Crypto Trading Platform Market Report Scope & Overview:

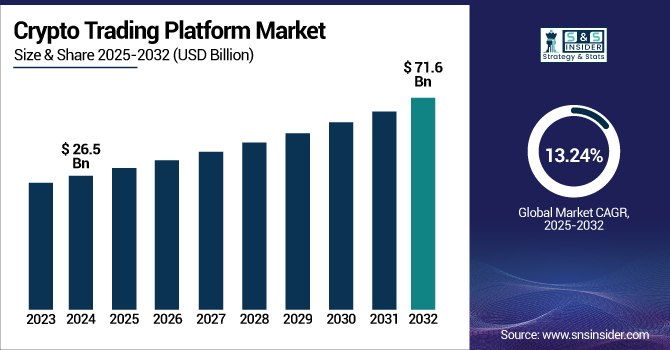

The Crypto Trading Platform Market was valued at USD 26.5 billion in 2024 and is expected to reach USD 71.6 billion by 2032, growing at a CAGR of 13.24% from 2025-2032.

To Get more information on Crypto Trading Platform Market - Request Free Sample Report

The Crypto Trading Platform Market is increasingly experiencing a dynamic transformation due to the growing global interest in decentralized finance, rising adoption of digital assets, and ever-evolving regulatory frameworks. With the influx of institutional investments into crypto, there is an exploding need for a powerful, secure, and easy-to-use trading platform. AI trading bots, real-time analytics, and advanced security protocols have started to change how users experience cryptocurrencies. Additionally, the market experienced increased user participation as a result of the trend witnessing the process of tokenization and the introduction of blockchain-based financial products facilitated for users ' access to. With mobile-first crypto trading apps ushering new retail investors into cryptocurrency in emerging economies, and the U.S., South Korea, and Switzerland paving the way in crypto infrastructure development. The uptick in hybrid platforms that offer centralised–decentralised advantages for transparency and liquidity. Moving forward, the industry will also continue to benefit from technologies enabling interoperability and smart contract automation.

As per Crypto.com's annual Crypto Market Sizing Report, the number of global cryptocurrency owners increased by 13% in 2024, rising from 583 million in January to 659 million in December 2024. This rise was supported by an influx of institutional crypto adoption, particularly through Bitcoin and Ethereum ETFs.

The U.S. crypto trading platform market is experiencing rapid growth due to rising institutional investments, mainstream financial integration, and increasing consumer adoption of digital assets. In 2024, the market is estimated at USD 3.9 billion and is projected to reach USD 11.3 billion by 2032, growing at a CAGR of 14.33%. This growth is further driven by the emergence of regulated crypto ETFs, improved cybersecurity standards, and the expansion of blockchain-based financial services, positioning the U.S. as a leading hub for crypto trading innovation and infrastructure.

Crypto Trading Platform Market Dynamics

Driver

-

Major financial institutions are increasingly investing in and offering crypto services.

Institutional interest in crypto assets has significantly boosted market credibility and volume. Major players like BlackRock and Fidelity have launched crypto-related products, signaling long-term confidence. As hedge funds and asset managers seek portfolio diversification, crypto trading platforms are witnessing increased demand for secure, regulated, and high-volume trading environments. The growing popularity of Bitcoin ETFs and other digital asset investment vehicles further fuels institutional engagement. This trend not only increases liquidity and trust but also encourages the development of sophisticated trading tools and compliance mechanisms on platforms, accelerating market maturity and stability.

A survey found that 86% of institutional investors either currently have exposure to digital assets or plan to allocate funds to them by 2025. Additionally, 59% of respondents intend to allocate more than 5% of their assets under management to cryptocurrencies in the coming year

Restraint

-

Inconsistent and evolving crypto regulations hinder platform expansion and user trust.

Crypto trading platforms face complex legal environments where rules differ vastly across jurisdictions. Some nations support crypto innovation, while others impose restrictions or offer vague guidance, creating confusion and operational risks. Regulatory unpredictability makes compliance burdensome and limits the ability to serve global users uniformly. This not only affects platform scalability but also deters institutional involvement in unclear markets. Platforms must allocate significant resources to legal counsel and adapt rapidly to policy changes. Until clear, standardized frameworks emerge, this uncertainty will continue to slow investment, innovation, and global growth across the crypto ecosystem.

Opportunity

-

Crypto platforms are incorporating decentralized finance tools like lending and staking.

The integration of DeFi functionality enables crypto trading platforms to provide expanded services beyond conventional buy-and-sell trading. Through smart contracts, users can stake tokens, participate in yield farming, or access peer-to-peer lending—all from within the same interface. These features attract new demographics seeking passive income and financial autonomy. As users shift toward decentralized, non-custodial experiences, platforms that integrate DeFi options gain a competitive edge. This also reduces reliance on intermediaries, improving efficiency and user control. Continued DeFi adoption positions trading platforms as comprehensive financial ecosystems, boosting engagement and driving platform stickiness in a maturing digital economy.

Challenge

-

Platforms remain prime targets for hacks, scams, and phishing attacks.

Cybersecurity remains a critical vulnerability in the crypto trading platform space. In 2024 alone, several high-profile exchange breaches led to losses in the millions, raising concerns about asset safety. Since blockchain transactions are irreversible, recovering stolen assets is nearly impossible, making prevention vital. Furthermore, new users often fall victim to phishing or fake platforms due to low awareness. As platforms scale and incorporate more complex functions, they also introduce additional vulnerabilities. Addressing this requires constant monitoring, multi-factor authentication, secure storage solutions, and public education. Failure to secure infrastructure can cause legal repercussions, financial damage, and severe loss of user trust.

Crypto Trading Platform Market Segmentation Analysis

By Platform Type

The Centralized exchanges segment dominated the Crypto Trading Platform market in 2024 and accounted for 48% of revenue share, owing to their user-friendly interfaces, high liquidity, and strong security protocols. For retail and institutional traders alike, these are a preferred option, due to their centralized trade management, reduced time to transaction and advanced support systems. The CEX trend is as a result of their accessibility, reliability, and institutional money seeking crypto exposure.

For Instance, in April 2025, Kraken launched commission-free trading for over 11,000 U.S.-listed stocks and ETFs, marking its entry into traditional financial markets. This move aims to create a seamless trading ecosystem that bridges the gap between digital and traditional assets.

Decentralized exchanges is expected to register the fastest CAGR during the forecast period in crypto trading platform market owing to the increasing demand for privacy, reduced transaction cost and increasing adoption of decentralized finance. These DEX platforms facilitate P2P, P2A trading without requiring you to be in touch with any central authority featuring a secure, transparent, and an automatic trading environment.

By trading Type

The spot trading segment dominated the market and accounted for a significant revenue share in 2024. This space is popular with individual investors and institutions around the world who want to own crypto directly. The simplicity of spot trading makes it the most prevalent style of trading in the crypto markets, and this is why its dominance has grown.

For Instance, In 2024, CME Group, the world's largest futures exchange operator, is reportedly planning to launch regulated spot Bitcoin trading through its EBS platform in Switzerland. This move aims to meet the growing demand among institutional investors for exposure to cryptocurrencies in a regulated environment.

Margin Trading segment is expected to register the fastest CAGR during the forecast period, owing to the rising trend of utilizing leverage on crypto assets to earn additional returns. It is an attractive option for experienced investors, as margin trading enables traders to borrow funds to trade positions that are larger than what their capital would generally allow.

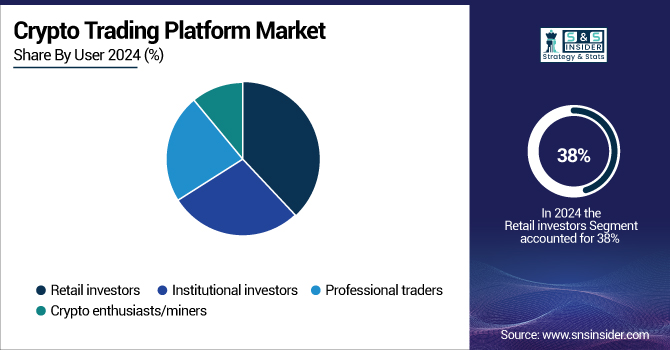

By User

Retail investors dominated the Crypto Trading Platform market in 2024 and accounted for 38% of revenue share, driven by growing accessibility through mobile trading apps, user-friendly interfaces, and increasing financial literacy around digital assets. The rise of social trading platforms, influencer-driven crypto content, and fractional trading has further encouraged retail participation. With platforms simplifying KYC processes and reducing fees, retail investors continue to form the bulk of trading volume. This segment is expected to retain its dominance as awareness and adoption of cryptocurrencies spread across younger, tech-savvy demographics globally.

Institutional investors are expected to register the fastest CAGR in the Crypto Trading Platform market, propelled by increasing regulatory clarity and secure custody solutions. The entry of major financial institutions and hedge funds, coupled with growing demand for crypto-backed ETFs and derivatives, is driving institutional involvement. Platforms are also enhancing liquidity, compliance features, and high-volume trading capabilities to attract this segment.

By Asset Type

Cryptocurrencies dominated the Crypto Trading Platform market in 2024 and accounted for a significant revenue share, driven by high liquidity, widespread acceptance, and strong investor interest in leading assets like Bitcoin and Ethereum. Their volatility attracts active traders seeking quick gains, while continuous innovation keeps users engaged. As global regulations become clearer and more supportive, mainstream adoption is expected to rise further. With enhanced security, institutional entry, and increasing merchant adoption, cryptocurrencies will continue to anchor the market throughout the forecast period.

For Instance, In November 2024, a consortium comprising Robinhood, Kraken, and Galaxy Digital launched USDG, a U.S. dollar-pegged stablecoin. This initiative, known as the Global Dollar Network, aims to promote stablecoin usage globally and provide economic benefits to its partners. USDG is governed by a committee of partner representatives and issued by Paxos, seeking to increase stablecoin adoption in a market dominated by Tether and USD Coin.

Tokenized assets are expected to register the fastest CAGR, driven by their ability to represent real-world assets, like real estate, equities, and bonds, on blockchain networks. This innovation enhances liquidity, transparency, and accessibility for traditionally illiquid investments. Institutions and fintech companies are accelerating adoption through asset tokenization platforms, enabling fractional ownership and global investor participation. As regulatory frameworks around tokenized assets mature and interoperability across blockchains improves, the segment is poised for rapid expansion, transforming how physical assets are accessed and traded digitally.

Regional Landscape

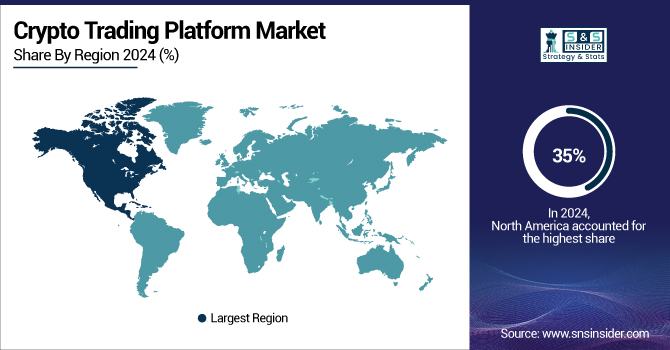

North America dominated the Crypto Trading Platform Market in 2024 and accounted for 35% of revenue share, due to the presence of major exchanges, favorable technological infrastructure, and increasing institutional involvement. The U.S. leads this region with advanced regulatory discussions, rising crypto-focused ETFs, and growing mainstream adoption by fintech giants. High awareness, deep capital markets, and a mature financial ecosystem continue to foster strong demand. As regulatory clarity improves and blockchain innovation deepens, North America is expected to maintain its market leadership over the coming years.

In North America U.S. dominated the crypto trading platform market due to increasing institutional adoption, rising interest in crypto ETFs, and greater regulatory engagement. Major firms like BlackRock and Fidelity have launched crypto services, driving investor confidence. Additionally, the expansion of regulated platforms and improved cybersecurity measures are fostering a safer trading environment.

A survey revealed that 49% of U.S. millennials, born between 1981–1994, reported owning or having previously owned cryptocurrency.

Asia Pacific is projected to register the fastest CAGR in the Crypto Trading Platform Market, fueled by surging crypto adoption in countries like India, Japan, and South Korea. Governments in the region are embracing blockchain for financial inclusion and digital transformation, while youth-driven demand for decentralized finance and tokenized assets is skyrocketing. Additionally, key players are launching region-specific platforms, offering localized services to tap into underserved populations. The combination of favorable demographics, tech-savvy users, and evolving regulatory openness will significantly accelerate growth through 2032.

India emerged as the dominant country in the Asia-Pacific crypto trading platform market in 2024, leading global cryptocurrency adoption for the second consecutive year. This leadership is attributed to a vast, tech-savvy population, increasing smartphone and internet penetration, and a growing interest in decentralized finance solutions.

According to a report, between June 2023 and January 2024, there was a 300% increase in the number of women in India investing in cryptocurrencies, highlighting a significant diversification in the investor base.

Europe remains a prominent hub for cryptocurrency trading, bolstered by progressive regulations, strong fintech infrastructure, and rising institutional interest. In Europe, Germany dominated the crypto trading platform market due to its robust legal framework, supportive stance by BaFin, and widespread crypto adoption among retail and institutional investors.

As of 2024, approximately 6% of Germany's population owns cryptocurrency, reflecting a growing interest in digital assets among the populace.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major Crypto Trading Platform companies are Binance, Coinbase, Kraken, Bitfinex, Huobi, OKEx, l, Bitstamp, KuCoin, Bittrex and others.

Recent Developments

-

In January 2024, Binance introduced an advanced free course as part of its educational project "Crypto School." This initiative aimed to provide in-depth knowledge on blockchain technology, decentralized applications (DApps), decentralized finance (DeFi), NFTs, and crypto trading.

-

In March 2024, Binance unveiled a new AI-powered trading assistant designed to provide real-time market analysis and personalized trading strategies. This tool aimed to enhance user experience by offering advanced trading insights and automation features.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 26.5 Billion |

| Market Size by 2032 | US$ 71.6 Billion |

| CAGR | CAGR of 13.24 % From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform Type (Centralized Exchanges (CEX), Decentralized Exchanges (DEX), Hybrid platforms) • By Trading Type (Spot trading, Margin trading, Futures trading, Options trading, Perpetual contracts, Token swaps) • By User (Retail investors, Institutional investors, Professional traders, Crypto enthusiasts/miners) • By Asset Type (Cryptocurrencies, Stablecoins, Tokenized assets, Non-Fungible Tokens (NFTs)). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Binance, Coinbase, Kraken, Bitfinex, Huobi, OKEx, Gemini, Bitstamp, KuCoin, Bittrex. |