Data Centre Cooling Market Report Scope & Overview:

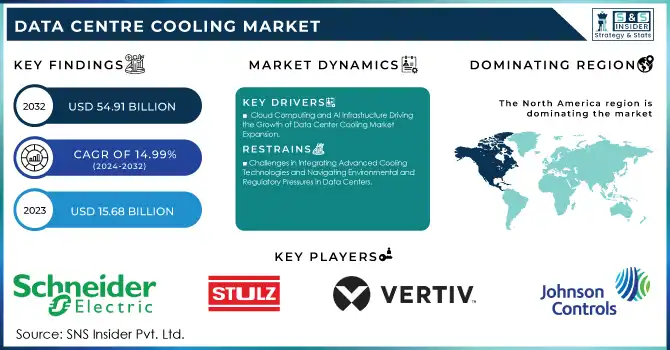

The Data Centre Cooling Market Size was valued at USD 15.68 Billion in 2023 and is expected to reach USD 54.91 Billion by 2032 and grow at a CAGR of 14.99% over the forecast period 2024-2032.

To get more information on Data Centre Cooling Market - Request Free Sample Report

Because of the widespread use of digital technologies, global demand for data storage and processing is rising, so the data center cooling market is growing rapidly. Following the increasing usage of industries providing cloud computing, artificial intelligence, and big data analytics, the demand for energy-efficient, high-performance data centers is rising. Data centers contain thousands of IT devices that output significant heat and require cooling systems for efficient operation and to keep equipment from failing. Various innovations in cooling technologies like liquid cooling and economizer systems have made it possible to meet this increasing demand. The rapid increase in data traffic generated by the growth of 5G networks and IoT devices also directly impacts the need for cooling systems in data centers. The energy consumption of liquid cooling systems can be reduced by 40% compared to traditional air-cooling methods. A failure to effectively cool U.S. data centers, which emit 2.6 million tons of CO2 every year, demonstrates one of the most essential elements of computing resource management. Due to the increase of 5G networks and IoT devices creating even more data all over the world, global data traffic will reach 1.4 exabytes per month by 2025. Due to high-density IT equipment, modern data centers are now having to contend with 40-50 kW per rack and increasing cooling demands.

The rising need for energy efficiency and sustainability is another major factor driving the growth of the data center cooling market. With rising energy costs and growing environmental initiatives, businesses are eager to learn how to lower their carbon footprint. Growing demand from market technological coolers which increase efficiency and consumption of lower energy. In addition, to that, regulatory push from the government and corporate sustainability objectives compels data center operators to migrate to greener technologies. This has resulted in the design of cooling systems that use less energy and thus are capable of reducing operating costs while fulfilling sustainability standards and supporting the growth of the market. The global average Power Usage Effectiveness (PUE) of data centers in 2024 reaches 1.6, where top performers achieve 1.1 and below. Close to half (50%) of the world output of data centers benefit from renewable energy wholes prompted by CO2-weak energy get-together, an aid boost from 2020 anyway a litter behind the targets accomplished of 2025. Cooling systems powered by AI can reduce energy usage by 25%. Here in the EU, the Green Deal requires data centers to cut carbon emissions by 55% by 2030. Moreover, 25% of U.S. data centers use water-saving solutions for cooling, and some of the tech giants are trying to achieve carbon neutrality in 2030.

MARKET DYNAMICS

KEY DRIVERS:

-

Cloud Computing and AI Infrastructure Driving the Growth of Data Center Cooling Market Expansion

One of the key factors driving the growth of the data center cooling market is the exponential growth of cloud computing services. While businesses and individuals are moving to a cloud-based infrastructure for data collection, processing, and management, the number of data centers needed to support the demand for its use rises exponentially. The data centers contain all the information and applications for many different fields of work, such as finance and entertainment. With increasing cloud computing adoption among enterprises, demand for reliable, scalable, and efficient cooling systems to keep servers and IT infrastructure running at high performance is anticipated to increase. The expansion of cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud is triggering demand for new cooling technologies that will handle higher thermal loads in these centers. Double the increase in the consumption of data center infrastructure to deliver cloud services results in round-the-clock operational data centers and cooling systems, with no room for downtime and failure, which will drive the growth of the global cooling Systems Market even more. AI infrastructure will cause a 33% annual increase in data center capacity, resulting in 70% of all data center capacity reserved for AI workloads by 2030. Cloud computing and AI infrastructure giant Amazon Web Services (AWS) is spending USD 11 billion in Georgia for a major expansion. Globally, the energy consumption of data centers will be growing at the rate of 4% each year.

-

The Rise of High-Density Computing and Advanced Cooling Technologies Driving Growth in Data Center Market

Increasing dependency on high-density computing with advanced cooling will further ignite the growth in the data center cooling market. Through advancements in technology, we have progressed from using old server racks for our data centers toward more compact High-Density servers, designed to process more petabytes of data in a smaller space. This most of the heat in tighter spaces, which requires more developed cooling technologies. Liquid cooling systems, immersion cooling, and even other newer methodologies are required if we have a very high-density environment seeing conventional air-based cooling systems saturate bounds. They not only tackle the heat-related challenges of high-density computing, but they also provide better energy efficiency which is becoming more and more important in a competitive landscape. High-density computing systems are being adopted into an increasing number of industries, and the requirement for specific cooling systems will drive the market. Data centers represent a solid 2–3% of electricity consumed in the world, a number that is anticipated to increase head-on. High-density computing is being employed at around 60% of new data centers and liquid cooling solutions are being utilized in around 18% of new data centers. Such technologies can decrease cooling energy consumption by 40%.

RESTRAIN:

-

Challenges in Integrating Advanced Cooling Technologies and Navigating Environmental and Regulatory Pressures in Data Centers

The complexity of integrating new cooling technologies with existing infrastructure is one of the major constraints for the data center cooling market. Most data centers that rely on traditional cooling systems cannot easily switch to advanced solutions such as liquid or immersion cooling without extensive upgrades. This can be a significant hurdle for aged plants or those that are constrained in the room for further plants. Additionally, there may not be sufficient maintenance and technical support suitable regionally for some cooling technologies like direct-to-chip generic or various forms of liquid cooling. From all of this, another challenge is that the cooling system itself has positive effects on the environment. Even though up-and-coming technologies are designed to use less energy, the built materials for some cooling methods (refrigerants) can affect the environment if not handled properly. Regulatory bodies are also putting more pressure on data centers to go green. They must now navigate strict regulatory frameworks that require them to balance performance with sustainability.

SEGMENTS ANALYSIS

BY COMPONENT

The solutions segment accounted for 60.4% of the data center cooling market share in 2023, as the need for efficient cooling technology solutions will help to improve the performance and efficiency of the data centers. These air conditioning systems, precision air conditioners, liquid cooling systems, and economizer systems are well-established solutions for ensuring that the desired temperature conditions are met so that high-performance servers and IT infrastructure can operate within range. Data centers are becoming an intrinsic part of business infrastructure, and these systems are used to ensure cooling for the rising amount of data as complexity increases, the need for a reliable, effective cooling solution will also rise. The higher market share is due to large investments put in by data center operators in installing these solutions for their cooling needs.

The services segment is anticipated to grow at the highest CAGR between 2024-2032, owing to the rising demand for maintenance and installation services, along with consulting services. Service providers have a hot hand too—even as the data center infrastructures they serve become more complex and require tailored cooling solutions, the seamless installation and maintenance of which demand that the integration of these approaches be well honed. In addition, the growing demand for professional advice related to energy efficiency optimization, operational cost reduction, and sustainability goal achievement further increases growth in the consulting segment. Maintenance and support services are also growing very fast with data centers needing the ability to continuously monitor and manage their cooling systems to prevent downtime and prolong the service life of the equipment. These trends mean that the services sector is expected to expand rapidly in the future.

BY SOLUTION

Air Conditioners held the largest share of 33.7% of the data center cooling market in 2023, as most small-scale and large-scale data centers utilize this equipment for cooling purposes. Conventional air conditioning systems can be effective in keeping steady temperatures for different infrastructure types. The combination of their laws of incumbency and how seamlessly they integrate into existing data centers gives them the lion’s share of the market. Air conditioners, more particularly precision air conditioner this type of air conditioners are commonly used in data centers since it's specially designed to cope with the volatile thermal management requirement that the data center poses, where sensitive equipment such as servers, and storage systems require very strict temperature ranges which is vital for maximum performance and failure avoidance. Air conditioning systems have become an integral part of the data center ecosystem due to their maturity and scalability.

Precision air conditioners will witness the fastest CAGR during 2024-2032 owing to the growing demand for greater precision & energy efficiency in cooling systems. Traditionally, air change control does not provide the same level of control in a high-density computing application that has become a necessity as data centers are evolving over the years. As data center heat loads increase and as they face escalating demand for overall energy consumption reductions, precision air conditioners were developed to offer precise temperature control along with more energy-efficient cooling solutions. Thereby, these systems are rapidly emerging due to gaining popularity in most modern high-performance data centers, especially for cloud computing, artificial intelligence, and other high-performance applications.

BY SERVICE

The Installation & Deployment captured the largest share of 48.7% in 2023, as these services are crucial right at the beginning with the setup of the data centers. It involves one of the crucial steps of building data centers, deploying cooling systems, and incorporating them with other infrastructure to avoid difficulties such as air conditioning, chillers, and additional cooling elements that need to be adapted and operated suitably. With data centers becoming increasingly large and complex, the demand for professional installation services is clearly apparent. The high share of this segment can also be attributed to the rapid growth of data centers in different industries, especially in cloud computing, AI, and edge computing, where high cooling systems are necessary to meet increasing computational requirements.

Maintenance & Support is predicted to grow with the highest CAGR from 2024-2032 owing to the continuous operational needs of data centers. With the expansion in the number of data centers and the advancement in cooling systems, the need for their maintenance, monitoring, and support services also increases. The cooling system in a data center must not hiccup, because any downtime — even for just a few minutes — can wreak havoc on operations and even result in permanent data loss. It is imperative to perform regular maintenance and monitoring of cooling equipment to improve energy efficiency and the lifetime of the systems. Furthermore, as sustainability and energy efficiency have become top priorities for the data center industry, more operators look to specialized maintenance services to further optimize their cooling systems and minimize carbon emissions. This increased need for continued support is expected to create the strongest growth in this segment.

BY TYPE OF COOLING

The data center cooling market share of room-based cooling accounted for 53.6% in 2023, the highest among all cooling types, with a sustainable highest CAGR from 2024-2032. This is because the bulk of the growth is attributable to the use of room-based cooling systems where small and large data centers are concerned. These systems are also capable of controlling the temperature throughout a complete server room, which is why they are commonly used by data centers that require end-to-end cooling solutions. More flexible, scalable, and cost-effective in terms of upfront provisioning than more dedicated systems, room-based cooling has continued to hold an admirable portion of the market share. Moreover, the expansion of data centers and the increasing heat load generated by dense computing infrastructures necessitate room-based cooling solutions to develop according to the changing requirements. This segment is growing due to the advancements in room-based cooling technology, including the incorporation of advanced, energy-efficient components and precision controls in the system design. At the same time, as we see edge data centers becoming more common, especially in smaller, distributed scenarios, room-based cooling systems add value through their flexibility and efficiency. Hence, room-based air conditioning will account for the highest growth over the next few years.

BY INDUSTRIES

IT & Telecom was the largest application segment with a market share of 28.4% in 2023, due to the rapid deployment of digital infrastructure in the IT & Telecom sector. IT and telecom companies have been increasing their data centers for handling higher and higher data units generated by their customers month on month as demand for cloud computing, data storage, and network services continues to grow. IT & Telecom, accounting for the major market share, demand highly reliable cooling solutions to maintain their system's performance and reliability. Due to the high density of servers and strict uptime requirements, IT & telecom data centers are highly reliant on advanced cooling technologies including precision cooling systems and liquid cooling systems, propelling this segment's growth over the forecast period.

Retail is anticipated to be the fastest-growing CAGR during 2024-2032, owing to the rising dependence on e-commerce platforms and digital transactions. As the world becomes increasingly digital, the retail industry is no exception traditional brick-and-mortar retail businesses are quickly going online, accumulating vast amounts of data, having tons of customer management systems, as well as e-commerce platforms to deliver what every consumer is looking for. When investing more in their digital infrastructure, retailers will be looking to data center cooling solutions that prove to be efficient and reliable. High-traffic retail data centers have peak seasons accompanied by demand variation and they need responsive cooling which can quickly adjust to sudden changes in the heat load. Increasing demand for digitalization, big data analytics, and customer personalization in retail will continue to fuel rapid expansion of the data center cooling solutions for this segment during the next few years.

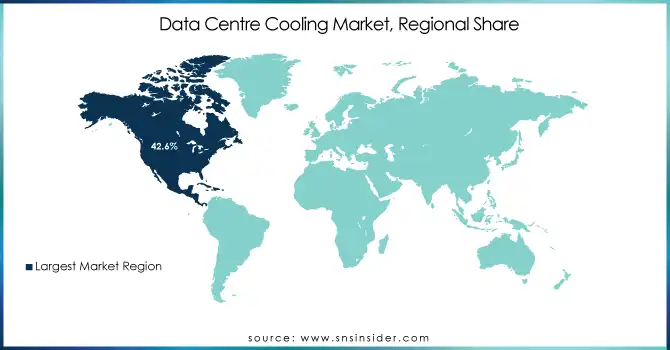

REGIONAL ANALYSIS

In 2023, North America led the data center cooling market with a 42.6% share due to the digital infrastructure and industrial scale of the data centers in this region. Cloud computing giants Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have established a presence in the region, all of which require innovative cooling solutions to cope with the ever-growing amounts of data. Moreover, North America is also characterized by high demand for data storage as it serves sectors from IT & telecom, healthcare, and financial services. Limited government grants and incentives, together with the high cost of initial investments, are giving businesses in this region the impetus to adopt energy-efficient and innovative cooling technologies to meet regulatory sustainability goals, as well as an increasingly combined building sector demand related to energy consumption. On the ground in North America, major data center hubs in Silicon Valley, Northern Virginia, and Dallas are home to some of the best data center operators in the business, including Digital Realty and Equinix, both of which provide high-performance cooling solutions to the supporting infrastructures.

Asia Pacific is anticipated to have the highest CAGR during 2024-2032, owing to the accelerated digitalization adoption and significant data center development across nations including China, India, Japan, and South Korea. The expansion of data centers specifically in emerging markets in this region is mainly boosted by the increasing need for cloud services, artificial intelligence, and big data analytics. Countries like China and India are rapidly expanding their number of internet users, e-commerce, and online services; and as companies deploy more data centers to support these digital platforms. Japanese firms such as NTT Communications have been building out their data center footprint with a focus on energy efficiency while using cutting-edge cooling techniques to handle the high thermal loads from the new generation of data centers. With the increasing adoption of cloud computing and other data-driven technologies in the Asia Pacific region, there will be a higher need for innovative cooling solutions like liquid and precision cooling, which is expected to drive the growth of the market in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Data Centre Cooling Market are:

-

Schneider Electric (Uniflair Precision Cooling, EcoStruxure Cooling)

-

Stulz (CyberAir 3 PRO, Chiller Units)

-

Vertiv (Liebert DSE, Liebert XDV)

-

Johnson Controls (York Chillers, Facility Management Systems)

-

Rittal (Blue e+ Cooling Units, Rittal Thermal Management)

-

Airedale International Air Conditioning (Airedale SmartCool, Airedale Perimeter Cooling)

-

Daikin (Air Cooled Chillers, Precision Cooling Systems)

-

Mitsubishi Electric (MELCO Precision Cooling, VRF Systems)

-

Kuehltech (Direct Expansion (DX) Cooling, Chilled Water Systems)

-

CoolIT Systems (Rack DCLC, Direct Liquid Cooling)

-

QCooling (Heat Exchangers, Adiabatic Coolers)

-

Celsius (Celsius Server Cooling, Celsius Chiller Systems)

-

Vanderbilt (Coolstream, Data Center Solutions)

-

Trane Technologies (Trane Chillers, Airside Equipment)

-

Airflow (High-Performance Precision AC Units, Containment Cooling)

-

Emerson Electric (Liebert PDX, Precision Air Conditioning Units)

-

Phononic (Thermoelectric Cooling Solutions, Active Cooling Systems)

-

Siemens (Smart Grid Cooling, Data Center Infrastructure Solutions)

-

Green Revolution Cooling (Immersion Cooling Systems, Liquid Cooling Solutions)

-

Eaton (Thermal Management Solutions, Uninterruptible Power Supply Cooling Systems)

Some of the Raw Material Suppliers for Data Centre Cooling Companies:

-

Alcoa

-

ArcelorMittal

-

Sumitomo Metal Mining

-

Nippon Steel Corporation

-

Taiyo Yuden

-

3M

-

DuPont

-

BASF

-

Kraton Polymers

-

Honeywell

RECENT TRENDS

-

In October 2024, Schneider Electric acquired a 75% stake in data center cooling firm Motivair for USD 850 million to enhance its liquid cooling capabilities. This acquisition strengthens Schneider's position in the rapidly growing data center cooling market.

-

In May 2024, STULZ launched the CyberCool CMU, a coolant distribution unit designed to optimize data center cooling efficiency. The unit offers precise temperature control and supports free cooling, enhancing energy savings for liquid cooling systems.

-

In October 2024, Vertiv expanded its high-capacity, low GWP free cooling chiller family to support high-density AI and machine learning data centers across EMEA. The new chillers offer up to 2.2 MW of cooling capacity, enhancing energy efficiency and sustainability.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 15.68 Billion |

|

Market Size by 2032 |

USD 54.91 Billion |

|

CAGR |

CAGR of 14.99% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Schneider Electric, Stulz, Vertiv, Johnson Controls, Rittal, Airedale International Air Conditioning, Daikin, Mitsubishi Electric, Kuehltech, CoolIT Systems, QCooling, Celsius, Vanderbilt, Trane Technologies, Airflow, Emerson Electric, Phononic, Siemens, Green Revolution Cooling, Eaton. |

|

Key Drivers |

• Cloud Computing and AI Infrastructure Driving the Growth of Data Center Cooling Market Expansion |

|

RESTRAINTS |

• Challenges in Integrating Advanced Cooling Technologies and Navigating Environmental and Regulatory Pressures in Data Centers |