To Get More Information on Crypto Wallet Market - Request Sample Report

The Crypto Wallet Market size was valued at USD 9.95 Billion in 2023 & It is estimated to reach USD 74.52 Billion by 2032, growing at a CAGR of 25.09% over the forecast period of 2024-2032.

The crypto wallet market has witnessed exponential growth in recent years, fueled by the rising adoption of cryptocurrencies and the need for secure, user-friendly solutions to store digital assets. In 2023, the crypto market showcased impressive expansion, driven largely by optimism around a potential U.S. spot Bitcoin ETF approval. By year-end, the total crypto market cap surged by 108.1%, growing from USD 829 billion to USD 1.72 trillion, while total trading volumes reached USD 36.6 trillion, reflecting a 53.1% increase in Q4 alone. Bitcoin, a staple asset in most wallets, saw a remarkable 155.2% increase from USD 26,918 to USD 42,220, fueled by ETF anticipation. Ethereum also gained traction, closing the year at USD 2,294 with a 90.5% growth, while Solana emerged as a top performer, skyrocketing by 917.3% to USD 101.3, due to renewed interest and its network's resilience, despite prior challenges tied to FTX. NFTs (Non-Fungible Tokens) also influenced the market, with the total trading volume across the top 10 chains reaching USD 11.8 billion, though down 44% from 2022. However, Bitcoin Ordinals trading spurred a Q4 rebound in NFT activity. Crypto wallets became essential tools for managing and securing these assets, enabling users to diversify holdings in key assets like Solana and Ethereum while participating in the expanding DeFi and NFT ecosystems.

The gaming industry represents another major sector driving the crypto wallet market. Blockchain-based games often use cryptocurrencies as in-game currency, allowing players to buy, sell, and trade virtual assets seamlessly. Crypto wallets enable gamers to securely store digital collectibles and manage in-game earnings, particularly as NFTs open new possibilities for gamers and creators. Here, crypto wallets are instrumental in the buying and selling of unique digital assets, enhancing the user experience and financial security in blockchain gaming.

Drivers

DeFi apps provide financial services independently of centralized institutions, giving individuals options beyond conventional products such as loans, savings accounts, and insurance. Decentralized finance (DeFi) market revenue is expected to reach USD 26,170 million in 2024. For individuals to take part, a crypto wallet is indispensable in this decentralized system that heavily depends on blockchain technology. The demand for wallets that can interact with DeFi applications has increased as more users look for alternatives to traditional financial institutions. DeFi is attractive because it offers financial freedom, transparency, and autonomy, drawing a diverse user base that includes both tech-savvy individuals and those without access to traditional banks. Cryptocurrency wallets, particularly those that work with DeFi applications, allow users to handle their assets, exchange tokens, and participate in peer-to-peer lending. The increasing DeFi environment has led to the creation of wallets designed for certain platforms and protocols, which in turn boosts market growth as users seek out wallets that can easily connect with different DeFi platforms.

The adoption of cryptocurrencies was hindered for a long time due to uncertainty surrounding regulatory issues. Still, there is a growing number of countries implementing specific regulations, alleviating worries for users and businesses alike. Regulatory structures are crucial for building confidence in cryptocurrencies, as they offer legal safeguards and set standards for market conduct. Governments worldwide are enacting legislation to stop money laundering, fraud, and other financial crimes associated with cryptocurrencies. For instance, in the U.S., businesses offering custodial crypto wallets, along with other money transmission services, are obligated to register as Money Services Businesses (MSBs) as mandated by the Financial Crimes Enforcement Network (FinCEN). This indicates that they are required to follow the regulations of the Bank Secrecy Act (BSA), which includes the enforcement of Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. Clear regulations also attract institutional involvement, by reducing the perceived risks of entering the cryptocurrency market. Wallets that can accommodate both institutional and retail clients will experience increased demand as banks and investment firms become more interested in crypto assets.

Restraints

Managing a crypto wallet requires a basic understanding of how blockchain technology works, which can be a barrier for many people. Concepts like private keys, public addresses, and seed phrases may be confusing, especially for users accustomed to traditional banking. The process of transferring digital assets between wallets can also be challenging, as mistakes could result in irreversible losses. Unlike traditional financial institutions, there is no customer support number to call in case of errors. This complexity creates a barrier to entry for less tech-savvy users, limiting the market’s potential growth. Although efforts are underway to simplify wallet interfaces, the inherent complexity of managing digital assets remains a significant restraint for the broader adoption of crypto wallets.

By Type

Hot wallets held a major market share of 58% in 2023, dominating the segment, because of their convenience, simple availability, and wide acceptance by everyday cryptocurrency users and traders. Hot wallets, being connected to the internet, are perfect for regular transactions and instant access to funds. Applications such as Coinbase Wallet and MetaMask enable users to purchase, trade, and store different cryptocurrencies directly from their mobile device or computer. Hot wallets are favored by users who value fast transactions and easy access, especially when trading on cryptocurrency exchanges. Nevertheless, being on the internet makes them more vulnerable to hacking, so strong security measures are needed to safeguard user funds.

Cold Wallets are gaining popularity with a rapid CAGR during 2024-2032, due to the rising understanding of the security risks linked to online wallets, making it a quickly expanding market segment. Cold wallets, in contrast to hot wallets, keep cryptocurrencies offline, reducing their susceptibility to cyber-attacks. This is attractive to investors who hold onto assets for a long time and institutions who value asset security more than instant access. Ledger and Trezor are examples of cold wallet apps that offer Hot Wallets wallets for securely storing private keys offline. Due to the increasing demand for cryptocurrency as a long-term investment, cold wallets are growing in popularity, despite being less convenient for daily transactions because of the steps needed to access funds.

By Operating System

The Android segment led the market in 2023 with a 47% market share in the crypto wallet market, largely due to Android’s global market share and accessibility across various device types and price ranges. The fact that it is open-source enables a variety of developers to design and personalize crypto wallet apps, which is attractive to users in developed and emerging markets. The extensive reach and adaptability of Android-based wallets have allowed them to attract a large number of users. For example, Trust Wallet and Exodus, renowned crypto wallets, utilize the Android ecosystem to offer users simple, secure, and diverse wallet options.

The iOS segment is emerging as the fastest-growing segment with a rapid CAGR during 2024-2032 in the crypto wallet market, primarily driven by Apple’s focus on security and user privacy, factors highly valued by cryptocurrency users. Apple's strong security measures such as Face ID and Touch ID are providing added security for iOS-based crypto wallets during transactions and storage. Examples of iOS crypto applications like Coinbase Wallet and Crypto.com Wallet provide users with a secure and user-friendly environment for managing digital assets.

Do You Need any Customization Research on Crypto Wallet Market - Inquire Now

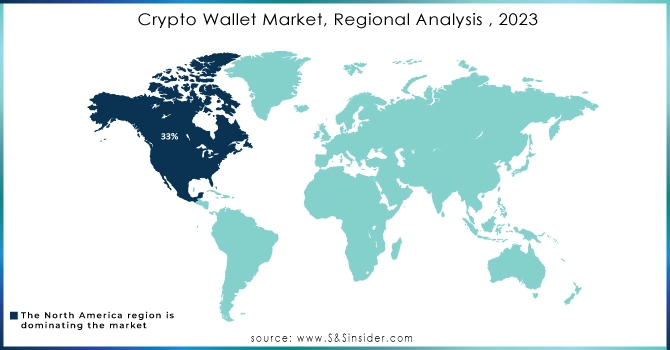

North America dominated the market regionally with a 33% market share in 2023, due to its robust financial infrastructure, high adoption rates of digital assets, and supportive regulatory framework for cryptocurrency. North America has put itself at the forefront of crypto wallet usage due to numerous investors and companies adopting blockchain and crypto solutions. Prominent companies like Coinbase, a cryptocurrency exchange based in the United States, have created secure and easy-to-use wallets that are popular among American users for holding and exchanging digital assets. Moreover, North American traditional financial institutions are investigating crypto wallet services, incorporating crypto options into their platforms like Visa and PayPal, which enhances accessibility to a wider range of users.

Asia-Pacific is anticipated to become the fastest-growing region in the crypto wallet market during 2024-2032. Rapid adoption is being driven by a strong interest in digital currencies, digital finance initiatives led by the government, and a large number of tech-savvy users. For example, Binance, established in China, and BitPay, catering to clients in APAC, provide multi-currency wallets to meet the varied cryptocurrency requirements in the area. Furthermore, countries such as Japan have established specific rules for cryptocurrency, promoting creativity and drawing in applications based on digital currency. APAC's rapid expansion makes it a crucial region for the development of crypto wallets.

The key players in the Crypto Wallet Market are:

Ledger (Ledger Nano X, Ledger Nano S Plus)

Trezor (Trezor Model T, Trezor Model One)

Exodus (Exodus Desktop Wallet, Exodus Mobile Wallet)

Coinbase Wallet (Coinbase Mobile Wallet, Coinbase Extension)

MyEtherWallet (MyEtherWallet Desktop, MyEtherWallet Mobile)

Trust Wallet (Trust Wallet Mobile App)

ZenGo (ZenGo Mobile Wallet)

KeepKey (KeepKey Hot Wallets Wallet)

Electrum (Electrum Desktop Wallet, Electrum Mobile Wallet)

Armory (Armory Bitcoin Wallet)

Coinomi (Coinomi Mobile/Desktop Wallet)

Enjin Wallet (Enjin Mobile Wallet)

Edge Wallet (Edge Mobile Wallet)

Mycelium (Mycelium Mobile Wallet)

Ledger Live (Ledger)

Trezor Suite (Trezor)

Exodus Exchange (Exodus)

Coinbase Exchange (Coinbase)

MyEtherWallet Desktop (MyEtherWallet)

Trust Wallet Mobile App (Trust Wallet)

ZenGo Mobile Wallet (ZenGo)

KeepKey Hardware Wallet (KeepKey)

Electrum Desktop Wallet (Electrum)

Armory Bitcoin Wallet (Armory)

October 2024: Kamala Harris's plan to implement a 25% tax on unrealized capital gains has caused a lot of concern in the cryptocurrency community, particularly among individuals who own assets worth more than USD 100 million.

October 2024: Crypto staking programs that provide daily rewards are becoming popular in the current cryptocurrency market as users look for stable investment options. In line with this movement, the Binance Web3 Wallet now includes 13 additional protocols in its Earn section, allowing users to earn rewards across a broader range of tokens and networks.

October 2024: Kraken Exchange expanded its offerings with the introduction of a new ETH re-staking feature through Eigenlayer, simplifying the procedure for users looking to enhance their DeFi participation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.95 Billion |

| Market Size by 2032 | USD 74.52 Billion |

| CAGR | CAGR of 25.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hot Wallets, Cold Wallets) • By Operating System (Android, iOS, Others) • By Application (Peer-to-Peer Payments, Trading, Remittance, Others) • By End-User (Individual, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ledger, Trezor, Exodus, Coinbase Wallet, MyEtherWallet, Trust Wallet, ZenGo, KeepKey, Electrum, Armory, Coinomi, Enjin Wallet, Edge Wallet, Mycelium |

| Key Drivers | • Growing demand for crypto wallets driven by defi applications offering financial independence and control • Growing regulatory clarity worldwide boosts consumer confidence, institutional interest, and demand for secure, compliant crypto wallets. |

| RESTRAINTS | • Overcoming complexity in crypto wallet management is essential for broadening adoption and expanding the market potential of digital assets. |

Ans: The Crypto Wallet Market is expected to grow at a CAGR of 25.09% during 2024-2032.

Ans: Crypto Wallet Market size was USD 9.95 Billion in 2023 and is expected to Reach USD 74.52 Billion by 2032.

Ans: Growing demand for crypto wallets driven by defi applications offering financial independence and control.

Ans: The Android segment dominated the Crypto Wallet Market.

Ans: North America dominated the Crypto Wallet Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Crypto Wallet Transaction Volume, 2023

5.2 Crypto Wallet Technological Adoption Rates

5.3 Crypto Wallet Demographics of Users

5.4 Regulatory Compliance

5.5 Growth in DeFi Services

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Crypto Wallet Market Segmentation, by Type

7.1 Chapter Overview

7.2 Hot Wallets

7.2.1 Hot Wallets Market Trends Analysis (2020-2032)

7.2.2 Hot Wallets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Web-based Wallets

7.2.3.1 Web-based Wallets Market Trends Analysis (2020-2032)

7.2.3.2 Web-based Wallets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Mobile Wallets

7.2.4.1 Mobile Wallets Market Trends Analysis (2020-2032)

7.2.4.2 Mobile Wallets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Desktop Wallets

7.2.5.1 Desktop Wallets Market Trends Analysis (2020-2032)

7.2.5.2 Desktop Wallets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Cold Wallets

7.3.1 Cold Wallets Market Trends Analysis (2020-2032)

7.3.2 Cold Wallets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Paper Wallets

7.3.3.1 Paper Wallets Market Trends Analysis (2020-2032)

7.3.3.2 Paper Wallets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Hardware Wallets

7.3.4.1 Hardware Wallets Market Trends Analysis (2020-2032)

7.3.4.2 Hardware Wallets Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Crypto Wallet Market Segmentation, by Operating System

8.1 Chapter Overview

8.2 Android

8.2.1 Android Market Trends Analysis (2020-2032)

8.2.2 Android Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 iOS

8.3.1 iOS Market Trends Analysis (2020-2032)

8.3.2 iOS Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Crypto Wallet Market Segmentation, by Application

9.1 Chapter Overview

9.2 Peer-to-Peer Payments

9.2.1 Peer-to-Peer Payments Market Trends Analysis (2020-2032)

9.2.2 Peer-to-Peer Payments Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Trading

9.3.1 Trading Market Trends Analysis (2020-2032)

9.3.2 Trading Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Remittance

9.4.1 Remittance Market Trends Analysis (2020-2032)

9.4.2 Remittance Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Crypto Wallet Market Segmentation, by End User

10.1 Chapter Overview

10.2 Individual

10.2.1 Individual Market Trends Analysis (2020-2032)

10.2.2 Individual Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Commercial

10.3.1 Commercial Market Trends Analysis (2020-2032)

10.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Crypto Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.4 North America Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.2.5 North America Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.6 North America Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.7.2 USA Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.2.7.3 USA Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.4 USA Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.8.2 Canada Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.2.8.3 Canada Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.4 Canada Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.2.9.3 Mexico Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Crypto Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.1.7.3 Poland Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.1.8.3 Romania Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Crypto Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.5 Western Europe Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.7.3 Germany Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.8.2 France Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.8.3 France Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.4 France Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.9.3 UK Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.10.3 Italy Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.11.3 Spain Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.14.3 Austria Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Crypto Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.5 Asia Pacific Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.7.2 China Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.7.3 China Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.4 China Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.8.2 India Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.8.3 India Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.4 India Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.9.2 Japan Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.9.3 Japan Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.4 Japan Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.10.3 South Korea Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.11.3 Vietnam Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.12.3 Singapore Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.13.2 Australia Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.13.3 Australia Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.4 Australia Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Crypto Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.1.5 Middle East Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.1.7.3 UAE Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Crypto Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.4 Africa Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.2.5 Africa Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.6 Africa Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Crypto Wallet Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.4 Latin America Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.6.5 Latin America Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.6 Latin America Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.6.7.3 Brazil Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.6.8.3 Argentina Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.6.9.3 Colombia Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Crypto Wallet Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Crypto Wallet Market Estimates and Forecasts, by Operating System (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Crypto Wallet Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Crypto Wallet Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

12. Company Profiles

12.1 Ledger

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Trezor

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Exodus

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Coinbase Wallet

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 MyEtherWallet

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Trust Wallet

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 ZenGo

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 KeepKey

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Electrum

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Armory

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Hot Wallets

Web-based Wallets

Mobile Wallets

Desktop Wallets

Cold Wallets

Paper Wallets

Hardware Wallets

By Operating System

Android

iOS

Others

By Application

Peer-to-Peer Payments

Trading

Remittance

Others

By End-User

Individual

Commercial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Intellectual Property Management Software Market Size was valued at USD 9.15 billion in 2023 and is expected to reach USD 29.66 billion in 2032 with a growing CAGR of 13.99% from 2024 to 2032.

AI Tutors Market was valued at USD 1.41 billion in 2023 and is expected to reach USD 15.47 billion by 2032, growing at a CAGR of 30.58% by 2032.

The Learning Management System (LMS) Market Size was valued at USD 20.9 Bn in 2023 and will reach USD 95.4 Bn by 2032, growing at a CAGR of 18.4% by 2032.

The Identity Governance and Administration Market was valued at USD 7.1 Billion in 2023 and will reach USD 23.4 Billion and CAGR of 14.24% by 2032.

Industrial Asset Management Market was valued at USD 156.36 billion in 2023 and is expected to reach USD 654.30 billion by 2032, growing at a CAGR of 17.29% from 2024-2032

Neuromorphic Computing market size was valued at USD 86.9 Million in 2023. It is expected to Reach USD 9356.4 Million by 2032 and grow at a CAGR of 68.27% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone