Data Integration Market Size & Overview:

Get more information on the Data Integration Market - Request Free Sample Report

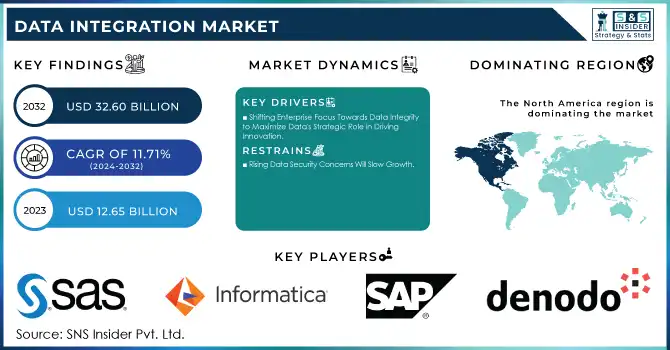

Data Integration Market was valued at USD 13.28 billion in 2023 and is expected to reach USD 37.78 billion by 2032, growing at a CAGR of 12.38% from 2024-2032.

The Data Integration Market has been experiencing significant growth in recent years, driven by the increasing volume of data generated across industries. This surge in data creation has made it essential for businesses to find efficient ways to integrate and manage this information. As organizations continue to adopt digital transformation strategies, the need to integrate disparate data sources has become a key factor in achieving actionable insights. Furthermore, the rise of cloud computing, big data analytics, and the Internet of Things has accelerated this demand. For example, on December 2024, AWS launched zero-ETL integration between Amazon DynamoDB and Amazon SageMaker Lakehouse, enabling users to analyze data without complex pipelines, further highlighting the growing need for seamless data integration solutions. This trend is expected to continue, as businesses increasingly rely on seamless data flow to enhance decision-making and operational efficiency, propelling the market forward at a strong pace.

The demand for data integration solutions is further fueled by the growing adoption of cloud platforms, which allow businesses to collect and process data from various sources in real time. This shift towards cloud-based infrastructures has made data integration even more crucial, as companies need to ensure data consistency, accuracy, and quality across multiple systems and applications. In September 2024, Salesforce announced significant innovations in its Data Cloud, which powers its Customer 360 and Agentforce, reflecting this trend. In response, businesses are striving to break down data silos, facilitating smoother integration across departments and platforms. This growing need for unified data solutions has led to the development of advanced tools incorporating AI and machine learning.

Looking ahead, the future of the data integration market presents ample opportunities, particularly with the continued advancement of artificial intelligence and automation technologies. On December 2024, Qlik unveiled new integrations with Databricks, SAP, and Snowflake aimed at enabling seamless data preparation for AI development, highlighting the growing role of AI in the market. As businesses prioritize data-driven decision-making, the need for solutions that can seamlessly integrate data across hybrid and multi-cloud environments is set to grow. This will be especially important in industries like healthcare, finance, and retail, where real-time data insights are crucial for operational success. Additionally, the rise of edge computing will drive innovation in data integration solutions.

Data Integration Market Dynamics

DRIVERS

-

The Increasing Demand for Seamless Data Access in Big Data and Advanced Analytics

As organizations increasingly rely on big data platforms and advanced analytics to derive actionable insights, the need for seamless data integration becomes paramount. To enable accurate and timely decision-making, businesses must access and unify vast amounts of both structured and unstructured data from various sources, including social media, sensors, and legacy systems. Effective data integration solutions ensure that this complex data can be processed, analyzed, and utilized efficiently. With the growing reliance on predictive analytics, machine learning models, and AI technologies, the ability to integrate real-time data from diverse sources is crucial. This integration is essential for businesses to stay competitive, innovate, and meet customer demands, propelling the demand for robust data integration tools and platforms.

-

The Impact of Automation and AI Integration on the Data Integration Market

Automation technologies and Artificial Intelligence (AI) are transforming industries by enabling smarter, more efficient operations. For AI and machine learning models to function effectively, they require access to high-quality data from multiple sources, which can be structured or unstructured. Integrated data management systems provide seamless connectivity between these diverse data points, ensuring that AI models receive real-time, accurate information. This capability is critical for automating processes, making data-driven decisions, and driving innovation across sectors such as finance, healthcare, and manufacturing. As organizations continue to adopt AI and automation, the need for robust data integration solutions grows. By ensuring that data from various systems and platforms can be easily accessed and processed, data integration becomes a crucial enabler of AI and automation success.

RESTRAINTS

-

The Financial Challenges and High Costs Hindering Widespread Adoption of Data Integration Market

Deploying data integration solutions often requires significant upfront investment in hardware, software, and specialized personnel. The costs associated with purchasing and maintaining these technologies can be a major financial burden, especially for small and medium-sized businesses. For SMBs, allocating resources for data integration may be challenging, as they may lack the capital or dedicated IT teams to manage complex systems. In addition to the initial setup costs, ongoing expenses for system updates, training, and maintenance can further strain budgets. This financial barrier limits the widespread adoption of data integration platforms, particularly among businesses with limited resources. As a result, many organizations may delay or opt out of implementing these solutions, hindering their ability to leverage data effectively.

-

The Technical Challenges and Complexities of Integrating Data Across Diverse Systems

Integrating data across diverse systems, especially when legacy infrastructure is involved, can be a highly complex and time-consuming process. Organizations often deal with data from various sources, each having different formats, structures, and technologies. Merging these disparate data sources requires specialized expertise and significant technical effort. Additionally, handling unstructured data, such as text, images, or videos, adds another layer of difficulty, as it often requires advanced techniques for parsing, cleaning, and normalizing data. The complexity of managing these integration challenges can lead to delays and increased costs, discouraging businesses from implementing data integration solutions. Organizations must invest in skilled personnel and sophisticated tools, further complicating the integration process and slowing down progress. This makes seamless data integration a significant obstacle for many companies.

Data Integration Market Segment Analysis

BY COMPONENT

In 2023, the Tools segment dominated the data integration market with a 72% global revenue share, driven by the growing demand for advanced software solutions. These tools, such as ETL platforms and API connectors, streamline data integration processes across diverse systems. Their ability to ensure seamless data flow and accessibility is crucial for businesses managing vast and complex datasets. This need for efficient, scalable tools is a key factor in their market dominance.

The Services segment is projected to grow at the fastest CAGR of 14.60% from 2024 to 2032, fueled by the increasing complexity of data integration needs. As businesses adopt hybrid and cloud environments, the demand for consulting, implementation, and support services rises. These services help organizations navigate custom integration challenges and optimize their data infrastructure. The continuous evolution of integration requirements further accelerates the growth of this segment.

BY ORGANIZATION SIZE

In 2023, the Large Enterprises segment dominated the data integration market with a 71% global revenue share, driven by the need for scalable solutions to manage large datasets. These organizations require advanced tools to integrate data across multiple departments and geographies. Their larger budgets allow them to invest in comprehensive, robust systems. The complexity of their operations further reinforces their dominance in the market.

The Small & Medium Enterprises segment is expected to grow at the fastest CAGR of 14.06% from 2024 to 2032, driven by the increasing adoption of affordable, cloud-based integration solutions. SMEs are embracing cost-effective tools that enable streamlined data management. As data becomes central to decision-making, Small & Medium Enterprises sare investing in integration platforms to stay competitive. This growing demand for accessible solutions fuels rapid market expansion.

BY DEPLOYMENT

In 2023, the On-premises segment dominated the data integration market with a 60% global revenue share, driven by the preference of large enterprises for secure, control-oriented solutions. Many organizations with sensitive data or legacy systems continue to rely on on-premises integration tools to maintain security and compliance. These solutions offer greater control over data and integration processes, making them essential for industries with strict regulatory requirements.

The Cloud segment is expected to grow at the fastest CAGR of 13.79% from 2024 to 2032, fueled by the growing shift towards cloud-based solutions for flexibility and scalability. Cloud integration platforms offer businesses the ability to streamline operations and manage data from anywhere, at lower costs. As more organizations move towards digital transformation, the demand for cloud-based data integration solutions grows rapidly, driven by ease of use, reduced infrastructure costs, and real-time access to data.

BY BUSINESS APPLICATION

In 2023, the Marketing segment dominated the data integration market with a 31% global revenue share, driven by the need for unified data across multiple customer touchpoints. Marketing teams require integrated data from sources like CRM systems and social media to personalize campaigns effectively. Access to real-time data helps optimize customer engagement and boost campaign ROI. This data-driven approach makes integration crucial for marketing success.

The Operations & Supply Chain segment is expected to grow at the fastest CAGR of 15.31% from 2024 to 2032, driven by the need for real-time data to optimize supply chain operations. Integration tools help businesses improve inventory management, reduce costs, and streamline logistics. As industries continue digital transformation, the demand for seamless integration in operations grows. This trend propels the rapid expansion of the segment.

REGIONAL ANALYSIS

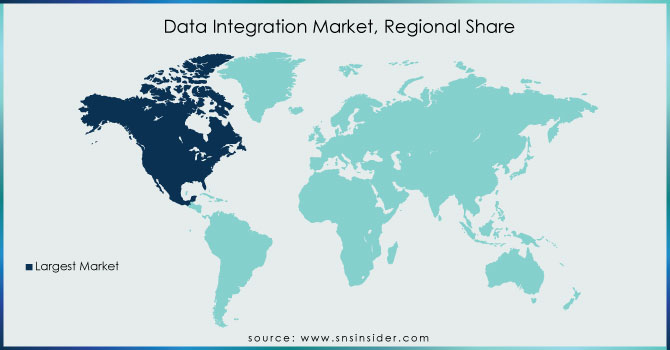

In 2023, North America dominated the data integration market with a 40% global revenue share, driven by the region's advanced technological infrastructure and high adoption rates of data-driven solutions. Enterprises across industries in North America prioritize digital transformation, leveraging data integration tools to streamline operations and enhance decision-making. The presence of major technology providers and a favorable business environment further strengthen North America's leadership in the data integration market.

Asia Pacific is expected to grow at the fastest CAGR of 14.68% from 2024 to 2032, fueled by rapid economic growth and increasing investments in digital technologies. As businesses in emerging economies embrace data integration to improve operational efficiency, demand for integration solutions rises. The region’s growing focus on cloud adoption, e-commerce, and manufacturing automation also accelerates the need for effective data management, driving significant market expansion.

Need any customization research on Data Integration Market - Enquiry Now

KEY PLAYERS

-

Microsoft (Azure Data Factory, SQL Server Integration Services)

-

Informatica Inc. (PowerCenter, Cloud Data Integration)

-

International Business Machines Corporation (IBM) (IBM DataStage, IBM InfoSphere Information Server)

-

SAP (SAP Data Services, SAP BusinessObjects Data Integrator)

-

Oracle (Oracle Data Integrator, Oracle GoldenGate)

-

Talend (Talend Data Integration, Talend Cloud Integration)

-

SAS Institute Inc. (SAS Data Integration Studio, SAS Data Management)

-

TIBCO Software Inc. (TIBCO Data Integration, TIBCO Cloud Integration)

-

Denodo Technologies (Denodo Platform, Denodo Express)

-

QlikTech International AB (Qlik Replicate, Qlik Compose)

-

Information Builders (WebFOCUS Data Integration, iWay Data Integration)

-

Cisco Systems Inc. (Cisco Data Virtualization, Cisco Tetration Analytics)

-

Attunity Ltd. (Attunity Replicate, Attunity Compose)

-

Denodo Technologies (Denodo Platform, Denodo Express)

-

Teradata (Teradata Data Integration, Teradata Vantage)

-

Talend (Talend Data Integration, Talend Cloud Integration)

-

Intel Corporation (Intel Data Platform, Intel Data Center Manager)

-

Syncsort (DMX, Connect)

-

Real-Time Technology Solutions (Real-Time Data Integration, Real-Time Analytics)

-

Panoply Ltd. (Panoply Data Integration, Panoply Data Warehouse)

-

Skyvia (Skyvia Data Integration, Skyvia Cloud Backup)

-

Amazon Web Services (AWS Glue, Amazon Redshift)

RECENT DEVELOPMENT

-

On December 18, 2024, Microsoft announced the general availability of healthcare data solutions in Microsoft Fabric, enabling organizations to integrate, store, and analyze healthcare data from diverse sources.

-

Informatica's Fall 2024 release enhances data preparation for AI, with improvements like better integration for Databricks and Google BigQuery. The update helps enterprises manage both structured and unstructured data, ensuring it's ready for AI development and improving model performance.

-

On September 10, 2024, Oracle announced the introduction of its Intelligent Data Lake as part of the Oracle Data Intelligence Platform, designed to unify data from diverse sources with advanced AI-powered analytics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.28 Billion |

| Market Size by 2032 | USD 37.78 Billion |

| CAGR | CAGR of 12.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Tools, Services) •By Organization Size (Large Enterprises, Small & Medium Enterprises) •By Deployment (Cloud, On-premises) •By Business Application (Marketing, Sales, Operations & Supply Chain, Finance, HR) •By End-user (IT & Telecom, BFSI, Healthcare, Manufacturing, Retail & E-commerce, Government & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Informatica Inc., International Business Machines Corporation (IBM), SAP, Oracle, Talend, SAS Institute Inc., TIBCO Software Inc., Denodo Technologies, QlikTech International AB, Information Builders, Cisco Systems Inc., Attunity Ltd., Denodo Technologies, Teradata, Talend, Intel Corporation, Syncsort, Real-Time Technology Solutions, Panoply Ltd., Skyvia, Amazon Web Services (AWS). |

| Key Drivers | • The Increasing Demand for Seamless Data Access in Big Data and Advanced Analytics • The Impact of Automation and AI Integration on the Data Integration Market |

| RESTRAINTS | • The Financial Challenges and High Costs Hindering Widespread Adoption of Data Integration Market • The Technical Challenges and Complexities of Integrating Data Across Diverse Systems |