Data Center Networking Market Report Scope & Overview:

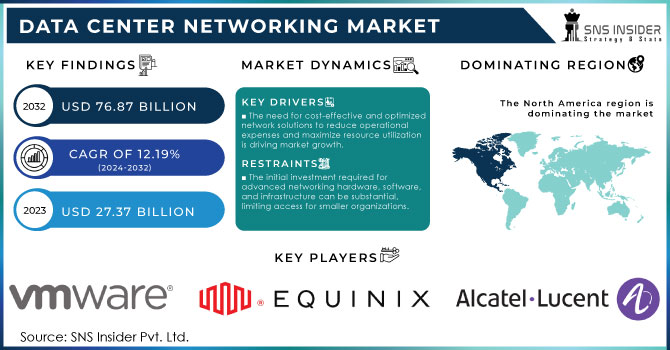

Data Center Networking Market was worth USD 27.37 billion in 2023 and is predicted to be worth USD 76.87 billion by 2032, growing at a CAGR of 12.19% between 2024 and 2032.

The Data Center Networking Market is experiencing robust growth driven by the increasing demand for data storage, cloud computing, and digital transformation. As enterprises and service providers continue to expand their digital infrastructure, the need for advanced networking solutions that ensure efficient, scalable, and secure data management is growing. The market scope encompasses a wide range of technologies and services including network switches, routers, firewalls, and software-defined networking (SDN) solutions. Key growth factors include the surge in Internet traffic, the proliferation of Internet of Things (IoT) devices, and the growing adoption of hybrid and multi-cloud environments. Businesses are seeking solutions that not only enhance performance but also offer greater flexibility and cost-efficiency.

Get more information on Data Center Networking Market - Request Sample Report

Additionally, the rise of edge computing, which brings data processing closer to the source, is further driving demand for sophisticated networking solutions capable of managing and integrating distributed data centers. The continuous advancements in network architecture, such as the integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics and automation, are also contributing to market expansion. The increasing focus on data security and compliance is pushing organizations to adopt more robust and resilient network solutions. As data centers evolve to meet the needs of modern applications and workloads, investments in high-performance networking technologies are set to increase, positioning the market for sustained growth in the coming years.

Market dynamics

Drivers

-

The need for cost-effective and optimized network solutions to reduce operational expenses and maximize resource utilization is driving market growth.

-

The rollout of 5G networks is boosting demand for data center networking solutions that can handle increased data throughput and connectivity needs.

-

The proliferation of Internet of Things (IoT) devices generates vast amounts of data, increasing the need for efficient data center networks to handle and process this data.

The rapid expansion of Internet of Things (IoT) devices has had a major impact on the data center networking market, producing vast quantities of data that must be efficiently managed and processed. As IoT devices proliferate across various industries—including smart homes, industrial automation, healthcare, and transportation—they generate and transmit large amounts of data continuously. This increase in data volume places significant strain on data center networks, which need to handle the growing influx and ensure reliable, real-time processing. To meet this challenge, data center networking solutions need to advance with improved scalability, faster data transfer rates, and stronger processing capabilities. Network infrastructures must be equipped to manage higher data traffic while maintaining low latency and high availability for critical real-time applications and services. Furthermore, the rising volume of data from IoT devices requires sophisticated analytics and storage solutions, leading to greater investments in technologies like software-defined networking (SDN) and network function virtualization (NFV). These technologies offer the flexibility and efficiency necessary to effectively manage and process the extensive data generated by IoT devices.

The rollout of 5G networks is significantly driving the demand for advanced data center networking solutions. As 5G technology becomes more widespread, it introduces higher data throughput, faster speeds, and improved connectivity, which translates to a greater volume of data being transmitted across networks. This increased data flow places additional pressure on data center networks to support and manage these demands effectively. Data centers need to evolve to accommodate the high-speed, low-latency requirements of 5G, which includes handling massive amounts of data traffic and ensuring that connections remain reliable and efficient. The higher bandwidth and capacity provided by 5G mean that data centers must upgrade their infrastructure to support faster data transfers and more robust connectivity. This includes investing in next-generation network technologies such as high-speed switches, advanced routing equipment, and enhanced storage solutions.

Restraints

-

The initial investment required for advanced networking hardware, software, and infrastructure can be substantial, limiting access for smaller organizations.

-

Ensuring robust security measures and compliance with privacy regulations can be challenging, especially with the increasing volume and sensitivity of data.

-

Dependency on specific vendors for networking solutions can lead to lock-in situations, limiting flexibility and increasing costs if changes or upgrades are needed.

Dependency on specific vendors for networking solutions can lead to a situation known as vendor lock-in, which poses significant challenges for organizations. When a company relies heavily on a particular vendor for its networking hardware, software, or services, it often faces difficulties if it wants to switch to a different provider or integrate new technologies. This dependency can arise from proprietary technologies or interfaces that are not easily compatible with other vendors' products. Vendor lock-in limits flexibility because the organization is constrained by the vendor's specific offerings, features, and pricing structures. This can make it challenging to adapt to new technological advancements or industry changes. For example, if a vendor introduces new technology or upgrades that do not align with the organization’s needs or budget, the company may be forced to accept these changes or incur significant costs to transition to a different vendor.

Moreover, such lock-in situations can lead to higher costs over time. The organization may face increased costs for ongoing maintenance, support, or proprietary upgrades, and may encounter difficulties negotiating better terms or pricing with the vendor due to the lack of competitive options. This can hinder innovation and strategic flexibility, making it difficult for the organization to optimize its network infrastructure according to evolving business requirements.

Market Segment

By Component

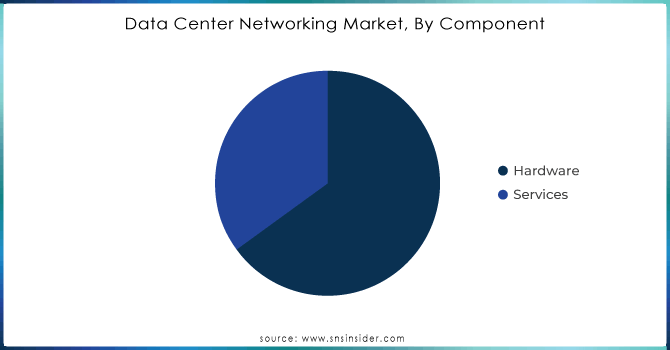

In 2023, the hardware segment accounted for approximately 77% of the market share. Essential components of data center networking solutions include high-capacity switches, sophisticated routers, and network fabrics engineered to manage large data volumes with minimal latency. Many organizations are using SAN solutions to efficiently manage their data center infrastructure while avoiding extra costs associated with expansion. The popularity of the SAN segment is due to benefits like centralized control, increased capacity, flexibility, and scalability.

On the other hand, the WAN optimization equipment segment is expected to show a significant compound annual growth rate (CAGR) during the forecast period. WAN optimization equipment is designed to handle real-time applications and reduce the need for infrastructure expansion, particularly through network acceleration.

Need any customization research on Data Center Networking Market - Enquire Now

By End-User

In 2023, the IT & telecom industry captured more than 26% of the market share and is expected to experience substantial growth over time driven by the rising demand for 4G services and the ongoing expansion of infrastructure for 5G services. Both 4G and 5G networks are data-intensive, and as smartphone usage and telecom subscriptions increase, there will be a surge in data generation. This will in turn drive the need for data centers and, consequently, for data center networking solutions throughout the forecast period.

The BFSI segment is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is driven by the increasing demand for strong data center infrastructure to effectively manage and protect critical user information and secure transactions. Banks are actively working to improve customer experiences by continuously upgrading their core banking systems. Additionally, the rising popularity of online trading platforms and mobile payment systems is contributing to this growth.

The Healthcare sector benefits from data center networking solutions that enable secure and efficient management of patient records, medical imaging, and telemedicine services.

Regional Analysis

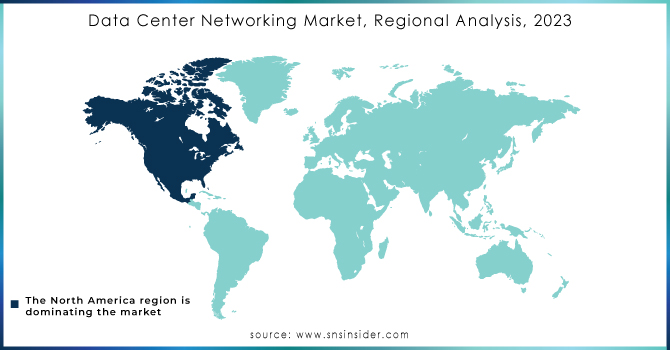

North America led the Data Center Networking Market, largely driven by the increased adoption of high-performance computing and cloud services, supported by favorable policy frameworks and government backing for data center infrastructure. The early integration of advanced technologies like artificial intelligence, big data, and the Internet of Things (IoT) in the region necessitates robust data center networks capable of managing vast data volumes. A well-established ecosystem of hardware and software vendors, service providers, and research institutions fosters continuous innovation and enhancement of data center networking capabilities. Collaborations among leading industry firms further advance the deployment of sophisticated networking solutions. Major hardware suppliers, including Cisco Systems, Juniper Networks, and Arista Networks, are pivotal in this development.

In the Asia-Pacific region, the growing need for data centers that can securely manage information is expected to be a key driver for the establishment of new data centers and the demand for advanced data center networking solutions. Emerging economies such as China and India, along with other Southeast Asian nations, are rapidly embracing on-demand, cloud-based, and high-speed internet services, contributing to a significant increase in data center networking services in the region.

KEY PLAYERS

The Major key players in the market include Alcatel-Lucent S.A., Fujitsu Limited, Dell Inc., Equinix Inc., Cisco Systems Inc., IBM Corporation, HP Development Company, Hitachi Data Systems Corporation, Vmware, Inc., Broadcom Corp, Juniper Networks Inc., and others.

RECENT DEVELOPMENTS

-

In March 2024, NVIDIA launched the X800 series of switches, featuring the Quantum-X800 InfiniBand and Spectrum-X800 Ethernet switches.

-

In June 20, 2023, Juniper Networks announced that it has launched a new software-defined networking (SDN) platform called Contrail Networking 3.0. The platform is designed to help businesses automate and manage their data center networks.

-

In June 8, 2023, Arista Networks announced that it has launched a new line of high-performance switches called 7800 Series. The switches are designed to meet the needs of businesses that are running demanding applications in their data centers.

| Report Attributes | Details |

| Market Size in 2023 | US$ 27.37 Billion |

| Market Size by 2032 | US$ 76.87 Billion |

| CAGR | CAGR of 12.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware and Services) • By End-User (BFSI, IT & Telecom, Healthcare, Retail, Education, Government, Media & Entertainment, Manufacturing, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Alcatel-Lucent S.A., Fujitsu Limited, Dell Inc., Equinix Inc., Cisco Systems Inc., IBM Corporation, HP Development Company, Hitachi Data Systems Corporation, Vmware, Inc., Juniper Networks Inc. |

| Key Drivers | • The growing adoption of cloud computing is the key driver of the data center networking market. • The rise of the IoT is another major driver of the market. • The expansion of 5G networks is also expected to boost the market growth. |

| Market Challenges | • Regulatory compliance issues can hinder the market growth. |