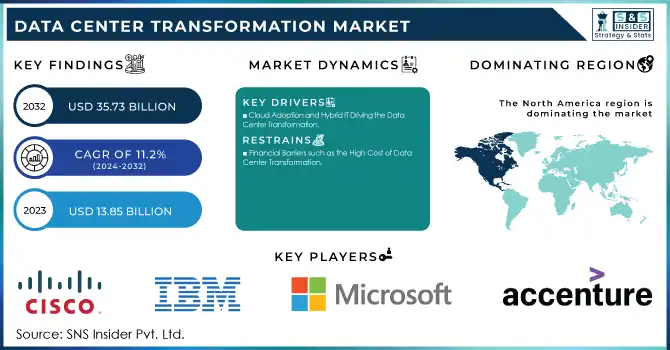

The Data Center Transformation Market Size was valued at USD 13.85 Billion in 2023 and is expected to reach USD 35.73 Billion by 2032 and grow at a CAGR of 11.2% over the forecast period 2024-2032.

To get more information on Data Center Transformation Market - Request Free Sample Report

The Data Center Transformation Market is the global industry involved in the optimization, upgrade, or reorganization of existing data centers to improve their efficiency, scalability, and ability to serve the needs of modern business. Typically, transformation takes the form of hardware consolidation, virtualization of the server, and upgrading the software-software, starting with automation, and moving to cloud as well as hybrid-cloud infrastructures. As organizations expand and increase their requirements for data, modernization of the data centers has become even more important to meet the needs of changing technology.

Data centers are among the most energy-intensive infrastructures; consuming up to 10 to 50 times more energy than a regular commercial building, and accounting for about 2% of the total electricity usage in the U.S. Cool alone represents nearly 40% of a data center's power consumption, which is one reason why it needs to be more energy efficient. It will consume up to 4% of the world's electricity if global data centers are not more energy-efficient by 2030. Keeping up with sustainable designs, like liquid cooling and renewable energy integration, is fast becoming a necessity that companies must embrace to shave off both carbon footprints and operational costs. Big hyperscale data centers eat between 20 and 50 megawatts in a year; this is more than enough power source to fuel tens of thousands of homes. This massive appetite for energy simply illustrates why data centers will need to be modernized to keep pace with the increasing technological demands coupled with the increasing green regulations.

Key Drivers:

Cloud Adoption and Hybrid IT Driving the Data Center Transformation

Organizations' urgency to adopt cloud-based infrastructures calls for modernization and transformation of data centers so that they can sustain hybrid cloud environments. Transitioning to cloud computing whether it is an all-cloud model or a hybrid cloud model positions businesses with expanded choices for scaling IT resources, reduces costs, and enhances flexibility. This is driving transformation in how traditional data centers are constructed into more agile and scalable environments that integrate with cloud platforms.

Cloud adoption and hybrid IT models still appear to have very strong impacts on the DCT market in 2023. As of now, it has been reported that 94% of enterprises have already adopted cloud services to some extent, while 90% of large organizations are likely to adopt hybrid cloud strategies by 2025. Apart from this, multi-cloud environments have also become popular, and currently, 87% of companies embrace multi-cloud strategies. As the firms continue to increase the adoption of public and private clouds, they must evolve and rationalize their current data centers into easily interlinking clouds. Moreover, global spending on cloud infrastructure exceeded USD100 billion in 2023, as more organizations go for operations that require them to change the traditional infrastructure of data centers. This has led to scalable, cost-effective, and flexible attributes, which result in the DCT market growth. Additionally, 72% of enterprises have been able to have their workloads managed effectively with an increase in operational resilience through on-premises and cloud solutions in place.

Restrains:

Financial Barriers such as the High Cost of Data Center Transformation

A completely overhauled conventional data center essentially requires massive outlays of money for hardware, software, and energy-efficient solutions. The introduction of cloud, automation, and virtualization will require a high level of investment in terms of finance. For this reason, most small and medium-sized companies are unable to afford data center refreshments. To put that into perspective, establishing a modernized data center will run into millions of dollars, and the cost of maintaining and upgrading may run into hundreds of thousands in the long term and make the data center slow to change.

The high capital investment for the requirement of DCTs mainly constitutes the main financial restraint that organizations face in upgrading their IT infrastructures. As Gartner states, worldwide IT spending is expected to increase by 9.3% in 2025, reaching a total of USD5.5 trillion. This level of growth represents an increasing amount spent to introduce new technologies and upgraded infrastructure. IT services will grow by 8.7% to USD1.5 trillion and will probably be invested even further into those things that make the organization more efficient. Yet, simultaneously, that initial cost is pretty problematic. The average cost of building a modernized data center exceeds USD12 million, and often there are supplementary expenses related to maintenance and retooling which can reach 30% of the initial investment annually. Moreover, 60% of the SMBs point to high initial costs as the primary reason for not adopting cloud and data center transformations. The added pressure of businesses dedicating 30-40% of their IT budgets to infrastructure improvement puts financial stress on most businesses operating at limited capacities.

By Services Type

The Consolidation Services segment emerged as one of the stronger players, holding a 34.5% revenue share in 2023. This is indicative of the growing demand for efficient and cost-effective data management solutions given organizations' inclinations toward operational efficiency and desires to reduce their infrastructure footprint. Interestingly, the latest survey showed that 61% of organizations are already doing some sort of data center consolidation, the trend toward the use of integrated infrastructures with improved performance but fewer overhead costs. IBM and Dell Technologies were at the lead of innovation, launching new products and services for embracing aspects of cloud integration and virtualization for streamlined operations.

The Automation Services segment is growing at a high rate of 12.90% in the forecast period. This growth is due to the necessity to increase the efficiency of processes and save costs associated with organizational operations. Notably, 72% of the organizations intend to spend more over the next two years on automation technologies. By 2023, it is also expected that 75% of organizations will focus their investments on automation as one of the key investment areas. Companies like IBM and Cisco are at the forefront of innovative automation solutions. For example, the cloud operations and automation capabilities offered by Cisco's Intersight platform can be used to enhance the management of a data center. The larger automation market is now expected to be USD214 billion by 2025, underlining the important place automation has in the DCT market.

By Vertical Type

The IT and Telecommunications segment accounted for the largest share of revenue in the DCT market. In 2023, the portion was 28.9%. The massive growth is mainly driven by an escalating demand for robust data connectivity as well as advanced telecommunications infrastructure. This has led major companies within this sector to heavily invest as a way of surpassing the growing need for cloud services and high-speed data transmission. Projections also indicate that the global data center market will continue to boom as it has been growing 10% annually up to 2030 with huge investments for new construction expected to reach USD49 billion. As organizations continue to climb the digital ladder, a deeper need for advanced IT infrastructure calls for more demands in the DCT market.

The BFSI segment in the Data Center Transformation market is anticipated to grow significantly, 13.6% compound annual growth rate over the forecast period, as financial institutions undergo their digital transformations and demand secure data processing for efficient compliance with regulatory standards. Gartner states that the "data center systems spend" - essentially the muscle of supporting operations for BFSI - will leap sharply from USD 236.2 billion in 2023 to USD 259.7 billion in 2024, growing by 10%.

In 2023, the North American region solidified its position as the leading market with an estimated market share of 43.5%. The lead is fueled by mainly the uptake of cloud services and the demand for more efficient data management solutions. North America allocated some USD30 billion to data center infrastructure in just the first half of 2024 as a means of further pushing data center capacity. The region has witnessed an increase of 15% in new data center construction, which shows development on a solid curve. The biggest technology players, such as Google and Microsoft, have immensely expanded their data center footprint, which is contributing to this growth. For example, Google announced that it would invest USD10 billion to strengthen its data center capabilities across North America, which is going to create thousands of jobs and the local economies further be spurred for growth.

The Asia Pacific (APAC) region is on remarkable growth with the highest CAGR of 13.68% in the forecasted period. This growth is supported by a 50% rise in expected data center capacity, power, and revenue from 2022 to 2026. Indeed, South Korea is anticipated to lead this growth with a 100% growth rate by the same period. Major players, including Alibaba Cloud, Microsoft, and GDS Holdings, are making huge investments in expanding their capacities in the data center to satisfy the rising demand for cloud services and digital solutions. Internet penetration in the APAC region is also on an upward trajectory to 60% in 2025 with such increased demand necessitating enhanced capabilities in the data center. Infrastructure in the likes of NTT Communications and Equinix is also stepping up its game, emphasizing energy efficiency and even sustainable practices in its operational strategies. With digitalization and cloud usage on the rise, the structure created is robust for growth in DCTs in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Data Center Transformation Market are:

IBM Corporation (IBM Cloud, IBM Storage Solutions)

Cisco Systems, Inc. (Cisco Data Center Network Solutions, Cisco HyperFlex)

Dell EMC (Dell EMC PowerEdge Servers, Dell EMC VMAX Storage)

Microsoft Corporation (Microsoft Azure Cloud Platform, Microsoft Azure Stack)

Schneider Electric SE (Schneider Electric Data Center Infrastructure, Schneider Electric Software-Defined Data Centers)

HCL Technologies (HCL Data Center Modernization Services, HCL Cloud Transformation Services)

Cognizant (Cognizant Data Center Optimization Services, Cognizant Cloud Migration Services)

Accenture (Accenture Data Center Transformation Services, Accenture Cloud Migration Services)

Atos (Atos BullSequana Servers, Atos Canopy Cloud Platform)

Wipro (Wipro Data Center Modernization Services, Wipro Cloud Migration Services)

Oracle (Oracle Cloud Infrastructure, Oracle Exadata Database Machine)

Hewlett Packard Enterprise (HPE) (HPE Synergy, HPE Apollo Servers)

Fujitsu (Fujitsu PRIMERGY Servers, Fujitsu Storage Solutions)

NTT DATA (NTT DATA Data Center Transformation Services, NTT DATA Cloud Services)

Infosys (Infosys Data Center Modernization Services, Infosys Cloud Migration Services)

TCS (TCS Data Center Transformation Services, TCS Cloud Migration Services)

Tech Mahindra (Tech Mahindra Data Center Modernization Services, Tech Mahindra Cloud Transformation Services)

Capgemini (Capgemini Data Center Transformation Services, Capgemini Cloud Migration Services)

DXC Technology (DXC Data Center Modernization Services, DXC Cloud Migration Services)

Rackspace (Rackspace Fanatical Support for Data Centers, Rackspace Cloud Services)

In October 2024, Huawei announced advancements in intelligent scenarios for data centers, focusing on flash storage technologies. These innovations aimed to enhance data processing speeds and operational efficiency, responding to the growing demand for agile and scalable data center solutions in the DCT market.

In January 2024, NTT launched a new data center campus in India, marking a significant expansion of its operations in the region. This facility was designed to support the increasing demand for digital infrastructure, enhancing connectivity and cloud services in one of the fastest-growing markets in the APAC region.

In May 2024, Microsoft introduced its first hyper-scale cloud data center region in Mexico, aiming to bolster its cloud service offerings in Latin America. This launch was part of Microsoft's strategy to provide more localized services and support digital transformation efforts across various industries in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.85 Billion |

| Market Size by 2032 | US$ 35.73 Billion |

| CAGR | CAGR of 11.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services Type (Consolidation Services, Optimization Services, Automation Services, Infrastructure Management Services) • By End-user (Cloud Service Providers, Colocation Providers, Enterprises) • By Vertical Type (BFSI, IT and telecommunications, Government and defense, Energy, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Cisco Systems, Inc., Dell EMC, Microsoft Corporation, Schneider Electric SE, HCL Technologies, Cognizant, Accenture, Atos, Wipro, Oracle, Hewlett Packard Enterprise (HPE), Fujitsu, NTT DATA, Infosys, TCS, Tech Mahindra, Capgemini, DXC Technology, Rackspace |

| Key Drivers | • Cloud Adoption and Hybrid IT: Catalysts for Data Center Transformation |

| Restraints | • Financial Barriers: The High Cost of Data Center Transformation |

Ans: The Data Center Transformation Market is expected to grow at a CAGR of 11.2% during 2024-2032.

Ans: The Data Center Transformation Market size was USD 13.85 billion in 2023 and is expected to Reach USD 35.73 billion by 2032.

Ans: The major growth factor of the Data Center Transformation Market is the increasing demand for digital transformation and cloud adoption, driven by factors such as big data, artificial intelligence, and the Internet of Things (IoT).

Ans: Consolidation Services dominated the Data Center Transformation Market.

Ans: North America dominated the Data Center Transformation Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Data Center Transformation Market Segmentation, By Services Type

7.1 Chapter Overview

7.2 Consolidation Services

7.2.1 Consolidation Services Market Trends Analysis (2020-2032)

7.2.2 Consolidation Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Optimization Services

7.3.1 Optimization Services Market Trends Analysis (2020-2032)

7.3.2 Optimization Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Automation Services

7.4.1 Automation Services Market Trends Analysis (2020-2032)

7.4.2 Automation Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Infrastructure Management Services

7.5.1 Infrastructure Management Services Market Trends Analysis (2020-2032)

7.3.2 Infrastructure Management Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Data Center Transformation Market Segmentation, By Vertical Type

8.1 Chapter Overview

8.2 BFSI

8.2.1 BFSI Market Trends Analysis (2020-2032)

8.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 IT and telecommunications

8.3.1 IT and Telecommunications Market Trends Analysis (2020-2032)

8.3.2 IT and Telecommunications Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Government and Defense

8.4.1 Government and Defense Market Trends Analysis (2020-2032)

8.4.2 Government and Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Energy

8.5.1 Energy Market Trends Analysis (2020-2032)

8.5.2 Energy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Manufacturing

8.6.1 Manufacturing Market Trends Analysis (2020-2032)

8.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Data Center Transformation Market Segmentation, By End-user

9.1 Chapter Overview

9.2 Cloud Service Providers

9.2.1 Cloud Service Providers Market Trends Analysis (2020-2032)

9.2.2 Cloud Service Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Colocation Providers

9.3.1 Colocation Providers Market Trends Analysis (2020-2032)

9.3.2 Colocation Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Enterprises

9.4.1 Enterprises Market Trends Analysis (2020-2032)

9.4.2 Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Data Center Transformation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.4 North America Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.2.5 North America Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.6.2 USA Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.2.6.3 USA Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.7.2 Canada Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.2.7.3 Canada Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.8.2 Mexico Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Data Center Transformation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.6.2 Poland Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.7.2 Romania Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Data Center Transformation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.4 Western Europe Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.6.2 Germany Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.7.2 France Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.7.3 France Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.8.2 UK Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.9.2 Italy Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.10.2 Spain Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.13.2 Austria Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Data Center Transformation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.4 Asia Pacific Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.6.2 China Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.6.3 China Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.7.2 India Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.7.3 India Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.8.2 Japan Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.8.3 Japan Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.9.2 South Korea Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.10.2 Vietnam Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.11.2 Singapore Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.12.2 Australia Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.12.3 Australia Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Data Center Transformation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.4 Middle East Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.6.2 UAE Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Data Center Transformation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.4 Africa Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.2.5 Africa Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Data Center Transformation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.4 Latin America Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.6.5 Latin America Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.6.2 Brazil Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.7.2 Argentina Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.8.2 Colombia Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Data Center Transformation Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Data Center Transformation Market Estimates and Forecasts, By Services Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Data Center Transformation Market Estimates and Forecasts, By Vertical Type(2020-2032) (USD Billion)

11. Company Profiles

11.1 IBM Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Cisco Systems, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Dell EMC

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Microsoft Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Schneider Electric SE

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 HCL Technologies

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Cognizant

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Accenture

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Atos

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Wipro

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

MARKET SEGMENTATION

By Services Type

Consolidation Services

Optimization Services

Automation Services

Infrastructure Management Services

By End-user

Cloud Service Providers

Colocation Providers

Enterprises

By Vertical Type

BFSI

IT and telecommunications

Government and defense

Energy

Manufacturing

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Smart Helmet Market was valued at USD 742.65 million in 2023 and is expected to reach USD 3049.63 million by 2032, growing at a CAGR of 17.06% from 2024-2032.

The Quality Management Software (QMS) Market was valued at USD 9.6 billion in 2023 and is expected to reach USD 24.0 billion & CAGR of 10.70% by 2032.

Cognitive Process Automation Market was valued at USD 6.55 billion in 2023 and will reach USD 53.48 billion by 2032, growing at a CAGR of 26.33% by 2032.

Location-Based Entertainment Market Size was USD 4.0 Billion in 2023 & is expected to reach USD 31.1 Billion by 2032 growing at a CAGR of 25.6% by 2024-2032.

The Enterprise Search Market Size was valued at USD 4.61 Billion in 2023 and is expected to reach USD 9.31 Billion by 2032 and grow at a CAGR of 8.2% by 2032.

The Urban Planning Software And Services Market was valued at USD 149.1 billion in 2023 and is expected to reach USD 266.7 billion by 2032, growing at a CAGR of 6.69% from 2024-2032.

Hi! Click one of our member below to chat on Phone