Data Center Automation Market Report Scope & Overview:

Get more information on Data Center Automation Market - Request Sample Report

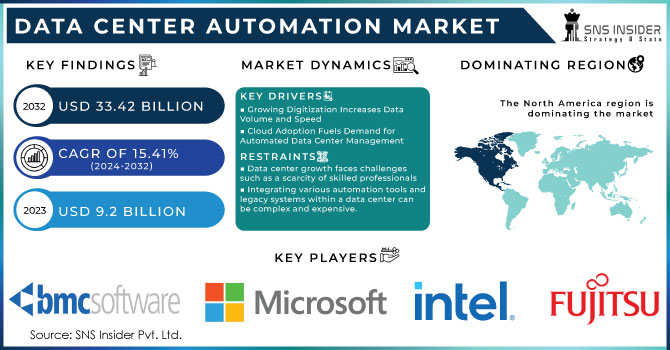

The Data Center Automation Market size was valued at USD 9.2 Billion in 2023. It is expected to hit USD 33.42 Billion by 2032 and grow at a CAGR of 15.41% over the forecast period of 2024-2032.

The Data center automation market growth is driven by the growing adoption of 5G networking tech and the growing popularity of hybrid cloud designs. The need for data center automation is increasing as companies invest more in building a dependable data center infrastructure. The increase in cloud computing usage, driven by the growing trend of working from home and the popularity of mobile streaming apps, is predicted to generate significant opportunities for the market. The increased focus on privacy and security prompted a growth in the automation sector. The volume and portability of healthcare data have greatly increased due to digitization. The growth in virtual Electronic Health Records (EHRs) and online prescriptions is the main healthcare providers invest money into data centers because of the increased storage need. Hartford HealthCare partnered with Google Cloud in November 2022 to accelerate the health gadget's digital transformation, data analytics and affected person access. The corporations will work together to harness the capability of patient information from Hartford HealthCare, which is regularly tough to get admission to and utilize because of being disorganized or buried in increasingly more complicated EHRs.

The increase in the global data center automation market is a result of various factors including the growing use of cloud services, video streaming platforms, social media, and Internet of Things (IoT) devices in businesses. Furthermore, with the advent of the 5G network and the growing need for enhanced data center efficiency due to surging data amounts, there are plenty of market expansion prospects. Roughly 80% of the data that is produced is unstructured, consisting of raw audio, files, or text gathered from different sources such as blogs and social networking sites. Analysing Big Data requires it to be concise. Yet, manually managing a vast quantity of data could result in a significant chance of mistakes. Therefore, automation is crucial in data centers for executing desired tasks, and this is projected to boost market growth in the predicted timeframe.

The market offers various possibilities when the company that owns and runs a data center contracts third parties to manage the data center. Simultaneously, they strive to retain as many processes within the company as they can. Instead of using managed services, automation can get rid of mistakes, cut down on time, and improve processes to achieve more cost-effective results. Another significant factor contributing to the data center automation market is its built-in ability to seamlessly work with various hardware brands, allowing for solutions to be executed regardless of the manufacturer, along with the benefit of supporting multiple tenants. The future use of automation technology is predicted to occur in diverse settings and mixed clouds, emphasizing software-defined security.

Driver

-

Consistently growing digitization greatly boosted the amount and speed at which data is being produced.

-

The rise of cloud adoption creates a need for automated data center management for efficient resource scaling and provisioning.

-

Automated systems optimize data center operations, minimizing energy consumption and reducing the environmental impact.

-

Increasing data generation necessitates automation to manage complex data center environments with high efficiency.

The main reason for data center automation is the increase in cloud usage by all sizes of businesses, driving the demand for flexibility and agility to keep up with rapid innovation and competition. The surge in data traffic results in to increase in the need for cloud data storage. As IoT usage grows globally, so does device connectivity. Therefore, large amounts of data are being accumulated. The Cisco states that there are more than 50 billion smart connected gadgets around the globe. Analyzing data from these devices can produce customer transaction patterns and aid companies in understanding their consumers' tendencies. Cloud adoption has been steadily increasing in recent years, As per an IBM report, over 2,196 terabytes of data can be produced in a month by one manufacturing site, while a single production line can generate more than 70 terabytes daily. Despite this, most data remain unexamined and unprotected. Organizations are transitioning to cloud storage to protect and make use of this information. Additionally, IBM said that around 89% of the data was created within the past two years. Because of the huge quantity of data being produced, there's an increasing need for low-priced data storage solutions in organizations.

Restrain

-

Data center growth faces challenges such as a scarcity of skilled professionals

-

Integrating various automation tools and legacy systems within a data center can be complex and expensive.

-

The initial cost of acquiring and deploying automation tools can be high for some organizations.

-

Automation introduces new vulnerabilities if security aspects aren't thoroughly addressed during implementation.

Having a workforce that is knowledgeable in the maintenance and programming of advanced technologies is crucial in a rapidly changing marketplace. The data center skills gap is expanding when it comes to addressing skill shortages. The rising need for skilled experts is fuelled by the anticipated expansion of cloud or internet giants and the growing capability of colocation data centers in Southeast Asia, China, Australia, and other APAC nations. In AFCOM’s 2021 State of the Data Center Report, it was found that a majority of participants encountered challenges in the recruitment of certain skilled professionals. Based on the survey results, 29% of participants encountered obstacles in hiring cloud experts, while 26% struggled with recruiting staff for data center facilities, engineering, and technician roles. Additionally, 25% of survey participants expressed challenges when it comes to locating the appropriate talent for network security, IT and data center management, and DevOps.

Data Center Automation Market Sengment Overview

By Component

The solutions segment led the market, in 2023, and held more than 56% of the data center automation market. These automation solutions offer mobility, expandability, and adaptability, allowing data centers to operate more efficiently. They essentially provide a control panel for complete automation and remote management. services segment is expected to grow with the fastest annual growth rate of 14.8% in the forecast period of 2024-2032. These services handle tasks such as installation and maintenance of hardware-controlled power delivery systems. Additionally, data center services cover areas like data archiving and backup, managing balanced load distribution, user authentication, and permission controls. They even handle monitoring firewalls, anti-virus software, and communication with numerous devices, all crucial for a fully automated data center's daily operation.

By Solution

Based on solution, data center automation solutions segmented into storage, server, and network automation. In 2023, the server automation segment dominated the market with more than 51% of the revenue share. This technology streamlines application deployment and management across both physical and virtual servers, offering a one-stop shop for automated workflows that minimize human error.

The network automation segment is poised for significant growth, with a projected CAGR of 12.65%. It helps optimize data centers by enabling rapid provisioning of new resources, improved scalability, and improved security. Additionally, network automation utilizes open APIs, allowing seamless integration across various data center software tools and providing universal user access. This translates to a more efficient and streamlined network management experience.

By Enterprise Type

Large enterprises dominated the data center automation market and held a revenue share of more than 69% in 2023. This growth is driven by their need to manage massive amounts of data for complex tools such as analytics and big data. Additionally, multinational corporations often choose well-secured corporate data centers, further fueling this segment's growth.

Small and medium-sized enterprises (SMEs) are projected to grow with a significant annual growth rate of 14.6%, SMEs are increasingly adopting data middle automation due to the increasing demand for quick deployment, scalability, and cloud offerings. Furthermore, the focus on greener and extra energy-efficient data centers aligns with their needs and is expected to contribute massive increase in the market.

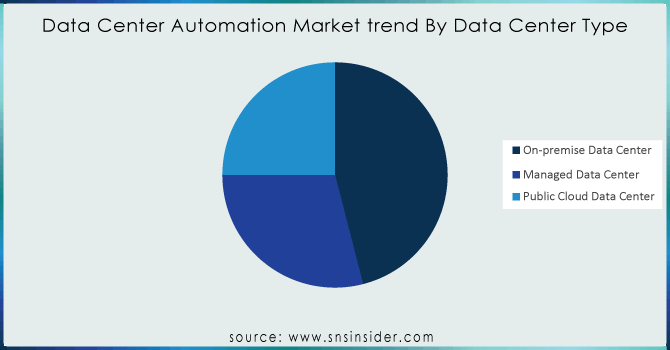

By Data Center Type

The public cloud data center is growing at the fastest growth rate. This surge is fueled by the increasing demand for cloud computing and various benefits such as affordability, easy setup, and remote data access. Public cloud information facilities provide a sturdy suite of automation tools and offerings. These tools can automate numerous records center duties which include provisioning, deployment, monitoring, and scaling. By leveraging this automation, businesses can achieve faster launches of projects, optimize useful resource usage, and adapt greater conveniently to converting wishes. Additionally, increasing investments in building cloud data centers, such as Google's $9.49 billion project in April 2022, further accelerate market growth.

Need any customization research/ data on Data Center Automation Market - Enquiry Now

By End-user

IT & Telecommunication dominated the data center automation market and held a revenue share of more than 22% in 2023. This growth is driven by way of the continuously growing mobile technology and the ever-growing demand for high-speed data services. This industry's boom helps to force the financial system with the aid of developing jobs and commercial enterprise opportunities, even as competition among service providers helps lessen costs for consumers. However, the BFSI (Banking, Financial Services, and Insurance) is expected to grow with a high annual growth rate of 14.7% in the forecast period of 2024-2032. This increase is pushed with the aid of the increase in online banking, payment apps, and mobile wallets. Additionally, the need for the BFSI sector to function 24/7 to make certain clean monetary activity is a major driving force for data-center automation adoption.

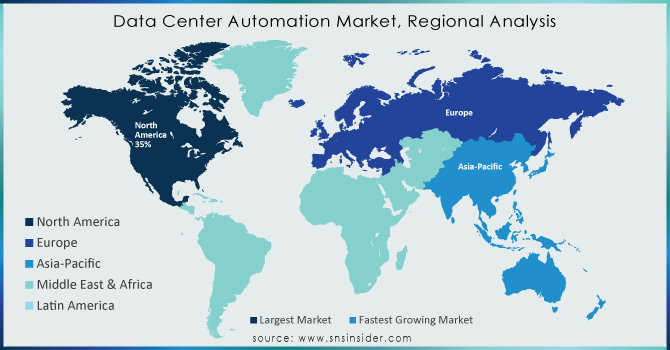

Data Center Automation Market Regional Analysis

North America dominated the market due to the biggest data centers and widespread use of automation technology in companies and held the largest revenue share of more than 35% in 2023. For example, North America possessed 3,005 data centers in January 2022. There have been about 2700 centers in the U.S. And 305 in Canada. Consistently growing use of IoT devices, smart home gadgets, and wearable tech in the U.S. Results in a large amount of data, leading to a need for data center automation to streamline tasks and speed up processes. In August 2022, Jazz chose Juniper Networks to put in force Juniper Apstra System for the motive of imparting Intent-primarily based Networking (IBN) abilities. The company’s goal is to improve its current architectural strategy by utilizing data-driven insights, automation, and assurance to streamline operations and improve user experience. Its reign will persist during the entire forecast period. Additionally, the market is expected to experience significant growth due to the early adoption of emerging technologies, consistently increased investments in research and development for cloud-based solutions, and improved IT infrastructure. The development of new technologies and applications is a key factor driving investments in the market to tap into volumes that were previously thought to be unprofitable. The market for cloud-based solutions is projected to experience significant growth in the country due to investment in healthcare, retail, communications, and manufacturing applications.

Europe is projected to maintain a substantial market share in the upcoming period due to the existence of major data centers in Germany, the U.K., the Netherlands, and France. The initiatives of government projects to assemble eco-friendly data centers and promote sustainability open up new market prospects inside the area. The purpose of the Climate Neutral Data Centre Pact of the European Union is to achieve carbon neutrality for the vicinity by way of 2050, making it the primary globally. In March 2022, Cisco rolled out Secure Access Service Edge (SASE) statistics facilities in Sweden and Denmark (Northern Europe) to cater to safety clients.

The Asia Pacific is projected to grow with the highest compound annual growth rate (CAGR) of 16.2% into the forecast period of 2024-2032. The diverse Countries in APAC which includes Japan, China, and India, together with others, are investing substantially in their IT infrastructure and constructing new statistics facilities to deal with the growing huge amount of data. Furthermore, the Asia-Pacific indicates promising increase possibilities because of the developing quantity of small and medium-sized agencies leveraging cloud computing. Key market players are expected to create new growth possibilities by way of investing closely in the development of cloud information centers. For example, in October 2022, Alibaba Cloud opened two additional facts facilities in Thailand and South Korea. The new information facilities are designed to help local corporations with their journey in the direction of digital transformation.

Key Players:

The major players of the market are Microsoft Corporation, Hewlett Packard Enterprise Development LP, Cisco Systems Inc., ABB, IBM Corporation, Fujitsu, Intel Corporation, BMC Software, Inc., Citrix Systems, Broadcom, Arista Networks, Inc., Red Hat Inc., Micro Focus, Dell Inc. and others in the final report.

Recent development

-

In February 2024, Cisco and NVIDIA announced a collaboration to assist businesses in efficiently creating and managing secure AI infrastructure. The merger among the companies combines enhancements to aid businesses, address the increasing need for greater computing capacity in the data center, and facilitate the transition towards AI using a secure and reliable framework.

-

In June 2023, Moody's Corporation and Microsoft revealed a collaboration focused on delivering advanced analytics, data, research, risk solutions, and collaboration tools for business services and global knowledge workers. The collaboration among colleagues results in innovative contributions that enhance understanding of business intelligence and risk evaluation within the company.

-

In April 2023, Arista Networks, a company that offers networking solutions, unveils an AI-powered network identity service for enhancing business security and IT functions. The CV AGNI ensures secure IT operations by offering easy deployment and scalability in the cloud for all employees, their devices, and IoT plans in the business network.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.2 Billion |

| Market Size by 2032 | US$ 33.42 Billion |

| CAGR | CAGR of 15.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Solutions, Services) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft Corporation, Hewlett Packard Enterprise Development LP, Cisco Systems Inc., ABB, IBM Corporation, Fujitsu, Intel Corporation, BMC Software, Inc., Citrix Systems, Broadcom, Arista Networks, Inc., Red Hat Inc., Micro Focus, Dell Inc. |

| Key Drivers | • The market is expected to increase as a result of factors such as expanding social media, online gaming, and big data applications. |

| Market Opportunities | • Early uptake of emerging technologies, sizable expenditures on cloud-based solution R&D, and improved IT infrastructure are also projected to fuel market expansion. |