Cosmetic Pigments Market Report Scope & Overview

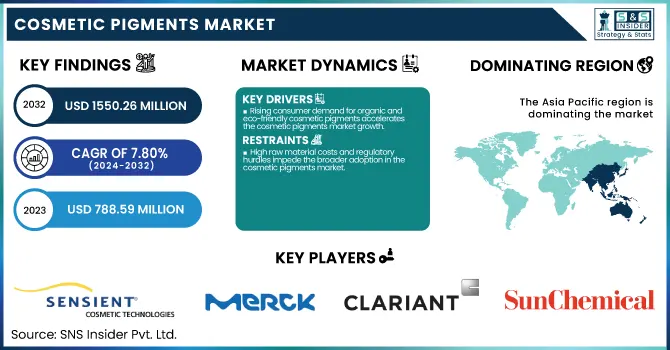

The Cosmetic Pigments Market size was USD 788.59 million in 2023 and is expected to reach USD 1550.26 million by 2032 and grow at a CAGR of 7.80% over the forecast period of 2024-2032.

To Get more information on Cosmetic Pigments Market - Request Free Sample Report

It offers detailed analysis of production capacities and utilization rates segmented by pigment type and region for 2023. It includes feedstock pricing trends across key countries, reflecting volatility and its impact on raw material costs. The report evaluates environmental metrics such as emissions levels and sustainable waste management practices adopted by major manufacturers. Regulatory frameworks influencing pigment safety, labeling, and usage limits are also covered, segmented by country. Innovation and R&D spending trends are analyzed, highlighting advancements in natural and surface-treated pigments. Additionally, adoption of digital color-matching software and formulation tools is assessed regionally. This data-driven section helps stakeholders understand operational dynamics, regulatory shifts, and sustainability priorities shaping the industry.

The Cosmetic Pigments market in the United States was Market size was USD 131.85 million in 2023 and is expected to reach USD 272.78 million by 2032 and grow at a CAGR of 8.41% over the forecast period of 2024-2032. This is due to its well-established cosmetics and personal care industry, driven by high consumer spending on premium and innovative beauty products. The presence of major global cosmetics brands, including Estée Lauder, L'Oréal USA, and Coty Inc., contributes significantly to the demand for advanced and diverse pigment formulations. Additionally, the country’s strong regulatory framework, such as FDA compliance for color additives, promotes the use of high-quality and safe pigments, encouraging innovation and product differentiation. The U.S. also benefits from a robust R&D ecosystem and early adoption of sustainable and natural cosmetic trends, which drives the demand for organic, special effect, and surface-treated pigments. With a rising preference for clean-label and visually appealing cosmetic products, the U.S. continues to lead in both pigment consumption and innovation.

Cosmetic Pigments Market Dynamics

Drivers

-

Rising consumer demand for organic and eco-friendly cosmetic pigments accelerates the cosmetic pigments market growth.

The Cosmetic Pigments Market is being significantly driven by the increasing consumer preference for organic and eco-friendly products. Modern consumers are more aware of the health and environmental impacts of synthetic chemicals and are actively seeking natural alternatives that offer safer, sustainable options for cosmetic formulations. This shift in consumer behavior is prompting manufacturers to invest in research and development to create high-performance, natural pigments. Market participants are focusing on innovative processing technologies and sourcing renewable raw materials, which not only enhance product quality but also reduce adverse environmental impacts. As trends like clean beauty and green cosmetic formulations continue to gain momentum, the demand for environmentally friendly cosmetic pigments is expected to fuel market expansion rapidly in both developed and emerging economies.

Restrain

-

High raw material costs and regulatory hurdles impede the broader adoption in the cosmetic pigments market.

One of the major restraints in the Cosmetic Pigments Market is the high cost associated with premium raw materials and the stringent regulatory landscape governing cosmetic ingredients. Manufacturers face rising expenses for high-quality, naturally derived pigments due to limited availability and complex extraction processes. In addition, the regulatory requirements across different regions demand rigorous testing and compliance protocols that further increase operational costs. These factors create a challenging environment, particularly for smaller players who may struggle with the capital needed for research, development, and extensive regulatory submissions. As a result, market growth is impacted by slower adoption rates in price-sensitive regions, with companies having to balance innovation with cost efficiency while navigating dynamic regulatory frameworks that vary widely by market and country.

Opportunity

-

Innovative R&D and emerging technological trends open boundless new frontiers for cosmetic pigments market expansion.

Advancements in research and development combined with emerging technological trends are creating significant growth opportunities for the Cosmetic Pigments Market. Companies are increasingly investing in innovative technologies to develop pigments that offer unique properties such as enhanced color stability, improved dispersion, and novel aesthetic effects that appeal to modern consumers. Breakthroughs in biotechnology and green chemistry are enabling the creation of pigments derived from renewable sources, reducing dependency on non-renewable resources, and aligning with consumer preferences for sustainable beauty solutions. These innovations also facilitate the development of multifunctional pigments that can be customized for various applications, further expanding market potential. Strategic collaborations between ingredient innovators, cosmetic formulators, and technology providers are poised to accelerate market growth by opening up new product categories and application segments worldwide.

Challenge

-

Intensifying market competition and price pressures challenge profit margins within the rapidly evolving cosmetic pigments market.

The Cosmetic Pigments Market faces a significant challenge due to intensifying competition among key players and escalating price pressures. As numerous companies vie for market share through product innovation, aggressive pricing strategies have become a common tactic, putting pressure on profit margins across the industry. Additionally, market saturation in developed regions has led to fierce competition, while emerging markets also present their own set of challenges in terms of cost variability and consumer price sensitivity. Companies are forced to continuously optimize their production processes and supply chains to maintain cost competitiveness without compromising quality. Furthermore, the dynamic nature of regulatory requirements across different geographies adds an extra layer of complexity, making it challenging for companies to sustain profitability while investing in new technologies and product enhancements to meet evolving consumer demands.

Cosmetic Pigments Market Segmentation Analysis

By Composition

Inorganic pigments held the largest market share around 68% in 2023. It is owing to the high stability, opacity and safety profile of the product. But pigments like iron oxides and titanium dioxide resist heat, light, and chemical degradation very well, which makes them ideal as long-lasting colorants in many products, such as foundations, lipsticks, eyeliners, and sunscreens. Inorganic versions on the other hand, are non-reactive and are therefore very much preferred in dermatologically tested and hypoallergenic formulations. Their ease of dispersion and ability to color consistently over wide range of concentrations also help in achieving uniformity of application in make-up products. In addition, the rise in the number of regulators evaluating synthetic and hazardous elements has naturally propelled the commercial growth of safe, FDA-approved inorganic colors, proven highly lucrative in North American and European regions, which have strict cosmetic regulations.

By Type

The surface treated pigments held the largest market share at around 36% in 2023. It is due to their enhanced properties, which make them ideal for high-performance cosmetic formulations. The surface treatment process improves the dispersibility, stability, and color intensity of pigments, ensuring that they blend more easily and evenly in cosmetic products. These pigments also offer superior resistance to environmental factors such as UV light, heat, and moisture, making them perfect for long-lasting applications like foundation, blush, and eye makeup. Additionally, surface-treated pigments can be tailored to meet specific needs, such as improving skin feel, adding shimmer, or enhancing durability. As consumer demand grows for multifunctional beauty products that offer both aesthetics and skincare benefits, the versatility and superior functionality of surface-treated pigments have made them increasingly popular, thus contributing to their dominance in the market.

By Application

Facial Makeup held the largest market share, around 25%, in 2023. This is due to its widespread use and high demand across diverse consumer segments. Products like foundations, concealers, blushes, and highlighters are essential components of daily beauty routines, making facial makeup the primary application for cosmetic pigments. The growing trend toward flawless, customizable looks and the increasing consumer focus on skin-perfecting products have further fueled the demand for facial makeup products. Additionally, advancements in formulations that offer long-lasting wear, buildable coverage, and a natural finish have boosted the popularity of facial makeup, leading to higher pigment usage. With the rising popularity of clean beauty and skin care-infused cosmetics, facial makeup formulations are incorporating a wide variety of organic and inorganic pigments, ensuring that the demand for these products remains robust across all age groups and demographics.

Cosmetic Pigments Market Regional Outlook

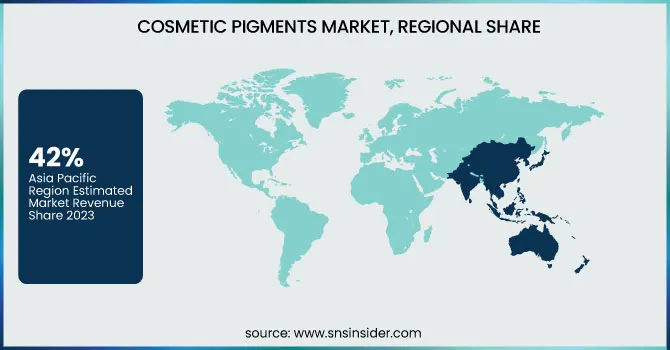

Asia Pacific held the largest market share, around 42%, in 2023. This is owing to the rapid development of beauty and personal care industry in the region, fuelling by increasing disposable incomes, urbanization, and consumers lifestyles. The expanding middle classes in China and India, along with a growing interest in cosmetics in Japan, have led to increased demand for premium and mass-market cosmetic products in all of these countries. Moreover, the demand for innovative inclusive cosmetic formulations has greatly surged in the region because of the burgeoning interest in beauty trends among the young and digits population particularly millennials and Gen Zs. In addition, the emergence of e-commerce platforms and impact of social media on beauty ideals have been instrumental in driving cosmetic product consumption across the region. Additionally, the pigment market is being propelled by a number of cosmetic manufacturers in Asia Pacific launching new and bespoke pigment solutions to match local requirements.

North America held a significant market share. It is due to the well-established presence of major global beauty and personal care brands, a strong consumer base, and high demand for premium cosmetic products. The region's consumers are highly invested in beauty and skincare, driven by a culture that emphasizes personal grooming and self-expression. With a preference for high-quality, innovative products, North American consumers are increasingly seeking advanced cosmetic formulations that include safe, effective, and unique pigments. Regulatory frameworks in the U.S. and Canada, such as those enforced by the FDA, ensure that only the safest, most effective ingredients are used, which has boosted consumer confidence in cosmetic products. Additionally, North America is a hub for research, development, and innovation in the cosmetics industry, making it a leader in introducing new trends and technology in pigment formulations. The rise of clean beauty and organic products, along with strong e-commerce growth, has further solidified North America's dominance in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Sensient Cosmetic Technologies (Unipure Red LC 381, Covapearl White ST 925)

-

Merck Group (Ronastar Golden Jewel, Colorona SynBerry Pink)

-

Clariant (Vibracolor Ruby Red, Hostaperm Pink E)

-

Sun Chemical (SunPURO Orange 5, SunCROMA Yellow Iron Oxide)

-

Eckart GmbH (Syncrystal Soft Ivory, Prestige Silver)

-

Kobo Products Inc. (KOBOPEARL Perpetual Tan, Iron Oxide Red 229C)

-

DayGlo Color Corp. (Zinc Sulfide Orange, Elara Glow Pigment)

-

BASF (Cosmenyl Red B, Reflecks MultiDimensions Glistening Gold)

-

LANXESS (Bayferrox 130 C, Colortherm Yellow 20)

-

Geotech International B.V. (Bi-Lite Silver 250, Gemtone Ruby Red)

-

Neelikon (Neeligran Red 6, Neeligran Yellow 5)

-

Toyal America Inc. (Aluminum Silver PG-903, Pearl Black S-901)

-

Nihon Koken Kogyo Co., Ltd. (Cokemica Red Iron Oxide, Cokemica Mica Pearl)

-

Miyoshi America, Inc. (MiyoNAT Yellow Iron Oxide, MiyoNAT Mica Titanium)

-

Venator Materials PLC (Durasheen 102, UV-Titan M160)

-

Kolortek Co., Ltd. (Holographic Pigment KTP, Thermochromic Pigment KT-WA)

-

Oxen Special Chemicals Co., Ltd. (Oxen Pearl Gold, Oxen Silver Crystal)

-

Sudarshan Chemical Industries (Sumicos White S210, Sumicos Copper S410)

-

Harman Finochem Ltd. (HFPink CP01, HFYellow CY02)

-

Yipin Pigments (Yipin Yellow Iron Oxide 920, Yipin Red 110)

Recent Development:

-

In 2024, Sun Chemical unveiled its next-gen INTENZA Hana effect pigments, blending FDA-approved colors with natural mica for enhanced shimmer. They also launched SunPURO Natural Carotenes from algae and mushrooms, and SACRANEX, a skincare active for hydration and pollution protection.

-

In April 2024, LANXESS expanded its cosmetics portfolio featuring Purox S Scopeblue, a more sustainable sodium benzoate. Made using green energy and renewable resources, it significantly lowers carbon emissions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 788.59 Million |

| Market Size by 2032 | USD 1550.26 Million |

| CAGR | CAGR of 7.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Composition (Organic Pigments, Inorganic Pigments) •By Type (Special Effect Pigments, Surface Treated Pigments, Nano Pigments, Natural Colorants), •By Application (Facial Makeup, Lip Products, Hair Color Products, Eye Makeup, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sensient Cosmetic Technologies, Merck Group, Clariant, Sun Chemical, Eckart GmbH, Kobo Products Inc., DayGlo Color Corp., BASF, LANXESS, Geotech International B.V., Neelikon, Toyal America Inc., Nihon Koken Kogyo Co., Ltd., Miyoshi America, Inc., Venator Materials PLC, Kolortek Co., Ltd., Oxen Special Chemicals Co., Ltd., Sudarshan Chemical Industries, Harman Finochem Ltd., Yipin Pigments |