Get more information on Cybersecurity Insurance Market - Request Sample Report

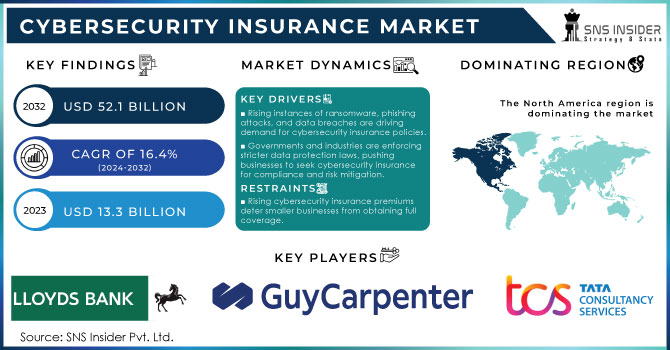

Cybersecurity Insurance Market Size was valued at USD 13.3 Billion in 2023 and is expected to reach USD 52.1 Billion by 2032, growing at a CAGR of 16.4% over the forecast period 2024-2032.

The cybersecurity insurance market is driven by the rising number of cyberattacks and data breaches, with governments globally taking action to mitigate the risks. According to the latest statistics from the U.S. Department of Homeland Security (DHS), cyberattacks in the U.S. increased by 27% in 2023 compared to the previous year, largely affecting financial institutions and healthcare sectors. In US the data breaches will increase 78% in 2023 as compared to 2022. The European Union Agency for Cybersecurity (ENISA) also reported a 20% increase in ransomware attacks across Europe in 2023. This has led to heightened awareness among businesses and governments regarding the need for cybersecurity insurance to mitigate the financial impact of data breaches. Additionally, various national and international regulatory bodies, such as the U.S. Federal Trade Commission (FTC) and the General Data Protection Regulation (GDPR) in Europe, have set stringent compliance requirements. These mandates incentivize organizations to purchase cybersecurity insurance policies, driving market growth further. Government funding for cybersecurity resilience and risk mitigation programs has also seen a significant uptick, contributing to the expansion of the cybersecurity insurance market.

Cyberattacks are on the rise globally, with many individuals, enterprises, and governments losing a lot of money because of these threats. Criminals are targeting a variety of IT infrastructures for political, financial, radical reasons, and others. The ransomware attacks that targeted thousands of organizations include SamSam, Petya, and WannaCry attacks. Atlanta city was also a victim of ransomware that left the administration with a demand to pay $50,000 by SamSam. Businesses are the biggest casualties of these emerging threats and thus, the best way to protect the most important IT infrastructure and data from any malicious attack. Besides the increased number and complexity of attacks, organizations are also spending a lot of money on cybersecurity products and services. The most notable trend is the high cybersecurity insurance buying rate by the different organizations that shield them from huge financial losses because of cyberattacks. About 40% of the breaches affect multiple environments, increasing the breach cost to slightly under $4.75 million. Breach costs will also affect the healthcare sector, affecting $11 million by 2023. However, the cost of critical infrastructure breaches is slightly above $5 million, increasing the cybersecurity cyber defense demand.

Market dynamics

Drivers:

Rising instances of ransomware, phishing attacks, and data breaches are driving demand for cybersecurity insurance policies.

Governments and industries are enforcing stricter data protection laws, pushing businesses to seek cybersecurity insurance for compliance and risk mitigation.

As businesses embrace cloud computing, Internet of Things (IoT), and remote work, they face heightened cybersecurity risks, boosting the need for insurance coverage.

Small and medium-sized enterprises are increasingly recognizing the importance of cybersecurity insurance as they become frequent targets of cyberattacks.

The rapid increase in the frequency and severity of cyberattacks and data breaches across industries is one of the major factors driving the cybersecurity insurance market. Cybercriminals are growing more sophisticated and employ a multitude of methods such as ransomware, phishing, and malware to affect and harm organizations of any size. According to a recent study, ransomware attacks across the globe increased 37 percent in 2023. The attack frequency sufficiently affected critical businesses including but not limited to healthcare, finance, and education. Data shows numerous colossal events occurred recently highlighting the pressing need for cybersecurity insurance. For instance, in May 2023, the MOVEit ransomware attack impacted over 1,000 organizations and released sensitive information to the public. It includes personal data from various businesses and government enterprises. Furthermore, MGM Resorts was targeted during a cyberattack in September 2023. The data leakage caused financial loss, affected customer reputation, and parallaxed company operations with staggering expenses and lawsuits.

The average cost of a data breach event reached $4.45 million, as compared to $4.24 million in 2022. The expense of financial loss drives organizations to seek cybersecurity insurance as a protective mechanism. It covers noticeable shares of the expenses related to incident response, legal fees, and reputation damage. With cyberattacks becoming more frequent and costly, companies are increasingly turning to cybersecurity insurance as a safeguard against the unpredictable and growing financial impacts of cybercrime, further fuelling the demand for coverage.

Restraints:

The rising cost of cybersecurity insurance premiums, especially for full-coverage policies, deters smaller businesses from purchasing adequate protection.

The absence of standardized policy frameworks and definitions complicates the underwriting process, leading to inconsistent coverage and creating challenges for policyholders.

Insurers face challenges in accurately assessing risk due to the evolving nature of cyber threats and limited historical data on cyber incidents, which can impact the cost and scope of policies.

One of the major restraints in the cybersecurity insurance market is the lack of standardization of policy frameworks and definitions. Cyber insurance policies vary widely in terms of coverage, definitions of cyber incidents, and the scope of protection offered. This inconsistency can create confusion for businesses, particularly when they need to file claims. Lack of a clear standard on an industry level or national level makes it problematic for businesses to understand whether they are protected correctly and play into the hands of the insurer during disappointment consideration matters. Many insurers may have varying understandings of ‘cyber incidents’ and ‘related events’ mentioned in their policy. This could lead to potentially legal battles with the insurer when the insured files a claim. As a result of such a lax framework, underwriters are forced to engage in the permanent redefinition of risks and the development of products for each new client. This led to significant delays in policy execution. Therefore, on the shortage of businesses purchasing cybersecurity insurance or purchasing it in inadequate scopes and with insufficient coverage.

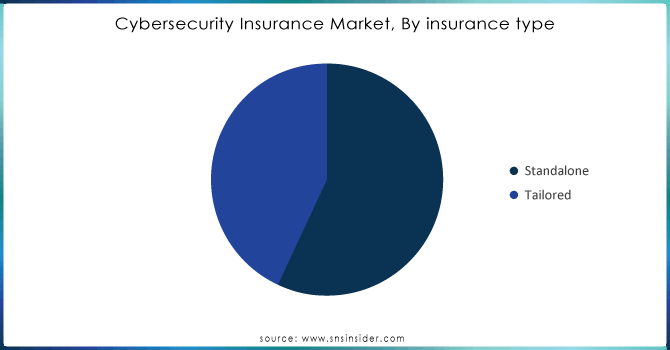

By Insurance Type

The standalone segment dominated the market in 2023, due to the comprehensive cover against cyber risk and because of its use among large enterprises. According to The U.S. In 2023, this type of insurance contributed to 58% share of the cybersecurity insurance market. Standalone cyberspace insurance provides broad protection against multiple cyber risks, ranging from data breaches to ransomware and business interruptions. In response to the numerous reports about cyber breaches in the past few years, organizations are increasingly selecting this type of insurance as the most effective maintenance of robust protection. However, the tailored segment is estimated to account for the highest compound annual growth rate in insurance type in the forecast period. According to The U.S. Small Business Administration’s data, SMEs account for 99.9% of all U.S.-based businesses. More and more of these organizations and companies within particular sectors, such as healthcare and retail, are selecting the cyber insurance marketed to meet their specific needs as cheaper, and more focused on their vulnerabilities. This growing preference is expected to drive the tailored segment’s rapid expansion.

Need any customization research on Cybersecurity Insurance Market - Enquiry Now

By Insurance Coverage

The cyber liability segment held a larger market share by insurance coverage. Cyber liability insurance accounted for 52% share of the market in 2023. The coverage primarily accounts for costs related to data breaches, including legal defense, public relations, notification of customers, and other costs. As businesses face increasing regulatory scrutiny, such policies are becoming critical to mitigating the financial and reputational damage caused by cyber incidents. The implementation of stringent data protection laws, like the California Consumer Privacy Act (CCPA) and GDPR, is further boosting the demand for cyber liability insurance, as non-compliance can result in hefty fines. The government’s push for stronger cybersecurity standards in the private sector is another factor driving demand for cyber liability policies.

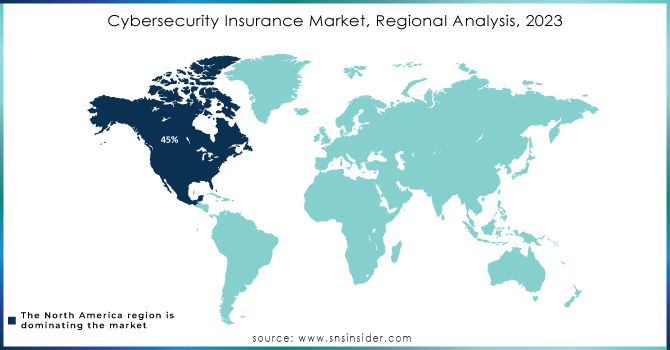

Regional Analysis

North America has led the cybersecurity insurance market in 2023 with a 45% share of the global market. The region dominates the market due to the high incidence of cyberattacks and stringent regulations. According to the Cybersecurity and Infrastructure Security Agency, the U.S. alone experienced over 2,500 significant attacks in 2023, leading to nearly $6.2 billion in losses. North America’s advanced technology infrastructure is a lucrative target for perpetrators, which has resulted in further market growth. Owing to the numerous threat actors in the area, such as Russia, North Korea, Iran, and China, insurance providers are able to deliver a large number of insurance schemes. Furthermore, the U.S. government’s intention to ensure that all federal departments and contractors have more robust cybersecurity frameworks, embodied by the U.S. Executive Order on Improving the Nation’s Cybersecurity, contributes to the growth of the target market. With the highest CAGR, the Asia-Pacific region is anticipated to undergo substantial growth led by escalating cyber threats, burgeoning digitalization, and mounting awareness regarding cyber risks across China, India, Japan, and others. Booming implementation of regulatory frameworks and cybersecurity solutions will boost the APAC market size for cybersecurity insurance.

Tata Consultancy Services Limited (TCS) (Cyber Insurance Advisory Services, Threat Management and Cybersecurity Insurance Solutions)

Guy Carpenter & Company LLC (Cyber Risk Analytics Platform, Cyber Reinsurance Services)

At-Bay Inc. (Cyber Insurance Coverage, Risk Monitoring Platform)

Lloyds Bank PLC (Cyber Liability Insurance, Cyber Event Response Services)

AXA SA (AXA Cyber Protect Insurance, AXA Risk Prevention Services)

Cisco Systems Inc. (Cisco Secure Endpoint Protection, Cisco Umbrella (Cybersecurity Insurance Support))

Chubb Limited (Cyber ERM (Enterprise Risk Management), Cyber Insurance Solution Suite)

Apple Inc. (Apple Device Security (Data Protection), iCloud Secure Backup (Cyber Risk Mitigation))

American International Group Inc. (AIG) (AIG CyberEdge Insurance, AIG Cyber Loss Prevention Services)

Zurich Insurance Group (Zurich Cyber Security & Privacy Insurance, Zurich Risk Engineering Cyber Solutions)

Marsh & McLennan Companies, Inc. (Marsh Cyber Policy Solutions, Marsh Cyber Risk Assessment Tools

Munich Re Group (Munich Re Cyber Insurance Solutions, Munich Re Risk Intelligence Service)

Travelers Companies, Inc. (Travelers CyberFirst Insurance, Travelers CyberRisk Assessment Services)

Beazley Group (Beazley Breach Response (BBR), Beazley InfoSec Cyber Insurance)

Aon PLC (Aon Cyber Insurance Brokerage Services, Aon Cyber Resilience Solutions)

Allianz SE (Allianz Cyber Protect, Allianz Cyber Risk Consulting)

Hiscox Ltd (Hiscox CyberClear Insurance, Hiscox Incident Response Services)

Liberty Mutual Insurance (Liberty Cyber Liability Insurance, Liberty Cyber Incident Management Services)

Sompo International (Sompo Cyber Liability Insurance, Sompo Cyber Risk Management Services)

XL Group Ltd (AXA XL) (AXA XL Cyber Insurance, AXA XL CyberRisk Mitigation Solutions)

and others in final Report.

Latest News from Key Players

AIG Cyber Insurance Product (March 2024) – AIG has revealed its new product of cybersecurity insurance that is expected to protect against an extended array of digital threats. The product includes coverage for vulnerabilities associated with different artificial intelligence applications, which is caused by the increasing implementation of AI technologies across a broad spectrum of industries.

Chubb Cyber Risk Services Expansion (June 2023) – Chubb has made an announcement regarding the expansion of its cybersecurity risk assessment operations targeted at company policyholders focusing on mid-sized companies in North America. These policies are designed to satisfy cyberattacks that are ever-growing in number across North American SMEs, frequently observed in the manufacturing and medical technology fields.

Government’s Promotion of Public-Private Partnership for Cybersecurity (September 2023) – The U.S. Department of Homeland Security has launched a new project that is aimed at establishing closer relationships between the private sector and the governing agencies. The program supports the implementation of various information exchange and risk mitigation strategies aimed at enhancing cybersecurity of the nation. Moreover, businesses that employ the advanced cybersecurity systems will be rewarded with insurance discounts.

| Report Attributes | Details |

| Market Size in 2023 | USD 13.3 Bn |

| Market Size by 2032 | USD 52.1 Bn |

| CAGR | CAGR of 16.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By offering (Solution {Cybersecurity insurance analytics platform, Disaster recovery and business continuity, Cybersecurity solution}, Service {Consulting/ Advisory, Security awareness training, Others}) • By coverage (Data breach, Cyber liability) • By Compliance Requirements (Healthcare Compliance, Financial Services Compliance, GDPR Compliance, Data Privacy Compliance, Others) • By insurance type (Tailored, Stand-alone) • By end user (Technology provider {Insurance companies, Third-party administrators, brokers, and consultancies, Government agencies}, Insurance provider {Financial services, IT and ITES, Healthcare and life science, Retail and ecommerce, Telecom, Travel, tourism, and hospitality, Others}) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Consultancy Services Limited, Guy Carpenter and Company LLC., At-Bay Inc., Lloyds Bank PLC, AXA SA, Cisco Systems Inc., Chubb Limited, Apple Inc., American International Group Inc., Zurich Insurance Group |

| Key Drivers | • Increased cybersecurity rules and legislation will increase demand for insurance cover • High rate of financial loss recovery to boost market growth |

| Market Opportunity | • The rising cost of cybersecurity insurance premiums, especially for full-coverage policies, deters smaller businesses from purchasing adequate protection. |

Ans: - The estimated market size for the Cyber Security Insurance market for the year 2032 is USD 52.1 Bn.

Ans: - The Cyber Security Insurance Market is to grow at a CAGR of 16.4% over the forecast period 2024-2032.

Ans: - The United States is often regarded as the world's most important market for cybersecurity insurance.

Ans: - The major key players are Tata Consultancy Services Limited, Guy Carpenter and Company LLC., At-Bay Inc., Lloyds Bank PLC, AXA SA, Cisco Systems Inc., Chubb Limited, Apple Inc., American International Group Inc., Zurich Insurance Group.

Ans: - The study includes a comprehensive analysis of Cyber Security Insurance Market trends, as well as present and future market forecasts. DROC analysis, as well as impact analysis for the projected period. Porter's five forces analysis aids in the study of buyer and supplier potential as well as the competitive landscape etc.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cybersecurity Insurance Market Segmentation, By offering

7.1 Chapter Overview

7.2 Solution

7.2.1 Solution Market Trends Analysis (2020-2032)

7.2.2 Solution Market Size Estimates And Forecasts To 2032 (USD Billion)

7.2.3 Cybersecurity Insurance analytics platform

7.2.3.1 Cybersecurity Insurance analytics platform Market Trends Analysis (2020-2032)

7.2.3.2 Cybersecurity Insurance analytics platform Market Size Estimates And Forecasts To 2032 (USD Billion)

7.2.4 Disaster recovery and business continuity

7.2.4.1 Disaster recovery and business continuity Market Trends Analysis (2020-2032)

7.2.4.2 Disaster recovery and business continuity Market Size Estimates And Forecasts To 2032 (USD Billion)

7.2.5 Cybersecurity solution

7.2.5.1 Cybersecurity solution Market Trends Analysis (2020-2032)

7.2.5.2 Cybersecurity solution Market Size Estimates And Forecasts To 2032 (USD Billion)

7.2.5.3 Cyber risk and vulnerability assessment

7.2.5.3.1 Cyber risk and vulnerability assessment Market Trends Analysis (2020-2032)

7.2.5.3.2 Cyber risk and vulnerability assessment Market Size Estimates And Forecasts To 2032 (USD Billion)

7.2.5.4 Cybersecurity resilience

7.2.5.4.1 Cybersecurity resilience Market Trends Analysis (2020-2032)

7.2.5.4.2 Cybersecurity resilience Market Size Estimates And Forecasts To 2032 (USD Billion)

7.3 Service

7.3.1 Laser Metal Deposition Market Trends Analysis (2020-2032)

7.3.2 Laser Metal Deposition Market Size Estimates And Forecasts To 2032 (USD Billion)

7.3.3 Consulting/ Advisory

7.3.3.1 Consulting/ Advisory Market Trends Analysis (2020-2032)

7.3.3.2 Consulting/ Advisory Market Size Estimates And Forecasts To 2032 (USD Billion)

7.3.4 Security awareness training

7.3.4.1 Security awareness training Market Trends Analysis (2020-2032)

7.3.4.2 Security awareness training Market Size Estimates And Forecasts To 2032 (USD Billion)

7.3.5 Others

7.3.5.1 Others Market Trends Analysis (2020-2032)

7.3.5.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

8. Cybersecurity Insurance Market Segmentation, By coverage

8.1 Chapter Overview

8.2 Data breach

8.2.1 Data breach Market Trends Analysis (2020-2032)

8.2.2 Data breach Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.3 Data loss

8.2.3.1 Data loss Market Trends Analysis (2020-2032)

8.2.3.2 Data loss Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.4 Denial of service and down-time

8.2.4.1 Denial of service and down-time Market Trends Analysis (2020-2032)

8.2.4.2 Denial of service and down-time Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.5 Ransomware attacks

8.2.5.1 Ransomware attacks Market Trends Analysis (2020-2032)

8.2.5.2 Ransomware attacks Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.6 Others

8.2.6.1 Others Market Trends Analysis (2020-2032)

8.2.6.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Cyber liability

8.3.1 Cyber liability Market Trends Analysis (2020-2032)

8.3.2 Cyber liability Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.3 Type

8.3.3.1 Type Market Trends Analysis (2020-2032)

8.3.3.2 Type Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.3.3 Data protection and privacy costs

8.3.3.3.1 Data protection and privacy costs Market Trends Analysis (2020-2032)

8.3.3.3.2 Data protection and privacy costs Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.3.4 Non-compliance penalty

8.3.3.4.1 Non-compliance penalty Market Trends Analysis (2020-2032)

8.3.3.4.2 Non-compliance penalty Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.3.5 Brand and related intellectual property protection

8.3.3.5.1 Brand and related intellectual property protection Market Trends Analysis (2020-2032)

8.3.3.5.2 Brand and related intellectual property protection Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.3.6 Others

8.3.3.6.1 Others Market Trends Analysis (2020-2032)

8.3.3.6.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.4 Source/ Target

8.3.4.1 Source/ Target Market Trends Analysis (2020-2032)

8.3.4.2 Source/ Target Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.4.3 Internal

8.3.4.3.1 Internal Market Trends Analysis (2020-2032)

8.3.4.3.2 Internal Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.4.4 External

8.3.4.4.1 External Market Trends Analysis (2020-2032)

8.3.4.4.2 External Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Cybersecurity Insurance Market Segmentation, By Compliance Requirements

9.1 Chapter Overview

9.2 Healthcare Compliance

9.2.1 Healthcare Compliance Market Trends Analysis (2020-2032)

9.2.2 Healthcare Compliance Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Financial Services Compliance

9.3.1 Financial Services Compliance Market Trends Analysis (2020-2032)

9.3.2 Financial Services Compliance Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 GDPR Compliance

9.4.1 GDPR Compliance Market Trends Analysis (2020-2032)

9.4.2 GDPR Compliance Market Size Estimates And Forecasts To 2032 (USD Billion)

9.5 Data Privacy Compliance

9.5.1 Data Privacy Compliance Market Trends Analysis (2020-2032)

9.5.2 Data Privacy Compliance Market Size Estimates And Forecasts To 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Cybersecurity Insurance Market Segmentation, By Insurance type

10.1 Chapter Overview

10.2 Tailored

10.2.1 Tailored Market Trends Analysis (2020-2032)

10.2.2 Tailored Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Stand-alone

10.3.1 Stand-alone Market Trends Analysis (2020-2032)

10.3.2 Stand-alone Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Cybersecurity Insurance Market Segmentation, By end user

11.1 Chapter Overview

11.2 Technology provider

11.2.1 Technology provider Market Trends Analysis (2020-2032)

11.2.2 Technology provider Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.3 Insurance companies

11.2.3.1 Insurance companies Market Trends Analysis (2020-2032)

11.2.3.2 Insurance companies Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.4 Third-party administrators, brokers, and consultancies

11.2.4.1 Third-party administrators, brokers, and consultancies Market Trends Analysis (2020-2032)

11.2.4.2 Third-party administrators, brokers, and consultancies Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.6 Government agencies

11.2.6.1 Government agencies Market Trends Analysis (2020-2032)

11.2.6.2 Government agencies Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Insurance provider

11.3.1 Insurance provider Market Trends Analysis (2020-2032)

11.3.2 Insurance provider Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.3 Financial services

11.3.3.1 Financial services Market Trends Analysis (2020-2032)

11.3.3.2 Financial services Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.4 IT and ITES

11.3.4.1 IT and ITES Market Trends Analysis (2020-2032)

11.3.4.2 IT and ITES Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.5 Healthcare and life science

11.3.5.1 Healthcare and life science Market Trends Analysis (2020-2032)

11.3.5.2 Healthcare and life science Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.6 Retail and ecommerce

11.3.6.1 Retail and ecommerce Market Trends Analysis (2020-2032)

11.3.6.2 Retail and ecommerce Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.7 Telecom

11.3.7.1 Telecom Market Trends Analysis (2020-2032)

11.3.7.2 Telecom Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.8 Travel, tourism, and hospitality

11.3.8.1 Travel, tourism, and hospitality Market Trends Analysis (2020-2032)

11.3.8.2 Travel, tourism, and hospitality Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.9 Others

11.3.9.1 Others Market Trends Analysis (2020-2032)

11.3.9.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Cybersecurity Insurance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.2.4 North America Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.2.5 North America Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.2.6 North America Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.2.7 North America Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.2.8.2 USA Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.2.8.3 USA Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.2.8.4 USA Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.2.8.5 USA Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.2.9.2 Canada Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.2.9.3 Canada Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.2.9.4 Canada Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.2.9.5 Canada Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.2.10.2 Mexico Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.2.10.3 Mexico Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.2.10.4 Mexico Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.2.10.5 Mexico Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.8.2 Poland Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.1.8.3 Poland Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.1.8.4 Poland Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.1.8.5 Poland Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.9.2 Romania Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.1.9.3 Romania Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.1.9.4 Romania Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.1.9.5 Romania Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.4 Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.5 Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.6 Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.7 Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.8.2 Germany Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.8.3 Germany Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.8.4 Germany Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.8.5 Germany Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.9.2 France Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.9.3 France Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.9.4 France Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.9.5 France Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.10.2 UK Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.10.3 UK Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.10.4 UK Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.10.5 UK Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.11.2 Italy Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.11.3 Italy Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.11.4 Italy Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.11.5 Italy Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.12.2 Spain Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.12.3 Spain Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.12.4 Spain Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.12.5 Spain Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.15.2 Austria Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.15.3 Austria Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.15.4 Austria Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.15.5 Austria Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.4 Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.5 Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.6 Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.7 Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.8.2 China Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.8.3 China Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.8.4 China Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.8.5 China Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.9.2 India Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.9.3 India Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.9.4 India Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.9.5 India Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.10.2 Japan Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.10.3 Japan Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.10.4 Japan Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.10.5 Japan Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.11.2 South Korea Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.11.3 South Korea Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.11.4 South Korea Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.11.5 South Korea Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.12.2 Vietnam Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.12.3 Vietnam Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.12.4 Vietnam Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.12.5 Vietnam Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.13.2 Singapore Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.13.3 Singapore Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.13.4 Singapore Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.13.5 Singapore Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.14.2 Australia Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.14.3 Australia Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.14.4 Australia Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.14.5 Australia Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Cybersecurity Insurance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.4 Middle East Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.1.5 Middle East Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.1.6 Middle East Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.1.7 Middle East Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.8.2 UAE Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.1.8.3 UAE Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.1.8.4 UAE Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.1.8.5 UAE Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Cybersecurity Insurance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.4 Africa Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.2.5 Africa Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.2.6 Africa Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.2.7 Africa Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Cybersecurity Insurance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.6.4 Latin America Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.6.5 Latin America Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.6.6 Latin America Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.6.7 Latin America Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.6.8.2 Brazil Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.6.8.3 Brazil Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.6.8.4 Brazil Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.6.8.5 Brazil Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.6.9.2 Argentina Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.6.9.3 Argentina Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.6.9.4 Argentina Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.6.9.5 Argentina Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.6.10.2 Colombia Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.6.10.3 Colombia Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.6.10.4 Colombia Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.6.10.5 Colombia Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Cybersecurity Insurance Market Estimates And Forecasts, By offering (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Cybersecurity Insurance Market Estimates And Forecasts, By coverage (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Cybersecurity Insurance Market Estimates And Forecasts, By Compliance Requirements (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Cybersecurity Insurance Market Estimates And Forecasts, By Insurance type (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Cybersecurity Insurance Market Estimates And Forecasts, By end user (2020-2032) (USD Billion)

13. Company Profiles

13.1 Tata Consultancy Services Limited

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Guy Carpenter and Company LLC.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 At-Bay Inc.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Lloyds Bank PLC

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 AXA SA

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Cisco Systems Inc.

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Chubb Limited

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Apple Inc.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 American International Group Inc.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Zurich Insurance Group

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By offering

Solution

Cybersecurity insurance analytics platform

Disaster recovery and business continuity

Cybersecurity solution

Cyber risk and vulnerability assessment

Cybersecurity resilience

Service

Consulting/ Advisory

Security awareness training

Others

By coverage

Data breach

Data loss

Denial of service and down-time

Ransomware attacks

Others

Cyber liability

Type

Data protection and privacy costs

Non-compliance penalty

Brand and related intellectual property protection

Others

Source/ Target

Internal

External

By Compliance Requirements

Healthcare Compliance

Financial Services Compliance

GDPR Compliance

Data Privacy Compliance

Others

By insurance type

Standalone

Tailored

By end user

Technology provider

Insurance companies

Third-party administrators, brokers, and consultancies

Government agencies

Insurance provider

Financial services

IT and ITES

Healthcare and life science

Retail and ecommerce

Telecom

Travel, tourism, and hospitality

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Low Code Development Platform Market size was recorded at USD 22.80 Billion in 2023 and is expected to surpass USD 271.7 Billion by 2032, growing at a CAGR of 31.7% over the forecast period of 2024-2032.

The Call Center AI Market Size was valued at USD 1.7 Billion in 2023 and is expected to reach USD 10.4 Billion by 2032, growing at a CAGR of 22.3% by 2032.

The Digital Signature Market size was valued at USD 5.6 Billion in 2023 and will grow to USD 107.1 Billion by 2032 and grow at a CAGR of 38.9 % by 2032.

The Digital Payment Infrastructure Market was worth USD XX billion in 2023 and is predicted to be worth USD XX billion by 2032, growing at a CAGR of XX by 2032.

The Web Real-Time Communication Market size was valued at USD 7.3 billion in 2023 and is expected to reach USD 128.2 Billion by 2032, growing at a CAGR of 37.51% over the forecast period of 2024-2032.

Real-Time Payment Market was valued at USD 21.1 billion in 2023 and is expected to reach USD 270.8 billion by 2032, growing at a CAGR of 32.8% over 2024-2032.

Hi! Click one of our member below to chat on Phone