Get More Information on Cosmetic Preservative Market - Request Sample Report

The Cosmetic Preservative Market Size was valued at USD 439.1 Million in 2023. It is expected to grow to USD 780.6 Million by 2032 and grow at a CAGR of 6.6% over the forecast period of 2024-2032.

The cosmetic preservative market has experienced growth over the years due to rising consumer awareness regarding the importance of product safety and hygiene. With the increasing demand for natural and organic cosmetic products, the market has witnessed a shift towards the use of preservatives derived from natural sources. The growing preference for eco-friendly and sustainable ingredients drives this trend. Several prominent companies dominate the cosmetic preservative market. These include global players such as Ashland Inc., BASF SE, Lonza Group Ltd., and Symrise AG. These companies invest heavily in research and development to introduce innovative and effective preservatives that meet the evolving needs of the cosmetic industry.

The European Commission reported that over 70% of cosmetics tested in 2020 contained preservatives, but about 25% of these products had insufficient levels to effectively inhibit microbial growth. This statistic highlights the ongoing challenges and the need for effective preservative solutions in the cosmetic industry.

The cosmetic preservative market is witnessing a trend of growing demand for multifunctional preservatives that not only provide antimicrobial properties but also offer additional benefits such as moisturization and antioxidant effects. This trend is driven by the increasing consumer demand for products that offer multiple benefits in a single formulation. Secondly, there is a rising preference for preservatives with broad-spectrum activity, capable of effectively inhibiting the growth of various microorganisms. This is particularly important as cosmetic products are exposed to a wide range of contaminants during their usage, making it crucial to ensure their safety and stability.

For instance, BASF introduced its Preservative Solutions line in 2023, which includes multifunctional preservatives designed to enhance product stability while providing moisturizing properties. This innovative range aims to meet the growing consumer demand for products that combine efficacy with additional skin benefits.

The clean beauty movement has been affecting heavily the cosmetic preservative market. A vast number of “free from” labels are being launched, as many brands are reformulating their products to exclude preservatives that have been shown to cause irritation or allergic reactions. Unilever, for example, launched in 2021 its “Clean Beauty” project, which focused on removing from its formulations over 1,000 potentially harmful ingredients, including preservatives.

In turn, L’Oréal launched a new line of products in 2022, in which the plant-based preservative has been positioned as the most important, signalling the commitment to clean beauty principles. In addition, Procter & Gamble announced in 2023 that it would prioritize the use of non-irritating preservatives across its entire cosmetic range, indicating that there is no sign of this market trend dissipating.

Drivers

Increasing awareness about personal hygiene and grooming

Rising disposable income in emerging economies

Increasing demand for cosmetic products drives market growth.

The rapid development of beauty application standards is boosting the demand for skincare, makeup, and personal care products as a whole. This demand is driven by the rise of influencers on social media, the boom of e-commerce, and the increasing awareness of self-care and wellness. However, as consumers are putting more emphasis on the safety of these cosmetics, manufacturers need to use more reliable preservatives to ensure the longevity and stability of their products. According to the Cosmetic Ingredient around 80% of consumers are bothered by questions about cosmetics’ safety and efficiency. Thereby, the ability of cosmetics to be effective leading to purchase is based on a direct correlation: to be efficient, you need to be safe, and to be safe, you need cosmetic preservatives. This has created a direct correlation between product effectiveness and safety, where consumers expect that for cosmetics to be deemed effective, they must also be safe for use. Consequently, manufacturers are compelled to incorporate reliable cosmetic preservatives into their formulations to ensure longevity and stability while meeting regulatory standards and consumer expectations. This necessity not only addresses safety concerns but also fosters consumer trust and loyalty, ultimately driving sales and growth in the cosmetic preservative market.

Restraint

Balancing the need for effective preservation with consumer safety and product quality.

The cosmetic industry relies on preservatives to extend the shelf life of products and prevent the growth of harmful microorganisms. However, the use of preservatives must be carefully managed to ensure they do not compromise consumer safety or product quality. The primary objective of cosmetic preservatives is to inhibit the growth of bacteria, fungi, and other microorganisms that can contaminate products and potentially harm consumers. Without effective preservation, cosmetics could become breeding grounds for harmful pathogens, leading to adverse health effects. On the other hand, consumer safety and product quality are equally crucial considerations. Some preservatives, while effective at preventing microbial growth, may cause skin irritation or allergic reactions in certain individuals. Additionally, preservatives can interact with other ingredients in cosmetics, potentially compromising their stability or efficacy. Finding the delicate balance between effective preservation and consumer safety requires thorough research, testing, and regulatory compliance. This presents an additional challenge, as natural preservatives often have limited efficacy compared to their synthetic counterparts.

By Product

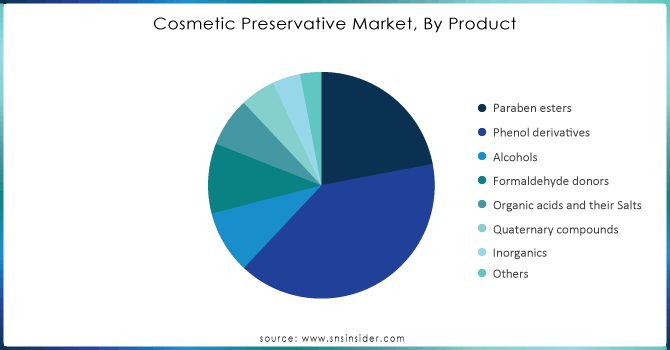

Phenol derivatives dominated the cosmetic preservative market with the largest revenue share of about 40% in 2023. The increasing use of phenol derivatives, especially phenoxyethanol, in the preparation of cosmetics such as skin lighting creams & and lotions, hair coloring solutions, and sunscreens is anticipated to drive the market growth from 2024-2032. Increasing demand for natural ingredients in cosmetics is expected to boost the growth of organic acids and their salt preservatives. The demand for organic preservatives such as clove, cinnamon, tea tree, lavender, rosemary, and other essential oils & and herbs is expected to grow at a high CAGR over the forecast period.

Get Customised Report as per Your Business Requirement - Enquiry Now

By Application

The hair care application segment dominated the cosmetic preservatives market with the highest revenue share of about 42% in 2023. Manufacturers of these products are extensively employing preservatives to enhance the longevity and quality of their offerings. This practice is expected to be a significant catalyst for the segment's growth in the future. The shift in consumer preferences towards natural skincare products, such as natural antioxidants, plant extracts, organic acids, and essential oils, necessitates a greater use of cosmetic preservatives during the manufacturing process. Consequently, this trend is anticipated to drive the growth and demand for these products in the coming years.

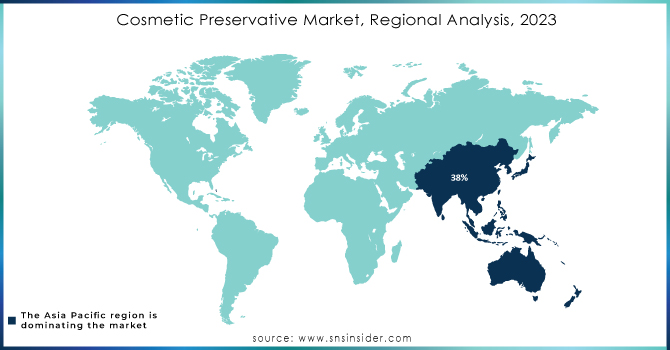

Asia Pacific dominated the Cosmetic Preservative Market with the highest revenue share of about 37% in 2023. This is mainly driven by an increase in the disposable incomes of the citizens of China and a change in the lifestyle leading to an increased demand for skincare and beauty products. Also, there has been an increase in urbanization and the growing power of social media leading to a furthermore increased demand for innovative cosmetic products leading to the cosmetic manufacturers to invest in ensuring their products are safe and stable by use of preservation techniques and chemicals. the region's growing awareness of health and wellness, combined with a shift towards clean beauty trends, has resulted in a higher demand for safe and effective cosmetic products, further boosting the need for reliable preservatives. The strong presence of major beauty brands and local manufacturers in the Asia-Pacific market, along with supportive government initiatives and favorable trade policies, also contribute to the region's dominance in the cosmetic preservative market. These factors combined create a robust environment for growth, making Asia-Pacific a leader in the global cosmetics landscape.

North America held a significant revenue share of the Cosmetic Preservative Market and is expected to grow with a CAGR of about 7% during the forecast period. The market for cosmetic preservatives in North America is expanding due to increasing disposable incomes and evolving consumer habits. There is a growing regional demand for natural cosmetic preservatives, driven by the high preference for organic beauty products that can counteract the harmful effects of sun, dust, and other environmental factors. The sales of toiletries are being propelled by changing consumer lifestyles and the expanding Fast-Moving Consumer Goods (FMCG) market in North America, which creates a positive business environment. Furthermore, the region's growing research and development efforts have resulted in a wide range of soaps and other toiletry products, contributing to an increase in the regional market share.

BASF SE (Preservative Euxyl K 100)

The Dow Chemical Company (DOWSIL™ 9040)

Clariant AG (Ethanol 99.9% - Preservative)

Ashland Inc. (Parabens-Free Preservatives)

Symrise AG (SymGuard)

Salicylates & Chemicals Pvt. Ltd. (Salicylates)

Evonik Industries (TEGO® Cosmo C 100)

Chemipol (Chemipol Preservative)

Akema Fine Chemicals (Akema Preservative)

Brenntag AG (Brenntag Preservatives)

Lonza Group Ltd. (Lonza Givaudan)

Mitsubishi Chemical Corporation (Preservative MCT)

Seppic (a subsidiary of Air Liquide) (Sepimax Zen)

Kraton Corporation (Kraton Polymers)

Hawkins Inc. (Hawkins Preservatives)

SABIC (SABIC Preservative Solutions)

Rahn AG (Rahn Preservative)

Kahl GmbH & Co. KG (Kahl Preservative)

Inolex (Preservative Lexgard)

Mitsui Chemicals (Preservative Epinone)

In May 2023, Symrise introduced two new products SymDiol 68T and SymOcide PT, both of which are tropolone-based. SymDiol 68T is a multifunctional antioxidant that effectively prevents the growth of yeast, bacteria, and mold, while also stabilizing emulsions. It is suitable for use in various skincare, sun care, hair care, personal care, and color cosmetic products. On the other hand, SymOcide PT offers both antioxidant and antimicrobial properties, effectively combating bacteria and fungi.

In August 2022, Brenntag, the global leader in chemicals and ingredients distribution, announced an expanded distribution agreement with ISCA, a renowned manufacturer and distributor of specialty chemicals. This partnership was formed to focus on providing preservatives for the cosmetics industry in several European markets.

In September 2021, the Chemipol technical sales department launched COSMOPOL®, an innovative software application designed to support the selection process of preservation systems for cosmetic and personal care products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 439.1 Million |

| Market Size by 2032 | US$ 780.6 Million |

| CAGR | CAGR of 6.6% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Paraben esters, Phenol derivatives, Alcohols, Formaldehyde donors, Organic acids and their Salts, Quaternary compounds, Inorganics, and Others) • By Application (Skin and Sun Care, Hair Care, Baby Products, Fragrances & Perfumes, Makeup & Color, Mouthwash and Toothpaste, Toiletries, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, The Dow Chemical Company, Clariant AG, Ashland Inc., Symrise AG, Salicylates & Chemicals Pvt. Ltd, Evonik Industries, Chemipol, Akema Fine Chemicals, Brenntag AG, Lonza Group Ltd |

| Key Drivers | • Increasing awareness about personal hygiene and grooming • Rising disposable income in emerging economies • Increasing demand for cosmetic products |

| Market Restraints | • Stringent regulations regarding the use of preservatives in cosmetics • Consumer preference for natural and organic products Potential health risks associated with certain preservatives |

Ans. The Compound Annual Growth rate for the Cosmetic Preservative Market over the forecast period is 6.6%.

Ans. The projected market size for the Cosmetic Preservative Market is USD 780.6 Million by 2032.

Ans: The Construction application segment dominated the Cosmetic Preservative Market with the highest revenue share of about 56% in 2022.

Ans: The expanding automotive industry and demand for thermal comfort drives the market growth.

Ans: Yes, you can ask for the customization as per your business requirement.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cosmetic Preservative Market Segmentation, by Product

7.1 Chapter Overview

7.2 Paraben esters

7.2.1 Paraben esters Market Trends Analysis (2020-2032)

7.2.2 Paraben esters Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Phenol derivatives

7.3.1 Phenol Derivatives Market Trends Analysis (2020-2032)

7.3.2 Phenol Derivatives Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Alcohols

7.4.1 Alcohols Market Trends Analysis (2020-2032)

7.4.2 Alcohols Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Formaldehyde donors

7.5.1 Formaldehyde Donors Market Trends Analysis (2020-2032)

7.5.2 Formaldehyde Donors Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Organic acids and their Salts

7.6.1 Organic acids and their Salts Market Trends Analysis (2020-2032)

7.6.2 Organic acids and their Salts Market Size Estimates and Forecasts to 2032 (USD Million)

7.7 Quaternary compounds

7.7.1 Quaternary compounds Market Trends Analysis (2020-2032)

7.7.2 Quaternary compounds Market Size Estimates and Forecasts to 2032 (USD Million)

7.8 Inorganics

7.8.1 Inorganics Market Trends Analysis (2020-2032)

7.8.2 Inorganics Market Size Estimates and Forecasts to 2032 (USD Million)

7.8 Others

7.8.1 Others Market Trends Analysis (2020-2032)

7.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Cosmetic Preservative Market Segmentation, by Application

8.1 Chapter Overview

8.2 Skin and Sun Care

8.2.1 Skin and Sun Care Market Trends Analysis (2020-2032)

8.2.2 Skin and Sun Care Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Hair Care

8.3. Hair Care Market Trends Analysis (2020-2032)

8.3.2 Hair Care Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Baby Products

8.4.1 Baby Products Market Trends Analysis (2020-2032)

8.4.2 Baby Products Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Fragrances & Perfumes

8.5.1 Fragrances & Perfumes Market Trends Analysis (2020-2032)

8.5.2 Fragrances & Perfumes Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Makeup & Color

8.6.1 Makeup & Color Market Trends Analysis (2020-2032)

8.6.2 Makeup & Color Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Mouthwash and Toothpaste

8.7.1Mouthwash and Toothpaste Market Trends Analysis (2020-2032)

8.7.2 Mouthwash and Toothpaste Market Size Estimates and Forecasts to 2032 (USD Million)

8.8 Toiletries

8.8.1 Toiletries Market Trends Analysis (2020-2032)

8.8.2 Toiletries Market Size Estimates and Forecasts to 2032 (USD Million)

8.9 Others

8.9.1 Others Market Trends Analysis (2020-2032)

8.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Cosmetic Preservative Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.4 North America Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.5.2 USA Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.6.2 Canada Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Mexico Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Cosmetic Preservative Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.5.2 Poland Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.6.2 Romania Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.7.2 Hungary Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.8.2 Turkey Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Cosmetic Preservative Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.4 Western Europe Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.5.2 Germany Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.6.2 France Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.7.2 UK Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.8.2 Italy Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.9.2 Spain Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.12.2 Austria Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Cosmetic Preservative Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.4 Asia Pacific Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 China Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 India Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 Japan Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.6.2 South Korea Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Vietnam Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.8.2 Singapore Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.9.2 Australia Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Cosmetic Preservative Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.4 Middle East Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.5.2 UAE Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.6.2 Egypt Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.8.2 Qatar Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Cosmetic Preservative Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.4 Africa Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.5.2 South Africa Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Cosmetic Preservative Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.4 Latin America Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.5.2 Brazil Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.6.2 Argentina Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.7.2 Colombia Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Cosmetic Preservative Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Cosmetic Preservative Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10. Company Profiles

10.1 BASF SE

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 The Dow Chemical Company

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Clariant AG

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Ashland Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Symrise AG

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Salicylates & Chemicals Pvt. Ltd,

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Evonik Industries

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Chemipol

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Akema Fine Chemicals

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Brenntag AG, Lonza Group Ltd.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Paraben esters

Phenol Derivatives

Alcohols

Formaldehyde Donors

Organic acids and their Salts

Quaternary compounds

Inorganics

Others

By Application

Skin and Sun Care

Hair Care

Baby Products

Fragrances & Perfumes

Makeup & Color

Mouthwash and Toothpaste

Toiletries

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Aluminum Nitride Market was Valued at USD 150.250 Million in 2023 and is now anticipated to grow to USD 245.58 Million by 2032, displaying a compound annual growth rate (CAGR) 4.98% of during the forecast Period 2024 - 2032.

The Liquid Ring Compressors Market Size was USD 1.22 Billion in 2023 and will reach to USD 1.97 Billion by 2032 and grow at a CAGR of 5.6% by 2024-2032.

The Sodium Benzoate Market size was valued at USD 1.3 Billion in 2023. It is expected to grow to USD 2.3 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

The Electrocoating Market Size was valued at USD 4.3 billion in 2023 and is expected to reach USD 6.4 billion by 2032 and grow at a CAGR of 4.6% over the forecast period 2024-2032.

The Industrial Cleaning Chemical Market Size was valued at USD 42.89 Billion in 2023 and is expected to reach USD 65.37 Billion by 2032, growing at a CAGR of 4.80% over the forecast period of 2024-2032.

The Emulsion Polymer Market Size was valued at USD 31.38 Billion in 2023 and is expected to reach USD 54.68 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone