Cyanate Ester Resin Market Key Insights:

To Get More Information on Cyanate Ester Resin Market - Request Sample Report

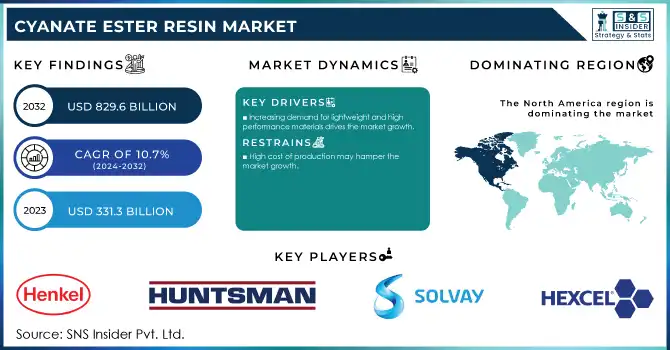

The Cyanate Ester Resin Market size was valued at USD 331.3 Million in 2023. It is expected to grow to USD 829.6 Million by 2032 and grow at a CAGR of 10.7% over the forecast period of 2024-2032.

Cyanate ester resins are increasingly being used in electronics and electrical applications due to their high thermal stability, electrical insulating behavior, and excellent mechanical strength. These resins are best suited for high-temperature performance and long-term performance components that are particularly well suited for printed circuit boards (PCBs) as well as semiconductor packaging and electrical insulation materials. Additionally, the increasing demand among rapidly growing sectors including consumer electronics, automotive electronics, and renewable energy further drives the usage of these high-performance materials. Cyanate ester resins exhibit high performance and durability for critical components in electric vehicle (EV) applications and renewable energy such as wind turbine blades and solar panels, thereby contributing to long-term viability.

The National Institute of Standards and Technology (NIST) and the U.S. Department of Commerce provide annual data on electronics manufacturing, including the usage of advanced materials in printed circuit boards (PCBs) and semiconductors. These materials are essential for the growing demand for high-performance components in electronics.

The increasing demand for cyanate ester resins is mainly attributed to the aerospace and defense industries which are supposed to gain a higher market in the coming years due to their greatest thermal stability, mechanical strength, and stability to high temperature. These resins are utilized in aerospace applications, especially for highly strategic parts like aircraft wings, fuselage structures, and engine parts that require outstanding performance over extreme conditions. Because they have much better strength-to-weight ratios, can handle the extreme thermal and mechanical stresses in flight than the common epoxies, and if lightweight, strong composites, so replacement is the ideal choice for the family of cyanote esters. Additional growth for these resins stems from the defense sector as they are used in unmanned aerial vehicles (UAVs), military aircraft, and several other high aeronautical defense technologies.

The FAA provides data on materials used in aerospace manufacturing, focusing on composites and advanced polymers for use in aircraft parts. Reports like the FAA’s Aircraft Materials and Processes Handbook and the Aerospace Manufacturing and Materials Reports typically discuss the use of advanced resins in lightweight aerospace applications, where cyanate esters are commonly utilized for components like wings, fuselage, and engine parts.

Drivers

-

Increasing demand for lightweight and high-performance materials drives the market growth.

The need for lightweight and high-performance materials stands as one of the biggest drivers for the growth of this market, especially in aerospace, automotive, and electronics. Due to the need to optimize manufacturing processes to achieve unintended efficiency, reduced energy consumption, and high performance, cyanate ester resins are one of the critical lightweight materials necessary. In the aerospace industry, for example, weight is one of the most critical factors to consider when designing a component since it significantly affects efficiency and performance. Because of their relative strength-to-weight ratio, cyanate ester resins can enable strong yet lightweight components like full wings and fuselage parts. Likewise, the automotive sector has been facing a need for lightweight, yet, high-durability materials that meet the weight reduction targets for electric vehicles (EVs). Lightweight materials help in lowering the weight of devices, thereby shrinking their size and weight without compromising performance in electronics. The increasing focus on lightweight exerts an ever-thickening demand for light compounds with cyanate esters, that end to the correct combination of low-density high-power, and thermally steady, small-scale applications without losing out on size or shape.

According to the European Commission’s Aerospace and Defense Industry Market Trends, lightweight composites are expected to grow by 7-10% annually, driven by the push for more fuel-efficient aircraft and spacecraft. The report also emphasizes how the integration of these materials reduces weight and improves the efficiency of both military and commercial aviation.

Restraint

-

High cost of production may hamper the market growth.

The extremely high production cost is a major restraint which may hinder the growth of the cyanate ester resin market. Cyanate esters, a class of high-performance resins, excel with unparalleled thermal stability, mechanical properties, and environmental resistance to serve applications in the aerospace, defense, and electronics industries. Nonetheless, it is a greater cost to produce than other common resins such as epoxy or polyester. Cyanate esters are intricate and costly to manufacture, as the raw materials and synthesis process require precise control to retain the target properties. Moreover, high-quality standards and testing also increase the price. Because of this high price level, cyanate ester resins do not compete in fields where the relative price is the dominant interest, nor do they compete on components where the extreme performance features of cyanate esters are not required. This leads to industries looking for cheaper alternatives with similar properties, thus limiting the massive uptake of cyanate esters and potentially hindering market growth.

Key Segmentation Analysis

By Type

The bisphenol derivatives held the highest share of 53% in 2023. This is due to their better performance properties and greater availability. Cyanate esters based on bisphenols, most commonly bisphenol-A (BPA) or more recently bisphenol-F, represent one of the most utilized types of cyanate ester resins as they combine good mechanical behavior with thermal as well as chemical resistance. Therefore, these properties make them very well suited for high-performance applications such as aerospace, defense, and electronics, in industries where high performance is essential. The fact that bisphenol derivatives are also cheaper compared to other types of cyanate ester resins further increases its popularity due to high performance at low prices offered by the resins. The preexisting supply chain and the comparatively low cost of manufacturing with bisphenol derivatives also contribute to their continued market dominance.

By Application

Composites held the largest market share around 51% in 2023. This is owing to the increasing demand for lightweight and high-performance materials from the aerospace, automotive, and electronics industries. When paired with reinforcing fibers, such as carbon fiber or glass fiber, cyanate ester resins become composite materials that provide very high strength-to-weight ratios, thermal stability, and resistance to environmental factors. These properties make them perfect for applications in aerospace, where components need to maintain both high temperatures and mechanical stress and low weight (to improve fuel efficiency and performance respectively).

Regional Analysis

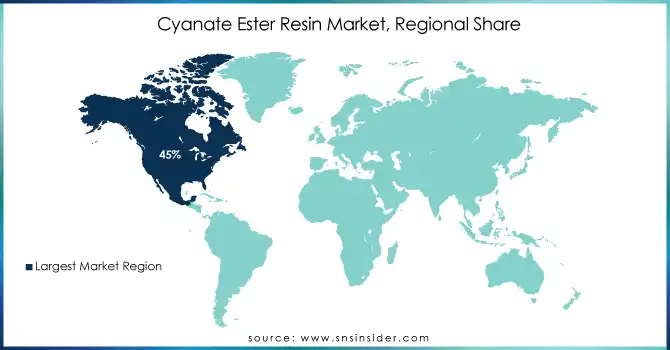

North America held the largest market share around 45% in 2023. This is due to the presence of lucrative consumer industries like aerospace, defense, and automotive industries, major aerospace manufacturers like Boeing and Lockheed Martin are located in the region, and cyanate ester-based resins are utilized for components that demand high mechanical strength and thermal performance. The U.S. Department of Defense (DoD) and other government agencies are also a key demand booster for these resins, especially for military aircraft, UAVs, and flexible circuit boards for advanced defense technologies. A favorable supply chain, solid research and development, as well as high investment in advanced materials adoption also help North America. Additionally, the region also dominates the market owing to the increasing demand for lightweight and energy efficiency materials in automotive industry, particularly with the growing trend of electric vehicles (EVs). In addition, strong manufacturing presence, and innovation in fields like electronics and telecommunication in North America is also accelerating the cyanate ester resins market growth. North America shall continue to dominate the cyanate ester resin market due to above mentioned factors combined.

Do You Need any Customization Research on Cyanate Ester Resin Market - Inquire Now

Key Players

-

Henkel AG (Loctite, Terostat)

-

Huntsman Corporation (Araldite, Xynomer)

-

Solvay (Cytec, FIBER-REZ)

-

Hexcel Corporation (HexPly, HexTool)

-

Kraton Polymers (Kraton, Cariflex)

-

DSM (Arnitel, EcoPaXX)

-

SABIC (LNP, Ultem)

-

Mitsubishi Chemical Corporation (Duracon, PEEK)

-

Lonza Group (LonzaOne, Lonza)

-

3M (Scotch-Weld, VHB Tapes)

-

Royal DSM (Arnitel, Xylenes)

-

Toray Industries (Torayca, Toray)

-

BASF SE (Akulon, Ultramid)

-

Mitsui Chemicals (Arpro, Ticona)

-

GKN Aerospace (Aerospace Composite, Epoxy Resins)

-

LyondellBasell (Hostalen, Lupolen)

-

Advent Technologies (HyRad, Hyliion)

-

Dow Inc. (Dow Corning, Sylgard)

-

TSE Industries (TSE3000, TSE202)

-

Hexion Inc. (Epikote, EPIKURE)

Recent Developments:

-

In 2023, Hexcel, a leading player in advanced composites, launched a new line of cyanate ester-based resin systems designed to improve performance and reduce manufacturing costs for the aerospace industry.

-

In 2022, Huntsman advanced its cyanate ester resin technology for use in both high-temperature aerospace applications and next-generation electric vehicle components. They introduced an innovative resin system with improved curing times and enhanced mechanical properties, aimed at reducing production costs while maintaining high performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 331.3 Million |

| Market Size by 2032 | USD 829.6 Million |

| CAGR | CAGR of10.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Bisphenol derivatives, Novolac, Others) •By Application (Composites, Adhesives, Coatings, Others) •By End-Use (Aerospace & Defense, Electrical & Electronics, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG, Huntsman Corporation, Solvay, Hexcel Corporation, Kraton Polymers, DSM, SABIC, Mitsubishi Chemical Corporation, Lonza Group, 3M, Royal DSM, Toray Industries, BASF SE, Mitsui Chemicals, GKN Aerospace, LyondellBasell, Advent Technologies, Dow Inc., TSE Industries, Hexion Inc. |

| Key Drivers | • Increasing demand for lightweight and high-performance materials drives the market growth. |

| Restraints | •High cost of production may hamper the market growth. |