Data Center Blade Server Market Report Scope & Overview:

The Data Center Blade Server Market was valued at USD 17.12 billion in 2023 and is expected to reach USD 37.35 billion by 2032, growing at a CAGR of 9.12% from 2024-2032.

To Get more information on Data Center Blade Server Market - Request Free Sample Report

This report highlights key factors driving market growth, such as power consumption and efficiency improvements, with blade servers offering enhanced energy use and cost reductions. It also discusses CAPEX and OPEX trends, showcasing the balance between investment in infrastructure and long-term operational costs. Data center expansion, fueled by increased demand for data processing and storage, is another crucial factor. Additionally, the impact of virtualization in optimizing resources and enhancing server utilization is explored. The report also touches on the average server lifetime, indicating the trend toward longer-lasting and more durable server solutions to support evolving business needs.

U.S. Data Center Blade Server Market was valued at USD 5.00 billion in 2023 and is expected to reach USD 11.04 billion by 2032, growing at a CAGR of 9.19% from 2024-2032

The growth of the Data Center Blade Server Market is driven by the increasing demand for efficient and scalable data storage solutions, as businesses expand their digital infrastructure. Blade servers offer superior power efficiency, reducing operational costs and improving energy use. Additionally, the rise of data center expansions, virtualization technologies, and the need for high-performance computing to support cloud services, big data, and AI applications are further boosting market growth. These factors contribute to the projected market growth at a CAGR of 9.12%.

Data Center Blade Server Market Dynamics

Drivers

-

Rising Demand for High-Performance Servers to Manage Increasing Business Data Drives Growth in Data Center Blade Server Market

The rapid growth in the data produced by companies from various industries has generated a critical need for sophisticated infrastructure that can efficiently handle and store huge pools of information. As organizations increasingly depend on digitalization, firms need high-capacity and strong servers to process the increasing data volume. Data centers are constantly being challenged to deliver faster data processing and secure storage solutions to accommodate new technologies such as AI, machine learning, and big data analytics. Consequently, the need for high-performance, scalable, and energy-efficient server systems, including blade servers, has increased. Blade servers provide maximum performance and can process heavy workloads, enabling companies to address the changing needs of data processing, storage, and accessibility.

Restraints

-

High Energy Consumption and Operational Costs of Blade Servers Pose Challenges for Large-Scale Data Center Deployments

While more energy-efficient than their traditional server counterparts, blade servers also need a significant amount of power, especially when utilized at large-scale data centers. As more servers are installed to satisfy increasing data requirements, overall power consumption increases exponentially. This can result in higher operational expenses, particularly for companies that are dependent on heavy data processing needs. For highly dense data centers with a lot of servers, the power demands not only contribute to electricity charges but also necessitate strong cooling systems, further increasing expenses. Moreover, with sustainability emerging as a key issue for most organizations, the green impact of high energy usage might become an issue in the future. These issues underscore the persistent issue of operational efficiency for massive blade server deployments in data centers.

Opportunities

-

Increasing Demand for Blade Servers Driven by the Rise of AI, Machine Learning, and Big Data Analytics

The increasing use of artificial intelligence (AI), machine learning, and big data analytics is driving the demand for high-performance computing infrastructure substantially. These technologies demand high-performance servers that can support complex data processing operations and execute advanced algorithms in real-time. With companies from different industries making investments in AI-based innovations and data analytics for insights and enhanced decision-making, the need for blade servers to support these high-intensity workloads is growing. Blade servers, being scalable, energy-efficient, and having the capacity to handle large volumes of data, are particularly suited to address these challenges. This trend offers an attractive opportunity for the data center blade server market to support the growing computational needs of AI, machine learning, and big data applications.

Challenges

-

Compatibility Issues Between Blade Servers and Legacy Systems Complicate Integration in Modern Data Center Upgrades

The integration of new blade server technology with existing infrastructure can be a complex and time-consuming process for many organizations. As data centers continue to modernize, compatibility issues commonly occur when trying to integrate advanced blade servers with existing legacy systems. These compatibility issues can hinder deployment and incur further costs to businesses as they need to adapt or replace their legacy infrastructure. In addition, facilitating smooth communication between new and old components involves meticulous planning, technical expertise, and resources. Organizations can experience delays in achieving the full potential of their blade server investments, as they struggle to harmonize old and new technologies. This integration issue can be a major obstacle for companies seeking to upgrade their data centers while ensuring business continuity.

Data Center Blade Server Market Segment Analysis

By Application

The Virtualization and Cloud Computing segment dominated the Data Center Blade Server Market with a revenue share of over 33% in 2023, courtesy of increased usage of cloud solutions and higher adoption of virtualized environments. The efficiency, scalability, and performance of blade servers make them particularly suitable to enable cloud infrastructure as well as virtualized workloads. As companies keep migrating to cloud environments, the demand for robust, stable blade servers in these spaces keeps increasing.

The AI and Machine Learning Workloads segment is anticipated to grow at the fastest CAGR of approximately 11.82% during 2024-2032 due to the fact that these technologies demand high computational capacity and data processing capabilities. Blade servers are well-suited to meet the needs of AI and machine learning applications, providing the necessary performance for running complex algorithms and large-scale data sets. As AI adoption increases across industries, the demand for blade servers to support these workloads is expected to grow rapidly.

By Form Factor

The Half-height Blade Server segment led the Data Center Blade Server Market with the largest revenue share of nearly 50% in 2023 because of its perfect blend of performance, space utilization, and affordability. These servers offer a compact form factor, which enables greater density and improved use of scarce data center space, making them extremely appealing to companies that must maximize their infrastructure without sacrificing computing power. Their scalability and flexibility further propel their usage in contemporary data centers.

The Full-height Blade Server market is anticipated to expand at the fastest CAGR of approximately 10.34% during 2024-2032 because it can process more powerful tasks and support higher-performance workloads. These servers offer more expansion possibilities, with higher capacity for high-end applications like AI, big data analytics, and virtualization. With growing demand for more sophisticated computational capabilities, full-height blade servers are emerging as a popular option for data centers with high growth needs.

By Channel

Direct segment led the Data Center Blade Server Market with the largest revenue share of approximately 51% in 2023 owing to its model of direct procurement, which provides companies the flexibility to design their server infrastructure based on certain requirements. Companies that need customized solutions, effective configurations, and strong post-sales support tend to prefer buying directly from the manufacturers. This strategy is more in control of product selection, pricing, and service, contributing to the domination of the direct segment in the market.

The Reseller segment is projected to grow at the fastest CAGR of nearly 11% between 2024 and 2032 due to growing demand for third-party distribution networks and sales channels. Resellers are instrumental in providing data center solutions to small and medium-sized enterprises that do not have direct dealings with manufacturers. With growing needs for cost-efficient solutions and access to professional guidance, resellers are likely to witness high growth, keeping pace with the growing requirement for blade server deployment.

By End-use

The BFSI segment led the Data Center Blade Server Market with the largest revenue share of approximately 32% in 2023 because of the urgent requirement for high-performance servers to handle massive amounts of financial transactions, data storage, and security needs. Financial institutions need secure, reliable, and scalable server solutions to facilitate their operations, maintain data integrity, and meet regulatory requirements. Blade servers provide the performance, reliability, and security required to fulfill these requirements, leading BFSI's market dominance.

The IT & Telecom sector is expected to expand at the fastest CAGR of around 10.72% from 2024-2032 because of the extensive growth in network infrastructure and growing demand for data processing and storage. With 5G, IoT, and digital transformation taking over, the telecom and IT industries require blade servers with high performance to deliver large-scale and high-speed data transmission and services. With increasing growth in these technologies, demand for scalable, efficient server solutions in the IT & Telecom market is expected to grow at a rapid pace.

Regional Analysis

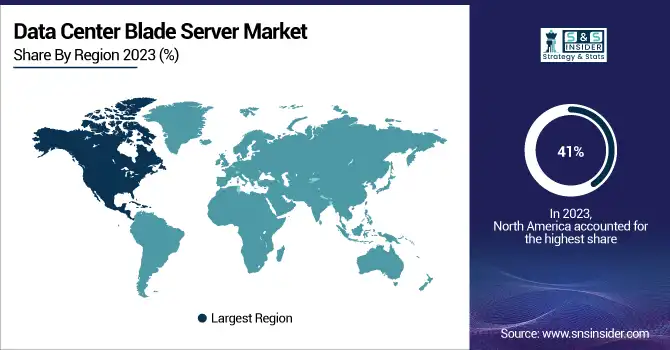

North America dominated the Data Center Blade Server Market with the highest revenue share of about 41% in 2023 due to its advanced technological infrastructure, widespread adoption of cloud computing, and high demand for data processing power across various industries. The region is home to major data center operators, tech giants, and financial institutions, all of which rely heavily on blade servers to support their critical operations. The focus on innovation and digital transformation also fuels North America's market dominance.

Asia Pacific is expected to grow at the fastest CAGR of about 9.47% from 2024-2032 due to rapid technological advancements, increased investment in IT infrastructure, and growing data center demand driven by the region’s booming digital economy. The expansion of cloud services, e-commerce, and industries such as AI, IoT, and telecommunications in countries like China, India, and Japan is driving the demand for high-performance blade servers, contributing to the region’s rapid market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Cisco Systems, Inc. (Cisco UCS B-Series Blade Servers, Cisco Nexus 9000 Series)

-

Dell Inc. (PowerEdge M-Series Blade Servers, Dell VRTX)

-

FUJITSU (PRIMERGY BX900 Blade Servers, Fujitsu Integrated System PRIMEFLEX)

-

Hewlett Packard Enterprise Development LP (HPE BladeSystem c-Class, HPE Synergy)

-

Huawei (FusionServer Pro 2288H V5 Blade Servers, Huawei CloudEngine Blade Switches)

-

IBM (IBM BladeCenter HS23, IBM Power Systems Servers)

-

INSPUR Co., Ltd. (Inspur NF5280M5 Blade Servers, Inspur AS9000 Blade Servers)

-

Lenovo (Lenovo ThinkSystem SN550 Blade Server, Lenovo Flex System x240 Blade Server)

-

Oracle (Oracle Server X8-2, Oracle Sun Blade 6000)

-

Super Micro Computer, Inc. (SuperBlade 8019, Supermicro TwinPro Blade Servers)

-

H3C (H3C UniBlade Series, H3C S12500X Blade Switch)

-

Mellanox Technologies (Mellanox Spectrum Ethernet Switch, Mellanox InfiniBand ConnectX Adapter)

-

Broadcom (Broadcom Ethernet Adapters, Broadcom NetXtreme II 10GbE Blade)

-

Sugon (Sugon 7200 Blade Server, Sugon 5100 Blade Server)

-

Wiwynn (Wiwynn M-series Blade Servers, Wiwynn T-series Servers)

-

Quanta Computer (Quanta Blade Servers, QuantaGrid D52B-1U Servers)

-

Netronome (Netronome Agilio CX, Agilio SmartNICs)

Recent Developments:

-

In February 2025, Cisco introduced its N9300 Series Smart Switches, integrating AMD Pensando data processing units (DPUs) to redefine data center architecture, enhancing AI design capabilities with advanced networking and security services.

-

In March 2025, Dell unveiled the PowerEdge XE8712 server at NVIDIA GTC, designed for AI and high-performance computing workloads. It integrates NVIDIA’s GB200 Grace Blackwell Superchip, setting new benchmarks in AI-powered server performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.12 Billion |

| Market Size by 2032 | USD 37.35 Billion |

| CAGR | CAGR of 9.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form Factor (Half-height Blade Server, Full-height Blade Server, Quarter-height Blade Server) • By Channel (Direct, Reseller, Systems Integrator, Others) • By Application (Virtualization and Cloud Computing, High-performance Computing (HPC), Storage and Backup, Web Hosting, Database Management, AI and Machine Learning Workloads) • By End-use (BFSI, Healthcare, Energy, IT & Telecom, Government & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Dell Inc., FUJITSU, Hewlett Packard Enterprise Development LP, Huawei, IBM, INSPUR Co., Ltd., Lenovo, Oracle, Super Micro Computer, Inc., H3C, Mellanox Technologies, Broadcom, Sugon, Wiwynn, Quanta Computer, Netronome |