Cross Laminated Timber Market Report Scope & Overview:

Get More Information on Cross Laminated Timber Market - Request Sample Report

The Cross Laminated Timber Market Size was USD 1.2 billion in 2023 and is expected to reach USD 4.1 billion by 2032 and grow at a CAGR of 14.8% over the forecast period of 2024-2032.

An increase in capital investments towards timber facilities for the utilization of wood through advanced wood processing technologies, capital retention of structural performance, and availability of CLT for enhanced applications are anticipated to fuel timber market growth. Advancements like precision cutting, adhesive technologies, and automated manufacturing systems have increased CLT panel quality and uniformity, making it a dependable and efficient construction material. The improvements made to enhance CLT's fire resistance, moisture protection, and load-bearing capacity have been instrumental in making it safe enough to conform to strict building codes and compete against traditional materials such as steel and concrete. Advancements in these technologies likewise lower production costs and waste, allowing even greater uptake by residential, commercial, and institutional building projects.

The EU is promoting CLT as part of its sustainable construction initiatives. In France, President Macron's mandate requires all new publicly-funded buildings to incorporate at least 50% wood or other bio-based materials from 2022 onwards.

The rapid growth of modular construction is a key driver for the use of cross-laminated timber (CLT) in commercial and institutional projects. Because this plywood is compatible with modular and prefabricated construction techniques, buildings using CLT can be assembled faster, with lower costs and less labor than traditional construction. With its precision-engineered panels manufactured off-site, CLT is a perfect fit for modular construction where frames are assembled from prefabricated panels. Not only is this method efficient but also provides environmental advantages, including less waste and energy consumption in the process of building. In addition to this, the lightweight properties of CLT allow for easier transportation and assembly, thereby supporting its widespread use in projects that require rapid and sustainable construction solutions. Rapidly increasing awareness about modular design along with regulations by the government to create green buildings is likely to drive the growth of CLT in these industries.

The U.S. Department of Agriculture (USDA) has supported various research projects to assess CLT’s sustainability and performance, reinforcing its role in the future of green building practices.

Cross Laminated Timber Market Dynamics

Drivers

-

Cross-laminated timber manufacturers expand capacity to meet soaring demand and drive market growth.

With the increasing need for Cross Laminated Timber (CLT), large production capacities are being built up at the manufacturers. The growth itself can be largely attributed to the shift towards the use of CLT in sustainable and modular construction along with its advantages of environmental performance and structural performance. To meet this increased demand, leading manufacturers of CLT are responding with manufacturing technology and facility upgrades. As an example, Binderholz or companies like Stora Enso are increasing the capacity of their production plants in Europe and North America to meet the demand CLT will generate for commercial and residential construction. Such investments not only guarantee a more stable availability of quality CLT but also allow producers to respond to the changing market demands for quicker, more efficient building solutions.

These expansions are further supported by government programs that encourage green building practices and the use of sustainable construction materials. In Canada, funding from the Canadian Forest Service has aided the development of CLT as part of a broader effort to sustainably manage forest products and minimize emissions from the building sector. Hence, increased production capacity not only caters to current demand but is also preparing the sector for sustained future growth, which is likely as resource-efficient technology continues to penetrate construction with wider acceptance.

Restraint

-

Lack of fire and moisture concerns hamper the market in the cross-laminated timber.

Cross Laminated Timber (CLT) has been widely adopted in the construction industry, the fire resistance and moisture absorption level of CLT are still very urgent problems that need to be solved to ensure its pilot application. Despite it being a wood-based material, and its engineered aspect to give it more strength and stability, this is one of the most critical issues with CLT as it is still flammable. Additional fire protection measures, such as sprinklers, fire-resistant coatings, or encapsulation with non-combustible materials, are usually required by fire safety codes for high-rise buildings or large-scale commercial projects. This makes CLT harder and more expensive to implement in some places. Coconut wood fitting And durability are also influenced by moisture factors. If not properly sealed or maintained, this moisture intrusion can cause problems such as swelling, warping, and decay. That also makes it questionable long-term, especially in humid areas, or extreme environmental conditions.

Opportunity

-

Certifications and Packaging Drive Demand for cross-laminated timber (CLT).

Companies are responding by emphasizing "clean labels" and certifications that demonstrate product authenticity and the use of responsibly sourced materials. These labels boost consumer confidence in the raw materials used. To capitalize on this trend, CLT manufacturers are increasingly investing in certifications. This is expected to drive significant demand growth. However, manufacturers should focus on clear and secure packaging that not only highlights the certified qualities but also deters counterfeiting. By addressing both product integrity and secure packaging, CLT manufacturers can effectively position themselves for success in a market where trust and transparency are paramount.

Cross Laminated Timber Market Segmentation Analysis

By Product

The adhesives bonded sub-segment has dominated the cross-laminated timber (CLT) market. Adhesive-bonded CLT dominated the market in 2023, capturing over 85% of global revenue. This dominance is fueled by the use of high-strength adhesives that create a strong bond between wooden planks. This translates to high demand across various sectors residential, institutional, commercial, and beyond. There are several advantages to adhesive-bonded CLT. It is typically less expensive to manufacture compared to mechanically fastened CLT due to lower machinery requirements. Second, these panels can be repurposed at the end of their lifespan and converted into biofuel pellets, promoting sustainability. Furthermore, adhesive-bonded CLT panels are custom-made to specific project dimensions, minimizing wood waste.

By Application

The residential sub-segment leads the cross-laminated timber (CLT) market, claiming over 47.3% of global revenue in 2023. Several factors drive this dominance. its excellent seismic resistance makes it a compelling choice in earthquake-prone regions like Japan, India, and Mexico. Here, CLT's ability to withstand strong tremors translates to safer and more resilient buildings. Furthermore, CLT boasts impressive structural strength and recyclability, further propelling its demand in the residential construction sector. Government initiatives also play a significant role. Increased investments across Asia Pacific, North America, and Europe are driving the adoption of sustainable materials like CLT. These efforts aim to reduce the construction industry's carbon footprint and promote environmentally conscious building practices.

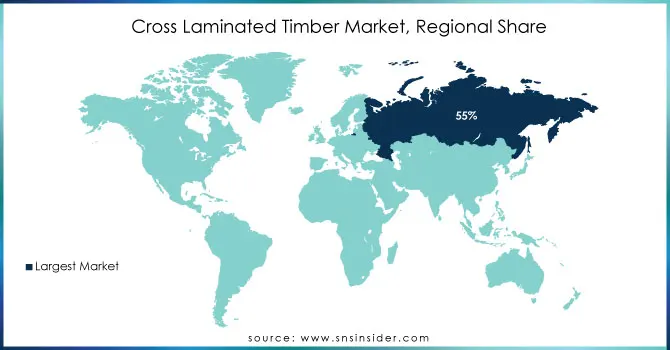

Cross Laminated Timber Market Regional Overview

Europe held the largest market share around 55% in 2023. Innovation and adoption of CLT have been led in Europe, countries such as Austria, Germany, and Sweden where the material originated and is used to construct both residential and commercial buildings. Sustainable building practices have been firmly established in the region, backed up by strong governmental policies in place to encourage green building practices and green materials. Indeed, CLT's rise as a renewable, low-carbon alternative to traditional engineering material has been greatly aided by the European Union's focus on sustainable carbon-neutral buildings.

In addition, Europe also has existing infrastructure to support mass production and usage of CLT and the technological know-how associated with wood processing. The abundance of large forests in Northern and Central Europe as well as well-practiced, sustainable forestry guarantees a constant supply of the raw materials for the stocks used in CLT. Such benefits, combined with favorable regulatory conditions have resulted in European manufacturers dominating the market. Finally, the use of CLT for different types of construction projects has also been promoted in some European countries by the inclusion of CLT into the national building codes.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players in Cross Laminated Timber Market

-

Stora Enso (Finland) (CLT, Wood Products)

-

XLam NZ Limited (XLam CLT, XLam Hybrid)

-

Mayr-Melnhof Holz (CLT, Mass Timber)

-

Structurlam Mass Timber Corporation (Structurlam CLT, Cross-Laminated Timber Panels)

-

Binderholz GmbH (BBS CLT, Binderholz Mass Timber)

-

KLH Massivholz GmbH (KLH CLT, KLH Mass Timber)

-

Hasslacher Holding GmbH (Austria) (CLT Panels, Structural Wood Products)

-

B&K Structures (CLT Panels, Hybrid Timber Systems)

-

Eugen Decker (CLT, Wooden Panels)

-

WebMan (CLT, Mass Timber Products)

-

SmartLam NA (SmartLam CLT, SmartLam Hybrid Panels)

-

MEIKEN LAMWOOD Corp (CLT, Laminated Wood Panels)

-

Sterling Company (CLT, Laminated Timber Products)

-

Schilliger Holz AG (CLT, Wooden Beams)

-

Nordic Structures (CLT, Mass Timber)

-

U.S. Engineered Wood Products (U.S. CLT, Cross-Laminated Timber)

-

Ligna Group (CLT, Wood Construction Systems)

-

Züblin Timber (CLT, Timber Structures)

-

Lignum (CLT, Mass Timber)

-

KUKA (CLT, SmartWood Solutions)

Recent Development:

-

In April 2024: The Bourdonnières School in Nantes, France, becomes the first project to utilize Stora Enso's innovative automated coating line for cross-laminated timber (CLT). This technology enhances protection against moisture, UV radiation, and insects, setting a new standard for mass timber construction.

-

In May 2022: Stora Enso ups its commitment to mass timber by acquiring a 35% stake in French wood processor ACDF Industrie SAS. This move strengthens their ability to deliver custom-made CLT solutions to long-term partners in France.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.2 Billion |

| Market Size by 2032 | US$ 4.1 Billion |

| CAGR | CAGR of 14.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Adhesive Bonded, Mechanically Fastened) • By Application (Residential, Institutional, Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stora Enso (Finland), XLam NZ Limited (New Zealand), Mayr-Melnhof Holz (Austria), Structurlam Mass Timber Corporation (Canada), Binderholz GmbH (Austria), KLH Massivholz GmbH (Austria), Hasslacher Holding GmbH (Austria), B&K Structures, Eugen Decker & WebMan, SmartLam NA, MEIKEN LAMWOOD Corp, Sterling Company, Schilliger Holz AG |

| Drivers | • Cross-laminated timber manufacturers expand capacity to meet soaring demand and drive market growth. |

| Restraints | • Lack of fire and moisture concerns hamper the market in the cross-laminated timber. |