Creative Software Market Report Scope & Overview:

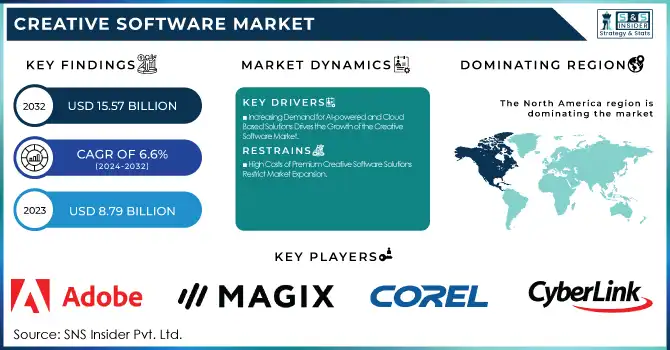

The Creative Software Market Size was valued at USD 8.79 Billion in 2023 and is expected to reach USD 15.57 Billion by 2032 and grow at a CAGR of 6.6% over the forecast period 2024-2032. The Market is growing due to rising demand for digital content creation, video production, and graphic design across industries. AI-powered tools, cloud-based solutions, and subscription models are reshaping the landscape. Adoption is increasing in media, entertainment, and education, with key players enhancing automation, collaboration, and mobile accessibility. The shift from on-premises to cloud-based Software-as-a-Service (SaaS) models is accelerating. Investments in AI, 3D content creation, and augmented reality (AR) are driving innovation. However, challenges like software piracy and pricing concerns persist, impacting market growth and accessibility.

To get more information on Creative Software Market - Request Free Sample Report

Creative Software Market Dynamics

Key Drivers:

-

Increasing Demand for AI-powered and Cloud-Based Solutions Drives the Growth of the Creative Software Market

The growing adoption of AI-driven creative tools and cloud-based solutions is a major driver of the Creative Software Market. AI-powered features, such as automated video editing, real-time collaboration, and smart content recommendations, enhance workflow efficiency and user experience. Cloud-based platforms offer flexibility, remote accessibility, and seamless integration with multiple devices, making them highly preferred across the media, entertainment, marketing, and education industries. The transition from traditional software licensing to subscription-based Software-as-a-Service (SaaS) models has also fueled market expansion. Additionally, the rise of content creators, digital marketing professionals, and e-learning platforms has further amplified demand. Companies continuously innovate by integrating AI, 3D rendering, and augmented reality (AR) features to stay competitive. As businesses and individuals increasingly rely on digital content creation, the demand for scalable, cost-effective creative software solutions continues to rise, driving market growth significantly.

Restraint:

-

High Costs of Premium Creative Software Solutions Restrict Market Expansion

The high cost of premium creative tools limits accessibility for small businesses, freelancers, and independent content creators. Industry-leading software often comes with subscription-based pricing models or expensive one-time purchase options, making it unaffordable for budget-conscious users. Additionally, professional-grade software often requires high-performance hardware, increasing overall costs. Many users turn to free or lower-cost alternatives with limited features, impacting the sales of premium products. Piracy and unlicensed usage further restrict revenue growth, as many users resort to cracked versions instead of paying for costly subscriptions. Businesses also face challenges in training employees on complex software interfaces, requiring additional investment in skill development. These cost barriers hinder market penetration, particularly in emerging economies where affordability plays a significant role in software adoption, slowing the overall growth of the creative software industry.

Opportunities:

-

Rising Popularity of Content Creation and Digital Marketing Creates New Growth Opportunities

The surge in content creation and digital marketing is a major opportunity driving the Creative Software Market. With the rapid expansion of social media, influencer marketing, video streaming platforms, and e-learning, there is a growing demand for high-quality digital content. Businesses, marketers, and individuals rely on graphic design, video editing, and animation software to produce engaging and interactive content. The rise of short-form video content on platforms like TikTok, Instagram Reels, and YouTube Shorts has created an increasing need for user-friendly editing tools with AI-driven automation and templates. Additionally, small businesses and startups are investing in creative software for branding and promotional activities. The expansion of freelance and remote work opportunities has also contributed to a rise in creative software adoption. As demand for digital advertising, visual storytelling, and online education grows, companies offering innovative and cost-effective creative tools are poised to capitalize on this booming market.

Challenge:

-

Growing Software Piracy and Unauthorized Usage Pose a Major Challenge to Market Revenue

Software piracy and unauthorized usage remain significant challenges in the Creative Software Market, directly impacting revenue and market growth. Many premium creative software solutions come with high subscription costs, making them targets for illegal distribution and unauthorized use. Cracked versions of software are widely available, particularly in emerging markets with limited purchasing power, leading to substantial financial losses for software developers. Piracy also affects user security, as these unlicensed versions often contain malware, spyware, or ransomware. Moreover, software companies face difficulties in enforcing strict licensing policies, as users find ways to bypass restrictions. To combat piracy, developers are increasingly adopting cloud-based services, AI-driven authentication, and digital rights management (DRM) solutions to protect intellectual property. However, despite these efforts, unauthorized access remains a persistent problem, requiring continuous innovation in cybersecurity measures and affordable pricing models to encourage legitimate software usage and sustain long-term market growth.

Creative Software Market Segments Analysis

By Type

The Sound & Video Recording Software segment dominated the Creative Software Market in 2023, driven by the growing demand for high-quality content production across entertainment, media, and digital marketing industries. The rise of video streaming platforms like YouTube, Netflix, and TikTok has significantly increased the need for professional-grade video editing and audio recording software.

For instance, Adobe released AI-powered features in Premiere Pro and After Effects in 2023, allowing real-time scene detection, automatic captions, and advanced audio enhancements. CyberLink introduced AI-assisted audio restoration tools in PowerDirector, catering to professionals and independent creators.

As businesses and individuals continue to invest in high-quality visual and sound content, the Sound & Video Recording Software segment remains a key driver of the overall Creative Software Market, with ongoing innovations ensuring its continued leadership in revenue contribution.

The Graphics & Illustration Software segment is projected to grow at the Fastest CAGR during the forecast period, driven by the increasing demand for digital design, branding, and creative content across industries. The rise of e-commerce, digital advertising, and NFT-based artwork has propelled the need for advanced design tools. In response, companies are launching innovative AI-powered solutions to streamline workflows.

The demand for customized branding, social media graphics, and web illustrations has also surged, increasing software adoption among businesses and independent designers. As industries shift towards visual storytelling and interactive design, the Graphics & Illustration Software segment is set to drive significant growth in the Creative Software Market, with AI-driven automation and cloud-based platforms playing a crucial role in its expansion.

By Deployment

The Cloud segment led the Creative Software Market in 2023, accounting for 63% of total revenue, driven by the widespread adoption of cloud-based creative tools, remote collaboration, and AI-powered automation. Businesses and independent creators increasingly prefer Software-as-a-Service (SaaS) models, allowing seamless accessibility, automatic updates, and cost-efficient subscription plans. The demand for mobile-friendly creative software solutions, along with the rise of digital marketing and social media content production, has significantly contributed to the cloud segment’s dominance. As AI-driven automation, cloud rendering, and collaborative editing tools become essential in content creation, cloud-based deployment will continue shaping the future of the Creative Software Market, offering scalability and efficiency to businesses and individual users alike.

The On-premises segment is expected to grow at the Fastest CAGR of 7.41% due to demand from industries requiring enhanced security, high-performance processing, and offline accessibility. Professional studios, broadcasting agencies, and enterprises handling sensitive creative projects prefer on-premises software solutions to maintain control over data and optimize performance. FXhome upgraded HitFilm’s motion tracking features, improving its standalone desktop editing experience. The growing preference for high-end graphics, animation, and video production tools in film studios, gaming, and AR/VR development has fueled this segment’s expansion.

Regional Analysis

REGIONAL ANALYSIS

North America led the Creative Software Market in 2023, holding an estimated 39% market share, driven by the strong presence of leading software companies, high adoption of AI-powered creative tools, and the increasing demand for digital content production. The region is home to industry giants like Adobe, Corel, and TechSmith, continuously innovating to meet the rising demand for professional-grade creative software. Adobe’s AI-powered updates in Creative Cloud, including Firefly generative AI in Photoshop and Premiere Pro, significantly boosted market growth.

Additionally, the growing film, entertainment, and digital marketing industries in the U.S. and Canada have driven demand for advanced video editing, graphic design, and animation software. North America's well-established tech infrastructure, high disposable income, and increasing investments in AR/VR and AI-driven creative solutions have solidified its dominance in the market.

The Asia Pacific region is the fastest-growing market for creative software, with an estimated CAGR of 8.06%, fueled by rapid digital transformation, growing internet penetration, and increasing content creation trends. Countries like China, India, Japan, and South Korea are experiencing significant growth due to the rise of social media influencers, digital marketing agencies, and e-learning platforms. The surge in demand for affordable and AI-driven creative software has led companies to expand their presence in the region.

For example, Wondershare, a China-based software company, enhanced Filmora with AI-powered video editing tools, making professional editing more accessible. Adobe expanded its operations in India and China, offering localized cloud-based solutions.

Additionally, the booming gaming and animation industry in Japan and South Korea has driven the demand for high-end graphic design and video production tools. With increasing government initiatives supporting digital transformation and a growing freelance creator economy, the Asia Pacific region is expected to lead the Creative Software Market’s future growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Creative Software Market are:

-

Adobe (Premiere Pro, After Effects)

-

MAGIX Software GmbH (VEGAS Pro, Music Maker)

-

Corel Corporation (CorelDRAW, Pinnacle Studio)

-

CyberLink Corp. (PowerDirector, PhotoDirector)

-

FXhome Limited (HitFilm, Imerge Pro)

-

TechSmith Corporation (Camtasia, Snagit)

-

Nero AG (Nero Video, Nero Burning ROM)

-

Movavi Software Limited (Movavi Video Editor, Movavi Picverse)

-

Sony Creative Software Inc. (Sound Forge Pro, ACID Pro)

-

Wondershare (Filmora, UniConverter)

-

Artlist Limited (Artgrid, Artlist Music)

Recent Trends

-

In February 2025, Adobe introduced a new artificial intelligence (AI) video generation service, allowing subscribers to create 5-second videos for monthly fees of USD 9.99 or USD 29.99. This service, part of Adobe's Firefly application, aimed to provide production-quality video content integrated with Adobe's Creative Cloud suite.

-

In February 2023, German software company MAGIX acquired several product lines from Sony Creative Software, including Vegas Pro, Movie Studio, Sound Forge Pro, and ACID Pro. This acquisition expanded MAGIX's presence in both European and U.S. markets, with plans to release updated versions of Vegas Pro and Movie Studio later that year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.79 Billion |

| Market Size by 2032 | US$ 15.57 Billion |

| CAGR | CAGR of 6.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premises, Cloud) • By Type (Sound & Video Recording Software, Image & Video Editing Software, Graphics & Illustration Software, Desktop Publishing Software, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe, MAGIX Software GmbH, Corel Corporation, CyberLink Corp., FXhome Limited, TechSmith Corporation, Nero AG, Movavi Software Limited, Sony Creative Software Inc., Wondershare, Artlist Limited |