Data Collection And Labeling Market Report Scope & Overview:

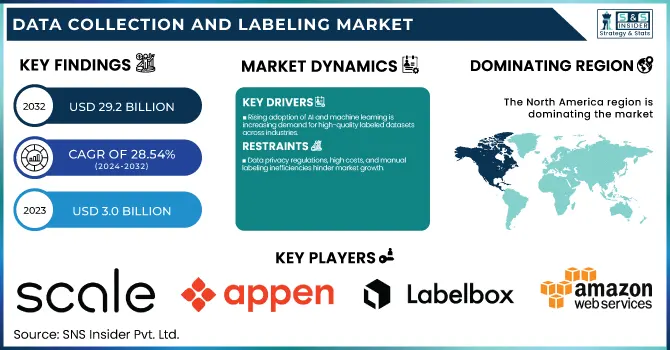

The Data Collection And Labeling Market was valued at USD 3.0 Billion in 2023 and is expected to reach USD 29.2 Billion by 2032, growing at a CAGR of 28.54% from 2024-2032.

To Get more information on Data Collection And Labeling Market - Request Free Sample Report

In 2023, AI-driven data labeling technologies saw increased adoption, enhancing speed and accuracy in annotation. Regional deployment of data annotation platforms showed North America and Asia-Pacific leading in AI adoption. AI and automation's impact on labeling efficiency improved processing large datasets while minimizing manual work. Meanwhile, crowdsourced data labeling services grew, offering scalable and cost-effective human-in-the-loop solutions. The latest report highlights a shift toward hybrid models that blend AI automation with human oversight, improving accuracy and efficiency in data labeling.

Data Collection And Labeling Market Dynamics

Drivers

-

Rising adoption of AI and machine learning is increasing demand for high-quality labeled datasets across industries.

There is a need for high-quality labeled datasets across industries due to the increasing adoption of AI and machine learning. As more companies look to train AI models for things like self-driving cars, medical diagnostics or natural language processing, data annotation is becoming. Automated as well as AI-driven data labeling tools have made the process more efficient, which in turn has reduced the time and cost of manual labeling. At the same time, the rapid growth of sectors including e-commerce, social media, and customer analytics is creating an insatiable demand for massive amounts of labeled data. Cloud-based platforms have allowed organizations to adopt scalable solutions for real-time data labeling, which will accommodate faster market expansion.

Restraints:

-

Data privacy regulations, high costs, and manual labeling inefficiencies hinder market growth.

Although it is being adopted slowly, we are bound to face non-trivial challenges regarding data collection, data labeling, data privacy, data security, and compliance. Regulations like GDPR and CCPA have a real impact on what you can do with user data, and the number of usable high-quality datasets out there is few and far between. Although manual labeling has been labor-intensive and error-prone, lowering accuracy and scalability. High expenses of proficient annotators as well as cutting-edge AI-driven tagging solutions can be challenging for small-to-mid-sized organizations. Bias data and its effect on the decision-making process of AI is another ethical issue that largely restrains the digital workforce, which forces organizations to implement transparent data labeling practices properly, according to the information they desire.

Opportunities:

-

AI-driven automation and self-supervised learning enhance scalability and accuracy in data labeling.

The growing penetration of AI-powered automation in data labeling, coupled with the enormous scope, creates lucrative growth opportunities in the market. The latency will be reduced, and costs will be lower because of the combination of AI-powered annotation tools with a human-in-the-loop model that provides a trade-off between the accuracy and costs. Self-supervised and semi-supervised learning grows the capability of an AI model to label data with little or no human input while providing strong scalability. New healthcare, robotics, and autonomous systems applications continue to open fresh use cases. Furthermore, the growth of edge computing and IoT devices naturally produces massive volumes of unstructured data, creating opportunities for AI-enabled data-labeling solutions to optimize real-time processing and analysis.

Challenges:

-

Ensuring data quality, managing large datasets, and addressing cybersecurity risks remain key concerns.

Maintaining the quality and the consistency of the data is one of the main challenges that the data collection and labeling market has to face. Human errors in labeling can cause adverse effects when feeding into AI models as the learning data is biased. Full-scale, heterogeneous text corpora in multiple languages and domains require a huge amount of resources, which makes for a consistently standardized labeling process problematic to implement. The increasing complexity of the models themselves is another hurdle requiring more complex labelled datasets. In addition, malicious actors may target these data annotation platforms as well, undermining the integrity and confidentiality of data. Addressing these hurdles demands constant automation innovation, rigorous quality controls, and secure frameworks.

Data Collection And Labeling Market Segmentation Analysis

By Data Type

In 2023, the image/video segment led the global market with a revenue share of more than 41%, attributed to the growing need for high-quality annotated visual data to train AI and machine learning models. Industries from autonomous driving to facial recognition and healthcare diagnostics depend on images and videos with annotations to train their algorithms to identify patterns accurately.

The text is expected to register the fastest CAGR During the forecast period, which has been driven by the demand for natural language processing and sentiment analysis across a wide range of sectors. High-quality labeled text data is necessary for training language understanding, chatbot, translation, and voice recognition models as businesses across finance, customer service, healthcare, and e-commerce increasingly embrace AI-driven tools.

By Vertical

In 2023, the IT segment dominated the market and accounted for significant revenue share. Driven by the increasing adoption of artificial intelligence and machine learning across the sector to automate and optimize business processes. As organizations see more value in AI-driven insights for their day-to-day operations, labeling data accurately — a key step that underpins the effectiveness of the algorithms and models — has become more critical than ever, driving demand. Labeled data is widely used in the IT industry for a variety of applications including predictive analytics, cybersecurity and IT automation, making accurate data labeling critical to improving the effectiveness of algorithms.

The automotive segment is expected to register the fastest CAGR during the period of forecast, with advanced driver-assistance systems. Automakers, technology companies and startups need high volume, accurately labeled image and sensor data to train neural networks and AI models to perform functions like object detection, lane recognition and pedestrian safety under normal driving scenarios.

Regional Analysis

North America dominated the market and accounted for 36% in 2023, owing to the region's high level of technological development and strong demand for AI and machine learning applications. North America is home to tech giants and AI research centers and has high demand for labeled data to support innovations across automotive, health, and retail industries.

The Asia Pacific region is also expected to see the fastest CAGR in the data collection and labeling industry over the forecast period, due to accelerated technology growth and a growing digital economy. Moreover, in countries such as China and India, the latent investment in AI research and development has led to a flourishing market of data annotation start-ups.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Scale AI – Scale Data Engine

-

Appen – Appen Data Annotation Platform

-

Labelbox – Labelbox AI Annotation Platform

-

Amazon Web Services (AWS) – Amazon SageMaker Ground Truth

-

Google – Google Cloud AutoML Data Labeling Service

-

IBM – IBM Watson Data Annotation

-

Microsoft – Azure Machine Learning Data Labeling

-

Playment (by TELUS International AI) – Playment Annotation Platform

-

Hive AI – Hive Data Labeling Platform

-

Samasource – Sama AI Data Annotation

-

CloudFactory – CloudFactory Data Labeling Services

-

SuperAnnotate – SuperAnnotate AI Annotation Tool

-

iMerit – iMerit Data Enrichment Services

-

Figure Eight (by Appen) – Figure Eight Data Labeling

-

Cogito Tech – Cogito Data Annotation Services

Recent Developments

-

In November 2024, Uber launched its "Scaled Solutions" division, leveraging gig workers for data labeling tasks to support machine learning and AI models. This initiative extends Uber's business model into the AI sector, offering services like data annotation and feature testing to external clients.

-

In 2024, Scale AI continued to grow, employing over 100,000 contractors worldwide for data labeling tasks essential in training AI models. This expansion has positioned Scale AI as a significant player in the AI data annotation industry.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 3.0 Billion |

|

Market Size by 2032 |

USD 29.2 Billion |

|

CAGR |

CAGR of 28.54% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Data Type (Text, Image/Video, Audio) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Scale AI, Appen, Labelbox, Amazon Web Services (AWS), Google, IBM, Microsoft, Playment (by TELUS International AI), Hive AI, Samasource, CloudFactory, SuperAnnotate, iMerit, Figure Eight (by Appen), Cogito Tech |