Data Center Virtualization Market Size & Overview:

Get More Information on Data Center Virtualization Market - Request Sample Report

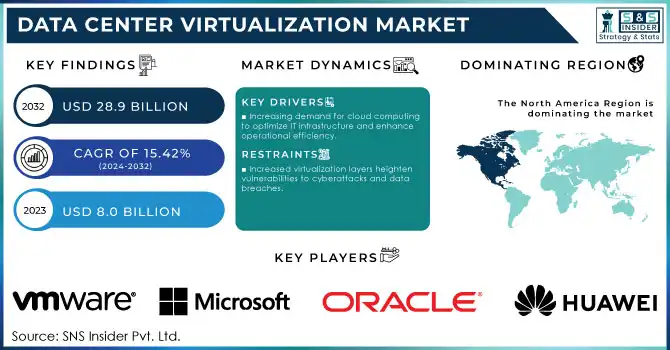

Data Center Virtualization Market was valued at USD 8.0 Billion in 2023 and is expected to reach USD 28.9 Billion by 2032, growing at a CAGR of 15.42% from 2024-2032.

The Data Center Virtualization Market plays a vital role in shaping contemporary IT infrastructure, offering enhanced operational efficiency, flexibility, and scalability to organizations across industries. This technology involves virtualizing servers, storage devices, networks, and other data center components, allowing organizations to maximize resource utilization, reduce costs, and enhance system reliability. Key drivers include the rising demand for cloud computing, the need for streamlined data management, and the growing adoption of software-defined technologies. Additionally, advancements in hyper-converged infrastructure (HCI) and the incorporation of artificial intelligence (AI) and machine learning (ML) into virtualization tools are spurring innovation across the sector. One of the primary factors fueling market growth is the accelerating pace of digitization across industries and the exponential rise in data generation, which demand agile and cost-efficient data center solutions. Organizations are turning to virtualization to optimize IT operations, boost energy efficiency, and meet sustainability goals. Moreover, the increasing adoption of hybrid cloud models and edge computing has intensified the need for advanced virtualization technologies that enable seamless workload mobility and streamlined management.

For instance, the deployment of virtual desktop infrastructure (VDI) has seen substantial growth. A 2024 industry analysis revealed that companies using VDI solutions achieved a 40% reduction in IT support costs and a 25% boost in workforce productivity. In parallel, global investments in software-defined data center (SDDC) technologies exceeded USD 65 billion in 2023, underlining the shift toward automated and programmable infrastructures. Key sectors such as healthcare and BFSI are leveraging virtualization to enhance efficiency while ensuring compliance with stringent data security standards.

Emerging economies in the Asia-Pacific region are witnessing rapid growth due to IT modernization initiatives and the proliferation of data-intensive applications. Countries like India and China are making significant investments in digital infrastructure, further driving the adoption of virtualization technologies. However, challenges like data security concerns, high upfront costs, and the complexities of managing virtualized environments remain potential barriers to market expansion.

Data Center Virtualization Market Dynamics

Drivers

-

Increasing demand for cloud computing to optimize IT infrastructure and enhance operational efficiency.

-

Growing data generation across industries necessitates agile and scalable data center solutions.

-

Expanding use of hybrid environments and edge computing drives the need for seamless workload management.

The rising adoption of hybrid environments and edge computing is transforming the Data Center Virtualization Market, as businesses increasingly prioritize efficient solutions for workload management. Hybrid environments integrate on-premises data centers with public and private clouds, providing enhanced flexibility and scalability to meet evolving workload demands. This integration necessitates effective resource allocation and real-time coordination across diverse infrastructures—challenges that virtualization technologies are uniquely positioned to address. By virtualizing physical resources, data center virtualization enables seamless workload migration within hybrid ecosystems, ensuring uninterrupted operations and optimized performance.

At the same time, the rapid growth of edge computing, driven by the proliferation of IoT devices and the demand for low-latency applications, has heightened the need for decentralized data processing closer to the source. Edge computing reduces latency, improves real-time data processing, and conserves bandwidth. However, managing distributed workloads across edge nodes and centralized data centers presents challenges such as scalability, resource optimization, and policy consistency. Virtualization technologies effectively mitigate these issues by offering centralized management tools and standardized policies for workload distribution, resource efficiency, and disaster recovery. For instance, virtualization platforms facilitate dynamic resource allocation between core data centers and edge sites, ensuring critical applications remain highly available and efficient. This capability is especially valuable in industries like telecommunications, manufacturing, and healthcare, where edge computing supports advanced use cases like 5G networks, predictive maintenance, and remote healthcare delivery. Additionally, virtualization enhances workload portability, enabling organizations to seamlessly shift applications and services between edge nodes and centralized data centers based on operational requirements.

The increasing integration of hybrid and edge computing is driving significant demand for advanced virtualization technologies. These solutions streamline workload management, boost scalability and flexibility, and reduce operational costs, making them indispensable for addressing the complexities of modern IT infrastructure. As hybrid and edge computing adoption continues to grow, the data center virtualization market is set to expand further, driven by its ability to support the demands of these evolving technological trends.

Restraints

-

Increased virtualization layers heighten vulnerabilities to cyberattacks and data breaches.

-

Shortage of professionals with expertise in virtualization technologies hampers efficient deployment and management.

-

Virtualized data centers still demand substantial energy and cooling solutions, impacting cost efficiency.

Data center virtualization has several benefits, such as higher utilization, flexibility, and lower cost, it also faces energy and cooling-related challenges. Virtualization environments increase each server's utilization by focusing workloads on fewer physical servers. This practice does decrease the number of machines on the floor but drives up the load of the other servers so they consume more power and pump more heat. Thus, a virtualized data center may still have significant energy requirements, requiring powerful cooling systems to prevent overheating and allow the systems to run efficiently.

In virtualized data centers, the cooling infrastructure has to handle the heat from high-performance servers tightly spaced together. With the rise in thermal output, traditional cooling methods like air conditioning may be unable to keep up, resulting in an inefficient system and a rise in overall operating costs. Hence the demand for energy-intensive cooling solutions may counterbalance virtualization-based operational cost advantages otherwise derived, particularly at higher workloads and as the data center infrastructure becomes increasingly complex. In addition, the question of energy consumption concerning environmental change continues to be a primary issue. Even though virtualization is great at minimizing the footprint of physical hardware, the power needed to run these systems and cool those remains sizeable—especially as growing needs in cloud, AI, and edge computing continue to wreak havoc on data center energy requirements. This has made organizations juggle the benefits of virtualization with the expenses of running energy-efficient cooling solutions. To mitigate this, several companies have begun looking at cooling improvements, from advanced cooling techniques and liquid cooling to AI technology to manage data center energy footprint and more sustainability in virtualized environments.

Data Center Virtualization Market Segmentation Analysis

By Component

The software segment dominated the market and held the largest revenue share of 80.8%, in 2023 and it is anticipated that this segment will maintain its dominance over the forecast period. Increased implementation of virtualization solutions like network virtualization, storage virtualization, and server virtualization in data centers are fuelling the growth. With this Software Defined Data Center or SDCC virtualization software businesses can manage the complete IT infrastructure as a single unit, and from a single interface. Reduced cost capital, speed & flexibility, Reduced Operating cost along reduced infrastructure & Real estate will be the segments that can assist the Software Development Segment to grow in full swing.

The service segment is also projected to register the highest CAGR (over 15%) between 2024 and 2032. Services provide organizations with a roadmap to understand the path of digital transformation that will take. Furthermore, such services provide functionalities to enable organizations to operate the entire data center infrastructure and associated cloud services as a single integrated unit. The service segment is also growing due to the presence of large players like Cisco Systems Inc. and HCL Technologies Limited that offer services for data center virtualization, such as advisory, and technical support, and others.

By Organization Size

Large enterprises led the market occupying more than 71.0% of the total market share in 2023. The data center virtualization software & services market is in high demand in large enterprises as a large volume of data and millions of customers need it, which needs space and networking for many servers. As the competition for market shares heats up more than ever before, advancements in technologies such as data center virtualization have caught the eyes of many development companies eager to find new ways to dominate the market, thanks to the simplified management, optimized resources, and better integration with managed services, and many other benefits of data center virtualization. These factors have all been responsible for helping grow the large enterprises segment.

The small and medium-sized enterprises segment is anticipated to mark the highest CAGR throughout the forecast period. The benefits of data center virtualization have led to significant growth in adoption among SMEs and are key drivers of cost savings, improved team production, disaster recovery, reduced downtime, provisioning and deployment, and migration to the cloud. In addition, several campaigns conducted in the data center virtualization industry targeting SMEs have been effective too in encouraging SMEs to adopt data center virtualization solutions. For example, VMware, Inc. provides a possible solution for SMEs as virtualization of server consolidation, business continuity, desktop management, operations management, and hybrid cloud.

By Type

In 2023, the server segment dominated the market and represented a significant revenue share. This is expected to maintain its leading position during the period of forecast. The server segment is projected to witness the highest growth owing to the advantages of server virtualization such as increased reliability and availability of servers, maximized utilization of physical services and power, reduced operational costs, and creation of virtual machines. Server improvements are generating server virtualization solutions, including capabilities from major organizations that encourage organizations to appeal to their solutions.

The desktop segment is expected to achieve the highest CAGR during the forecast period. The segment is majorly driven by the advantages provided by desktop virtualization. It offers some notable advantages over traditional desktop environments — ease of rollout, improved security, tighter controls on installed software, and lower downtime, to name a few. The desktop segment has also been propelled by multiple strategic activities such as partnership, acquisition/merger, and collaboration of different companies.

Regional Analysis

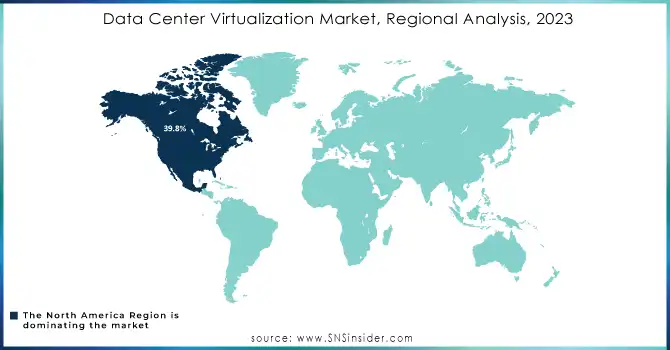

In 2023, North America dominated the market and held more than 39.8% of the revenue share which is likely to stay dominant over the forecast period. Firstly, this region has always ensured that they are the first to adopt the latest technologies, and that has been the key factor, in growing this region. Additionally, the presence of some of the key companies in this region, including Microsoft; VMware, Inc.; and Cisco Systems Inc., also continued supporting the growth of data center simulation software adoption in the region. Numerous data centers reside in the U.S., which has been one of the key drivers for the growth of the region.

Asia Pacific is anticipated to register the highest CAGR during the forecast period. The increasing growth of the region can be credited to a variety of aspects including the emerging number of data centers, enhancement of such infrastructure, business digitalization, increased demand for cloud services, and cost-effective features of data center virtualization in the region. In addition, the continuous existence of key players working in the data center virtualization industry which includes names like Huawei Technologies Co., Ltd. and Fujitsu, and beyond region-wise have kept on pushing the development of the regional market too.

Do You Need any Customization Research on Data Center Virtualization Market - Enquire Now

Key Players

The major key players along with their products are

-

VMware - VMware vSphere

-

Microsoft - Microsoft Hyper-V

-

Cisco Systems - Cisco Nexus 9000 Series

-

IBM - IBM Cloud Virtual Servers

-

Amazon Web Services (AWS) - Amazon EC2

-

Oracle - Oracle VM

-

Hewlett Packard Enterprise (HPE) - HPE OneView

-

Dell Technologies - VMware Cloud on Dell EMC

-

Huawei - Huawei FusionSphere

-

Citrix Systems - Citrix Virtual Apps and Desktops

-

Red Hat - Red Hat Virtualization

-

Nutanix - Nutanix AHV

-

Google Cloud - Google Cloud VMware Engine

-

Alibaba Cloud - Alibaba Cloud Elastic Compute Service (ECS)

-

Juniper Networks - Juniper vMX

-

Brocade (now part of Broadcom) - Brocade Virtual Traffic Manager

-

Parallels - Parallels Desktop

-

Fujitsu - FUJITSU Cloud Service K5

-

VirtualBox (Oracle) - Oracle VM VirtualBox

-

Zerto - Zerto IT Resilience Platform

Recent Developments

April 2024 – IBM and Siemens Digital Industries extended their long-term cooperation to create a new software solution that integrates systems engineering, asset management, and service lifecycle management

March 2024 – Cisco announced the launch of its enhanced data center virtualization solutions, aimed at streamlining operations for hybrid environments, improving scalability, and optimizing workload management

February 2024 – VMware revealed its advancements in AI-based automation for data center management, focusing on simplifying resource allocation and improving disaster recovery capabilities for virtualized environments

| Report Attributes | Details |

| Market Size in 2023 | USD 8.0 Billion |

| Market Size by 2032 | USD 28.9 Billion |

| CAGR | CAGR of 15.42 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Software) • By Type (Server, Storage, Network, Desktop, Application, Others) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By End - Use (BFSI, IT & Telecommunication, Manufacturing & Automotive, Government, Healthcare, Education, Retail & SCM, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

VMware, Microsoft, Cisco Systems, IBM, Amazon Web Services (AWS), Oracle, Hewlett Packard Enterprise (HPE), Dell Technologies, Huawei, Citrix Systems, Red Hat, Nutanix, Google Cloud, Alibaba Cloud |

| Key Drivers |

• Increasing demand for cloud computing to optimize IT infrastructure and enhance operational efficiency. |

| Market Restraints |

• Increased virtualization layers heighten vulnerabilities to cyberattacks and data breaches. |