Counter Bags Market Report Scope & Overview

Get More Information on Counter Bags Market - Request Sample Report

The Counter Bags Market was Valued at USD 1,426.30 Million in 2023 and is now anticipated to grow to USD 2062.50 Million by 2032, displaying a compound annual growth rate (CAGR) 4.14% of during the forecast Period 2024 - 2032.

The growing need for practical and fashionable bags in retail and business environments is fueling the growth of the counter bag industry. These thin bags also referred to as point-of-sale or checkout bags are made of different materials and are available in a range of sizes to meet a variety of requirements. They are essential in helping retailers expedite the checkout process and provide customers with a useful way to carry their products.

The market is growing because of a number of reasons. There will always be a need for counter bags due to the global retail and commercial sectors' explosive growth. Hassle-free shopping experiences are becoming more and more important to customers, and these bags offer a practical solution. Since counter bags are frequently used to package home goods, the growing e-commerce sector has further increased demand.

Sustainability is a significant factor impacting the counter bag industry. With mounting environmental concerns, both businesses and consumers are opting for eco-friendly packaging solutions. As a result of this trend, there is a high demand for counter bags made of recyclable paper and biodegradable plastic. The market for counter bags is changing; these practical necessities are becoming strategic brand extensions and silent defenders of sustainability.

Checkout or point-of-sale bags, sometimes referred to as counter bags, are no longer an afterthought. These days, they serve as a canvas for eye-catching patterns, environmentally friendly materials, and useful elements. Counter bags, which range from sturdy, reusable totes to eye-catching paper bags imprinted with personalized logos, are revolutionizing both consumer behavior and business-customer interactions.

Market Dynamics

Drivers

The Surprisingly Strong Counter Bags Increase Sales

The shopping experience is transforming, placing importance on convenience and building relationships with the brand. In this landscape, an unlikely hero emerges: the counter bag. Once a mundane afterthought, counter bags are now strategic tools. They streamline the checkout process, provide effortless carrying solutions, and eliminate post-purchase hassles - all contributing to customer satisfaction.But the power of counter bags goes beyond convenience. They transform into silent salespeople, acting as walking billboards with customizable designs and brand messaging. A well-designed bag can leave a lasting impression, enhance brand recall, and even create emotional connections with customers. This synergy between convenience and branding is the true strength of counter bags, shaping a positive customer experience and fostering brand loyalty.

The Unexpected Appearance Stars Counter Bags Arise on the Online Marketplace

The e-commerce revolution has fundamentally reshaped retail, but its impact extends beyond just online shopping carts. A surprising player has emerged in this digital realm – the humble counter bag. While their traditional purpose resided in brick-and-mortar stores, counter bags are finding exciting new applications in the world of e-commerce deliveries.

Counter bags, particularly those crafted from durable and reusable materials, are stepping up as eco-friendly packaging solutions for home deliveries. This addresses a crucial aspect of the e-commerce experience – the physical delivery of goods. Counter bags offer a secure and convenient way to transport products, ensuring items arrive safely while aligning with the sustainability expectations of today's environmentally conscious online shoppers. This shift towards sustainable packaging not only satisfies customer preferences but also helps businesses navigate the growing regulations on plastic use, making counter bags a win-win for both parties.

The impact of counter bags goes beyond just functionality. They can be powerful brand advocates, even in the digital realm. Companies can utilize custom-designed counter bags for packaging online orders, ensuring their brand identity is present upon product delivery. This creates a consistent brand experience across all touch points, from browsing online to receiving the product at home. Imagine a customer receiving their online purchase – a pair of shoes perhaps – in a stylish, reusable bag emblazoned with the company's logo and eco-friendly messaging. This not only reinforces brand recognition but also creates a positive association between the brand and sustainability. This consistency fosters stronger customer loyalty, encouraging repeat business and positive word-of-mouth recommendation

Restraints

The Financial Difficulties of Sustainable Counter Bags Can Be Increased by the Green Solution

The push for sustainability in the counter bags market presents a significant hurdle – cost. While eco-friendly options made from recycled materials or organic fibers are increasingly in demand, their production often comes at a higher price compared to traditional plastic bags. This cost difference can be a major barrier for businesses, particularly smaller retailers operating with tighter margins. These cost considerations can be particularly challenging for smaller retailers. Operating with lower profit margins, they might be less able to absorb the initial price increase of sustainable counter bags. This can create a dilemma – prioritize sustainability and potentially sacrifice short-term profits, or opt for the cheaper, less eco-friendly plastic option. The initial purchase price of sustainable counter bags can be substantially higher than their plastic counterparts. Recycled materials might require additional processing, and organic fibers like cotton or jute may have higher base costs. The durability of these sustainable bags can vary. While some may be reusable and offer a long-term cost benefit, others might require more frequent replacement, further impacting the overall budget.

The Emergence of Reusable as a Counterweight to Bags

The counter bag market faces a complex challenge in the form of inconsistent regulations. This patchwork of regulations across geographical areas creates a logistical headache for businesses operating in multiple locations. Consumers increasingly prioritize sustainability, and reusable bags offer an attractive alternative. With their extended lifespan, they can replace countless single-use counter bags, potentially leading to a decline in overall counter bag demand. Some reusable bags are designed with style and functionality in mind, blurring the line between a practical carrying solution and a fashion statement. This can incentivize consumers to invest in a few high-quality reusable bags, further reducing their reliance on counter bags. The counter bag market can adapt. by focusing on eco-friendly materials and promoting reusability, counter bags can carve out a niche within this evolving landscape. Imagine well-made paper bags with reinforced handles or stylish cloth counter bags offered as a premium option. These sustainable counter bags can cater to customers who still value the convenience of a disposable option but also seek an eco-conscious alternative.

Segment Analysis

By Application

Food & Beverages

Pharmaceuticals

Homecare

Personal Care

Cosmetics

Other Applications

The Food & Beverage (F&B) segment dominates the counter bag industry with the market share of 23%, due to its enormous volume and the extremely different needs of its players. Consider how busy restaurants require grease-resistant bags to protect delicate pastries, while supermarkets require larger, sturdier options to handle heavy grocery hauls. Counter bags are used in a wide range of food and beverage facilities, from modest cafés to contemporary restaurants, to ensure a seamless and gratifying customer experience. This category thrives on the variety of counter bags. Counter bags' capacity to accommodate to a wide range of needs, from delicate pastries to massive beverage bottles, is what makes them such an important aspect in the F&B sector. Counter bags come in a variety of sizes, materials, and styles, allowing F&B firms to discover the ideal fit for their specific services, resulting in satisfied consumers and a successful food and beverage industry. Sponge counter bags provide a unique and potentially advantageous option. Their soft, absorbent substance is great for protecting delicate pastries, bakery products, and fresh fruits. This can help to avoid damage during shipment, reduce food waste, and provide a great client experience.

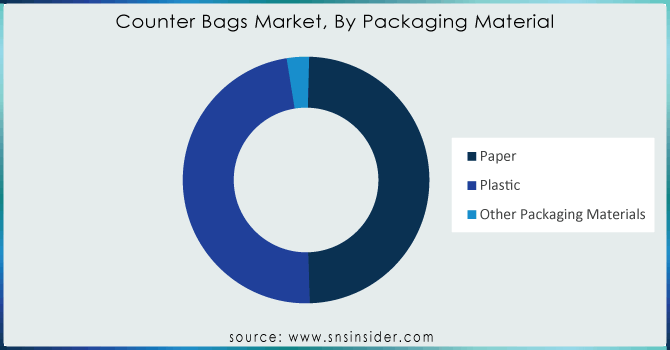

By Packaging Material

Paper

Plastic

Other Packaging Materials

Paper dominates the counter bag market because of its eco-friendliness, which is particularly relevant as environmental concerns gain traction. Recycled paper bags further lessen their impact on the environment, and it's a sustainable resource. Both businesses and consumers find this to be meaningful. Paper is incredibly versatile and goes beyond sustainability. Paper is available in a variety of sizes and thicknesses to meet every requirement, from delicate pastry bags to robust shopping sacks. Paper can be more affordable, especially for applications that are meant to be used just once. Its low cost makes it an economical option for companies, thus establishing its authority in the counter bag industry.

Need any customization research on Counter Bags Market - Enquiry Now

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Regional Analysis

The counter bags Market is dominated by the Asia Pacific region is estimated to 30%. This means that plastic bags, which are frequently thought to be the most affordable option, continue to rule a price-sensitive market. A strong countermovement known as the increasing environmental consciousness movement is taking shape. More sustainable alternatives are growing in popularity as a result of consumers' and businesses' growing awareness of plastic's negative environmental effects. Paper bags are becoming more popular since they are an easily accessible and recyclable alternative. Biodegradable plastics are beginning to gain popularity, appealing to consumers looking for a sustainable and affordable solution. The development in environmental consciousness and the possibility of stronger government limits on plastic use in the Asia Pacific area are anticipated to be the primary drivers affecting a future move away from standard plastic counter bags and towards more sustainable alternatives.

The counter bag market in North America is indicative of a worldwide trend, where paper is dominant. Paper bags have remained the most popular option due to consumers' increasing attention to sustainability and their natural adaptability. From bakery bags to grocery sacks, paper is available in a variety of sizes and thicknesses to meet the needs of a broad spectrum of industries. Paper is the preferred option for numerous organizations due to its versatility and environmentally beneficial properties as a recyclable and renewable material. Enticing to both businesses and ecologically conscious consumers, these bags provide a durable substitute for single-use ones. Despite the fact that paper is still the most popular material, the reusable section of the North American counter bag industry is expected to increase at a rapid pace.

In the counter bag market, Europe follows a distinct beat. Environmental concern reigns supreme, and rules follow suit. Stringent laws aimed at reducing plastic consumption have allowed paper to become the dominant player. They are made from renewable resources and can be recycled, reducing environmental effect. This connects strongly with both European consumers and businesses, resulting in a market driven by sustainability. But the story does not stop there. Europe's environmentally aware mindset extends beyond paper. There is a growing prevalence of reusable cloth bags, especially in countries where protecting the environment is a key priority.

The counter bag landscape in Latin America, the Middle East, and Africa is divided into two areas, each driven by a complicated interaction of cost and environmental considerations. Plastic bags currently have a competitive advantage due to their low cost. This is particularly relevant in developing economies, where cost is a top priority for both firms and consumers. The tide is beginning to turn. Governments in these regions are increasingly enacting restrictions to reduce plastic use, acknowledging the environmental damage it can do. This paves the path for a transition to more sustainable solutions such as paper bags and, eventually, reusable fabric equivalents.

Key Players

Some of the major Players International Paper Company ,Novolex Holdings, LLC ,Mondi Group ,Genpak, LLC ,WestRock Company ,Berry Global, Inc. ,Smurfit Kappa Group ,Firstpack Corporation Sdn. Bhd. ,The Kroger Co. ,Wenzhou Chuangjia Packaging Co., Ltd.,Brown &Co., Sirane Ltd.

Recent Development

Launched in June 2022, this range offers SPOUTED pouches made from mono-material recyclable plastic. The entire RePEat range, including stand-up pouches and films, uses pure PE, allowing them to be recycled in the LDPE recycling stream. This caters to businesses seeking a more eco-friendly plastic packaging solution.

Big Brown Paper Bags offers a comprehensive selection of high-quality and practical paper counter bags designed with both functionality and sustainability in mind. All their paper bags, including popular options like sulfite bags, are carefully chosen for their recyclability, making them an eco-friendly choice for businesses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1,426.30 Million |

| Market Size by 2031 | US$ 2062.50 Million |

| CAGR | CAGR of 4.14 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Application (Food & Beverages, Pharmaceuticals, Homecare, Personal Care, Cosmetics, Other Applications), • by Packaging Material (Paper, Plastic, Other Packaging Materials) • by Manufacturing (Make-to-Order Manufacturing, Make-to-Stock Manufacturing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | International Paper Company ,Novolex Holdings, LLC ,Mondi Group ,Genpak, LLC ,WestRock Company ,Berry Global, Inc. ,Smurfit Kappa Group ,Firstpack Corporation Sdn. Bhd. ,The Kroger Co. ,Wenzhou Chuangjia Packaging Co., Ltd.,Brown &Co., Sirane Ltd. |

| Key Drivers | • The Surprisingly Strong Counter Bags Increase Sales • The Unexpected Appearance Stars Counter Bags Arise on the Online Marketplace |

| RESTRAINTS | • The Financial Difficulties of Sustainable Counter Bags Can Be Increased by the Green Solution • The Emergence of Reusable as a Counterweight to Bags |

Ans: Rising environmental awareness and regulations promoting sustainable packaging are driving the counter bags market.

Ans: The Counter Bags Market is expected to grow at a CAGR of 4.14%

Ans: The Counter Bags Market was Valued at USD 1,426.30 Million in 2023 and is now anticipated to grow to USD 2062.50 Million by 2032, displaying a compound annual growth rate (CAGR) 4.14% of during the forecast Period 2024 - 2032.

Ans: The North America region is anticipated to record the Fastest Growing in the Counter Bags Market.

Ans: The Food & Beverages is leading in the market revenue share in 2023.

Ans: Asia Pacific is expected to hold the largest market share in the Counter Bags Market during the forecast period.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Counter Bags Market Segmentation, by Application

7.1 Introduction

7.2 Food & Beverages

7.3 Pharmaceuticals

7.4 Homecare

7.5 Personal Care

7.6 Cosmetics

7.7 Other Applications

8. Counter Bags Market Segmentation, by Packaging Material

8.1 Introduction

8.2 Paper

8.3 Plastic

8.4 Other Packaging Materials

9. Counter Bags Market Segmentation, by Manufacturing

9.1 Introduction

9.2 Make-to-Order Manufacturing

9.3 Make-to-Stock Manufacturing

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Counter Bags Market by Country

10.2.3 North America Counter Bags Market by Application

10.2.4 North America Counter Bags Market by Packaging Material

10.2.5 North America Counter Bags Market by Manufacturing

10.2.6 USA

10.2.6.1 USA Counter Bags Market by Application

10.2.6.2 USA Counter Bags Market by Packaging Material

10.2.6.3 USA Counter Bags Market by Manufacturing

10.2.7 Canada

10.2.7.1 Canada Counter Bags Market by Application

10.2.7.2 Canada Counter Bags Market by Packaging Material

10.2.7.3 Canada Counter Bags Market by Manufacturing

10.2.8 Mexico

10.2.8.1 Mexico Counter Bags Market by Application

10.2.8.2 Mexico Counter Bags Market by Packaging Material

10.2.8.3 Mexico Counter Bags Market by Manufacturing

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Counter Bags Market by Country

10.3.2.2 Eastern Europe Counter Bags Market by Application

10.3.2.3 Eastern Europe Counter Bags Market by Packaging Material

10.3.2.4 Eastern Europe Counter Bags Market by Manufacturing

10.3.2.5 Poland

10.3.2.5.1 Poland Counter Bags Market by Application

10.3.2.5.2 Poland Counter Bags Market by Packaging Material

10.3.2.5.3 Poland Counter Bags Market by Manufacturing

10.3.2.6 Romania

10.3.2.6.1 Romania Counter Bags Market by Application

10.3.2.6.2 Romania Counter Bags Market by Packaging Material

10.3.2.6.4 Romania Counter Bags Market by Manufacturing

10.3.2.7 Hungary

10.3.2.7.1 Hungary Counter Bags Market by Application

10.3.2.7.2 Hungary Counter Bags Market by Packaging Material

10.3.2.7.3 Hungary Counter Bags Market by Manufacturing

10.3.2.8 Turkey

10.3.2.8.1 Turkey Counter Bags Market by Application

10.3.2.8.2 Turkey Counter Bags Market by Packaging Material

10.3.2.8.3 Turkey Counter Bags Market by Manufacturing

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Counter Bags Market by Application

10.3.2.9.2 Rest of Eastern Europe Counter Bags Market by Packaging Material

10.3.2.9.3 Rest of Eastern Europe Counter Bags Market by Manufacturing

10.3.3 Western Europe

10.3.3.1 Western Europe Counter Bags Market by Country

10.3.3.2 Western Europe Counter Bags Market by Application

10.3.3.3 Western Europe Counter Bags Market by Packaging Material

10.3.3.4 Western Europe Counter Bags Market by Manufacturing

10.3.3.5 Germany

10.3.3.5.1 Germany Counter Bags Market by Application

10.3.3.5.2 Germany Counter Bags Market by Packaging Material

10.3.3.5.3 Germany Counter Bags Market by Manufacturing

10.3.3.6 France

10.3.3.6.1 France Counter Bags Market by Application

10.3.3.6.2 France Counter Bags Market by Packaging Material

10.3.3.6.3 France Counter Bags Market by Manufacturing

10.3.3.7 UK

10.3.3.7.1 UK Counter Bags Market by Application

10.3.3.7.2 UK Counter Bags Market by Packaging Material

10.3.3.7.3 UK Counter Bags Market by Manufacturing

10.3.3.8 Italy

10.3.3.8.1 Italy Counter Bags Market by Application

10.3.3.8.2 Italy Counter Bags Market by Packaging Material

10.3.3.8.3 Italy Counter Bags Market by Manufacturing

10.3.3.9 Spain

10.3.3.9.1 Spain Counter Bags Market by Application

10.3.3.9.2 Spain Counter Bags Market by Packaging Material

10.3.3.9.3 Spain Counter Bags Market by Manufacturing

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Counter Bags Market by Application

10.3.3.10.2 Netherlands Counter Bags Market by Packaging Material

10.3.3.10.3 Netherlands Counter Bags Market by Manufacturing

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Counter Bags Market by Application

10.3.3.11.2 Switzerland Counter Bags Market by Packaging Material

10.3.3.11.3 Switzerland Counter Bags Market by Manufacturing

10.3.3.12 Austria

10.3.3.12.1 Austria Counter Bags Market by Application

10.3.3.12.2 Austria Counter Bags Market by Packaging Material

10.3.3.12.3 Austria Counter Bags Market by Manufacturing

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Counter Bags Market by Application

10.3.3.13.2 Rest of Western Europe Counter Bags Market by Packaging Material

10.3.3.13.3 Rest of Western Europe Counter Bags Market by Manufacturing

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Counter Bags Market by Country

10.4.3 Asia-Pacific Counter Bags Market by Application

10.4.4 Asia-Pacific Counter Bags Market by Packaging Material

10.4.5 Asia-Pacific Counter Bags Market by Manufacturing

10.4.6 China

10.4.6.1 China Counter Bags Market by Application

10.4.6.2 China Counter Bags Market by Packaging Material

10.4.6.3 China Counter Bags Market by Manufacturing

10.4.7 India

10.4.7.1 India Counter Bags Market by Application

10.4.7.2 India Counter Bags Market by Packaging Material

10.4.7.3 India Counter Bags Market by Manufacturing

10.4.8 Japan

10.4.8.1 Japan Counter Bags Market by Application

10.4.8.2 Japan Counter Bags Market by Packaging Material

10.4.8.3 Japan Counter Bags Market by Manufacturing

10.4.9 South Korea

10.4.9.1 South Korea Counter Bags Market by Application

10.4.9.2 South Korea Counter Bags Market by Packaging Material

10.4.9.3 South Korea Counter Bags Market by Manufacturing

10.4.10 Vietnam

10.4.10.1 Vietnam Counter Bags Market by Application

10.4.10.2 Vietnam Counter Bags Market by Packaging Material

10.4.10.3 Vietnam Counter Bags Market by Manufacturing

10.4.11 Singapore

10.4.11.1 Singapore Counter Bags Market by Application

10.4.11.2 Singapore Counter Bags Market by Packaging Material

10.4.11.3 Singapore Counter Bags Market by Manufacturing

10.4.12 Australia

10.4.12.1 Australia Counter Bags Market by Application

10.4.12.2 Australia Counter Bags Market by Packaging Material

10.4.12.3 Australia Counter Bags Market by Manufacturing

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Counter Bags Market by Application

10.4.13.2 Rest of Asia-Pacific Counter Bags Market by Packaging Material

10.4.13.3 Rest of Asia-Pacific Counter Bags Market by Manufacturing

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Counter Bags Market by Country

10.5.2.2 Middle East Counter Bags Market by Application

10.5.2.3 Middle East Counter Bags Market by Packaging Material

10.5.2.4 Middle East Counter Bags Market by Manufacturing

10.5.2.5 UAE

10.5.2.5.1 UAE Counter Bags Market by Application

10.5.2.5.2 UAE Counter Bags Market by Packaging Material

10.5.2.5.3 UAE Counter Bags Market by Manufacturing

10.5.2.6 Egypt

10.5.2.6.1 Egypt Counter Bags Market by Application

10.5.2.6.2 Egypt Counter Bags Market by Packaging Material

10.5.2.6.3 Egypt Counter Bags Market by Manufacturing

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Counter Bags Market by Application

10.5.2.7.2 Saudi Arabia Counter Bags Market by Packaging Material

10.5.2.7.3 Saudi Arabia Counter Bags Market by Manufacturing

10.5.2.8 Qatar

10.5.2.8.1 Qatar Counter Bags Market by Application

10.5.2.8.2 Qatar Counter Bags Market by Packaging Material

10.5.2.8.3 Qatar Counter Bags Market by Manufacturing

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Counter Bags Market by Application

10.5.2.9.2 Rest of Middle East Counter Bags Market by Packaging Material

10.5.2.9.3 Rest of Middle East Counter Bags Market by Manufacturing

10.5.3 Africa

10.5.3.1 Africa Counter Bags Market by Country

10.5.3.2 Africa Counter Bags Market by Application

10.5.3.3 Africa Counter Bags Market by Packaging Material

10.5.3.4 Africa Counter Bags Market by Manufacturing

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Counter Bags Market by Application

10.5.3.5.2 Nigeria Counter Bags Market by Packaging Material

10.5.3.5.3 Nigeria Counter Bags Market by Manufacturing

10.5.3.6 South Africa

10.5.3.6.1 South Africa Counter Bags Market by Application

10.5.3.6.2 South Africa Counter Bags Market by Packaging Material

10.5.3.6.3 South Africa Counter Bags Market by Manufacturing

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Counter Bags Market by Application

10.5.3.7.2 Rest of Africa Counter Bags Market by Packaging Material

10.5.3.7.3 Rest of Africa Counter Bags Market by Manufacturing

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Counter Bags Market by country

10.6.3 Latin America Counter Bags Market by Application

10.6.4 Latin America Counter Bags Market by Packaging Material

10.6.5 Latin America Counter Bags Market by Manufacturing

10.6.6 Brazil

10.6.6.1 Brazil Counter Bags Market by Application

10.6.6.2 Brazil Counter Bags Market by Packaging Material

10.6.6.3 Brazil Counter Bags Market by Manufacturing

10.6.7 Argentina

10.6.7.1 Argentina Counter Bags Market by Application

10.6.7.2 Argentina Counter Bags Market by Packaging Material

10.6.7.3 Argentina Counter Bags Market by Manufacturing

10.6.8 Colombia

10.6.8.1 Colombia Counter Bags Market by Application

10.6.8.2 Colombia Counter Bags Market by Packaging Material

10.6.8.3 Colombia Counter Bags Market by Manufacturing

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Counter Bags Market by Application

10.6.9.2 Rest of Latin America Counter Bags Market by Packaging Material

10.6.9.3 Rest of Latin America Counter Bags Market by Manufacturing

11. Company Profiles

11.1 International Paper Company

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Novolex Holdings,LLC.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Mondi Group

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 WestRock Company

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Berry Global

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Smurfit Kappa Group

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 The Kroger Co.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Wenzhou Chuangjia Packaging Co.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Brown &Co.,

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Sirane Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Smart Labels Market size was valued at USD 9.29 billion in 2023. It is expected to grow to USD 21.02 billion by 2032 and grow at a CAGR of 9.50% over the forecast period of 2024-2032.

The Paper Machinery Market Size was USD 22.32 billion in 2023 and is expected to reach USD 33.45 billion by 2032, growing at a CAGR of 4.6% by 2024-2032.

The Thermoformed Healthcare Packaging Market Size was valued at $48.41 billion in 2023 & will reach $94.53 billion by 2032 growing at a CAGR of 7.72% from 2024-2032

The High Density Polyethylene Bottles (HDPE) Market size was USD 55.07 billion in 2023 and is expected to Reach USD 80.10 billion by 2031 and grow at a CAGR of 4.80% over the forecast period of 2024-2031.

In 2023, the E-Commerce Logistics Market was USD 462.26 billion. It is projected to grow significantly to USD 2585.37 billion by 2032, with CAGR of 21.56%.

The Smart Packaging Market Size was valued at USD 24.8 billion in 2023 and is expected to reach USD 36.36 billion by 2031 and grow at a CAGR of 4.9% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone