

Inconsistent data formats and interoperability challenges hinder seamless integration and utilization of healthcare datasets.

-

Advanced tools like AI and block chain require expertise, which may not be readily available in all healthcare institutions.

The integration of advanced tools like artificial intelligence (AI) and block chain in the Data Monetization in Healthcare Market brings transformative potential. However, these technologies require specialized expertise, which is often lacking in many healthcare institutions. AI, with its capacity to analyze large datasets for predictive analytics, and block chain, known for secure and transparent data transactions, are pivotal for efficient and secure data monetization. Yet, the shortage of skilled professionals proficient in these advanced technologies limits their widespread adoption. Healthcare organizations often face challenges in recruiting and retaining talent with expertise in machine learning, natural language processing, or block chain development. For instance, implementing AI-driven analytics to forecast patient outcomes demands not only technical know-how but also domain-specific knowledge of medical data. Similarly, the deployment of block chain for secure data sharing requires skilled developers to design and maintain the system while ensuring compliance with healthcare regulations. The lack of expertise leads to delayed projects, underutilized tools, and increased reliance on external vendors, driving up costs. Smaller healthcare providers, in particular, struggle to adopt these technologies due to financial and resource constraints, further widening the gap between large organizations and smaller institutions in leveraging data monetization.

Training programs, partnerships with tech companies, and government incentives are some strategies being adopted to address these challenges. For example, collaborations between healthcare providers and AI firms are helping bridge the expertise gap by offering ready-to-use solutions and training programs.

| Challenges | Impact | Potential Solutions |

|---|---|---|

| Shortage of skilled AI/Blockchain experts | Limited adoption, increased costs | Training and certification programs |

| High complexity of technology integration | Slower project implementation | Use of pre-built AI/blockchain platforms |

| Compliance with healthcare regulations | Delays in deployment, non-compliance risks | Collaboration with tech-focused firms |

| Financial constraints in smaller institutions | Limited access to advanced tools | Government subsidies and partnerships |

Data Monetization in Healthcare Market Segmentation Analysis

By Method

The Analytics-enabled platform as a service segment dominated the Market and represented significant revenue share of 34.50% Market share during the year 2023. This segment is expanding due to increasing demand for healthcare enterprises to assess uniformity in the trends among the data, which led to heightened focus on their computational and statistical capabilities. Further boosting the segment growth in data monetization in healthcare Market is the rising application of analytical solution for product demand sensing in the pharmaceutical industry. The pharmaceutical sector witnesses the high usage of demand sensing, which assists retailers to identify possible customers of a particular product minus direct/indirect impact due to consumer behaviour to the entire supply chain.

During the forecast period, embedded analytics segment is projected to grow at the highest CAGR of 20.04%. Embedded analytics provides a set of analytical features for app level analysis of collected data to make data driven decisions. These analytics tools help health care organizations enhance their customer interaction. Moreover, the embedded analytics Market is garnering significant traction among SMEs and large enterprises due to their services in data analysis, data visualization, data visualization, and data management.

By Enterprise Size

In 2023, large enterprises segment held a Market share of more than 67.23%. This segment will continue to reach the highest growth due to the increasing efficiency of the cloud infrastructure technique that is seen being adopted by large healthcare enterprises. Furthermore, these businesses have multiple managed plus unmanaged devices that generate huge amounts of structured plus unstructured data, and they largely depend on cloud infrastructure to store and protect the data. The Market is driven by large enterprises who data monetize to organize their huge data sets and to yield economic value in measurable quantifiable units to realize business objectives.

The Small & Medium Enterprises (SMEs) segment is anticipated to grow at the highest CAGR of 18.80% during the forecast period. The growth of SME segment is attributed to wide adoption of AI platforms and economic data monetization solutions. In addition, the growing data volumes in SMEs are driving demand for standalone database systems, further driving Market growth. Moreover, impressive digitization in the healthcare sector is providing new avenues for SMEs to accept advanced solutions. Amidst SMES concentrating around operational cost cutting and maintaining operations in a more simplified manner, the demand for data monetization is on a boom.

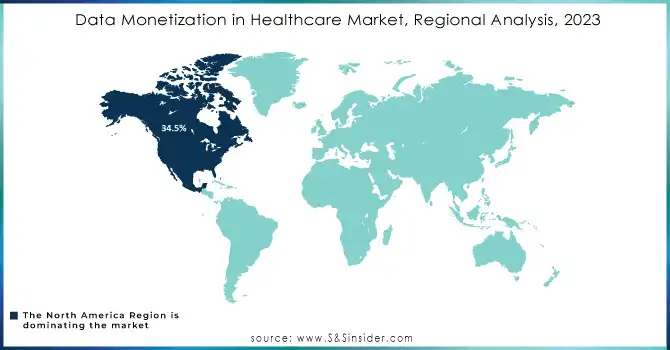

Data Monetization in Healthcare Market Regional Overview

The North America dominated the Market and represented the share of around 34.5% in 2023, High adoption of big data analytics and ongoing digital transformation in the healthcare sector are anticipated to drive North America data monetization in healthcare industry through the research period. U.S. healthcare data monetization Market is witnessing a rise in services that provide improved transparency processes within the industry as governments are increasingly encouraging digitization of several industries.

The potential growth opportunities of Asia Pacific data monetization in healthcare industry are attributed to the increasing adoption of cloud computing, growing adoption of artificial intelligence, and developing rapid investments in data centers by major players. In addition, the region's growing number of healthcare services and companies investing in data management solutions is expected to drive Market expansion during the predicted period.

Need Any Customization Research On Data Monetization in Healthcare Market - Inquiry Now

Key Players in Data Monetization in Healthcare Market

The major key players along with one products

-

Accenture – Accenture HealthTech Innovation

-

Informatica – Informatica Intelligent Data Management Cloud

-

Infosys Limited – Infosys Healthcare Analytics Platform

-

Innovaccer Inc. – Innovaccer Health Cloud.

-

Microsoft – Microsoft Azure Healthcare APIs.

-

Oracle Corporation – Oracle Health Data Analytics

-

SAP SE – SAP Health Engagement Platform

-

Optum (UnitedHealth Group) – OptumIQ.

-

Cerner Corporation – Cerner HealtheIntent.

-

Epic Systems – Epic Cosmos Data Network.

-

IBM Corporation – IBM Watson Health.

-

Allscripts Healthcare Solutions – Veradigm Network.

-

IQVIA – IQVIA Real-World Insights Platform.

-

Philips Healthcare – Philips HealthSuite Platform.

-

McKesson Corporation – McKesson Decision Support Tools.

-

Siemens Healthineers – Teamplay Digital Health Platform.

-

GE Healthcare – Edison Data Monetization Solutions.

-

athenahealth – athenaOne Analytics.

-

NextGen Healthcare – NextGen Population Health Analytics.

-

Cloudera – Cloudera Data Platform for Healthcare.

Recent Developments

-

January 2024 - Salesforce: Salesforce introduced advanced tools for real-time patient data analysis, enhancing personalized care using its Customer 360 platform integrated with Einstein AI and Data Cloud functionalities

-

February 2024 - Google Cloud: Google launched a new data platform aimed at healthcare providers to accelerate the monetization of patient data while adhering to HIPAA regulations. This service focuses on AI-enhanced insights for improving diagnostics and operational efficiency

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 472.7 Million |

| Market Size by 2032 | USD 2169.8 Million |

| CAGR | CAGR of 18.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Method (Data as a Service, Insight as a Service, Analytics-enabled Platform as a Service, Embedded Analytics) • By Enterprise Size (Large enterprises, Small & Medium Enterprises (SMEs)) • By End-User (Pharmaceutical and Biotechnology Companies, Healthcare Players, Medical Technology Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Informatica, Infosys Limited, Innovaccer Inc., Microsoft, Oracle Corporation, SAP SE, Optum (UnitedHealth Group), Cerner Corporation, Epic Systems, IBM Corporation. |

| Key Drivers | • AI-powered tools provide actionable insights from healthcare data, driving innovation in personalized medicine and predictive care. • Data monetization helps organizations reduce operational expenses by optimizing resource allocation and identifying inefficiencies. |

| Restraints | • Strict regulations like GDPR and HIPAA restrict the sharing and monetization of sensitive healthcare data, limiting Market growth. • Inconsistent data formats and interoperability challenges hinder seamless integration and utilization of healthcare datasets. |