Covered Stent Market Report Scope & Overview:

Get More Information on Covered Stent Market - Request Sample Report

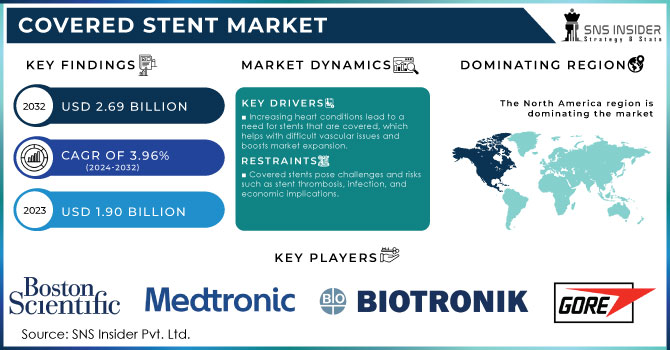

The Covered Stent Market size was valued at USD 1.90 billion in 2023 and is expected to reach USD 2.69 billion by 2032 and grow at a CAGR of 3.96% over the forecast period 2024-2032.

Advances in medical technology and rising demand for minimally invasive treatments are driving significant growth in the covered stent market. Stents covered with a graft material, known as covered stents, are created to treat challenging vascular issues like aneurysms, arteriovenous fistulas, and vascular leaks. These stents offer a special solution by providing both structural support and a barrier to stop blood from leaking through the vessel wall, thus improving the effectiveness of treatment. Covered stents have shown remarkable success rates in the field of endogenous laser therapy (EVLT) for varicose veins treatment. Usually, these procedures have a success rate of about 90% after one year, indicating effectiveness in relieving symptoms and closing veins. In the management of peripheral artery disease (PAD), covered stents are also utilized to treat blockages in the arteries of the legs. Typically, these stents have a patency rate of 70% to 80% after one year, showing a positive result in keeping the arteries open. Covered stents are utilized in endovascular aneurysm repair (EVAR) procedures for the treatment of abdominal aortic aneurysm (AAA). This method boasts a strong track record, achieving a 5-year survival rate of around 70% to 80%, with an aneurysm-linked death rate of roughly 1% to 2% during the same timeframe. The use of covered stents in treating coronary artery disease has demonstrated a lower incidence of restenosis in comparison to bare-metal stents, with a one-year patency rate of approximately 90%.

The increasing incidence of vascular diseases is a key factor driving the market for covered stents. Aging populations and increasingly inactive lifestyles are leading to a rise in the prevalence of conditions like aneurysms and peripheral artery disease. Covered stents are a valid choice for these patients, providing the advantages of stenting while also offering the extra safeguard of a graft to improve overall patient results. Moreover, progress in materials science and stent design is also aiding in the growth of the market. Advancements like drug-coated covered stents, releasing drugs to avoid restenosis, and bioresorbable stents, dissolving post-use, are revolutionizing vascular interventions.

Market Dynamics

Drivers

-

Increasing heart conditions lead to a need for stents that are covered, which helps with difficult vascular issues and boosts market expansion.

The rise in cardiovascular diseases like CAD, PAD, and aneurysms is a key factor driving the covered stent market. Cardiovascular diseases (CVDs) are one of the top reasons for illness and death on a global scale, resulting in a considerable need for successful treatment choices. Covered stents are especially useful for treating complicated vascular conditions that traditional stents may not be able to treat effectively. For instance, they are utilized in the treatment of chronic total occlusions (CTOs) and in the restoration of aneurysms. The increasing prevalence of these diseases caused by reasons such as older populations, inactive habits, and elevated levels of diabetes and hypertension leads to a demand for advanced medical options like stents that are covered. Furthermore, with the enhancement of knowledge about cardiovascular health and advancements in diagnostic technology, there is a growing number of people receiving CVD diagnoses, leading to a higher need for covered stents. The increasing emphasis on early identification and preventative treatment is also fueling the increasing demand for stenting procedures, driving market expansion.

-

Increasing need for covered stents fueled by the rise in minimally invasive surgical methods.

The movement towards less invasive methods in healthcare is a major factor influencing the covered stent market. Minimally invasive surgeries have various benefits compared to traditional open surgeries, such as quicker recovery periods, decreased infection risks, and reduced postoperative pain levels. Covered stents are included in this pattern, as they can be inserted using catheter-based methods that don't involve extensive cuts. This method provides advantages to patients by shortening recovery times and hospital stays, while also enabling healthcare providers to carry out procedures more accurately and with reduced risk. The growing demand for covered stents is fueled by the rising popularity of minimally invasive techniques among patients and healthcare providers. The covered stent market is projected to expand as more medical centers incorporate these methods and technologies.

Restraints

-

Covered stents pose challenges and risks such as stent thrombosis, infection, and economic implications.

Although covered stents have advantages, they do come with potential risks. Possible issues and negative outcomes linked to covered stents include stent thrombosis, infection, and bleeding. Although improvements in stent technology have decreased these dangers, they have not eradicated them. The chance of experiencing these difficulties may dissuade certain patients and healthcare professionals from choosing covered stents. Furthermore, the expense of managing and treating complications increases the total cost of the procedure, posing a potential worry for patients and healthcare systems alike. The market's growth may be hindered by complications, restricting the use of covered stents in specific patient groups or clinical situations.

-

Challenges and Consequences of Regulatory Obstacles in Approval of Covered Stents for Market Growth.

The process for approving covered stents can be intricate and prolonged. Manufacturers have to go through strict regulatory demands to secure approval for new stent designs and technologies. This procedure requires thorough clinical trials, submission of data, and adherence to safety regulations. Obtaining regulatory approval can cause a delay in bringing newly covered stent products to the market due to the time and resources involved. Furthermore, differing regulatory standards in various regions can make the global market strategy for covered stent producers more complex. These obstacles related to regulations and approvals may impede the expansion of the market by delaying innovation and restricting access to new covered stent technologies.

Market Segmentation Analysis

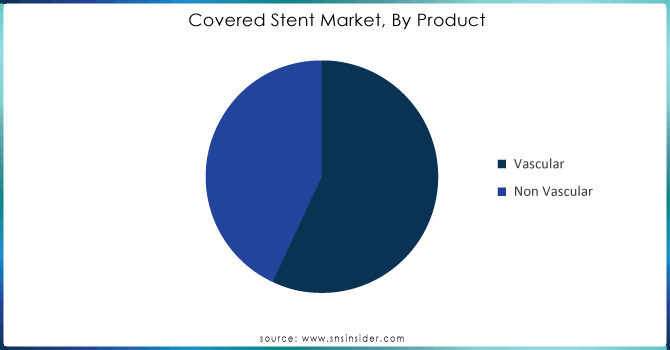

By Product

The vascular stent dominated in 2023 with a market share of 60%. Vascular stents are created to provide assistance to blood vessels and are mainly utilized in treating cardiovascular conditions. They play a crucial role in operations like angioplasty by assisting in maintaining the openness of arteries following their expansion. The growing occurrence of coronary artery diseases, peripheral artery diseases, and other vascular conditions is the main reason for the rising need for vascular stents. The growth of this sector has been further supported by technological advancements like drug-eluting stents that release medication to prevent restenosis.

The non-vascular stents are the fastest-growing segment during the forecast period 2024-2032. Non-vascular stents are utilized in various procedures beyond the vascular system, such as gastrointestinal, urological, and respiratory applications. They play a vital role in conditions like esophageal strictures, ureteral obstructions, and airway stenosis. Advancements in material science and stent design have boosted growth in this sector, leading to the increased use of non-vascular stents and better patient results.

Need any customization research on Covered Stent Market - Enquiry Now

By End User

Hospitals held a market share of around 55% in 2023. Hospitals play a significant role in the covered stent market as they frequently utilize advanced medical devices to treat various cardiovascular conditions. The range of services they provide, such as emergency care, surgical procedures, and complex interventional therapies, leads to a strong demand for covered stents. Specialized departments and advanced technology help reinforce this dominance. Hospitals can deal with complex cases that necessitate advanced stent technology, playing a crucial role in market share.

Ambulatory care centers (ACCs) are expected to remain the fastest-growing segment during the forecast period. ACCs are becoming more popular because of their capability to offer effective, affordable care and their emphasis on procedures done on an outpatient basis. The increase in outpatient care for various procedures, such as those requiring covered stents, is contributing to this trend. ACCs are more and more utilizing advanced stent technologies for patients who do not need long hospital stays, in line with a larger movement to decrease hospital admissions and lower healthcare expenses.

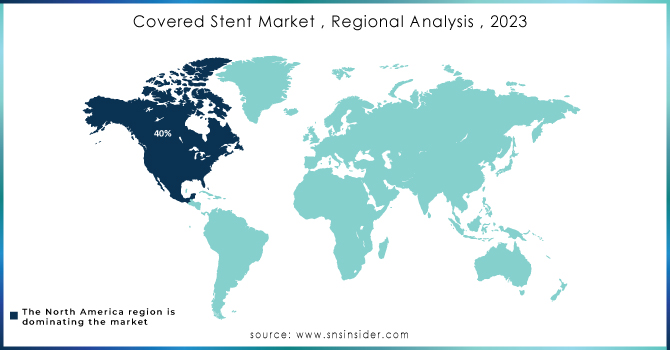

Regional Analysis

North America led the market in 2023 with a market share of over 40%. The main region dominating the covered stent market is North America due to its advanced healthcare system and widespread use of cutting-edge medical technology. The United States is known for its strong healthcare system and significant investments in research and development, leading to a great need for covered stents. The increasing incidence of heart-related illnesses and the rise in procedures like angioplasty and stent placements are also contributing to the growth of the market.

Asia Pacific is expected to grow at a faster rate during 2024-2032. Rapid economic growth and improving healthcare infrastructure are fueling the rapid expansion of the covered stents market in the Asia-Pacific region. Nations such as China and India are seeing a rise in cardiovascular diseases because of lifestyle modifications and aging populations, resulting in a higher need for sophisticated medical treatments. The area is experiencing accelerated market growth due to the increasing number of healthcare facilities and investments in medical technology.

Key Players

The major key players in the market are Boston Scientific Corporation, Medtronic, Cook, W.L. Gore & Associates, B.Braun Systems Inc., Getinge, Biotronik, Terumo Corp, GE Healthcare, Abbott Labs, Koninklijke Philips N.V, Nihon Kohden Corporation, Baxter, Spacelabs Healthcare, & others

Recent Development

-

In January 2024, Boston Scientific introduced the Eluvia Drug-Eluting Stent System for the treatment of peripheral artery disease (PAD). The covered stent features a drug-eluting polymer that releases a drug designed to inhibit restenosis, thereby improving long-term outcomes for patients.

-

In June 2023, Medtronic launched the IN.PACT AV Luminate, a covered stent integrated with a drug-coated balloon system. This device is intended to treat complex vascular lesions and improve the patency of arteriovenous fistulas used in dialysis patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.90 billion |

| Market Size by 2032 | USD 2.69 billion |

| CAGR | CAGR of 3.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Vascular, Non-Vascular) • By End User (Hospitals, Ambulatory Care Centers, Specialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boston Scientific Corporation, Medtronic, Cook, W.L. Gore & Associates, B.Braun Systems Inc., Getinge, Biotronik, Terumo Corp, GE Healthcare, Abbott Labs, Koninklijke Philips N.V, Nihon Kohden Corporation, Baxter, Spacelabs Healthcare |

| Key Drivers | • Increasing heart conditions lead to a need for stents that are covered, which helps with difficult vascular issues and boosts market expansion. • Increasing need for covered stents fueled by the rise in minimally invasive surgical methods. |

| RESTRAINTS | • Covered stents pose challenges and risks such as stent thrombosis, infection, and economic implications. • Challenges and Consequences of Regulatory Obstacles in Approval of Covered Stents for Market Growth. |